In this review, we are going to take a comprehensive look at Moneybox and the products they have to offer. We will take a look at their fees, investment offerings, customer experience and more. After reading this, you should be able to make an informed decision on whether or not Moneybox is the right choice for you.

Quick Overview

Moneybox is an all-in-one savings, investment and pension platform. It’s a great app to manage all of your savings and investments in one place. They offer reasonable interest rates and high-performing pre-built portfolios. This is a great platform for new investors who are ready to take their finances more seriously. You can get started with as little as £1.

Moneybox is a financial platform offering multiple finance products such as savings, investments, pensions, and even mortgage advice services. They have promising returns in their risk-based portfolios and offer reasonable fees.

- - Wide range of financial products

- - Great returns on their pre-built portfolios

- - Great customer support

- - Free Mortgage advice

- - Only 20 stocks available

- - £1 Monthly Subscription

Who Are Moneybox

Moneybox is one of the UK’s innovative digital savings and investment platforms. This fintech firm offers a variety of products to help individuals save and invest, including rounding up daily purchases to the nearest pound and investing the change, as well as providing pension services, lifetime ISAs, and general investment accounts.

Founded in 2015 by Charlie Mortimer and Ben Stanway in London, Moneybox has rapidly made a name for itself as a go-to solution for younger generations keen on kickstarting their savings and investment journeys. From its humble beginnings, Moneybox has successfully harnessed the power of technology to break down traditional barriers to saving and investing.

Moneybox has several features leading to their great reputation:

Innovation and Adaptability: Despite being relatively younger in the financial space, Moneybox has consistently been at the forefront of leveraging technology to simplify savings and investments for its users.

Regulation: Moneybox operates within the UK’s rigorous financial regulatory framework, overseen by the Financial Conduct Authority (FCA), ensuring that users’ investments are managed with the utmost professionalism and care.

Expanding User Base: Moneybox has garnered a significant user base since its inception, a testament to its user-friendly platform and effective savings strategies. Feedback from the platform’s users is consistently positive, reflecting the trust the company has built.

Transparency: Like its peers in the fintech sector, Moneybox prioritises a transparent fee structure and an ethos centered around its users. Its straightforward approach and comprehensive customer support have cemented its position as a trustworthy and accessible platform for many.

What Products Does Moneybox Offer

Moneybox offers investing products as well as savings products. This includes savings accounts, Stocks and Shares ISAs, Junior ISAs, Lifetime ISAs and General Investment Accounts.

Stocks & Shares ISAs

This account allows you to invest up to £20,000 per year without paying any tax on your profits, even when you withdraw. You pay no tax on capital gains, income, or dividends. Remember you can only have £20,000 spread across multiple ISAs in a single year. You can start investing in a Moneybox ISA with just £1.

General Investment Account

This is a general investment account with no tax benefits. You can buy and sell ETFs and stocks as you please but will have to pay capital gains tax on any profit over your yearly allowance of £6,000. With Moneybox you can start investing from as little as £1.

Junior ISA

A junior ISA allows you to invest up to £9,000 for your child. Once they turn 18 they can access this money. It’s a great way to put money away for their first car, house deposit, or university.

Lifetime ISA

Moneybox offers both a cash Lifetime ISA and a Stocks and Shares Lifetime ISA. A Lifetime ISA allows you to save up to £4,000 per year and receive a 25% government bonus. This means you can claim a maximum £1,000 bonus each year when saving in a LISA.

A Stocks and Shares LISA allows you to invest the money in your account while a Cash LISA will earn a set amount of interest each year on the money you deposit.

Pension

You can manage your personal pension within Moneybox by tracking down all of your old workplace pensions and transferring them to one place. Their team will help you find pensions in your name and get them added to your account.

You can then make deposits to your pension account and continue saving and investing for retirement.

Savings Accounts

As well as all of the Investment options above, Moneybox offers a range of savings accounts. They offer a simple saver and 32, 45, 95 and 120-day notice accounts.

How Moneybox Works

Moneybox is one of the most popular Digital Wealth management companies in the UK right now. Most platforms in this space offer managed investment portfolios. Moneybox offers this but also has a whole range of other features on its platform.

They are trying to become a one-stop shop for your financial life. They offer savings, investments, pensions and have even ventured into mortgage recommendation services.

With Moneybox you can get started investing or saving in their accounts with as little as £1 making it a great place for anyone to get started improving their finances.

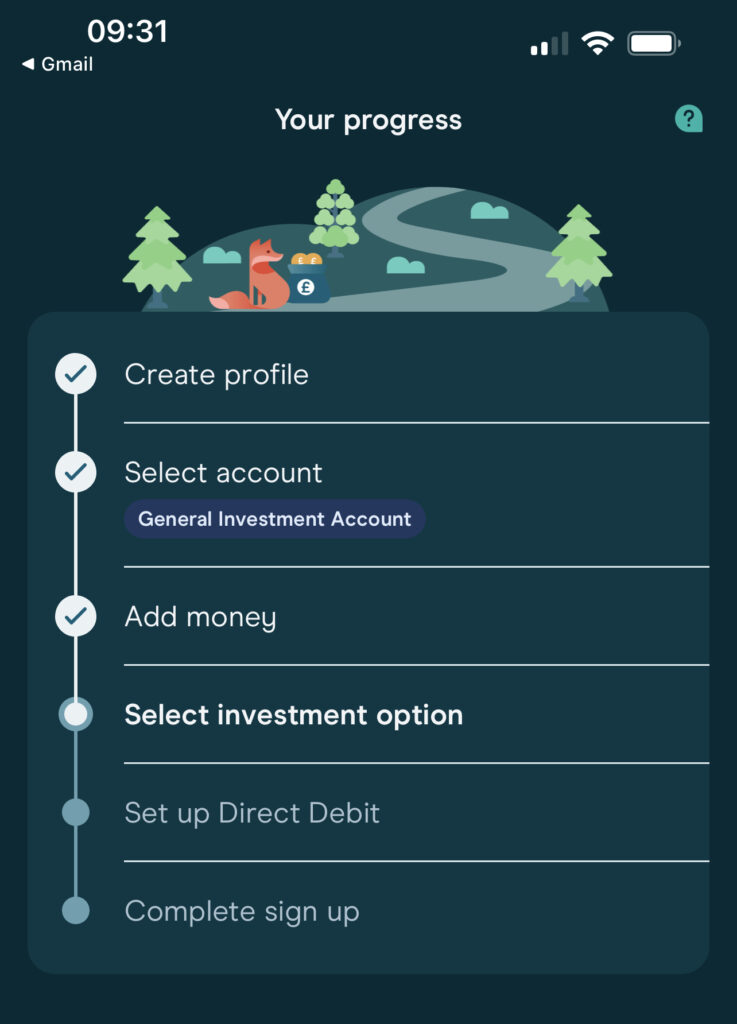

Their website is a great place to start learning about their products but you will need to use their mobile app if you want to start utilising their platform. When you download the app you will first choose the type of account you want to set up. This can be any of the accounts we outline above.

Next, you decide how much you want to fund your account with and whether or not you want to set up a monthly savings plan on your account. We can decide where we want to invest our money.

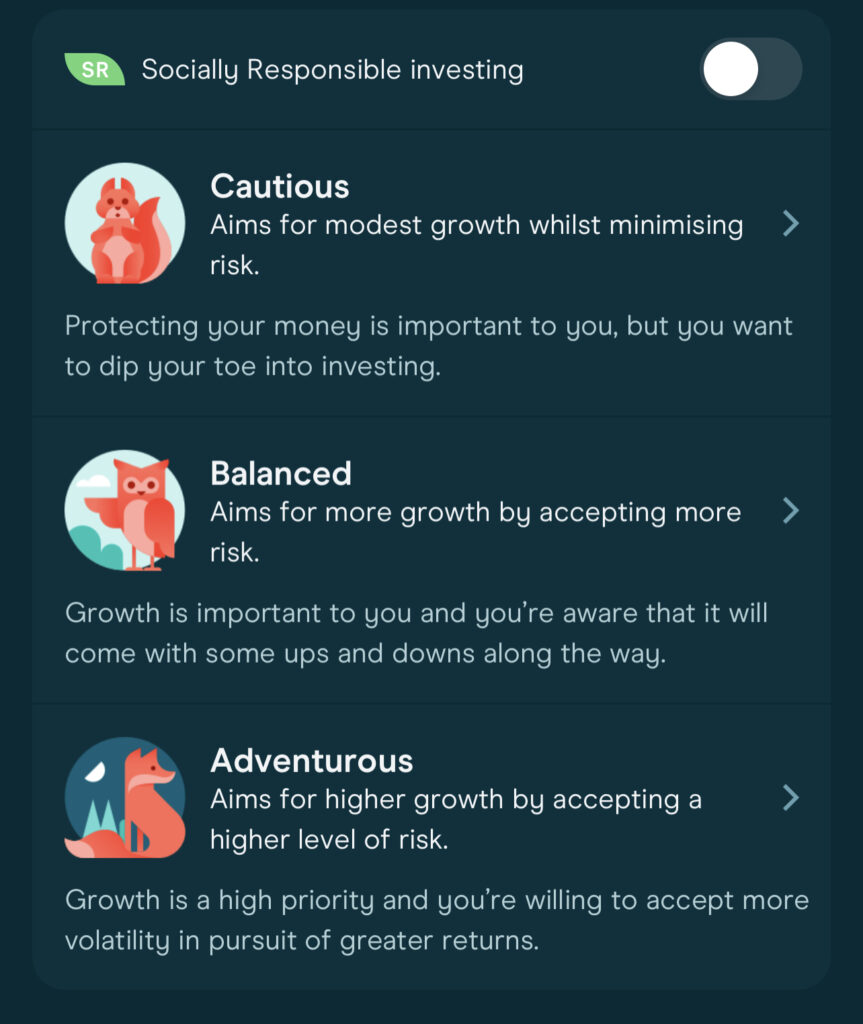

Like most robo-advisor services they offer a range of risk-based portfolios for investors. Moneybox has three portfolios to choose from. This consists of a cautious, balanced and adventurous portfolio. You can also select “Socially Responsible Investing” which will invest in a socially responsible version of each of these portfolios.

Once you have decided on your portfolio, you will need to set up a direct debit to fund your account. Lastly, finalise your details and you are good to go.

Once your account is set up, you can also connect bank accounts and credit cards to Moneybox. This allows you to utilize their roundup feature, where you can save the spare change after each transaction. Moneybox does this by monitoring your spending over the course of the month and then taking a single direct debit for the total of your round-ups from your connected bank account. If you connect multiple bank accounts, the total of all roundups will be taken from the bank account you set up the direct debit with.

Moneybox Investment Options

Moneybox has multiple investment options to choose from. You can either utilise their pre-made portfolios, customise your own portfolio or invest in individual stocks available on their platform.

Pre-Made Portfolios

Moneybox has 3 pre-made portfolios available for investors. These portfolios are set up to give new investors an easy way to invest based on their risk tolerance. All of these portfolios include a global shares fund paired with a range of other assets to adjust the risk level. We’ll take a deeper look at these portfolios and their historical returns later in this review.

Each portfolio also has a socially responsible version available if you want to invest in companies with better environmental, social and governance practices.

Custom Portfolio

If you want to take more control of your portfolio, Moneybox has a range of funds which you can invest in. You can build your own portfolio with the 24 funds they currently have available. This includes a range of popular funds covering different sectors and regions of the market. Most people will be able to build a well-diversified portfolio with these funds however other platforms such as Invest Engine have over 550 funds to choose from.

Individual Stocks

Moneybox has a selection of US stocks available solely for their Stocks and Shares ISA customers. The stocks available can be purchased as fractional shares meaning you can purchase a portion of a share which is great for new investors who have a small portfolio and want to diversify between stocks.

Unfortunately, Moneybox only has 20 stocks available on their platform right now. You can view the full list of stocks available here. If you are looking to invest in individual stocks I would recommend looking at Trading 212 or Hargreaves Lansdown.

Moneybox Portfolio Performance

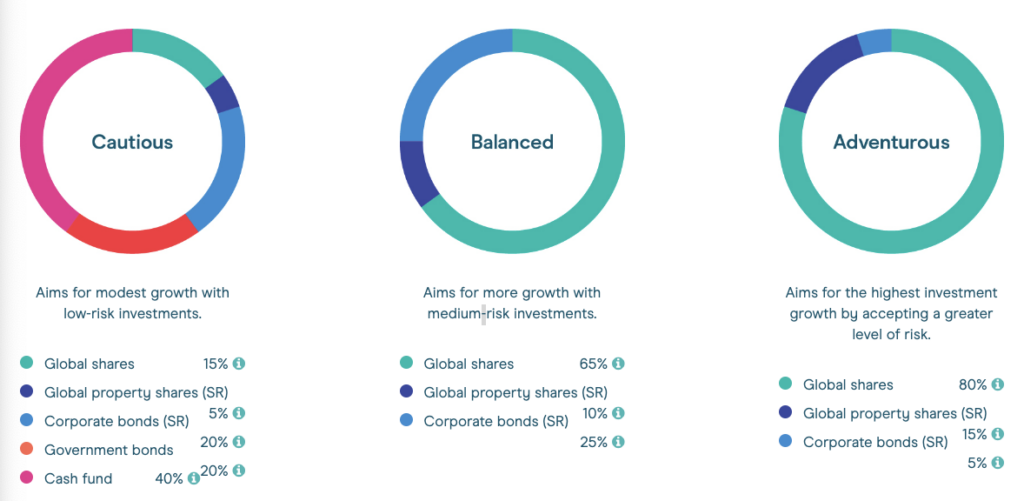

Moneybox has 3 preset portfolios available. Let’s take a look at how they have performed over the past 5 years.

| Portfolio | 5 Year Total Returns | Yearly Avg Returns (Past 5 Years) |

|---|---|---|

| Cautious | 10.5% | 2.02% |

| Balanced | 34.5% | 6.1% |

| Adventurous | 40.5% | 7.04% |

Let’s compare these returns to some of Moneybox’s biggest competitors.

| Risk Level | Moneybox 5 Year Returns (Total) | Moneybox 5 Year Return (Yearly Avg) | Moneyfarm 5 Year Returns (Total) | Moneyfarm 5 Year Return (Yearly Avg) | Nutmeg 5 Year Returns (Total) | Nutmeg 5 Year Returns (Yearly Avg) |

|---|---|---|---|---|---|---|

| Low | 10.5% | 2.02% | -7.1% | -1.5% | -3.9% | -0.8% |

| Medium | 34.5% | 6.1% | 10.6% | 2.1% | 3.6% | 0.72% |

| High | 40.5% | 7.04% | 25.5% | 4.7% | 24.09% | 4.49% |

In the 5 years leading to Dec 2022, Moneybox has massively outperformed their competitors, Moneyfarm and Nutmeg with all three of their portfolios. In fact, their low-risk portfolio was the only low-risk portfolio to generate positive returns in this time period.

Moneybox portfolios are extremely simple compared to their competitors. For equities, they hold a single Index World Fund from fidelity which gives you broad exposure to the worldwide stock market at extremely low cost. Moneybox categorises these as Global Shares. Depending on your risk tolerance a portion of the portfolio is allocated toward these Global Shares. The higher your risk, the more of your portfolio will be allocated toward equities.

The remaining allocation goes towards Property, Corporate Bonds, Government Bonds and Cash depending on the portfolio you choose.

Moneybox Fees

Moneybox has different fee structures for its different products. Let’s take a look at how much they are charging for each of them.

Savings & Cash Lifetime ISAs

All savings accounts and the Cash Lifetime ISA have zero fees.

Investment Account Fees

If you open any investment account on Moneybox you will have to pay 3 types of fees. Moneybox has a fixed monthly subscription fee of £1 per month plus platform fees of 0.45% and the underlying fund fees.

If you invest in individual stocks through your investing account you will have to pay a currency conversion fee.

| Fee Type | Fee |

|---|---|

| Fixed Subscription | £1 Per Month |

| Platform Fees | 0.45% |

| Fund Fees | 0.12% to 0.58% (Set by the fund) |

| Currency Conversion (Only on Individual Stocks) | 0.45% |

If you have an account balance of zero you will not be charged any fees.

Pension Fees

The Moneybox pension has no monthly subscription fee and has tiered fees depending on the size of your pension. The annual platform fee is 0.45% up to £100k and 0.15% over £100k.

| Fee Type | Fee |

|---|---|

| Platform Fees (Up to £100k) | 0.45% |

| Platform Fees (Over £100k) | 0.15% |

| Fund Fees | 0.12% to 0.58% (Set by the fund) |

Moneybox Savings Options

Moneybox has 5 different savings accounts available on their platform right now. This includes a Simple Saver account and Notice accounts for 32, 45, 90, and 120 days.

These accounts can be opened with as little as £1.

The simple saver account is an instant-access savings account. You can withdraw and deposit money as you need without incurring any penalties. However, you are limited to one withdrawal per calendar month. You can deposit up to £85,000 in this account.

Notice accounts offer higher interest rates however you are required to give Moneybox a certain period of notice before you withdraw. The longer the notice period, the higher the interest you will receive.

You can view the latest Moneybox interest rates here.

Personally, if you are looking for a high-interest savings account I would recommend Chip. They are currently offering market-leading interest rates on an easy-access savings account where you can access your money at any time.

Chip is an award-winning savings and investment app. They became popular with their high-interest savings account but also offer investment services and automatic saving.

Moneybox Unique Features

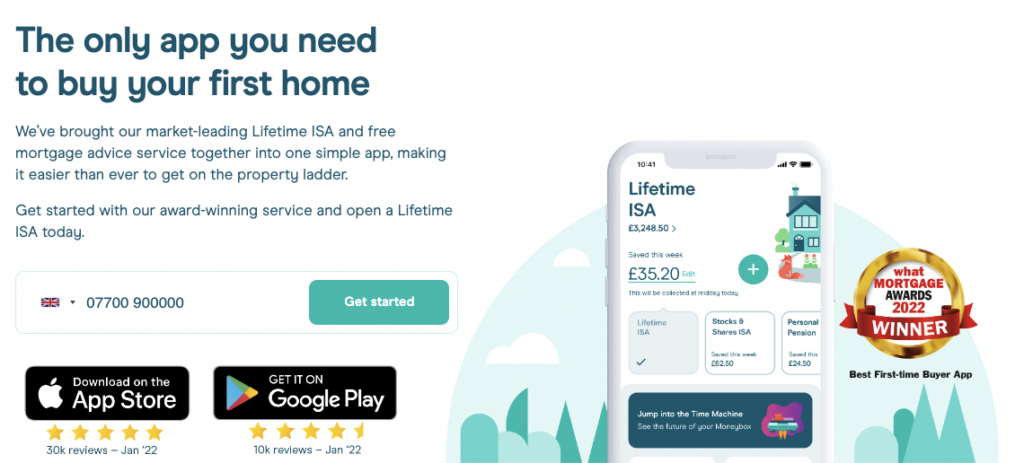

Moneybox has a number of unique features that other similar platforms don’t have. It looks like Moneybox is trying to help people with a number of different financial decisions in their life, not just investing. One of the areas they have tapped into is home buying. Not only do they offer Lifetime ISAs which help people get on the property ladder but they are now offering mortgage advice.

This makes sense as many of their customers will be using their service to save for their first house. Once they’re ready to start the buying process, Moneybox is there to help them find out how much money they can borrow as well as find them a suitable mortgage.

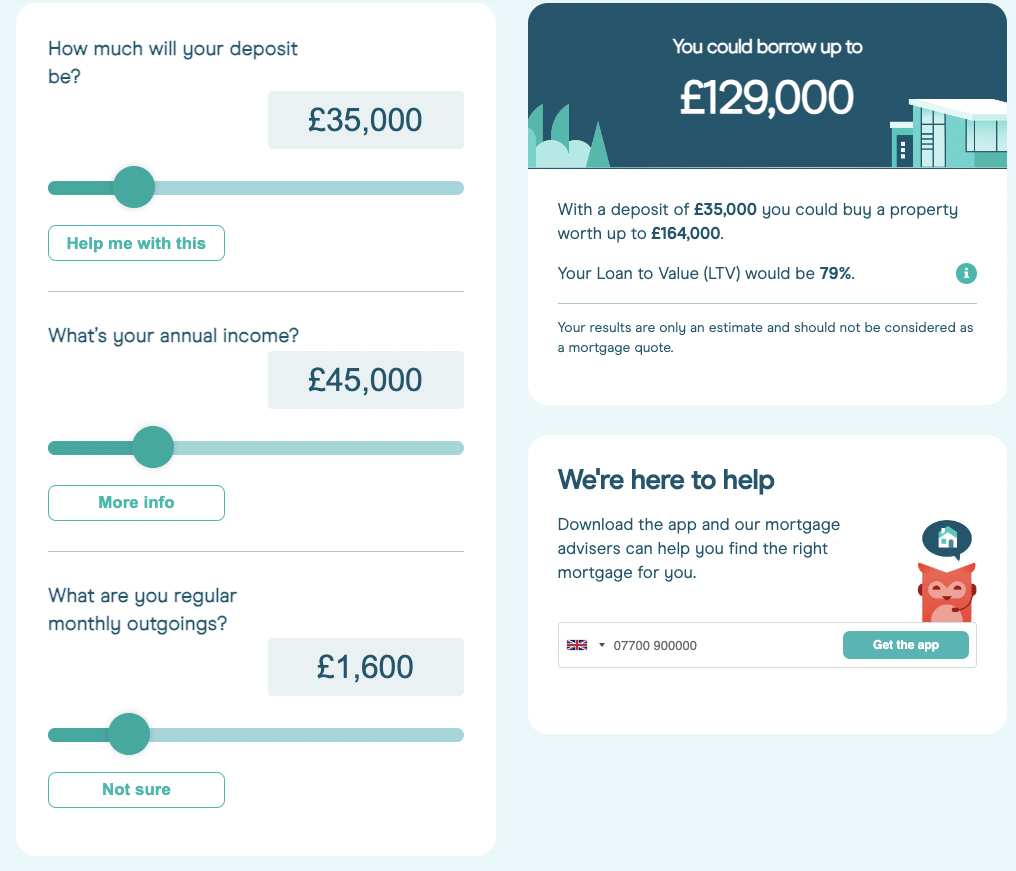

Moneybox Mortgage Calculator

Once you start thinking about purchasing a house, one of the first questions you ask is “How much can I borrow?”. Moneybox offers a calculator that will give you a rough idea of how much you can borrow, depending on your deposit, annual income and monthly outgoings.

Moneybox Mortgage Advice

When you’re finally ready to purchase your house, you can get free impartial mortgage advice from Moneybox’s experienced team and access mortgages from over 90 lenders.

You can complete your full mortgage application within the app. Once complete you will be able to see an estimated monthly payment and interest rate, as well as the number of lenders available for you. You will also get a copy of your mortgage in principal and have the opportunity to connect with one of Moneybox’s advisors to help you with the next steps.

Your mortgage advisor will help you find the best mortgage for your needs and even go ahead and help you submit your application to the lender.

This service is also free of charge to users. Moneybox will make their money by getting a kickback from the mortgage providers. Traditional mortgage advisors also get this commission but will charge you an extra fee on top.

Moneybox Reviews

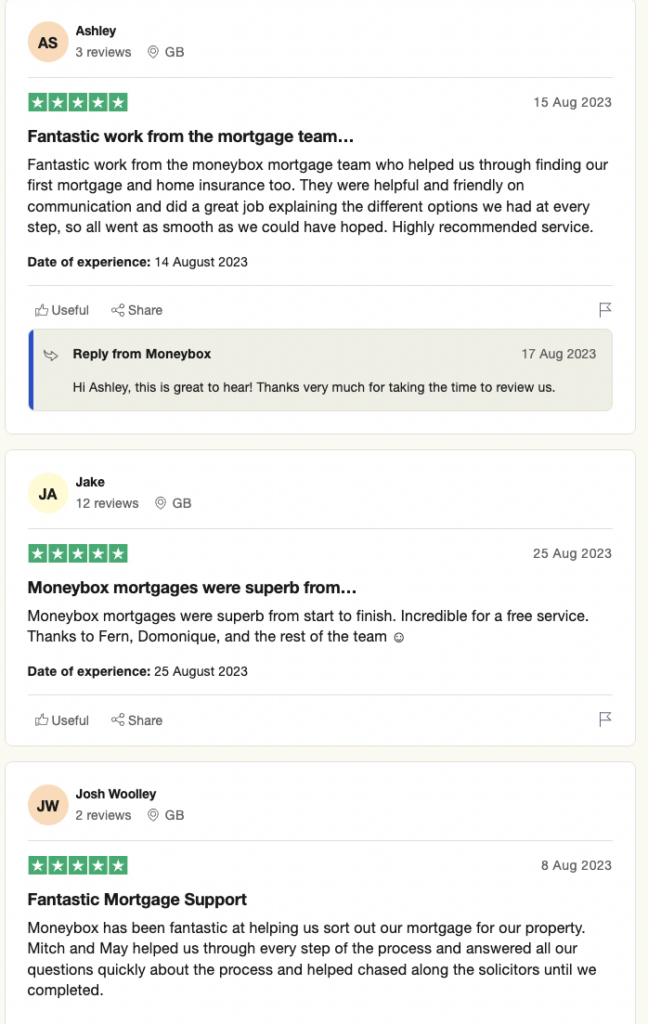

Moneybox has an amazing score of 4.6 stars on Trust Pilot. This is one of the highest scores out of all the financial platforms we have reviewed. It has over 1,500 reviews with 78% of them coming in at 5 stars and only 8% of them coming in at 1 star.

Many of the positive reviews praise Moneybox for making saving easy when they previously struggled with it and helping them to get their finances in order. A lot of the positive reviews are actually based on Moneybox’s mortgage advice service rather than their investment products. People state that their team is extremely helpful, getting on the phone with them and going back and forth with their solicitor to get mortgages finalised.

There aren’t many negative reviews but the ones that do appear on Trustpilot mainly talk about returns on their savings products, tech trouble with the app and high platform fees.

Moneybox Customer Support

Moneybox has a great customer support system in place for their customers. Most of their competitors only offer email or chat support but Moneybox goes the extra mile and offers phone support.

You can contact Moneybox support through the following methods:

– In-app chat (Settings > Help)

– Email (support@moneyboxapp.com)

– Phone (0330 808 1866)

Is Moneybox Safe?

Yes, Moneybox is a safe platform to invest your money. They are authorised and regulated by the Financial Conduct Authority (FCA). These are the people who ensure that Moneybox is following strict rules and regulations to keep your money safe.

Your money is also protected by the Financial Services Compensation Scheme (FSCS), which means that if Moneybox went out of business, your money would be covered up to £85,000.

How Does Moneybox Make Money?

Moneybox makes money in a few different ways on its platform:

- Subscriptions fees – They charge a £1 monthly subscription fee to use their investment products.

- Platform Fees – When using one of Moneybox’s investment accounts you will be charged a 0.45% platform fee yearly. On pension accounts, this fee is 0.45% up to £100k and 0.15% after £100k.

- Currency Conversion Fees – When you buy US stocks on Moneybox you will be charged a 0.45% currency conversion charge.

- Partner Deals – When using Moneybox’s free mortgage advice service, they will receive a kickback from the mortgage provider they refer you to.

Who Should Use Moneybox?

Moneybox is a great app for someone who wants to manage their savings, investments and pension all under a single app. If you’re a beginner you probably don’t want to be spreading your money across multiple apps and platforms. Being able to keep everything in a single place makes managing your finances much easier.

They make investing easy with their pre-made risk-based funds and offer reasonable interest rates on their savings accounts. While they don’t have the most comprehensive investment offering, they do have enough for beginners to get started and ultimately that’s the most important thing.

Moneybox is a great place for beginner investors and savers to get started.

Final Thoughts

Moneybox overall is a great app for people who want to improve their financial situation. It has some great features for users new to saving and investing such as their round-up and auto-save features. This can help people who struggle to save, put more money away.

While they don’t have the most comprehensive investment offerings they do offer multiple services in one place. If you want to keep your savings, investments and pensions in one place, you can do it with Moneybox.

While these are some benefits to using Moneybox, the platform fees are more expensive than a product like Invest Engine, where you could easily build the same portfolios offered on Moneybox and pay zero platform fees.

More experienced investors will likely want to put their money somewhere they can invest in a wider range of ETFs and individual stocks such as Trading 212 or Hargreaves Lansdown.

Read More From Money Sprout: