If you’re ready to start your investing journey, you may be considering using Invest Engine or Moneyfarm. These are two of the best Robo-advisor platforms on the market. Honestly, they’re both great products but which one is best for you?

In this article, we are going to break down both of these platforms to see which has the best fees, performance and user experience. Let’s jump in.

|

5.0

|

4.0

|

|

Pros:

|

Pros:

|

|

Cons:

|

Cons:

|

- Fee free investing for DIY portfolios

- 0.25% Managed Portfolio Fees

- 550+ ETFs Available

- Auto-investing with savings plans

- Easy to use

- No pension plan

- Only offers ETFs

- Slick easy to use app

- Great for passive investors

- Large range of Portfolio options

- High fees on certain products

- Poor returns on low risk funds

Invest Engine vs Moneyfarm Overview

For those delving into the digital investment realm, two noteworthy platforms emerge from the UK: Invest Engine and Moneyfarm. Both platforms leverage cutting-edge technology to offer tailored investment solutions, but their offerings and target audiences differ in several respects.

Invest Engine

Invest Engine is particularly appealing for investors keen on ETFs. Known for its zero-fee investing for DIY portfolios, it offers over 550 ETF options. The platform provides users with the choice to craft their own DIY funds or opt for managed portfolios at a nominal 0.25% fee. Catering predominantly to the needs of newcomers who wish to avoid individual shares, it has the allure of a minimal deposit requirement of £100. A distinguishing feature is its technological edge in investment management, complemented by financial acumen. However, it limits its offerings to ETFs and doesn’t cater to pension plans.

Moneyfarm

On the other hand, Moneyfarm emerges as one of the UK’s pioneering digital wealth managers. Founded in 2011, it made its mark by simplifying investment processes, focusing on tailor-made portfolios based on personal risk assessments and financial objectives. It amalgamates the best of modern technology with traditional investment principles. Moneyfarm’s reputation is built on its transparency, with clear fee structures and a resolute commitment to keeping clients in the loop about their investments.

Both platforms operate under the stringent guidelines of the Financial Conduct Authority (FCA), ensuring safety and compliance. Choosing between the two would hinge on individual preferences, financial goals, and investment strategies.

Let’s take a look at both of the products in more detail so you can decide which is best for you.

Invest Engine & Moneyfarm Comparison

| Moneyfarm | Invest Engine | |

|---|---|---|

| Rating | 4.2 | 5 |

| Minimum Investment | £500 | £100 |

| Products | – General Investment Account – Stocks & Shares ISA – Junior ISA – Pension | – Stocks & Shares ISA – General Investment Account |

| Investing Styles | – Fixed Allocation – Active Management – Thematic – ESG (Socially Responsible) | – Over 550 ETFs – 10 Risk Based Managed Portfolios |

| Fees | Up to £10k – 0.75% £10k to £20k – 0.70% £20k to £50k – 0.65% £50k to £100k – 0.60% £100k to £250k – 0.45% £250k to £500k – 0.40% Over £500k – 0.35% The fee tier you are in applies to the whole portfolio. If you have £100k invested, you will pay 0.45% on the £100k. | – Zero platform fees on DIY investments – 0.25% platform fees on managed portfolios |

| Portfolios Available | 7 | 10 |

Invest Engine vs Moneyfarm: Products

Both platforms offer a range of different products you can choose to invest with.

Money farm has:

- General Investment Accounts

- Stocks & Shares ISA

- Junior ISA

- Pension (SIPP)

Invest Engine has:

- General Investment Accounts

- Stocks & Shares ISA

- Business Account

If you are looking to invest in a Junior ISA or Pension, Moneyfarm is the platform for you. A business account is the only account Invest Engine offers that Moneyfarm doesn’t have.

Both platforms offer Stocks and Shares ISAs and General Investment accounts.

Invest Engine vs Moneyfarm: Investing Options

Both platforms have a selection of different investing options. Moneyfarm solely focuses on managed portfolios whereas Invest Engine has managed portfolios as well as DIY investing through ETFs.

Managed Portfolios

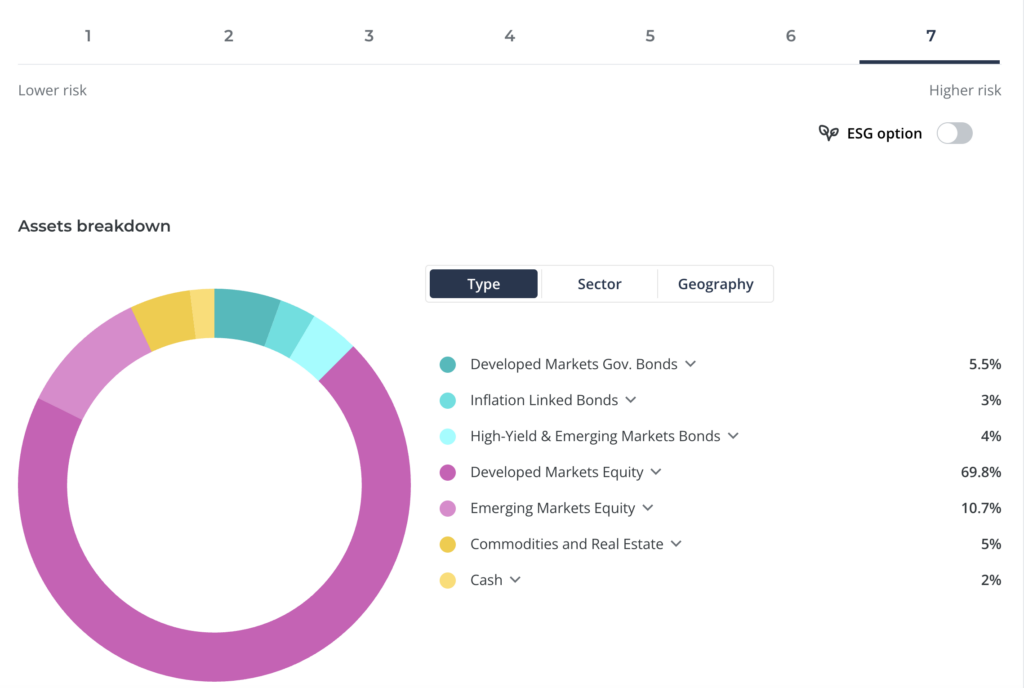

Moneyfarm and Invest Engine both have managed portfolios run by their investing experts. However, Moneyfarm has a much wider range of portfolios and customisations you can make while Invest Engine solely has 10 preset risk-based portfolios to choose from.

Moneyfarm

- 7 core risk-based portfolios

- Ethical variations of each of their 7 portfolios

- Fixed Allocation Funds with cheaper fees

- Thematic Investing (Growth theme options you can add to your portfolio such as Technology, sustainability, society, and more)

Invest Engine

- 10 core risk-based growth portfolios

- 3 Income focused portfolios

Moneyfarm has much more customisation options when it comes to choosing a portfolio to suit you. If you are someone who wants a managed fund but wants to be able to invest ethically or add a focus to your portfolio such as Tech then Moneyfarm is a great choice. These “extras” will generally increase your fees on Moneyfarm.

Invest Engine has a much simpler offering. They offer 10 growth-based portfolios and 3 income-based portfolios. There are no options to for ethical investing or theme-focused twists to your portfolio. Simply choose a portfolio based on risk and start investing.

If you just want somewhere simple to invest your money and don’t need a massive range of options Invest Engine is likely the best option here as they’re simple and have much cheaper fees on their managed portfolios.

If you want added customisation Moneyfarm could be a better option for you but it does come with higher fees.

DIY Investing

Moneyfarm offers no DIY investment options. They only have their managed and fixed allocation portfolios available.

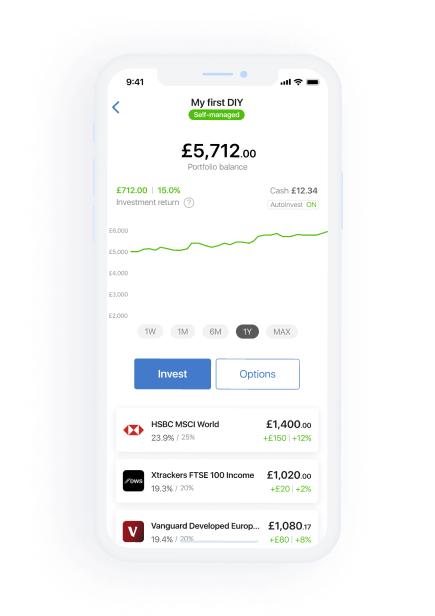

Invest Engine has a complete ETF brokerage offering over 550 ETFs for you to Invest in. The best part is, that there are no platform fees when using DIY investing. You can build your own diversified portfolio of ETFs completely from scratch.

While Invest Engine doesn’t offer much customisation on their managed portfolios, they offer complete control over which ETFs you want in your portfolio on their DIY. This is arguably better but may be too complex for new investors.

I like this offering from Invest Engine as it allows users to get started with managed investing plans and then take more control over their portfolio as they learn more about investing.

Individual Shares

Invest Engine does not offer the ability to trade in individual shares but does have over 550 ETFs to invest in.

Moneyfarm has recently released “Early Access” to share investing. Here you have direct access to a vast array of UK stocks and ETFs. They do plan to release access to thousands of US and European stocks in the near future.

Trades on Moneyfarm will cost £3.95 per trade with no account fees on a general investment account. With an ISA they will charge a 0.35% custody fee.

This feature is very new to Moneyfarm. If you are looking to invest in individual stocks, I would recommend looking at Trading 212 or Hargreaves Lansdown who have a much longer track record of dealing with individual share investing.

Invest Engine vs Moneyfarm: Transparency

When it comes to transparency there are a few things to note on both platforms.

Portfolio Breakdown

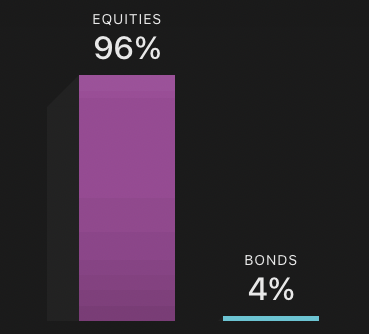

Unfortunately, on Moneyfarm you are unable to view the exact holdings of your portfolio. You are only able to view a breakdown of the asset types your money is invested in such as Equities, Bonds etc.

With Invest Engine you can see a full breakdown of the holdings in each portfolio as well as the percentage of your funds allocated to that specific ETF. I like this level of transparency as it allows you to see exactly where your money is being invested.

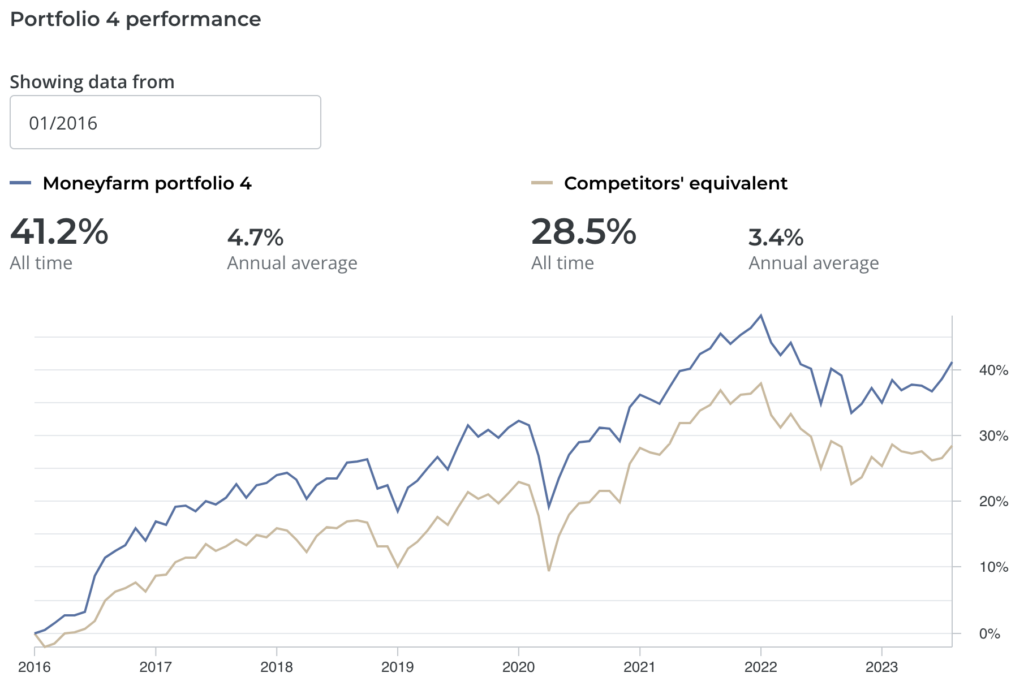

With Moneyfarm you are able to view the performance history of each of their portfolios. This is important to see how each of the portfolios has performed historically through good and bad periods over the past 5-10 years.

Unfortunately with Invest engine, you are unable to see any historical performance of their portfolios. This is likely because they are so new to the market. Hopefully, in the near future, we will start to see them publish portfolio returns.

If you wanted to dive into the historical returns of their portfolios, you could look at each of the ETFs they invest in individually to see how they have performed and run the calculations to calculate how much each of the portfolios would have returned historically. Personally, I think Invest Engine should make this easy to access for their customers. Most of their competitors are publishing these numbers.

Invest Engine Vs Moneyfarm: Performance

As we have discussed above, Moneyfarm has been publishing its historical results, while Invest Engine has not so we are unable to give a direct comparison. However, let’s take a look at the returns from Moneyfarm.

| Risk Level | Moneyfarm 5 Year Returns (Total) | Moneyfarm 5 Year Return (Yearly Avg) |

|---|---|---|

| Low | -7.1% | -1.5% |

| Medium | 10.6% | 2.1% |

| High | 25.5% | 4.7% |

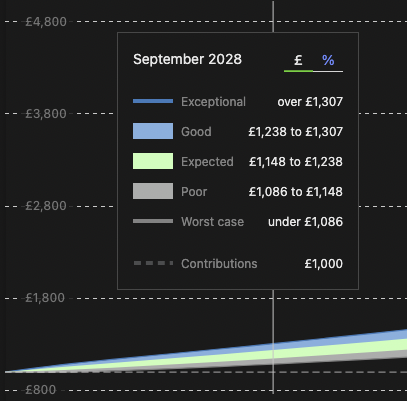

While Invest Engine does not publish their portfolio returns, they do show you projections of what to expect from each of their portfolios when signing up. Let’s see the returns they are predicting for a low, medium and high-risk portfolio.

Invest Engine provides projections based on 5 different scenarios. For the table below we have used the high number on the “Expected” results projections.

| Risk Level | Invest Engine 5 Year Projections (Total) | Invest Engine 5 Year Projections (Yearly Avg) |

|---|---|---|

| Low | 12.38% | 4.36% |

| Medium | 14.05% | 7.04% |

| High | 16.19% | 10.12% |

There really is no value in comparing these with Moneyfarm’s actual results as they are forward-looking projections. However, it does give us an idea of the returns Invest Engine is aiming for.

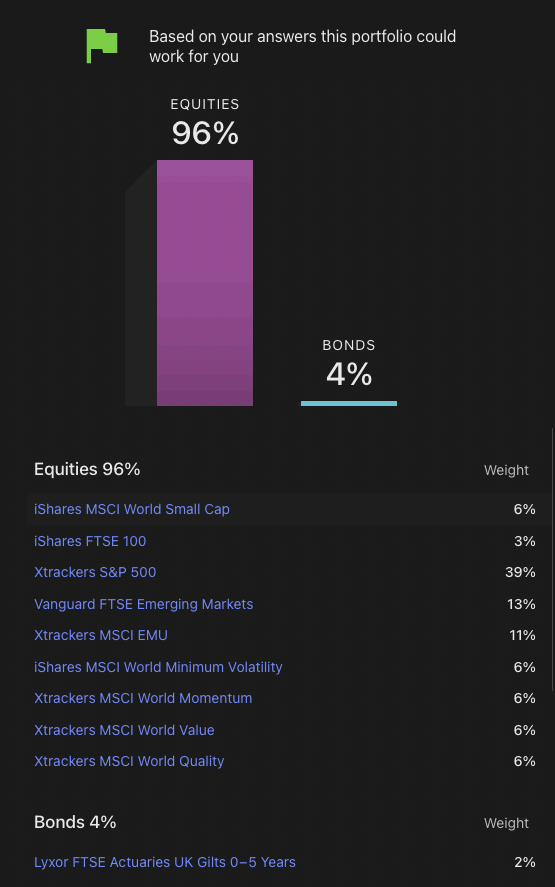

Portfolio Allocation

One thing I found interesting about Invest Engine is their high-risk portfolio allocation. I have mentioned in many of my robo-advisor reviews that I thought most platforms’ high-risk portfolios were too skewed toward low-risk assets.

For example, Moneyfarm’s highest-risk portfolio has only 80.5% of the portfolio allocated towards equities whereas Invest Engine has 96% of the portfolio allocated towards equities. If you are a long-term investor with many more expected years in the market, it’s usually better to invest in equities if you want higher returns.

Personally, I think it’s great that Invest Engine’s “High Risk” portfolio is actually quite aggressive.

Invest Engine vs Moneyfarm: Fees

When it comes to fees, there is a clear winner. Invest Engine does not charge any fees when using its DIY portfolios and charges a 0.25% fee on its managed portfolios.

Moneyfarm on the other hand has a more complicated fee structure which I have outlined in the table below. Fees on Mneyfarm start at 0.75% for actively managed portfolios and 0.45% for their fixed allocation funds. As you grow your portfolio, the fees become cheaper however they never get as low as the 0.25% fees on Invest Engine.

Moneyfarm Fees

| From | Actively Managed | Fixed Allocation |

|---|---|---|

| £500 | 0.75% | 0.45% |

| £10k | 0.70% | |

| £20k | 0.65% | |

| £50k | 0.60% | |

| £100k | 0.45% | 0.35% |

| £250k | 0.40% | 0.30% |

| £500k | 0.35% | 0.25% |

Invest Engine Fees

| Investment Type | Fees |

|---|---|

| ETFs | Free |

| Managed Portfolios | 0.25% |

Invest Engine is a clear winner here with much cheaper fees. Especially if you are confident enough to put together your own portfolio, you can invest fee-free.

It’s important to note that the funds you invest in through Moneyfarm or Invest Engine will have their own fees. These are not charged by the platform, they’re charged by the funds themselves. These usually range from 0.12-0.2% for low-cost ETFs however some mutual funds can charge as much as 1%.

Invest Engine vs Moneyfarm: Minimum Deposit

| Platform | Moneyfarm | Invest Engine |

|---|---|---|

| Minimum Investment | £500 | £100 |

Moneyfarm has a minimum investment of £500. If you don’t have £500 ready to go as a lump sum investment, you won’t be able to get started on the platform.

Invest Engine has a minimum investment of £100 which is significantly lower than Moneyfarm. This allows new investors to get started investing with a much lower threshold.

This is great as not everyone has £500 to invest initially. Some people may even be wary of investing £500 in one go so having a low minimum deposit allows new investors to get their feet wet without investing more than they want to.

Invest Engine vs Moneyfarm: Reviews & Support

Invest Engine has an amazing score of 4.5 Stars on Trust Pilot which is one of the best scores on any financial platform we have reviewed. Of the reviews, 78% of them are 5-star while 15% of them are 1-star.

Moneyfarm sports a slightly lower rating of 3.8 stars on Trustpilot which is still great for a financial app. 68% of them are 5-star while 6% of them fall into the 1-star category.

Primary Complaints:

For Invest Engine the primary complaints are around the KYC process and signing up however, this is a requirement on all financial platforms and is to be expected. Some people have complained about poor returns but this could depend on many factors such as the funds they invested in and how long they have been invested.

Moneyfarm has faced similar complaints when it comes to returns. Many of Moneyfarm’s low-risk funds have performed poorly over the past 5 years especially compared to the broad market. This has left people disappointed with their returns. However, when you invest in low-risk funds you have to expect lower returns in bull markets and less aggressive losses in bear markets.

Positive Highlights:

On the positive side, both apps are praised for their amazing customer service and how easy it is to get started on both of the platforms.

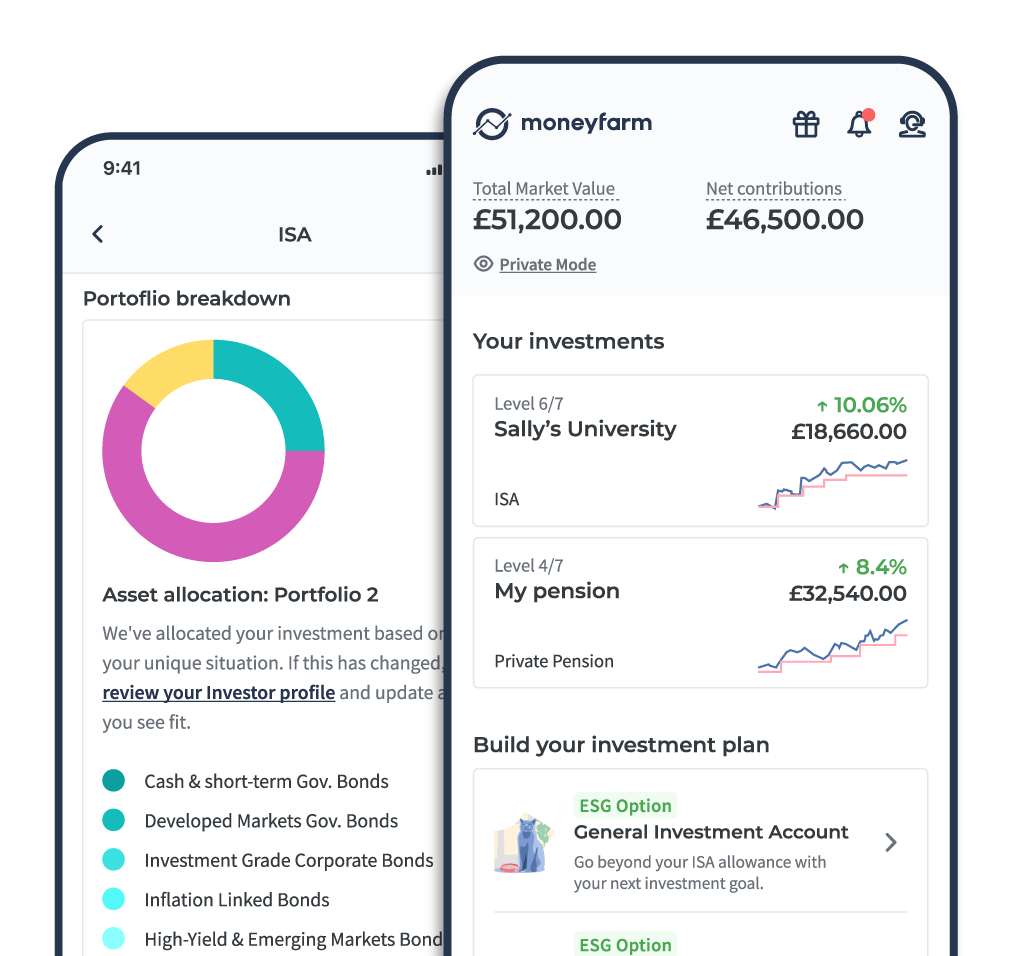

Invest Engine vs Moneyfarm: App & Interface

When managing your money, you want a sleek easy-to-use interface where you can track your portfolio performance. Both of these platforms have great web and mobile apps. You can see a preview of both of them in the screenshots below. Both are easy to use, so it really comes down to personal preference.

Invest Engine vs Moneyfarm: Safety

Both apps are a safe place to invest your money. They are both regulated by the Financial Conduct Authority (FCA) which ensures the companies are following strict financial regulations to keep your money safe. They are both also part of the Financial Services Compensation Scheme (FSCS) which means if any of the companies went out of business, you would be covered up to £85,000.

Who Should You Invest With?

While both platforms are good choices for passive investors we prefer Invest Engine as our go-to platform. The main reason for this is their low fees and ability to create your own portfolio from over 550 ETFs.

They offer a similar managed investing service as Moneyfarm for people who want a more passive approach to investing at a much cheaper cost than Moneyfarm.

We believe that Invest Engine is a great place for beginner investors to start their journey by starting with managed funds and eventually graduating to create their own portfolio as they grow as investors.

The only situation where we would recommend Moneyfarm is if you need to open a Junior ISA or Pension. These are not currently available on Invest Engine.

Invest Engine is a zero-fee investing platform for ETFs as well as offering managed funds for more passive investors. They have a sleek, easy-to-use platform which makes building your portfolio a breeze. With no platform fees and over 550 ETFs on offer, we highly recommend Invest Engine.

If you have realised that you don’t want a Digital Wealth Management platform and instead want to manage your own money and invest in individual shares, I would recommend checking out Hargreaves Lansdown or Trading 212.

Read More From Money Sprout:

I used to invest with Money Farm and Nutmeg (alpha)

Nutmeg outperformed Money farm by a large degree over a few years.

Nutmeg customer support was much better too.

I haven’t assessed Invest Engines managed products, but I find them excellent for Self Managed portfolios.