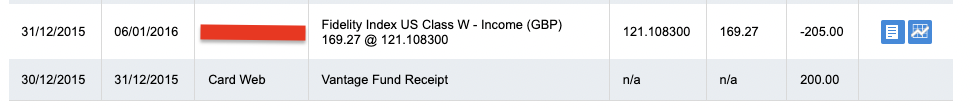

I have been using Hargreaves Lansdown since 2015. It was actually the first company I ever made an investment with.

Over the past 8 years, I have stuck with them and they have served me well. However, over the years there have been some great experiences as well as some not-so-great experiences.

In this comprehensive review, I am going to give you my opinion on Hargreaves Lansdown after 8 years of using it. We’ll look at the products they offer, their pricing, safety, and whether or not they’re worth using in 2024 with the vast amount of modern competition. Let’s jump in.

Hargreaves Lansdown is one of the most trusted investment platforms in the UK. They offer amazing customer service with access to someone on the phone at any time. However, these come at a high price in terms of fees.

- Amazing customer service

- Reliable trustworthy brand name

- High fees on stock trading & ETFs

- Less Modern interface than competitors

Quick Overview

Hargreaves Lansdown is one of the longest running brokerages in the UK. While their fees are slightly more expensive than some of the competition, they have the best reputation in the business. They have great customer support and their mobile app is catching up. If you want someone reliable, Hargreaves Lansdown is a great choice.

Who Are Hargreaves Lansdown?

Hargreaves Lansdown is one of the UK’s leading independent financial service providers and asset management specialists. The firm offers a wide array of financial products and services, including stockbroking, pension products, ISAs, funds, and wealth management services.

Established in 1981 by Peter Hargreaves and Stephen Lansdown in Bristol, the company has grown exponentially over the decades. Starting as a small operation from a bedroom in Bristol, it has transformed into a FTSE 100 company, serving millions of clients.

Reliability: Several factors contribute to Hargreaves Lansdown’s reputation for reliability:

- Experience and Longevity: With over four decades in the business, the firm has successfully navigated numerous market cycles and economic shifts.

- Regulation: As a UK-based firm, Hargreaves Lansdown is regulated by the Financial Conduct Authority (FCA), providing an added layer of protection and oversight to its operations.

- Strong Client Base: Serving millions of clients, the firm has consistently received positive feedback and built trust within its customer base.

- Transparency: The company is known for its transparent fee structure, customer-centric approach, and readily available customer support.

What Products Do Hargreaves Lansdown Offer?

Hargreaves Lansdown offers a full suite of investing products. If you’re looking to keep all of your accounts in one place, they are a great choice. Let’s take a look at everything they have to offer.

Fund & Share Account

This is a general investment account with no tax benefits. You can buy and sell shares as you please but will have to pay capital gains tax on any profit over your yearly allowance of £6,000.

Stocks & Share ISA

This account allows you to invest up to £20,000 per year without paying any tax on your profits, even when you withdraw. You pay no tax on capital gains, income, or dividends. Remember you can only have £20,000 spread across multiple ISAs in a single year.

Stocks & Share Lifetime ISA

A lifetime ISA allows you to invest up to £4,000 per year and get a 25% bonus from the government. You are required to use this money to buy your first home or withdraw at 60+ or else you will incur penalties on withdrawal.

Junior ISA

A junior ISA allows you to invest up to £9,000 for your child. Once they turn 18 they can access this money. It’s a great way to put money away for their first car, house deposit or university.

SIPP (Pension)

You can manage your personal pension within Hargreaves Lansdown through a SIPP (Self Invested Personal Pension). Any money added to your pension will get a 25% bonus from the government, potentially more if you’re a higher-rate taxpayer. You can then manage your own pension investments.

Cash ISA

They also offer a Cash ISA if you just want to save and collect interest on your money. However, there are currently other savings accounts and ISAs offering better rates than Hargreaves Lansdown.

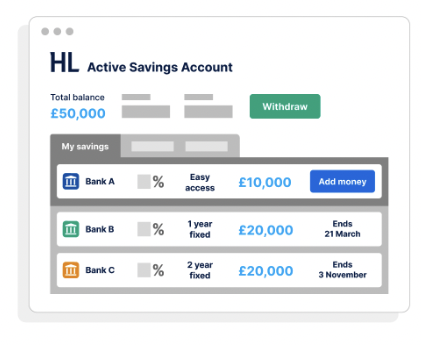

Active Savings Account

If you want to save cash outside of an ISA, Hargreaves Lansdown also offers an active savings account. This account offers multiple savings products from different banks. While they do offer competitive rates, you can find better from other providers.

Hargreaves Lansdown Fees

Hargreaves Lansdown has a few different types of fees on their platform. They are transparent about these fees but it can be quite confusing when you initially look at them. Below we have broken down all of the different fees you may face with HL.

Annual Management Charge

Each account on HL comes with a different annual charge %. These are charged as a % of the assets held in the account.

| Account Type | Charge |

|---|---|

| Stocks & Shares ISA | 0.45% (Capped at £45/Year) |

| SIPP | 0.45% (Capped at £200/Year) |

| Lifetime ISA | 0.25% (Capped At £45/Year) |

| Fund & Share Account | No Annual Charge |

| Junior ISA | No Annual Charge |

The Stocks & Shares ISA and Lifetime ISA has a competitive fee especially if you are holding over £10,000 whereas the SIPP is quite expensive if you have significant sums invested. The fun and share account as well as the Junior ISA have no fees for holding.

Management Charges On Funds

As well as annual management charges, there is also a charge for holding funds. These charges are tiered depending on the size of your account. Once you reach £2m invested these charges go to 0%.

My account is just closing in on 6 figures so I haven’t unlocked any discounts just yet. However, I have heard of people with over £250k negotiating their fees to a lower level.

| Total Of Funds Held | Charge |

|---|---|

| £0 – 250,000 | 0.45% |

| £250,000 to £1m | 0.25% |

| £1m to £2m | 0.1% |

| £2m+ | 0% |

Fees On Share Dealing

If you want to trade individual shares, investment trusts, ETFs, gilts, and bonds you will also incur share dealing charges. However, these investments do not incur any management charges when holding them.

| Deals Previous Month | Dealing Charge |

|---|---|

| 0 – 9 Deals | £11.95 |

| 10 – 19 Deals | £8.95 |

| 20 or more Deals | £5.95 |

These are some of the highest share trading fees on the market right now. Other brokerages such as Freetrade and Trading212 offer this service completely free.

Charges On Individual Funds

As well as the fees above, each fund will have its own individual management fee. This has nothing to do with Hargreaves Lansdown and would be the same as any other brokerage. Ensure the fund you’re investing in has reasonable fees as some can be extortionate and eat massively into your returns.

Most Index Funds charge anywhere from 0.1% to 0.3% depending on the provider and type of fund.

FX Charges

Another fee that can be expensive is FX charges. If you’re in the UK and investing in US stocks you will have to convert GBP to USD to purchase the stock. Hargreaves Lansdown charges a fee on this exchange when you purchase shares and when you sell shares. This is something you should be aware of. HL charges a 1% fee each time this occurs. They don’t allow you to hold USD in your account so the only option is exchanging if you’re looking to buy international shares.

If you are only purchasing index funds, finding a fund that is dealt in GBP is a good idea. This means you can invest and sell without incurring FX fees on your end. The fund will have to convert the cash themselves however as they deal with such large amounts of money, they will be able to get much better rates than we can.

Is The Hargreaves Lansdown Platform & App Good?

I’ve been using the Hargreaves Lansdown app and website for 8 years now and honestly, not much has changed over time. The app has got some nice design updates to make it look a bit cleaner but the basic functionality hasn’t changed much. Let’s take a look at some of the specifics.

Ease Of Use

Hargreaves Lansdown has a lot to offer in terms of shares, stock, and funds. If you’re new to investing it may be a bit overwhelming. If you have a basic understanding of stocks and shares and funds you should be able to navigate around the dashboard and app with ease.

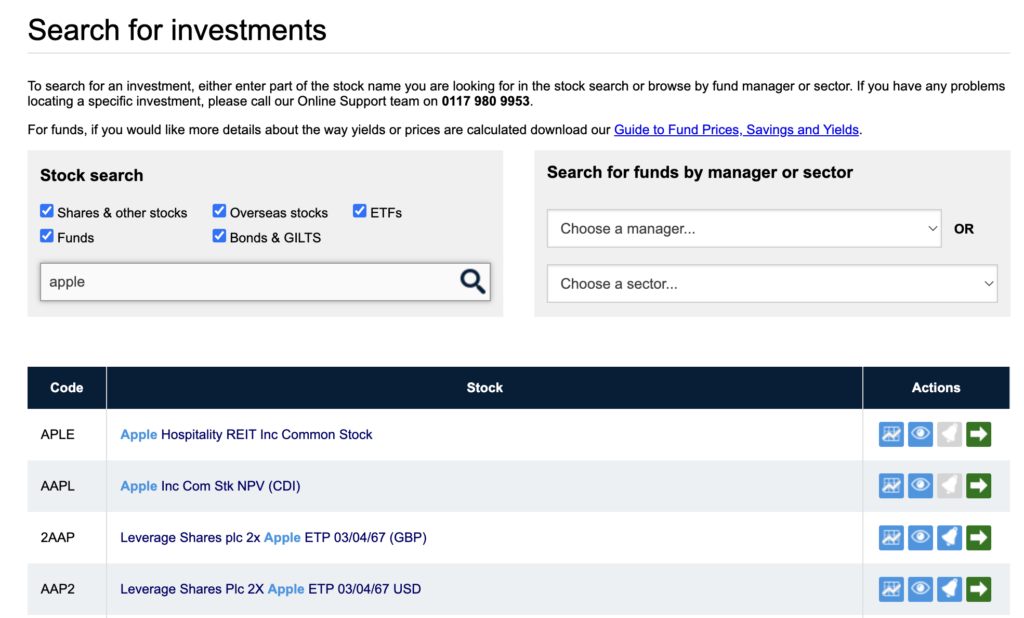

Finding shares is easy through the simple search function in the app. If you know the name of the stock or ticker you’re looking to purchase you’ll have no issue finding it.

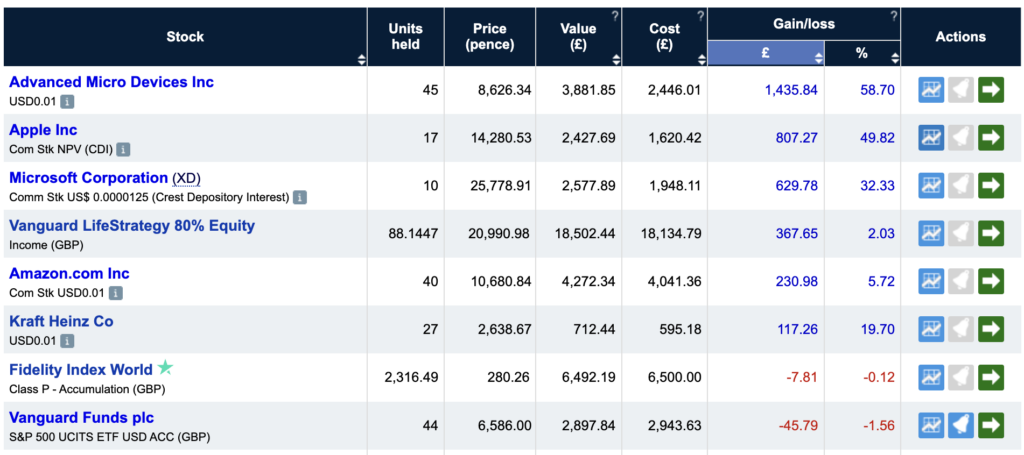

When viewing your holdings you get a very “classic brokerage” feel. It’s essentially a pretty spreadsheet. While it does provide everything you need to know at a glance, there are other brokerages with more modern interfaces.

One of my biggest problems with Hargreaves Lansdown is the inability to display a lifetime graph of your account. It makes it hard to see your returns over time and view how your portfolio is actually doing. I’m not sure why this hasn’t been added yet as many other apps offer this basic feature.

Share & Fund Information

If you’re looking to do a deep dive into specific stocks or funds, HL offers comprehensive information on each asset available on the platform. You can view historical performance, news, financial information, insider dealing and more.

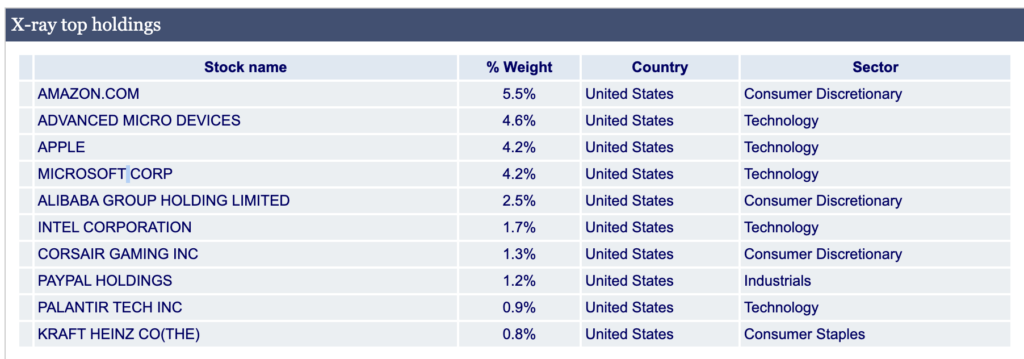

Portfolio Analysis

One feature HL has that impressed me is its portfolio analysis tool. This allows you to get an X-ray view of your portfolio. When you hold funds as well as individual stocks it’s hard to know what companies you actually own and how much of them you own. This feature allows you to see the weighting of each company in your portfolio including the holdings inside funds.

You can also see which sectors you are invested in, helping you make decisions about your portfolio.

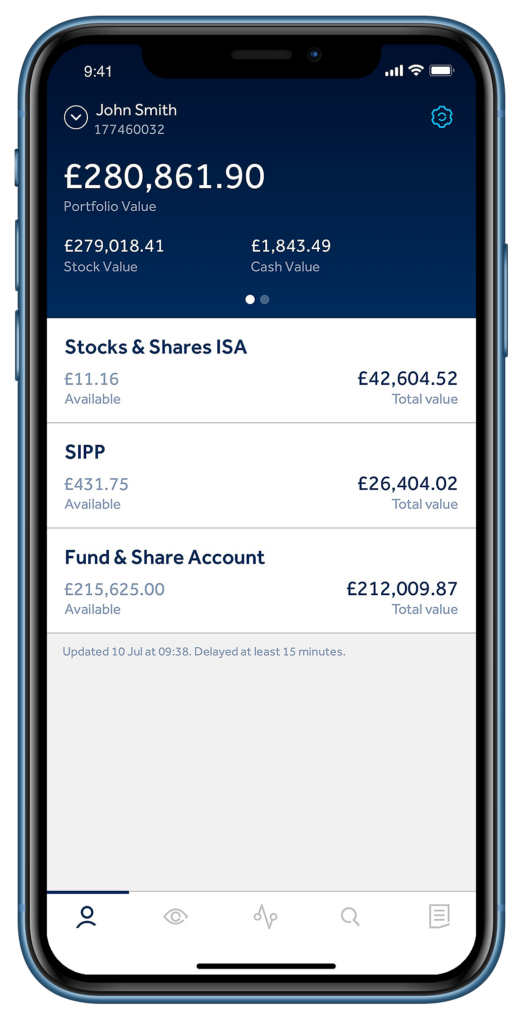

Hargreaves Lansdown App

The HL app is a simple-to-use app, giving you a good overview of your portfolio. Purchasing shares on the go with the app is easy. Simply make a search for the stock you are looking for and make the purchase.

Just like the desktop version of the platform you are unable to view a historical performance chart which is disappointing. The app has some other features such as a watch list to keep track of shares you are interested in and a market overview feature showing you how the market is performing today. Here you can see the biggest winners and losers of the day.

What Investments Does Hargreaves Lansdown Offer?

Hargreaves Lansdown offers access to a wide range of investments including shares, international shares, funds and ETFs. Out of all of the brokerages we tested, HL has one of the biggest offerings in the UK market.

Shares -They offer trading of thousands of shares in the UK market as well as international markets.

Funds – They offer over 3000 different funds to choose from including their own managed funds. You can even use their fund finder to find a fund that meets your needs.

ETFs – HL also offers ETFs on their platform as well as funds. ETFs can be traded during the day whereas funds can only be traded after the price has been settled at the end of each trading day.

Does Hargreaves Lansdown Offer Crypto Trading?

No, Hargreaves Lansdown does not offer any form of Crypto trading right now. They are a legacy broker and tend to move slower on new features and products than some of the competitors out there.

Does Hargreaves Lansdown Offer CFDs?

No, Hargreaves Lansdown does not offer CFD trading. CFDs allow you to enter into an agreement with the broker on whether or not the price will go up or down. If you make the right decision you will pocket the difference between the entry price and exit price. Many of these brokerages offer leverage on these trades. While HL doesn’t offer this service, eToro does.

Is Hargreaves Lansdown Safe?

Yes, HL is a safe place to keep your money. They are regulated by the Financial Conduct Authority (FCA) which means they have a regulatory body looking over their shoulder to ensure your money is safe.

Your money is also protected by the Financial Services Compensation Scheme (FSCS), which means you are protected up to £85,000 should Hargreaves Lansdown ever go out of business.

Your money is also held separately in a trust account. HL cannot access this money and it can only be returned to you.

Hargreaves Lansdown Support Review

Hargreaves Lansdown has a 4.2/5 rating on Trustpilot. This is an impressive score for a financial company. They have an overwhelming amount of good reviews with a few negative ones here and there which is natural for any company.

Over the 8 years of using Hargreaves Lansdown I haven’t had to contact them very much. However, any time I have contacted them, they have always been helpful and easy to get in touch with. Many other services don’t offer phone support which can be concerning for some investors. Personally, I like to be able to get on the phone with a human when I need something sorted promptly. HL offers that.

The phone lines are open 8 am to 5 pm weekdays and 9:30 am to 12:30 pm on Saturday mornings.

You can even book an in-person appointment with one of their Financial Advisors at their London office or via telephone with one of their bristol team members.

Does Hargreaves Lansdown Offer Options Trading?

No, you cannot trade options at Hargreaves Lansdown. If you want to trade options in the UK you should look at Plus500 or IG which offer this service. Most standard brokerages in the UK do not offer options trading.

Who Should Use Hargreaves Lansdown?

Hargreaves Lansdown is a great platform for sophisticated investors with large sums of money to invest. With a long track record, you can invest with confidence. When dealing with large sums of money, it’s always good to be able to get on the phone with someone quickly in the event of an emergency. This is something that many of the newer brokers just don’t offer.

While fees are slightly higher, you’re paying for safety and service. Once your account is big enough, you will also start to benefit from those tiered discounts on certain assets.

Is Hargreaves Lansdown Good For Beginners?

Personally, I think there are better options than HL for beginners. If you are trading stocks with small amounts of money, the £11.95 per trade fee is going to kill any possible gains you would get.

A good alternative for beginners is a platform like Trading 212.

Final Thoughts

Overall, Hargreaves Lansdown is a great platform. If you’re an experienced investor with large sums of money to invest they are a great option. Their great track record and impressive customer service are important when dealing with large portions of your wealth. If you can deal with their slightly higher fees, they’re a great choice.