Disclaimer: We make every effort to ensure our tools are accurate however we are not held liable for any damages or monetary losses arising out of or in connection with their use.

How To Use Our Compound Interest Calculator

By using our compound interest calculator you can calculate the estimated interest you could possibly earn on your savings or investments over a chosen number of years.

Simply choose your Initial Investment (principal), Annual Interest Rate, Investment period and Monthly contributions.

Using this information we can calculate the future value of your investments, total interest earned and the total deposits made over the duration.

Visualising future returns can be a great way to plan for retirement, FIRE or just to motivate you to start saving.

How Compound Interest Is Calculated (Formula)

FV = P(1+r/n)^nt

FV = The future balance of your investment

P = Initial Investment or Principal Balance

r = Annual Interest Rate

n = Number of times interest is compounded per year

t = Time in years for money to compound

^ = To the power of

This formula works with an initial lump sum but does not take into account monthly contributions. To calculate the final balance of our monthly contributions we can use the formula below.

Monthly Contributions Compound Interest Formula

FV = MC × {[(1 + r/n)^(nt) – 1] / (r/n)} × (1+r/n)

MC = Monthly Contribution

P = Initial Investment or Principal Balance

r = Annual Interest Rate

n = Number of times interest is compounded per year

t = Time in years for money to compound

^ = To the power of

Using both of these formulas and adding them together gives us the total balance of our portfolio at the end of the defined period.

If this seems a little confusing, simply use our calculator above to work out your projected compound interest figures.

What Is Compound Interest?

Compound interest is the process where the interest you earn on a savings or investment account becomes part of the account balance. Then, that new, larger balance will earn even more interest. This leads to growth that accelerates over time. You can think of it like a snowball rolling down a hill, gathering more snow as it goes.

Compound Interest Example

Let’s take a look at a simple example of £10,000 compounding at 10% per year.

In the first year you would earn £1000 in interest. In year two you would earn interest on £11,000 which is £1,100. This leaves you with a balance of £12,100 at the end of year two.

As time passes, you earn more and more interest each year. At the end of year 10 in this example you would have £25,937.42

In the above example we are compounding yearly, however in financial situations such as a savings account you will receive interest monthly which leads to greater returns. Our calculator above uses Monthly compounding to calculate your future balance.

20 Years Of Compound Interest

Let’s take a look at a visualisation of how £10,000 can grow over 20 years in the stock market at an average of 10% return. The stock market has returned over 10% on average per year, over the past 50 years.

As you can see, a £10,000 initial investment will turn into £67,275, over a 20 Year period, at 10% yearly returns. Initially the amount of interest you earn will be relatively small however as time goes on the earn you earn every year grows significantly.

20 Years Of Compound Interest With Monthly Contributions

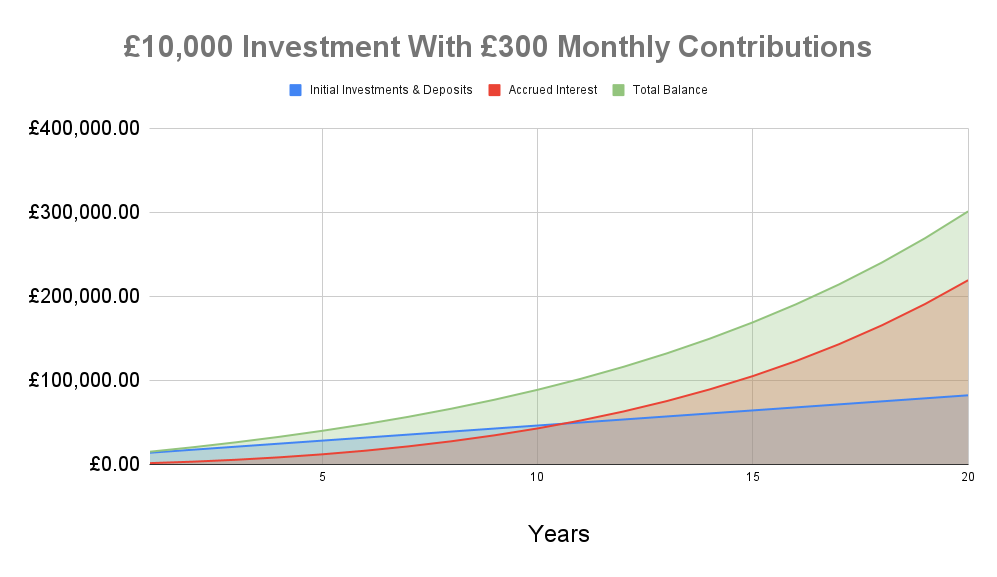

If you initially invest a lump sum but also contribute to your portfolio or savings monthly, your gains become even larger. Let’s take a look at how that plays out over 20 years. In the chart below we initially invest a lump sum of £10,000 and then invest £300 per month, at a 10% yearly return.

By adding £300 per month for 20 years, plus the initial investment of £10,000 you will have contributed a total of £82,000 to your portfolio. However, with compounding returns of 10% per year you would have a balance of £301,091.

Why Compound Interest Is Important In Personal Finance

If you want to get wealthy over time, compound interest, through investing in index funds is one of the most reliable ways to do it.

As long as you are consistent with your contributions monthly over a long period of time, you should end up with a considerable amount of wealth based on historical data.

You may have heard the story of Ronald Read who was a retired Janitor. He passed in 2015 but shocked his family and friends when they learned he had an estate worth £6.2 Million ($8 Million).

He never had a massively high paying job but lived frugally and invested dilligently throughout his lifetime. By being extremely frugal one of his estimated he was able to save up to 80% of his income in any given week.

He invested well throughout his life, investing into companies such as P&G, Colgate-Palmolive and Wells Fargo and gained a large portion of his wealth in his later years. This comes down to benefiting massively from the power of compound interest.

Now, I’m not saying you have to pick stocks or save 80% of your income, but putting a focus on this in your financial life and being disciplined about it will allow you to amass more wealth than you potentially every thought possible.

You can probably cut out a few subscriptions and cut down on going out as much if it sets you up for massive success later down the line.

As I mentioned above, this is the most reliable way to become a millionaire while working a normal job. You don’t need to get lucky, win the lottery or exit a business. You can simply be smart with your finances and become a millionaire over a long period of time.

Personally, I think starting a business is one way to accelerate your path to financial freedom but thats not for everyone. That’s where the power of compound interest can work in your favour.