We have spent hours comparing and reviewing the best investment apps on the market to give you our best recommendation for your situation. All apps included in the article are worthy of a spot and are good, safe places to invest in their own right. However, every app has its advantages and disadvantages.

Depending on your individual needs, one platform may be better than another for you. Let’s take a look at what each of these apps has to offer.

5 Best Investment Apps In The UK

Trading212 is a zero-commission trading platform offering general investment accounts, ISAs and CFD accounts. They are a trusted broker who has been around for almost 2 decades now. They have a range of features such as pies and multi-currency accounts which aren't offered by other brokerages.

- Commission Free Trading

- Access to over 12,000 Stocks and Funds

- Impressive features such as Pies and Multi-currency

- No phone support

Moneyfarm is one of the UK's premier digital wealth managers, dedicated to simplifying investments and helping individuals grow their assets. Providing innovative investment solutions, Moneyfarm focuses on delivering tailor-made portfolios based on individual risk appetites and financial goals.

- Slick easy to use app

- Great for passive investors

- High fees on certain products

- Poor returns on low risk funds

Hargreaves Lansdown is one of the most trusted investment platforms in the UK. They offer amazing customer service with access to someone on the phone at any time. However, these come at a high price in terms of fees.

- Amazing customer service

- Reliable trustworthy brand name

- High fees on stock trading & ETFs

- Less Modern interface than competitors

Invest Engine is a zero-fee investing platform for ETFs as well as offering managed funds for more passive investors. They have a sleek, easy-to-use platform which makes building your portfolio a breeze. With no platform fees and over 550 ETFs on offer, we highly recommend Invest Engine.

- Fee free investing for DIY portfolios

- 0.25% Managed Portfolio Fees

- 550+ ETFs Available

- Auto-investing with savings plans

- Easy to use

- No pension plan

- Only offers ETFs

eToro is a popular global trading and investing platform for new and experienced investors. They offer zero-commission trading and have over 3,000 stocks available on the platform.

One of their most unique features "Copytrader" allows you to copy other high-performing traders portfolios.

- Zero commission trading

- Easy To Use App

- Regulated By The FCA

- $5 Withdrawal Fees

- Heavily promotes active trading and CFDs

Best Investment App For Individual Stocks

If you are looking somewhere to invest in a wide range of ETFs and Stocks with an easy-to-use app, Trading 212 is the way to go. It’s perfect for all levels of investors as you can start out investing with some simple ETFs and eventually move on to individual stocks and even more advanced instruments such as leveraged shares.

Trading 212 also has no platform fees or commission fees on trading making them great for active traders as well as those of us with small portfolios. Fees can eat massively into your returns, so having no fees on transactions goes a long way. They also have fractional shares allowing you to purchase a portion of a share rather than needing to purchase a full one, allowing you to diversify further with a small portfolio.

Trading 212 Features

- Commission free trading

- Fractional Shares

- Easy-to-use app

- Over 13,000 stocks and ETFs to invest in

- Multi-currency accounts

- Pies feature which allows you to invest new deposits across all of your portfolio in one click

- General Investment, ISA and CFD accounts available

- Authorised by the FCA and covered by the FSCS

Best Investment App For Passive Investors

If you are someone who wants to get into investing but doesn’t want to spend hours researching stocks and ETFs then Moneyfarm is the best choice for you. Their platform has a range of fully managed funds you can invest in based on your risk tolerance.

These funds are managed by Moneyfarms experts who will rebalance the portfolios to reflect market trends, overweight allocations and more. They even have a range of thematic portfolios based around different market sectors such as technology, sustainability, society and more.

Moneyfarm is the app to use if you know you should be investing for your future but don’t want to spend your life looking at stock charts. Have Moneyfarms digital wealth management team look after your investments for you.

Moneyfarm Features:

- 7 Risk-based Portfolios to choose from

- Socially responsible alternatives are available as well as themed portfolio options

- Fees start at 0.75% but get discounted the larger your portfolio get

- ISA, General Investment, Pension and Junior ISA are available

- Great historical portfolio performance

- Authorised by the FCA and covered by the FSCS

Best Investment App For ETFs

If you want to have full control over your money but don’t want to invest in individual stocks, ETFs are a great option. Invest Engine solely offers investors access to over 550 ETFs. They also have a range of pre-made managed portfolios based on risk. If you’re a completely passive investor you can utilize these portfolios, similar to Moneyfarm.

This platform has some of the cheapest investing fees on the market. It’s completely free to create your own DIY portfolio of ETFs (Highly Recommended) making it the best option for ETF investors. Of course, you will still have to pay underlying fund fees but there are no trading or platform fees making it extremely cheap.

Invest Engine Features:

- Fee-free investing for DIY portfolios

- 0.25% Managed portfolio fees

- 550+ ETFs available

- Auto-investing with savings plans

- Offers Stocks & Shares ISA, General Investment Account and a Business Account

- Easy to use

Best Investment App For Large Sums Of Money

If you’re investing large sums of money, you will likely want to invest with a platform that has been around for a long time, has a strong reputation and also has someone you can pick up the phone and talk to if you need to. That’s the main reason I personally use Hargreaves Lansdown.

Hargreaves Lansdown is one of the longest-running brokerages in the UK and has a great track record and reputation. It’s no secret that their fees are slightly higher but when you are dealing with large sums of money, you want to pay for a good service. They have great customer support available allowing you to get on the phone with them if you ever need to.

I have personally used Hargreaves Lansdown for the past 8 years and have had a great experience with them. They are not the ideal broker if you have a portfolio under £10k as trading fees are high but for those with a reasonably large portfolio, Hargreaves Lansdown is a great choice.

Hargreaves Lansdown Features:

- Amazing customer service

- Over 8,000 Stocks and ETFs to invest in

- Reliable Trustworthy brand name

- Easy-to-use mobile app

- Offers Fund and Share account, Stocks and Shares ISA, Lifetime ISA, Junior ISA, SIPP and a Cash ISA

Best Investment App For Trading

If you’re someone who wants to day trade then you will need an app with no trading fees and an easy-to-use app. Our recommendation for new traders is eToro.

eToro has over 3,000 stocks and assets to trade. They also offer CFD trading allowing you to use leverage and short stocks by using Contracts for Difference (CFDs). As well as stocks you can trade cryptocurrencies, commodities, currencies and more.

To make trading easier eToro has a full “Pro Charts” feature giving you access to detailed, customisable stock charts.

If you’re a new trader looking to get started, eToro is a great place to do it.

eToro Features:

- Zero Commission Trading

- Pro trader stock charts

- Easy To Use App

- Over 3,000 assets available to trade

Best Investment Apps Compared

Below we have compared some of the main features available on each platform, so you can see where is best to invest your money at a glance.

| Platform | Trading 212 | Moneyfarm | Invest Engine | Hargreaves Lansdown | eToro |

|---|---|---|---|---|---|

| Minimum Deposit | £1 | £500 | £100 | £1 | £7.50($10) |

| Platform Fees | Zero | 0.75% | Zero | 0.45% | Zero |

| Trading Commission Per Trade | Zero | Zero | Zero | £11.95 | Zero |

| Managed Portfolios | ❌ | ✅ | ✅ | ✅ | ✅ |

| DIY Portfolios | ✅ | ❌ | ✅ | ✅ | ✅ |

| ETFs | ✅ | ❌ | ✅ | ✅ | ✅ |

| Stocks | ✅ | ✅ | ❌ | ✅ | ✅ |

| Products | – Stocks and Shares ISA – General Investment Account – CFD Account | – Stocks & Shares ISA – General Investment Account – Pension – Junior ISA | – Stocks & Shares ISA – General Savings Account – Business Account | – Stocks & Shares ISA – General Investment Account – Lifetime ISA – Junior ISA – Pension – Cash ISA | – General Investment Account – CFD Account |

| Sign Up | Sign Up | Sign Up | Sign Up | Sign Up |

Are These Investment Apps Safe?

All of the apps we have recommended above are authorised by the Financial Conduct Authority (FCA) and also protected by the Financial Services Compensation Scheme (FSCS).

The FCA are the people who ensure these companies are following strict regulatory guidelines to keep your money safe. When choosing any investment app in the UK, make sure they are regulated by the FCA before investing.

If any of the companies above were to go out of business, you would be covered by the FSCS up to £85,000.

What Is Investing?

Investing is putting your money to work in some form of asset for a period of time, hoping it will go up in value or generate cash flow. In the context of Investing apps, you will be investing in companies listed on the stock market with the expectation of them going up in value or paying you cash through a dividend.

A Stock is the company as a whole and a share is a portion of the company. When you purchase a share you are buying a small piece of that company.

You may choose to invest in individual companies or you can also invest in funds which are large baskets of multiple stocks. Investing in funds allows you to diversify your portfolio without purchasing many individual stocks.

Many people will try to purchase individual shares of stocks and try to “beat the market”. However, most aren’t successful at beating the market over long periods of time. For most investors, investing in the stock market as a whole would produce better returns in the long term.

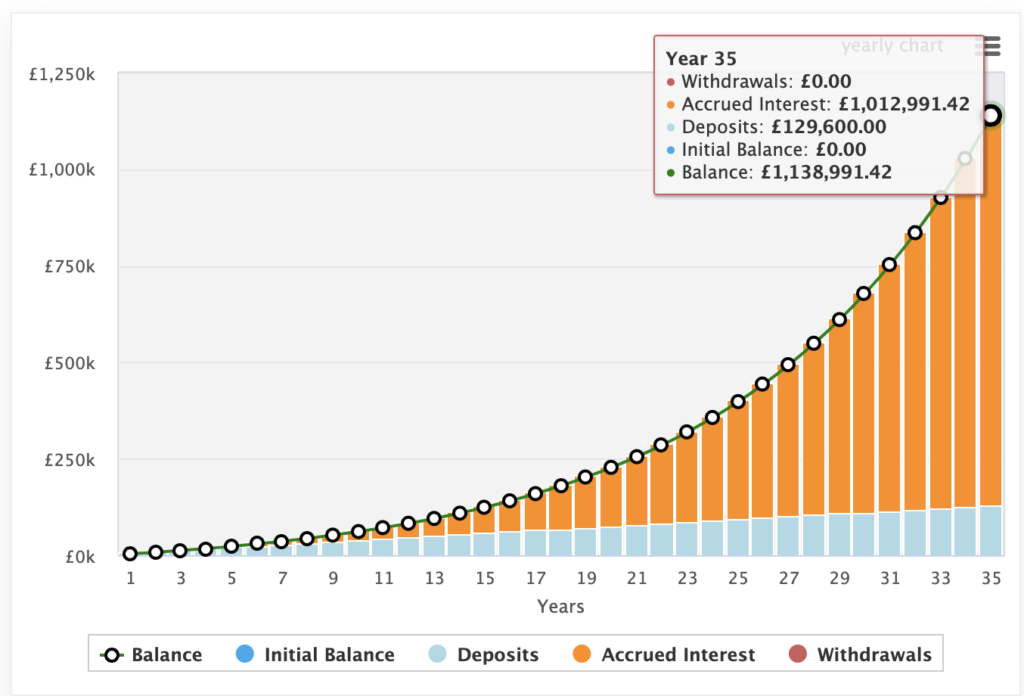

The stock market as a whole has historically returned an average of 10% per year over the past 50 years. 10% may not sound like a lot but over time you benefit from compounding interest and can generate massive returns. The graph below was the one thing that convinced me I needed to start investing at a young age. Small amounts of money invested over long periods of time can generate massive returns.

If you invest just £300 at a 10% return over 35 years, you would have over £1.1 million. In contrast, if you saved £300 per month in a bank account for 35 years, you would only have £129,600. Compound interest is powerful. It can be used against you if you get into debt or you can use it to your advantage by investing.

If this chart doesn’t motivate you to start investing, I don’t know what will. You can use our compound interest calculator to see how much different monthly investments would be worth over time.

You may decide that you want to invest in individual stocks or you may want to take a diversified path by investing in funds. The route you want to take will determine the app you sign up for.

The Two Types Of Investment Apps

The type of investor you are will determine the app that you choose to invest with. There are two main types of apps on the market right now:

- Self Managed Apps

- Managed Apps

Self Managed Apps

Self-managed apps allow you to invest in a wide range of stocks, ETFs and more. You have full control over where your money is invested and you are making your own investment choices. Trading 212 and Hargreaves Lansdown are two of the best options for this. They have a very large range of assets available to invest in.

If you plan to manage your own portfolio and invest in individual companies, you will need to use a self-managed app.

Managed Apps

Managed apps are fairly new to the market. They are sometimes referred to as “Digital Wealth Advisors” or “Robo-advisors“. These apps have managed portfolios which are managed by their investment experts. Usually when signing up to the app you will be asked a series of questions to determine your level of risk. You will then be assigned a portfolio that fits your risk tolerance.

Once you choose a portfolio, investing becomes passive. You don’t have active decisions on which stocks to buy or sell or how to reallocate assets. This makes it the perfect solution for someone who knows they should be investing but doesn’t want to spend hours per week trying to choose their own stocks.

Managed apps usually have slightly higher fees but that’s the premium you pay to have someone else manage your money. Moneyfarm and Invest Engine are two great platforms that have managed portfolio options. This is the route I would take if I wasn’t confident picking my own stocks but wanted to get started with investing.

Different Types Of Investment Products

When investing, there are multiple different types of investing accounts available. Some accounts offer tax benefits such as an ISA or some even offer government bonuses such as SIPPs and Lifetime ISAs. Each investment app has a different range of accounts available which we listed in the comparison table above. Let’s take a look at each of the account types available when investing, so you can see which is best for you.

General Investment Account

This is a general investment account with no tax benefits. You can buy and sell shares as you please but will have to pay capital gains tax on any profit over your yearly allowance of £6,000.

ISA

This account allows you to invest up to £20,000 per year without paying any tax on your profits, even when you withdraw. You pay no tax on capital gains, income, or dividends. Remember you can only have £20,000 spread across multiple ISAs in a single year. You can access this money at any time without any penalties.

Pension

You can manage your private Pension through a SIPP. Any money added to your pension will get a 25% bonus from the government, potentially more if you’re a higher-rate taxpayer. You can then manage your own pension investments.

Junior ISA

A junior ISA allows you to invest up to £9,000 for your child. Once they turn 18 they can access this money. It’s a great way to put money away for their first car, house deposit or university.

Stocks and Shares Lifetime ISA

A lifetime ISA allows you to save up to £4,000 per year and claim a 25% bonus from the government up to a maximum of £1,000. You can withdraw from your Lifetime ISA when you are purchasing your first home or when you are over 60/terminally ill with 12 months to live. You will pay a 25% withdrawal charge if you withdraw for any other reason.

Which Account Should You Use?

The account you choose will depend on your own individual circumstances. For most people, you will want to max out your employer match pension scheme at work. After that, any extra investments you make should be in a Stocks and Shares ISA to shelter you from Tax as your money grows over time. Obviously, if you are saving for a house you would want to fill your Lifetime ISA before continuing with your Stocks and Shares ISA. If you max out your ISA within a year and want to invest more, you would then start investing in a General Investment account or pension depending on whether or not you will need the money before retirement.

How Much Do I Need To Start Investing

You don’t need much to start investing. We have showcased the minimum deposit amounts for each platform in the comparison table above. Some platforms such as Moneyfarm require an initial deposit of £500 to get started whereas others such as Trading 212 allow you to get started with as little as £1.

Even if you can only start with £50-100 per month it’s great to get into the habit of investing consistently every month and then increasing your deposits as you make more money. The earlier you start investing, the longer your money has to compound meaning you will have significantly more when it comes to retirement.

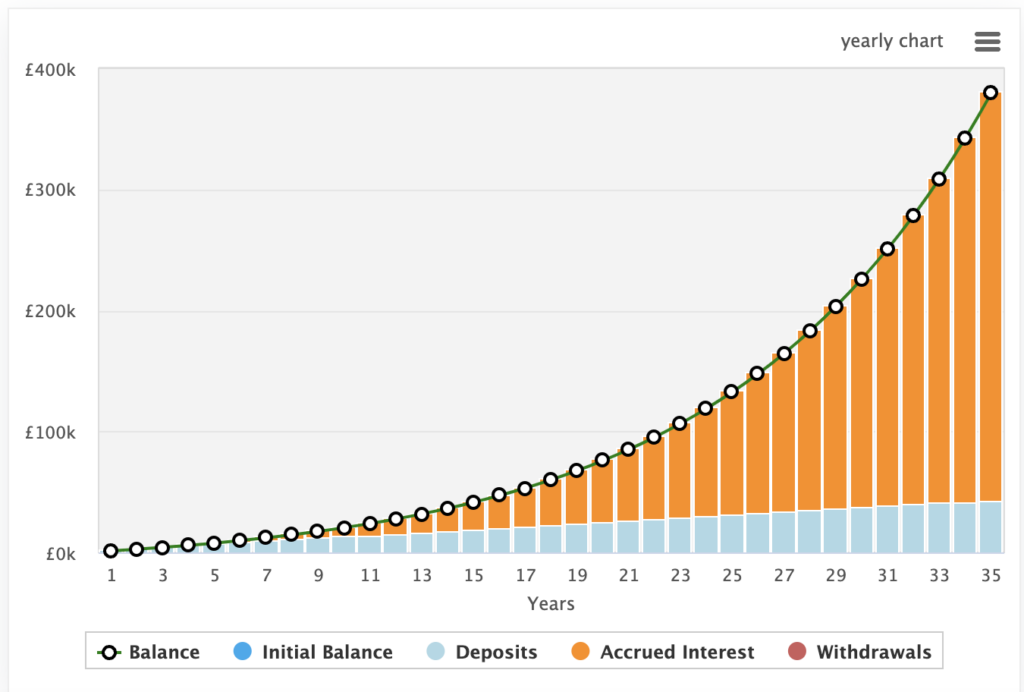

Even investing £100 per month starting at 25 with a 10% return would leave you with a portfolio value of £379,663 at 60 years old. This is significantly more than the average retirement pot in the UK.

However, if you wait and start investing at 35 years old, you will only have £132,683 in your portfolio at retirement. That’s a difference of over £250k because you started investing 10 years later.

So, even if you only have what seems like an insignificant amount of money to invest, get started anyway. You will thank your future self.

Can I Make Passive Income Through Investing?

Yes, it is possible to make passive income from investing but you have to be investing for the long term. In the short term investment values can go up as well as down. The main way to earn passive income by investing is by buying companies that pay a dividend. This means the company pays a portion of its profits out to shareholders, usually on a quarterly basis.

You can then re-invest these dividends for more portfolio growth or alternatively withdraw them and use them as income. If you have a large enough portfolio, you can eventually start to live off the Dividends.

For example, if your portfolio has an average dividend yield of 4% and you have £1 Million invested, you would earn £40,000 per year in dividend income. You would also benefit from the appreciation of the stock.

If you want to purchase dividend stocks or ETFs, I would recommend Trading 212 or Hargreaves Lansdown.

Ethical Investing

Ethical investing or Socially responsible investing has become very popular over the past 5 years. Most investing platforms now have some form of Ethical investment portfolio or ETFs available. This means you will only be investing in companies that meet your own ethical standards. This may affect your returns in the long run but if investing in certain types of companies goes against your morals, then this is a great way to address that issue.

Final Thoughts

For most people, I would recommend either Moneyfarm for a passive investment strategy or Trading 212 for those of you who want to invest in individual stocks. If you have large amounts of money and want great customer support and advice then I would go with Hargreaves Lansdown.

Read More From Money Sprout: