The cost of living feels like it’s constantly on the rise, and salaries struggle to keep pace. It’s so easy nowadays to feel the pinch in our wallets. Three out of five UK employees even express dissatisfaction with their current earnings, so it’s clear that many of us are feeling the squeeze.

Even though the struggle is real, cutting corners doesn’t have to mean sacrificing our quality of life. That’s where our comprehensive guide comes in. Here are the best ways to cut UK living costs without compromising on the things that make life worth living.

Track Your Spending

You’re on a mission to take control of your finances and cut down on living costs. Where do you start? It all begins with the fundamental practice of tracking your spending.

One popular method to kickstart your personal finance journey is the 50/30/20 rule – a simple yet effective way to allocate your income.

- First up, “Needs” commands 50% of your after-tax income for non-negotiables like housing, utilities, groceries, transportation, and health insurance.

- Next is “Wants,” claiming 30% of your income for little luxuries and indulgences for dining out, entertainment, shopping sprees, vacations, and more.

- Last is “Savings and Debt Repayment” that accounts for 20% of the pie. This secures your emergency fund, prepares you for retirement, or chipping away at high-interest debt.

For more details, check out our 50/30/20 budget calculator.

- Monthly Budget Overview

- Custom Categories

- Transaction Log

- View Daily Spending Overview

- Track Needs, Wants, Savings/Investments & Debts

Tracking your spending lets you see where your money really goes, giving you valuable insights into your financial habits. This necessary first step gets you up close and personal with your expenses, uncovering opportunities to trim the fat, redirect funds toward your goals, and ultimately live more comfortably within your means.

Discounts Wherever You Can

Looking for discounts is a savvy saver’s secret weapon against ballooning expenses. With the cost of living on the rise, it’s no wonder that thrifty Brits are on the hunt for ways to pinch pennies wherever they can. In fact, a third of residents have taken to haggling on bills as they grapple with the cost-of-living crisis.

When it comes to negotiating, shoppers aren’t shy about flexing their bargaining muscles, especially when it comes to everyday essentials like broadband and TV packages, car insurance, mobile phones, home insurance, and energy costs. These bills are prime targets for negotiation, whether you’re facing a rate hike or your promotional deal is coming to an end.

You can also get discounts for a variety of products with these thrifty strategies:

- Research and Compare: Before making any purchase or signing up for a service, take the time to research and compare prices from different providers. Look for promotional offers, discounts, and special deals that may be available.

- Sign Up for Loyalty Programs: Many retailers and service providers offer loyalty programs that reward frequent customers with discounts, coupons, and exclusive offers.

- Stay Alert for Promotions: Keep an eye out for promotional events, sales, and special offers from your favourites. Subscribe to newsletters, follow them on social media, and download their apps to stay informed about upcoming deals.

- Negotiate: Don’t be afraid to negotiate prices, especially for big-ticket items or recurring expenses like insurance premiums or utility bills. Be polite but firm, and highlight any competing offers or loyalty to the company to leverage a better deal.

- Bundle Services: Many providers offer discounts for bundling multiple services together, such as combining internet, TV, and phone services from the same provider.

- Take Advantage of Student, Senior, or Military Discounts: If you’re eligible, make sure to inquire about student, senior citizen, or military discounts. Many retailers and service providers offer special pricing for these demographics.

- Use Discount Codes and Coupons: Look for discount codes, coupons, and vouchers online before making a purchase. Websites and apps dedicated to deals and discounts often have a wide range of offers available from various retailers and services.

- Consider Cashback and Rewards Programs: Use credit cards or payment apps that offer cashback or rewards points for purchases. These programs can help you earn discounts or redeem points for future savings.

Using these strategies and staying alert for opportunities to save, you can maximize your chances of getting more discounts and keeping more money in your pocket.

Using Electricity Wisely

Smart electricity usage is an efficient and sustainable approach to managing your energy usage that not only benefits your wallet but also the environment. You can do this in many ways, and here are a few examples.

Heating and hot water costs account for almost half of energy bills. Simply turning your thermostat down by just one degree could put an extra £80 back in your pocket each year on your heating bill.

You can also make some adjustments to your lighting habits. Turning off lights when not in use may seem like a no-brainer, but the savings can really add up over time. And if you’re still using traditional incandescent bulbs, it’s time to make the switch to LED bulbs. Not only do they last longer, but they also use significantly less energy, helping you save even more on your energy bill.

When it comes to appliances, it pays to be picky. Check the Energy Label before making a purchase. This serves as your guide to choosing the most energy-efficient options on the market. With products now rated on a scale from “A” (most efficient) to “G” (least efficient), it’s easier than ever to make eco-friendly choices that save you money in the long run.

Take, for example, your fridge freezer. Opting for an A-rated unit over an F-rated one could save you around £610 (or 610kgCO₂e) in energy bills over the 17-year lifetime of the product.

Making smart choices like these can help you control your electricity bill and reduce your carbon footprint.

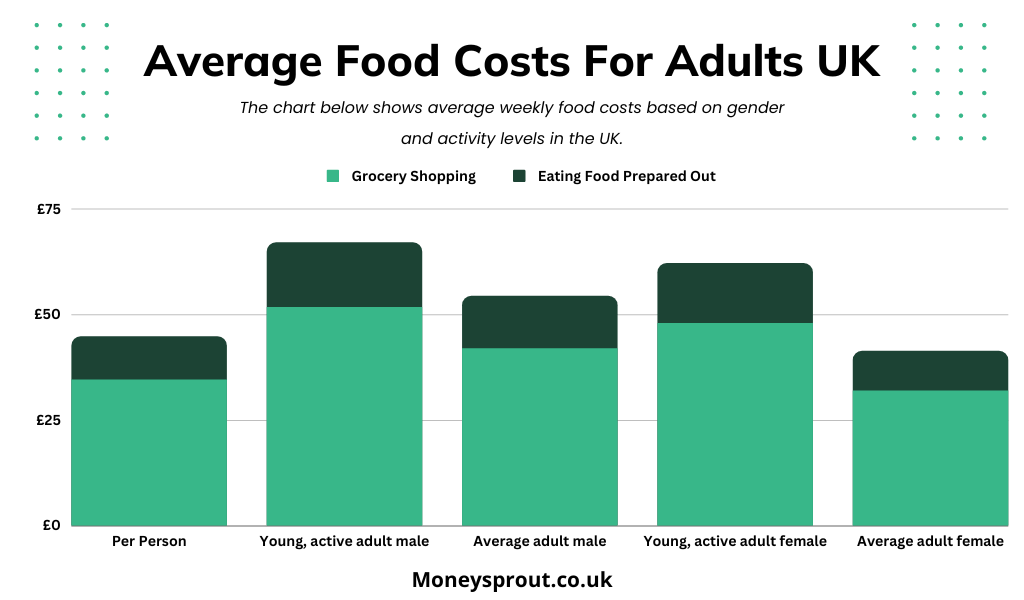

Getting Food for Less

It’s scary to think that healthy foods are usually twice as expensive per calorie compared to less healthy options. With a bit of smart shopping, however, it’s entirely possible to budget your weekly food bill for less without sacrificing taste or nutrition.

- Take some time to plan your meals for the week ahead.

- Set a budget for your groceries and stick to it.

- Look for coupons, deals, and discounts on groceries.

- Consider buying non-perishable items in bulk, especially if they are on sale.

- Purchase fruits and vegetables that are in season, as they are often cheaper and fresher.

- Eating out can be expensive, so try to cook at home as much as possible.

- Get creative with meal planning to incorporate leftover ingredients into new dishes, and consider freezing leftovers for future meals.

Shopping on a tighter-than-usual budget may seem daunting at first, but with a little creativity and determination, you can learn how to get quality food for less.

What to Know About Mortgages

UK homeowners are bracing themselves for a significant £19 billion increase in mortgage costs as fixed-rate deals expire. On top of this, the current inflation and tax rises are further denting spending power.

If your current mortgage term is nearing its end, prepare for higher monthly payments as you refinance to a higher interest rate. However, you can mitigate the financial impact by proactively seeking out the most affordable deal. It’s crucial to stay ahead of the curve and not procrastinate until the last minute.

You have the option to secure a new rate up to six months before your current agreement ends and can negotiate for a better deal at any point before then. Failing to remortgage or request a product transfer could land you on a more costly standard-variable rate.

If you find yourself unable to meet mortgage payments, reach out to your provider right away to explore temporary support options. These may include a mortgage holiday, a temporary switch to interest-only payments, or extending the mortgage term to reduce monthly payments.

Small Lifestyle Changes

Even minor adjustments to your lifestyle can make all the difference in your expenses. Here are some practical tips to help you cut living costs and stretch your budget further.

- Use Public Transportation: Opt for mass transit or carpooling instead of driving alone. Choosing to walk or ride a bike helps, too.

- Cut Down on Subscriptions: Review your monthly subscriptions and consider cancelling those you don’t use frequently.

- Reduce Water Usage: Take shorter showers when you can, fix leaks quickly, and use water-saving devices such as low-flow faucets and showerheads to lower your water bill.

- Grow Your Own Produce: Consider starting a small garden or growing herbs indoors. It can save you money on fresh produce and can be a fun hobby.

- DIY Projects: Instead of hiring professionals for home repairs or improvements, consider tackling smaller projects yourself. There are many tutorials available online for DIY tasks.

- Sell Unused Items: Declutter your home and sell items you no longer need or use. This can generate extra income and free up space in your living area.

- Free Entertainment: Look for free or low-cost ways to entertain yourself in your area. Check out nearby parks, museums with free admission days, community events, and local libraries.

- Shop Secondhand: Explore thrift stores, garage sales, and online marketplaces for gently used items such as clothing, furniture, and household goods.

- Enjoy Off-Season Offers: From travel discounts to holiday decorations and gifts, you’ll find some of the best deals when things aren’t in season.

- Practice Mindful Spending: Implement a “wait and see” approach to non-essential items to avoid impulse buys and save money.

Also, Keep an eye out for money habits that might actually hurt you.

Implementing these lifestyle changes can have a big impact on your overall financial health. Don’t deprive yourself of the things you enjoy, but rather find smarter and more efficient ways to manage your finances.

Wrapping Up

There is no doubt that even small changes can lead to big savings. From energy-efficient habits to savvy shopping strategies, we’ve uncovered plenty of ways to help you take control of your finances and stretch your budget further.

Remember, the journey to financial freedom is about making informed choices and finding creative solutions to everyday challenges. So, keep looking, keep adapting, and keep seizing opportunities to save.