Here at Money Sprout we are trying to provide easy-to-understand information on personal finance in the UK. When it comes to personal finance, it can seem like an overwhelming amount of information. However, if you follow the seven rules I outline in this post, you will have mastered 90% of personal finance.

The seven steps below will allow you to build a strong foundation for a great financial future. Whether you’re fresh out of school and getting your first job or you’re currently 33 and struggling with debt, following the steps below will allow you to get in control of your financial life.

I’m not someone who preaches frugality to the extreme. I believe that balance is needed. While I’m big on saving and investing for the future, I also recognize the need to enjoy your life in the moment. Sometimes you will have to make sacrifices to get your finances in order but it’s not forever. You should do everything you can to complete up to step 4 of this plan as fast as possible, then you can start to enjoy balance.

Below are my seven steps to financial freedom. Don’t get me wrong, I didn’t invent any of these. It’s the product of everything I have read, learned, and experienced going from being broke to having a 6 figure investment portfolio at 26.

1. Live Below Your Means

This is the most basic rule of personal finance and is the foundation of everything else. Simply spend less than you make and you will never have to worry about money.

Most people struggle with finances because they buy stuff they don’t need, have a house that’s too big and a car that is too expensive. They go through life one month away from catastrophic failure. Not only is this an extremely stressful way to live life, but it keeps you trapped in a job you hate, to keep the stuff you didn’t need. You end up working so much you can’t even enjoy the things you bought.

So, if you earn £2,500 per month and only spend £2,000 a month you can save and invest £500. Every month you put £500 away into investments unlocks opportunity. Over time it creates the freedom to pursue something you enjoy. However, if you are perpetually living paycheck to paycheck, you have to go to work, or your life crumbles.

Avoid upgrading your car and purchase a bigger house now. If taking a car payment or mortgage payment is pushing you right to the edge of your monthly budget, you are inevitably going to end up in financial trouble.

We are seeing this in the UK right now with high-interest rates. Many people took on mortgages that were the maximum they could afford monthly while interest rates were at record lows. Now that interest rates are rising they are facing a cost of living crisis. Their outgoings are exceeding their income putting them in a terrible position.

You can avoid this being you if you simply live below your means. Take the smaller house and drive the crappy car until you’re in a comfortable financial position to afford the more expensive options.

Avoid Lifestyle Creep

As you grow in your career you are likely to receive pay raises and promotions. When most people receive a pay rise they start to instantly spend more money on their lifestyle. This is a big mistake. If you can live below your means in your early years and invest the rest, you will be significantly more wealthy by retirement.

Resist the urge to upgrade your lifestyle at every possible opportunity. Every time you do this, you’re trapping yourself in the work-to-live cycle. By staying lean and investing the excess money, you will eventually reach a point where your investments pay more than your job. This is what you are working towards. At that point, you have the freedom to purchase and work on what you want without having to worry about where the next paycheck is coming from.

In conclusion, Step 1 is to ensure you are earning more than you are spending. Right now, with the cost of living crisis that can be easier said than done but with some discipline and earning some extra money outside your job, you can get there.

2. Avoid Bad Debts

Avoiding Debt

Next up we have debt. Getting into unnecessary debt is the easiest way to end up in a bad financial situation. I recommend avoiding it at all costs unless it is for a house and in some circumstances a cheap car.

You should never take on debt for “things you want”. It’s insane to take on debt for holidays, random daily purchases, technology, clothes etc. The rise in buy now, pay later platforms has massively increased the amount of people going into debt for useless nonsense.

If you can’t afford to purchase something without putting it on credit, it means you can’t afford it. If you can’t afford it now, how are you going to afford it later with interest on top?

The best advice is to avoid taking any debt out like this at all. It’s going to massively hinder your financial progress.

Getting Out Of Debt

If you are currently in debt, your first priority is getting out of it as soon as possible. With interest working against you and compounding over time, it’s hard to get ahead. You need to kill these debts as soon as possible. You should be willing to cut back on any fun and luxuries at all until you are debt-free.

There are two popular methods for getting rid of your debt:

Debt Snowball

The debt snowball is a popular method of paying down your debts, popularized by Dave Ramsey. The basic principle of this method is to pay off your debts in order of smallest to largest regardless of the interest rates.

The main benefit of this method is the psychological win of paying off a debt in full quickly. The pleasure you get from paying off the smallest debt in full will encourage you to continue paying off your larger debts. The method is also simple to understand and execute. Simply list out your debts and start tackling them from smallest to largest.

While this can be a motivating way to pay down your debts, it isn’t mathematically the best decision. This method is more about gaining momentum and getting into the habit of paying down your debts.

Debt Avalanche

The debt avalanche is mathematically the best way to pay down your debt. This method focuses on tackling your highest-interest debts first excluding your mortgage. During this process, you continue to pay minimum payments on all of your debts while devoting any extra money toward your highest-interest debt.

Once the highest interest rate debt has been paid off, you move on to the next highest interest debt and start devoting any extra income towards it.

By utilizing this method you will pay less interest over time compared to the debt snowball method. The main disadvantage to this method is many people feel like they aren’t making progress. If your highest-interest debt is also your biggest loan it can take some time to pay it down, while never actually closing any accounts during this period.

The method you choose really depends on your personal choice. For me, I would go with the avalanche method as it is the cheapest way to pay off your debt. However, if you struggle with motivation and want to feel like you’re making progress, go with the snowball method.

Acceptable Debts

There are two debts that are acceptable. A mortgage is largely unavoidable and some people need a car for work but can’t afford to purchase one outright.

Mortgage

Mortgage debt is an example of “good debt”. Most people cannot buy a house in cash and their only way to purchase one is through a mortgage. When buying a house you’re also buying an appreciating asset. When the house is paid off you will be the sole owner of the property, which has likely appreciated in value over time.

Ideally, you want to find the best mortgage rate possible to minimise the amount of money you are paying in interest.

If you’re looking to get on the property ladder, getting a mortgage is unavoidable for most of us. Just ensure you are not overextending yourself by purchasing too much house for your budget. We recommend keeping your total housing costs below 30% of your total post-tax income.

Car

In the UK, many people need a car for their work. There’s just no way around it. If you do need a car and you can’t afford to purchase one outright, then you may need to finance it. This doesn’t mean you walk into a dealership and tell them you have x spare each month and want a car to fit your budget.

You still want to find a relatively cheap reliable car. Ideally under £10k. Put down as much of a deposit as you can afford and ensure you are getting a solid interest rate on the loan. Avoid PCP deals as you won’t own the car at the end of the term and will get sucked into purchasing another vehicle.

I bought a 2009 Honda Civic in 2019 and have been driving it for 4 years without any major problems. The car cost me £2,400 and I have put about £300 in maintenance into the car.

There are cheap cars out there if you want one. Don’t lock yourself into an expensive car loan that doesn’t serve you. Focus on investing first and you can purchase whatever cars you want in the future.

3. Set Yourself A Budget

Creating a budget is a basic way to take control of your finances. A budget allows you to see exactly what’s coming in and going out each month. Budget your necessities and set aside some money for entertainment and wants. This way you can still have fun and enjoy life while not spending more than you can afford.

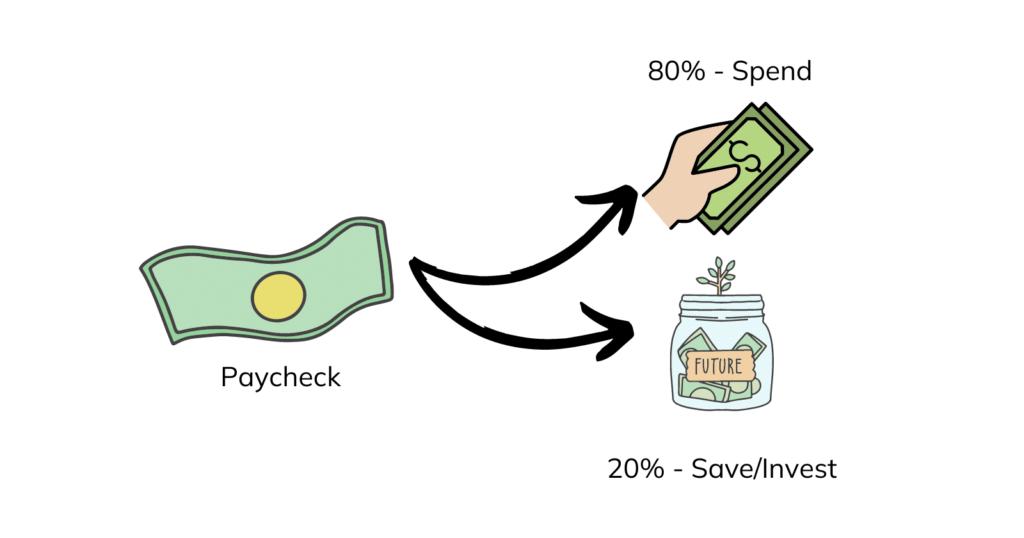

I personally like the 50/30/20 budgeting plan. This is where you spend 50% of your money on necessities such as food, housing, and bills. 30% goes towards your wants and 20% goes towards savings and investments. Some people may need to adjust these numbers slightly depending on their income and where they live.

- Monthly Budget Overview

- Custom Categories

- Transaction Log

- View Daily Spending Overview

- Track Needs, Wants, Savings/Investments & Debts

There are lots of budgeting apps that can help you manage your finances from your phone. One of our favorites is Money Dashboard. These apps automatically categorise your transactions and help you see exactly where your money is going each month. It might surprise you how much you are spending on unnecessary purchases. Alternatively, you can use a spreadsheet or pen and paper to create your budget.

4. Build An Emergency Fund

Once you have all of your debt paid off and have a budget created, you can start working on building your emergency fund. An emergency fund allows you to prepare for the unexpected. We all have problems pop up like a car breaking down, losing our job, home maintenance, etc. The emergency fund allows you to tackle these problems without having to go into debt.

We recommend having an emergency fund of 6 months’ living costs. That’s 6 months of your necessary living costs not including your wants and savings.

If a problem pops up, you will have a 6-month safety net allowing you to get back on your feet before needing to take on any debt. With an emergency fund behind you, financial stress is much less of a burden. You know if a problem pops up you have it covered, if you lose your job, you have 6 months to find a new one.

You should keep your emergency fund in a high-interest easy access savings account so you can easily access the money at any time while still having your money work for you.

5. Saving

Next up is saving. You may have some goals you want to save for in the future. This could be a house deposit, a wedding, or even a car.

Once you have a goal, you should set up automated saving. This means you will be saving without even thinking about it. Set up your accounts so your savings get automatically direct debited out of your account on payday. That way you won’t be tempted to spend this money before the end of the month.

The timeframe of your goal will determine where you keep this money. If you’re saving for something in the short term you should keep the money in an easy-access savings account or potentially a Notice account if you won’t need the money for more than 6 months. If you’re saving for a house you may want to keep your money in a Lifetime ISA and claim the 25% bonus from the government.

At a bare minimum, any money you are saving should be earning interest. The account I currently save with is Chip which offers market-leading interest rates.

Chip is an award-winning savings and investment app. They became popular with their high-interest savings account but also offer investment services and automatic saving.

If you are not saving for a specific goal and you have a fully funded emergency fund it’s time to start investing.

6. Invest For Your Future

Investing is historically one of the most reliable ways to build wealth over long periods of time. Historically the S&P 500 has produced an average return of 10.15% per year since 1957.

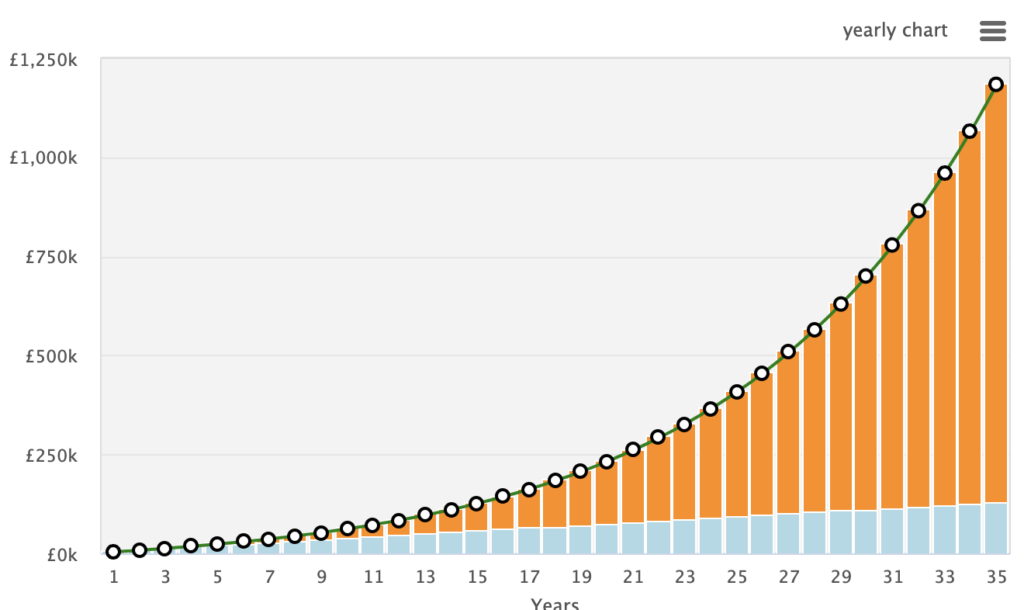

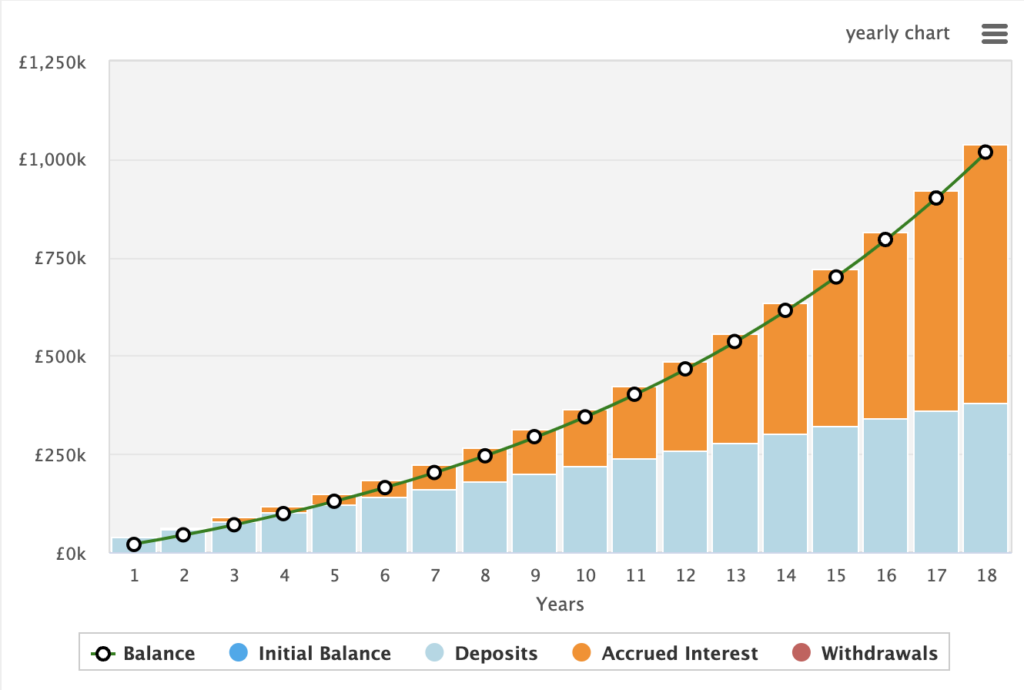

If you invested £300 per month from 25 years old to 60 years at 10.15%, by the time you’re 60, you would have a portfolio value of £1,184,024.

It might seem like a long journey, but this strategy is proven and effective. The best part? Almost anyone can achieve it. You don’t need a high-paying job or a successful business. Just budget wisely, invest £300 every month, and let the power of compounding do its job over time.

Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it

Albert Einstein

If you’re aggressive like me, you may want to try and max out your ISA allowance each year. This equates to around £1,666 per month. With a £1,666 contribution each month at a 10.15% interest rate, you would reach millionaire status in just 18 years.

If these charts don’t get you excited about personal finance, I don’t know what will. Simply understanding that a pound invested today could be worth 50-100x that in the future should encourage you to invest rather than spend your money.

You can use our compound interest calculator to see how much your investments could be worth in different time frames and return scenarios.

Where Should You Invest

When it comes to investing I keep it really simple. I don’t recommend going out there trying to pick individual stocks. This is a great way to start losing money. I personally invest in index funds of the global market. This means that you own tiny parts of thousands of companies all around the world. Most fund managers can’t even beat the market over long periods of time so I don’t try to either.

There are two platforms I would currently recommend.

If you are looking to manage your own money, pick your own funds and have full control, I would recommend investing with Hargreaves Lansdown.

Hargreaves Lansdown is one of the most trusted investment platforms in the UK. They offer amazing customer service with access to someone on the phone at any time. However, these come at a high price in terms of fees.

If you just want to get started investing but don’t want the hassle of picking your own funds, check out Moneyfarm. They are a digital wealth advisor who assesses your risk levels and creates a portfolio based on your risk tolerance. This is great for someone who wants to be a passive investor.

Moneyfarm is one of the UK's premier digital wealth managers, dedicated to simplifying investments and helping individuals grow their assets. Providing innovative investment solutions, Moneyfarm focuses on delivering tailor-made portfolios based on individual risk appetites and financial goals.

Pensions

Most people working in a normal job will be able to contribute to their workplace pension. If your company offers a pension match scheme make sure to contribute the full matched amount. If they match up to 5%, take advantage of this. This is essentially free money and should be the first place you invest.

Most companies will have set portfolios that you can choose to invest in. Even though you may not have the most control over the portfolio the 100% match is well worth it.

If you are self-employed you can invest in a private pension using a SIPP (Self-Invested Personal Pension). This will give you more control over where you invest your money.

How To Get Started

Start investing ASAP through your workplace pension with the match. Once you have cleared all of your debts and filled an emergency fund you can start investing in the stock market.

When using the 50/30/20 rule, the 20% should go towards your investments each month.

7. Build Assets, Avoid Liabilities

The 6 rules above are enough to allow you to become financially free throughout your lifetime. However, if you’re like me, you may want to reach the 7 figure status a little faster. Personally, I believe the best way to do this is by building a business.

Even if you have a small side hustle that contributes an extra £500 per month to your portfolio this will make a huge difference in the length of time it takes to retire.

If business isn’t for you, there are other avenues to start bringing in extra income such as real estate.

I’m not going to go into any more detail in this article but if you’re interested in making extra income, I would check out the two articles below:

Final Thoughts

The steps above are simple to understand but hard to follow. It will take discipline to master your finances but the sacrifices you make to get there are absolutely worth it. Your future self will thank you for the work you put in now.

Ask yourself, 20 years from now do I want to be living the same life I am now, or do I want a great future with abundant wealth? If you want a wealthy future, start putting these steps into action.

Read More From Money Sprout: