If you’re ready to start your investing journey you may be considering using Moneyfarm or Nutmeg. These are two of the biggest robo-advisors or “Digital Advisors” on the market right now. They’re also some of the most trustworthy companies to invest with in this space. However, if you have landed on this article, you’re likely wondering which service is the better option for you.

In this article, we are going to break down both of these investing platforms to see which has the best fees, performance, and user experience. Let’s jump in.

|

4.2

|

3.5

|

|

Pros:

|

Pros:

|

|

Cons:

|

Cons:

|

- Slick easy to use app

- Great for passive investors

- Assesses risk tolerance before investing

- Cheap fees

- Poor returns on low risk funds

- High minimum deposit

- Easy to use website and app

- Assesses your risk tolerance before investing

- Set and forget investing

- Transparent fees

- Fund performance on lower risk funds has been poor historically

Nutmeg vs Moneyfarm Overview

Nutmeg and Moneyfarm are two leading platforms in the realm of digital wealth management, both established in 2011 but originating from different geographical roots.

Nutmeg, a UK-based pioneer in the robo-advisory world, focuses on providing a transparent, cost-effective, and user-friendly investment alternative. With an easy-to-use online platform, Nutmeg recommends portfolios based on users’ risk appetites. These portfolios, built using Exchange Traded Funds (ETFs), offer diversification across multiple asset classes. Additionally, Nutmeg’s automated algorithms adjust portfolios in response to market fluctuations, ensuring investments align with users’ risk preferences.

On the other hand, Moneyfarm, initially founded in Italy and later expanding to the UK, blends innovation with traditional investment principles. With its tech-forward approach, Moneyfarm tailors portfolios to individual needs, ensuring investments align with users’ financial aspirations. Their platform is not just user-friendly but also transparent, offering clarity on fees and investment strategies. Both platforms prioritize transparency, with clear fee structures and a commitment to keeping hidden charges at bay.

For new investors seeking modern, digital-first investment solutions, both Nutmeg and Moneyfarm offer compelling choices, backed by technology, transparency, and a focus on user experience.

If you’re interested in checking out each platform in more detail we have written full reviews on both Moneyfarm and Nutmeg.

Nutmeg & Moneyfarm Comparison

| Moneyfarm | Nutmeg | |

|---|---|---|

| Rating | 4.2 | 3.5 |

| Minimum Investment | £500 | £500 (Except for LISA & Junior ISA which are £100) |

| Products | – General Investment Account – Stocks & Shares ISA – Junior ISA – Pension | – General Investment Account – Stocks & Shares ISA – Lifetime ISA – Junior ISA – Pension |

| Investing Styles | – Fixed Allocation – Active Management – Thematic – ESG (Socially Responsible) | – Fixed Allocation – Fully Managed – Socially Responsible – Smart Alpha Portfolios |

| Performance | View Performance Comparison | View Performance Comparison |

| Fees | Up to £10k – 0.75% £10k to £20k – 0.70% £20k to £50k – 0.65% £50k to £100k – 0.60% £100k to £250k – 0.45% £250k to £500k – 0.40% Over £500k – 0.35% The fee tier you are in applies to the whole portfolio. If you have £100k invested, you will pay 0.45% on the £100k. | Up to £100k – 0.75% Balance over £100k – £0.35% Everyone pays 0.75% on their first £100k and then 0.35% on the balance above £100k. |

| Portfolios Available | 7 | 10 |

Nutmeg Vs Moneyfarm: Products

Both platforms offer a very similar range of products. Both offer:

- General Investment Accounts

- Stocks and Shares ISA

- Junior ISA

- Pension (SIPP)

Nutmeg offers a Lifetime ISA which is not currently available on Moneyfarm. If you can benefit from a Lifetime ISA which allows you to get a 25% bonus on contributions as long as you use the money to purchase a house or leave the money in the ISA until you’re 60.

Unless you’re planning on opening one of these Lifetime ISAs, both platforms have the same product offering.

Nutmeg Vs Moneyfarm: Investing Options

Both platforms provide investors with a range of different investing styles. This includes passively managed fixed allocation portfolios, as well as more specialized funds, focused on sustainability and specific industries.

Passive Management

Moneyfarm’s Fixed Allocation:

- A passive approach letting portfolios move with the market.

- Expertly constructed portfolios rebalanced annually.

- Allows tailoring to investors’ personal values.

Nutmeg’s Fixed Allocation Portfolios:

- A hands-off approach using a global assortment of ETFs.

- Rebalances automatically to align with the chosen risk level.

- Reviewed annually to ensure alignment with investor preferences.

Active Management:

Moneyfarm’s Active Management:

- Dynamic investment experience with constant supervision.

- Portfolios are adjusted frequently to capitalize on market shifts.

- Aims to align portfolios with evolving goals and market dynamics.

- Dedicated consultant available for any assistance.

Nutmeg’s Fully Managed Portfolios:

- Expert management of globally diversified portfolios.

- Primarily utilizes ETFs to track market indices.

- Proactively monitored and rebalanced based on current economic data and news.

- Ensures alignment with the client’s long-term goals.

Social Responsibility:

Moneyfarm:

- Offers a socially responsible investment opportunity.

- Invest in companies that prioritise environmental, social and corporate governance factors.

- Actively managed by the Moneyfarm team.

Nutmeg’s Socially Responsible Portfolios:

- Focuses on companies and bond issuers with strong ESG standards.

- Investments predominantly in ETFs excluding controversial companies.

- Continuously overseen and adjusted by Nutmeg’s in-house investment team.

Specialized Investments:

Moneyfarm:

- Offers a Thematic fund option allowing investments in specific industries.

Nutmeg’s Smart Alpha Portfolios:

- Exclusive collaboration with J.P. Morgan Asset Management.

- Global diversification of ETFs adjusted to individual risk and goals.

- Incorporates research-informed security selection and a mix of passive and innovative active ETFs.

- Collaborative monitoring and adjustment by both Nutmeg and J.P. Morgan teams.

In summary, both Moneyfarm and Nutmeg offer a range of investment styles catering to diverse investor needs. Whether someone is looking for a passive approach or an actively managed portfolio, both platforms provide tailored solutions.

Nutmeg Vs Moneyfarm: Transparency

When it comes to transparency both platforms are extremely transparent about their fees and past portfolio performance.

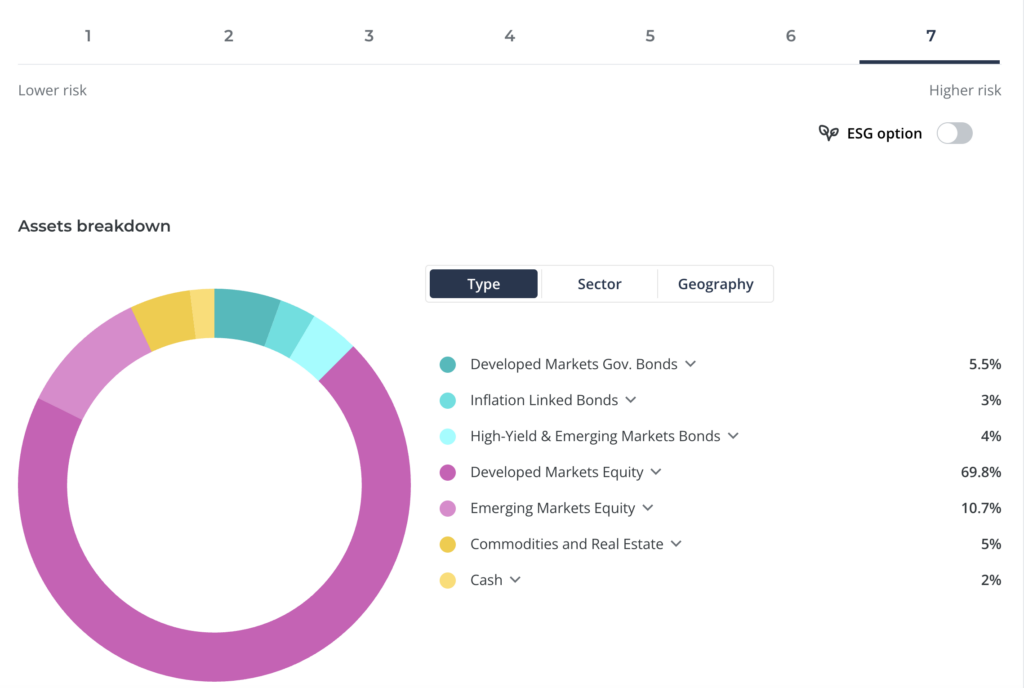

Both platforms allow you to see what your money is invested in but Nutmeg has a much more granular breakdown. Unfortunately, Moneyfarm only allows you to see what asset types your money is invested in, whereas Nutmeg gives you a full breakdown of each individual fund your money is invested in. This is one thing that Nutmeg beats Moneyfarm on.

Even though most users of these platforms won’t need to see that much detail, it’s nice to be able to see where your money is being invested if you want to.

Nutmeg Vs Moneyfarm: Performance

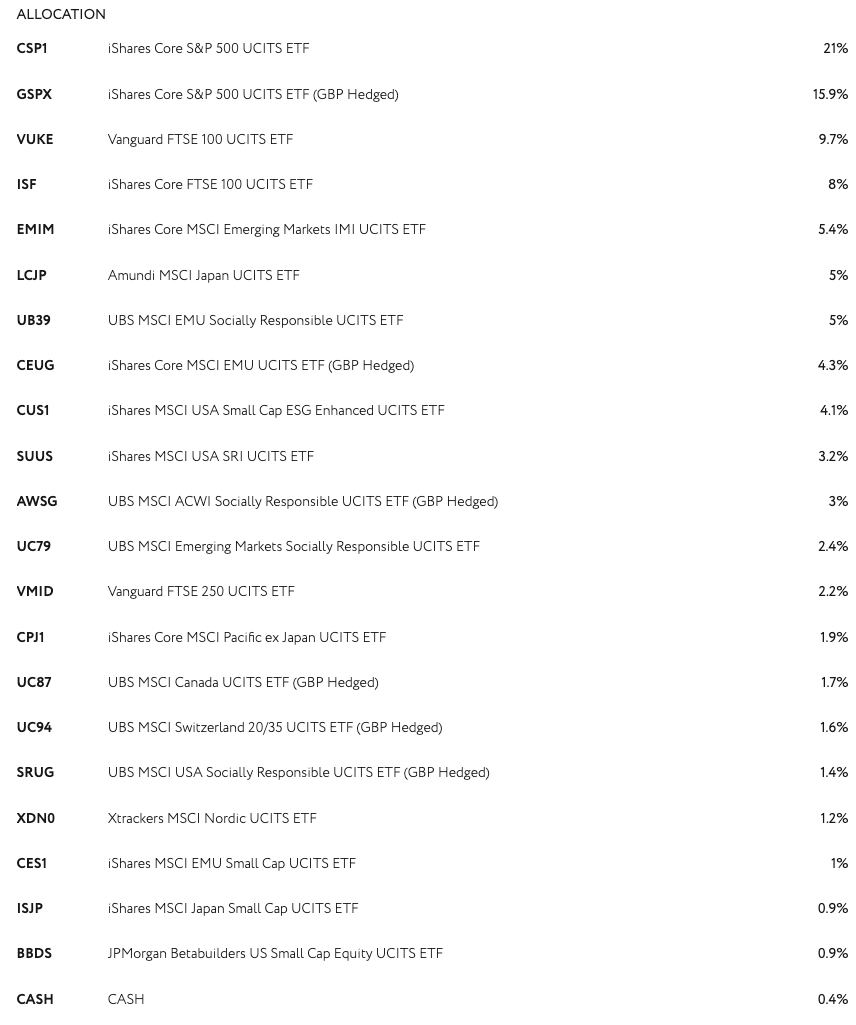

While past performance is not a guarantee of future performance it’s a good indicator of successful funds over long periods of time. Let’s take a look at how both of these funds have performed over the past few years.

These numbers are based on the actively managed funds at both providers.

| Risk Level | Moneyfarm 5 Year Returns (Total) | Moneyfarm 5 Year Return (Yearly Avg) | Nutmeg 5 Year Returns (Total) | Nutmeg 5 Year Returns (Yearly Avg) |

|---|---|---|---|---|

| Low | -7.1% | -1.5% | -3.9% | -0.8% |

| Medium | 10.6% | 2.1% | 3.6% | 0.72% |

| High | 25.5% | 4.7% | 24.09% | 4.49% |

Low risk relates to each provider’s lowest-risk fund. Medium relates to their middle fund and high relates to their highest risk fund.

Moneyfarm outperforms Nutmeg in both the medium and high-risk funds but lost more in the low-risk fund. Both companies’ low-risk funds performed horribly over the 5 year period losing money.

Moneyfarm performed significantly better with their medium-risk fund (10.6% vs 3.6%) and only marginally better with the high-risk fund (25.5% vs 24.09%).

Overall Moneyfarm has performed better than Nutmeg based on returns over the past 5 years.

Nutmeg Vs Moneyfarm: Fees

Moneyfarm and Nutmeg both have similar fee structures, comprising a platform fee, fund fee, and spread fee. While their fund fees are almost identical, they differ mainly in their platform fees. Let’s compare them side by side.

Actively Managed Fees

| From | Moneyfarm | Nutmeg |

|---|---|---|

| £500 | 0.75% | 0.75% |

| £10k | 0.70% | 0.75% |

| £20k | 0.65% | 0.75% |

| £50k | 0.60% | 0.75% |

| £100k | 0.45% | 0.35% |

| £250k | 0.40% | 0.35% |

| £500k | 0.35% | 0.35% |

Moneyfarm generally has lower fees than Nutmeg. At Moneyfarm, you’re charged a percentage of your total balance; for instance, a £100k balance incurs a 0.45% fee. On the other hand, Nutmeg uses a tiered fee system: balances up to £100k are charged 0.75%, while any amount over £100k is charged at 0.35%.

For most people, Moneyfarm will work out much cheaper than Nutmeg.

Fixed Allocation Funds

Both platforms have fixed allocation products which means the portfolio is not actively managed and only gets rebalanced once a year. The fees on these are cheaper than actively managed products.

| From | Moneyfarm | From | Nutmeg |

|---|---|---|---|

| Up To £100k | 0.45% | Up to £100k | 0.45% |

| £100k to £250k | 0.35% | £100k+ | 0.25% |

| £250k to £500k | 0.30% | ||

| £500k+ | 0.25% |

Up to £100k both platforms have the same fee. Nutmeg is 0.1% cheaper for users who have a balance of £100k to £500k.

Nutmeg vs Moneyfarm: Reviews & Support

Nutmeg boasts a Trustpilot score of 3.7 stars, which is commendable for a financial platform. Of the reviews, 69% rate the service with 5 stars, while 15% awarded it just a single star.

On the other hand, Moneyfarm sports a slightly higher rating of 3.8 stars on Trustpilot. Out of their reviews, 68% are glowing 5-star ratings, with a mere 6% falling into the 1-star category.

Primary Complaints:

For Nutmeg, the dominant complaint centers around the disappointing investment performance. It’s evident that over the past half-decade, many of their lower-risk funds have lagged, with some even showing negative returns.

Moneyfarm has faced similar feedback. Most of their grievances are rooted in the unsatisfactory returns from certain funds, particularly the lower-risk ones. Over recent years, these funds have not met the expectations of some users.

However, this is to be expected as 2022 was a rough year for returns in the market. People who have got bad returns over longer periods of time are likely invested in their low risk funds which we documented in more detail in the full Moneyfarm and Nutmeg reviews.

Positive Highlights:

On the positive side, Nutmeg has garnered praise for its stellar customer service. Many users have emphasized the ease with which they can connect with a representative over the phone to address and resolve any concerns.

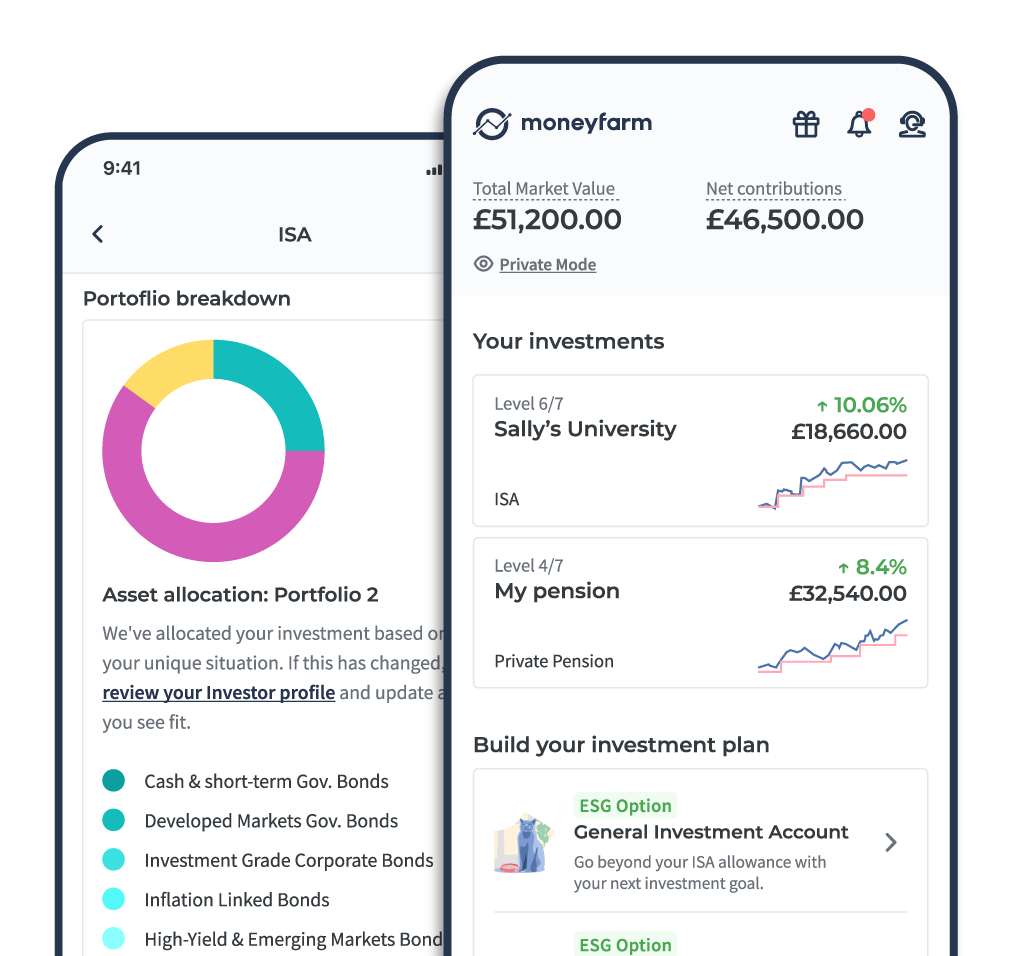

Moneyfarm, meanwhile, receives accolades for the intuitiveness and user-friendliness of its app. Users often highlight the ease of use and streamlined functionality of the platform as well as a great customer service experience when needed.

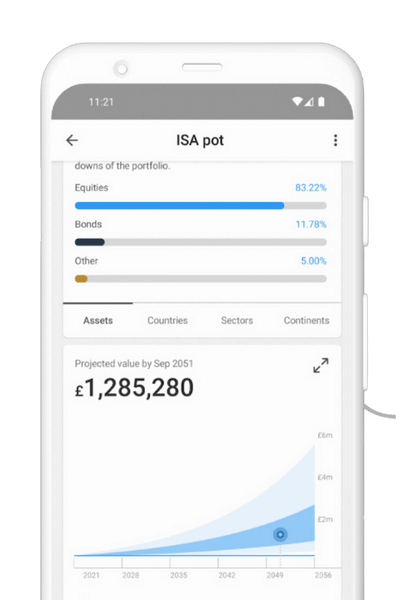

Nutmeg vs Moneyfarm: App & Interface

When you are managing your money, it’s nice to have an easy-to-use interface that allows you to see your investments at a glance. Both platforms have great web apps and mobile apps. You can see a preview of both of them below. As both are simple to use, it really comes down to personal preference.

Who Should You Invest With?

While both platforms are good options for passive investors, we believe that Moneyfarm is the better option. I’m a big fan of investing in low-cost index funds and Moneyfarm offers better fees on their fixed allocation portfolio as well as better investment returns.

When it comes to the products these companies are offering, they are very similar. Both have general investment accounts, ISAs and pensions.

Both platforms are very easy to use and have great features allowing you to manage and track your portfolio as it grows. They’re also both safe to use and regulated by the Financial Conduct Authority as well as being covered by the Financial Services Compensation Scheme.

Really our choice here comes down to fees and performance. For most investors, Moneyfarm wins!

Moneyfarm is one of the UK's premier digital wealth managers, dedicated to simplifying investments and helping individuals grow their assets. Providing innovative investment solutions, Moneyfarm focuses on delivering tailor-made portfolios based on individual risk appetites and financial goals.

If you have realised that you don’t want a digital wealth management platform and instead want to manage your own money, I would recommend checking out Hargreaves Lansdown.

Read More From Money Sprout: