We have spent hours comparing and reviewing 6 of the best robo-advisor platforms in the UK to give you our best recommendation. In this article, we give you our recommended platform and also provide you with a full comparison of each of the platform’s fees, products, investment options and more.

Depending on your individual needs, one platform may be better than another for you. Let’s take a look at what each of these apps has to offer.

|

5.0

|

4.0

|

4.0

|

4.0

|

4.0

|

3.5

|

|

Minimum Deposit:

£100

|

Minimum Deposit:

£500

|

Minimum Deposit:

£1

|

Minimum Deposit:

£1

|

Minimum Deposit:

£10

|

Minimum Deposit:

£500

|

|

Subscription Fees:

Zero

|

Subscription Fees:

Zero

|

Subscription Fees:

£1/Month

|

Subscription Fees:

Zero

|

Subscription Fees:

£1/Month

|

Subscription Fees:

Zero

|

|

Platform Fees:

Free / 0.25%

|

Platform Fees:

0.75%

|

Platform Fees:

0.45%

|

Platform Fees:

0.6%

|

Platform Fees:

0.1%

|

Platform Fees:

0.75%

|

Best Robo Advisors In The UK

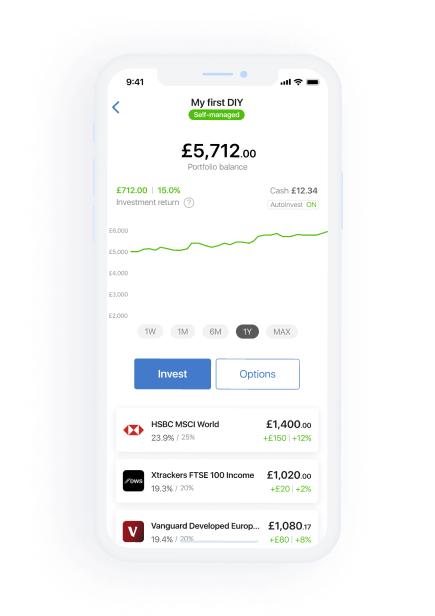

#1 – Invest Engine

Invest Engine is a dynamic player in the UK’s financial technology space, specializing in providing robust investment management solutions. The firm offers a comprehensive suite of services, including tailored investment portfolios, ISAs, and user-friendly digital tools, appealing to both novice and seasoned investors alike.

Invest Engine has made a name for itself through its innovative technology-driven approach. Unlike traditional asset management firms, it employs cutting-edge algorithms alongside financial expertise to craft personalized investment strategies for its clients.

Key Features

- Zero platform fees for DIY investment Portfolios / 0.25% Fees on managed portfolios

- 550+ ETFs available to invest in

- Offers Stocks & Shares ISA, General Investment Account and Business Accounts

- Managed & DIY Portfolios Available

- £100 Minimum Deposit

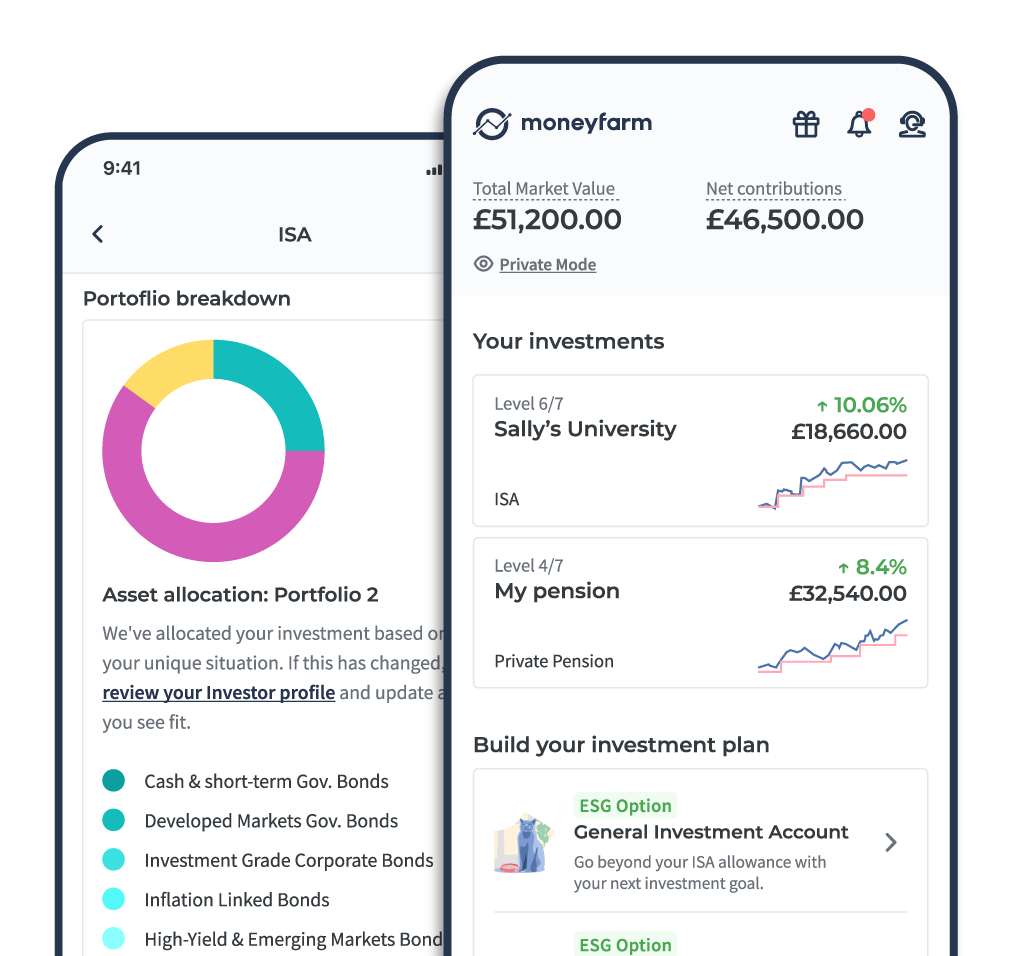

#2 – Moneyfarm

Moneyfarm is one of the UK’s premier digital wealth managers, dedicated to simplifying investments and helping individuals grow their assets. Providing innovative investment solutions, Moneyfarm focuses on delivering tailor-made portfolios based on individual risk appetites and financial goals.

Established in 2011 by Paolo Galvani and Giovanni Daprà in Italy, before expanding its operations to the UK, Moneyfarm has experienced significant growth in a relatively short span of time. Emerging from the digital revolution’s intersection with financial services, it has rapidly secured its position as a favoured choice among tech-savvy investors seeking modern investment approaches.

Key Features

- Great portfolio performance over the past 5 years

- Sleek and easy-to-use platform

- 0.75% to 0.35% platform fees depending on portfolio size

- £500 Minimum first deposit

- Wide range of fully managed portfolios and investment options such as socially responsible investing and thematic portfolios

- Offers ISA, General Investment, Junior ISA and Pensions

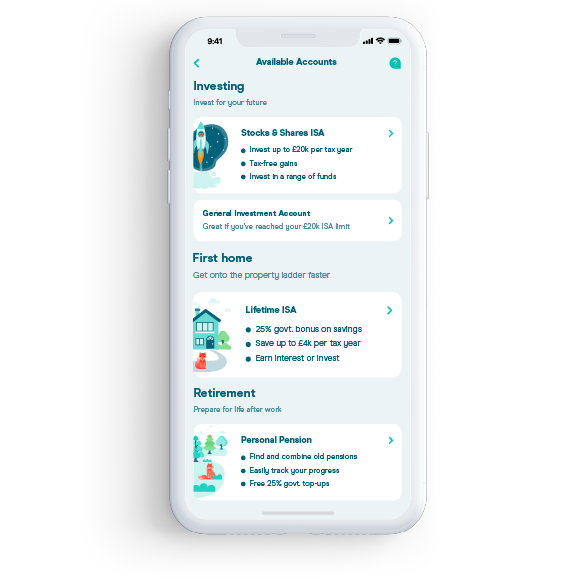

#3 – Moneybox

Moneybox is one of the UK’s innovative digital savings and investment platforms. This fintech firm offers a variety of products to help individuals save and invest, including rounding up daily purchases to the nearest pound and investing the change, as well as providing pension services, lifetime ISAs, and general investment accounts.

Founded in 2015 by Charlie Mortimer and Ben Stanway in London, Moneybox has rapidly made a name for itself as a go-to solution for younger generations keen on kickstarting their savings and investment journeys. From its humble beginnings, Moneybox has successfully harnessed the power of technology to break down traditional barriers to saving and investing.

Key Features

- Great portfolio performance over the past 5 years

- £1 Minimum Deposit

- Wide range of financial products in one place including investing, savings and mortgages

- Three risk-based pre-made portfolios are available

- 0.45% platform fees and £1/Month subscription fee

- Offers Stocks & Shares ISA, General Investment Account, Junior ISA, Lifetime ISA, Savings and Personal Pensions

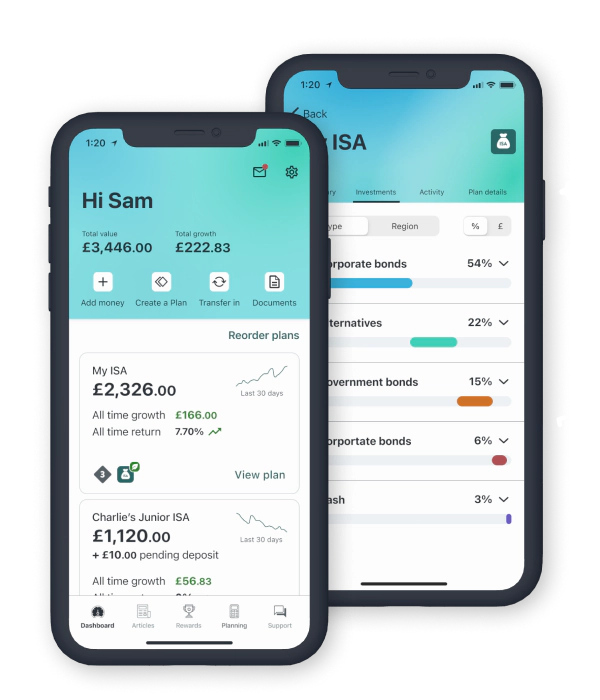

#4 – Wealthify

Wealthify is a distinguished name in the UK’s growing robo-advisory sector. This digital wealth management platform offers a refreshing and accessible approach to investing. Catering to both the seasoned investor and those taking their first steps, Wealthify provides a range of investment plans, including ISAs, general investment accounts, and junior ISAs.

Founded in 2016 and headquartered in Cardiff, Wealthify represents the new age of financial tech innovation. Even in its relative youth, the platform has been rapidly adopted, in part due to its simplicity, user-focused design, and commitment to making investment more accessible to the general public.

Key Features

- £1 Minimum Deposit

- 0.6% Platform fees

- 5 Risk-based portfolios available

- Ethical investing options

- Poor 5-Year Investment Returns

- Offers a General investment account, Stocks and Shares ISA, Pension and Junior ISA

#5 – Nutmeg

Nutmeg stands as a pioneering force in digital wealth management or “robo-advisory”. With a vision to transform traditional investment services, Nutmeg offers a transparent, affordable, and user-friendly online platform. Users are assessed for risk appetite and then recommended tailored portfolios, primarily constructed using diversified Exchange Traded Funds (ETFs). Nutmeg prides itself on transparency, presenting straightforward fees and granting clients full visibility into their investment breakdowns.

Key Features

- Easy-to-use website and app

- Transparent buy expensive 0.75% fees

- £500 Minimum investment

- 4 Different investment styles to choose from (Fully Managed, Smart Alpha, Socially Responsible and Fixed Allocation)

- Poor portfolio performance last 10 years

- Offers Stocks & Shares ISA, Lifetime ISA, Junior ISA, General Investment Account and a Personal Pension

Best Robo Advisors Comparison Table

Below we have put together a handy comparison table of all of the brokers above. Hopefully, you can quickly find the broker that works best for your needs right now.

For example, if you’re looking to save for a house in a Lifetime ISA you would have to invest with Moneybox or Nutmeg as they’re the only two brokers to offer the product.

| Invest Engine | Moneyfarm | Moneybox | Wealthify | Nutmeg | |

|---|---|---|---|---|---|

| Minimum Deposit | £100 | £500 | £1 | £1 | £500 |

| Subscription Fees | Zero | Zero | £1/month | Zero | Zero |

| Platform Fees | Free / 0.25% | 0.75% | 0.45% | 0.60% | 0.75% |

| Managed Portfolios | ✅ | ✅ | ✅ | ✅ | ✅ |

| DIY Portfolios | ✅ | ❌ | ❌ | ❌ | ❌ |

| ETFs | ✅ | ❌ | ✅ | ❌ | ❌ |

| Stocks | ❌ | ✅ | ✅ | ❌ | ❌ |

| Products | – Stocks & Shares ISA – General Savings Account – Business Account | – Stocks & Shares ISA – General Investment Account – Pension – Junior ISA | – Stocks & Shares ISA – General Investment Account – Junior ISA – Savings – Pension – Lifetime ISA | – Stocks & Shares ISA – General Investment Account – Junior ISA – Pension | – Stocks & Shares ISA – Lifetime ISA – General Investment Account – Pension – Junior ISA |

| Sign Up | Sign Up | Sign Up | Sign Up | Sign Up |

If you’re looking for a Stocks & Shares ISA or General savings account, Invest Engine has the lowest fees of them all as well as having the ability to trade your own ETFs and create DIY portfolios.

Lowest Fee Robo Advisor Comparison

When you are investing on a platform you will face multiple different types of fees. With robo-advisor platforms, this usually consists of a platform fee, fund fees and spread fees.

Platform fees are the main fee we want to look at as that’s what the platform is charging. Fund fees are very similar across all platforms as they come from the fund rather than the platform. Multiple platforms may invest in the same fund and would therefore pay the same fee to that fund. The platforms usually do not make any money off these fund fees.

Platform Fee Comparison

This table shows how much you will be paying in yearly fees based on the size of your portfolio. While some platforms are cheap when you first get started, they don’t offer any cost breaks as your portfolio grows.

For example, Moneyfarm looks expensive for portfolios under £10k it gets quite competitive as your portfolio starts to grow.

| Starting Fee | Platform | £1,000 | £10,000 | £50,000 | £100,000 | £250,000 | £500,000 |

|---|---|---|---|---|---|---|---|

| 0.25% | Invest Engine | £2.50 | £25.00 | £125.00 | £250.00 | £625.00 | £1,250.00 |

| 0.75% | Moneyfarm | £7.50 | £70.00 | £300.00 | £450.00 | £1,000.00 | £1,750.00 |

| 0.45% | Moneybox | £4.50 | £45.00 | £225.00 | £450.00 | £1,125.00 | £2,250.00 |

| 0.60% | Wealthify | £6.00 | £60.00 | £300.00 | £600.00 | £1,500.00 | £3,000.00 |

| 0.75% | Nutmeg | £7.50 | £75.00 | £375.00 | £750.00 | £1,275.00 | £2,150.00 |

Across the board, Invest Engine is the cheapest for a managed portfolio. Once your account value starts to grow you make significant yearly savings by being with them vs the competition when it comes down to fees. If you build your own DIY portfolio with invest engine you can literally avoid these fees altogether.

It’s important to note that you will have to pay fund fees for the underlying funds as well as a market spread fee of approximately 0.07-0.12% each year as well. The numbers above are solely platform fees and do not include these.

What Is A Robo Advisor Platform?

Imagine if you could have a personal financial advisor at your fingertips, ready to help you manage your investments 24/7. That’s essentially what a robo-advisor does – but instead of a human, it’s powered by advanced computer algorithms.

A robo-advisor is a digital platform that provides automated investment management services. Here’s how it works in simple terms:

- Understanding You: When you sign up, the platform will typically ask you a series of questions about your financial goals (e.g., buying a house, saving for retirement) and your risk tolerance (how comfortable you are with the ups and downs of the market).

- Creating a Strategy: Based on your answers, the robo-advisor will then craft an investment strategy tailored to you, usually by allocating your funds into a mix of stocks, bonds, and other assets.

- Automated Management: Once your money is invested, the platform keeps an eye on it, automatically rebalancing your portfolio when needed and ensuring it aligns with your investment goals. This happens without you needing to manually make any trades or decisions.

- Accessible Anytime: Most robo-advisors come with user-friendly apps or websites, allowing you to check on your investments, withdraw money, or adjust your goals at any time.

In a nutshell, a robo-advisor is like a digital financial assistant. It’s designed to make investing more accessible, taking out much of the guesswork and manual effort, all while often charging lower fees than traditional human advisors.

Robo Advisor vs Traditional Brokerage

There are a few main differences between Robo Advisors such as Moneyfarm and traditional brokerage platforms such as Trading 212.

Differences

- Robo advisors have a range of pre-built portfolios they will have you invest in based on your risk level and goals. With a traditional brokerage, you will usually have to build your own portfolio from scratch by buying individual stocks or ETFs.

- Robo Advisors are generally tailored towards beginner investors who want a passive way to invest. If you are investing in a pre-built portfolio you aren’t able to adjust your portfolio or make decisions yourself. These decisions are made by the investment managers at the robo-advisor platform. On a traditional brokerage, you can sell in and out of investments as the market landscape changes. You are in full control of your portfolio.

- Fees on robo-advisor platforms are generally much more expensive than traditional brokers. This is because they are charging a premium for actively managing your money. On a traditional brokerage, you are managing your money yourself and making your own decisions. Therefore the fees are usually less expensive.

- Many traditional brokerages will have actual investment advisors who can offer you specific advice based on your particular situation. Robo advisors have 5-10 preset portfolios and put you in one that is closest to your situation.

- Most robo-advisors have modern, easy-to-use apps and platforms that make it easy for new investors to onboard. Many old traditional brokerage apps are way behind when it comes to the features they offer. While most of them have made improvements to their apps they’re still behind the curve when it comes to ease of use.

Similarities

- Both traditional brokerages and robo advisors are giving you exposure to the market. They both allow you to invest your money in equities, bonds and more and benefit from compounding returns over long periods of time.

- Both are safe places to invest your money and are usually covered by the same regulatory bodies and guarantees.

- Both robo advisors and traditional brokers offer the same type of accounts such as general investment accounts, Stocks and shares ISAs etc.

Advantages & Disadvantages Of Robo Advisor Platforms

Advantages

- The biggest advantage of using a robo-advisor is the ability to invest passively based on your risk level. Once you have chosen a portfolio right for you, simply contribute to your portfolio monthly and that’s it. You don’t have to keep up to date with every stock or rebalance your own portfolio. The expert investment managers at these robo-advisor companies will do that for you.

- These platforms are modern and easy to use. You can get started building your portfolio directly from your phone.

- Gives you a diversified portfolio of assets without having to individually research certain ETFs or Stocks.

Disadvantages

- Fees can be expensive compared to using an app like Trading 212 and investing directly in the ETFs yourself. In fact, you could simply copy one of the portfolios from a robo-advisor and build it yourself in a brokerage that doesn’t have platform fees.

- Many of the robo-advisor platforms only have mobile apps. They don’t have a platform you can log in to online, which may be annoying for some investors.

- When using robo-advisors you are limited to the funds they provide on their platform. In many cases, there can be very limited options.

- Most of these robo-advisor platforms do not have phone support. Personally, as my portfolio approached the 6-figure mark, I wanted to be able to contact someone on the phone if anything ever went wrong.

Is a Robo Advisor Investment Platform Right For You?

Everyone has different needs when it comes to their finances. While robo-advisors are great for some people, they’re not the right choice for everyone. We would recommend using a robo-advisor platform if the following sounds like you:

- You’re a new investor and aren’t familiar with the markets

- You know you need to invest but don’t want it taking up too much time

- You’re not interested in picking individual stocks

- You want a fast easy way to track and monitor your investments

- You are just getting started and only have a small amount of money to invest

If you meet some or all of these criteria a robo advisor is a great choice for you. However, if you’re someone who wants to invest in individual stocks, has lots of money to invest and wants to build and manage their own portfolio, a traditional broker is a better option.

Important Things To Think About When Choosing A Robo Advisor

Hopefully, our guide has helped you find a robo advisor that suits you. If you’re not set on investing with our recommendations of Invest Engine or Moneyfarm, here are a few things you should consider when researching other brokers.

- Do you want to invest in Ethical or ESG invest investments? If so, does the platform have options for this?

- How much are the fees on the platform? High fees can significantly eat into your returns over time.

- Is the platform based in the UK

- Is the platform regulated by the Financial Conduct Authority (FCA)

- Is the platform covered by the Financial Services Compensation Scheme (FSCS)

- What are the historical returns of the platform portfolios

- What products does the platform offer (Stocks and Shares ISA, General Investment Account, etc)

- Does the platform offer an easy-to-use app for beginners?

Are Robo Advisor Platforms Safe?

Yes, Robo advisor platforms are just as safe as a regular brokerage. On Money Sprout, we aim to only review and recommend reputable investing platforms.

Every platform listed above is regulated by the Financial Conduct Authority (FCA) who ensures that these companies are following strict regulatory rules to keep your money safe.

They are all also part of the Financial Services Compensation Scheme (FSCS) which will guarantee up to £85,000 in a scenario where one of these companies goes out of business.

Final Thoughts

Here at Moneysprout, we recommend going with Invest Engine if you want a simple robo-advisor platform that provides risk-based portfolios as well as the opportunity to create your own DIY portfolio when you’re ready. Bonus, the fees are extremely cheap.

If you want a completely hands-off investing experience with a range of portfolio options, we would recommend Moneyfarm as they have some of the best returns out of the platforms above. While their fees are initially expensive, they do come down significantly as your portfolio grows.

Read More from Money Sprout: