In this review, we are going to take an honest look at Wealthify and the products they offer on their platform. We take a look at fees, fund performance and customer reviews for the service.

Like most financial platforms, Wealthify comes with its benefits and drawbacks. The platform caters to investors who want a hands-off approach to their investing. After reading this you will be able to make a decision on whether or not Wealthify is for you.

Quick Overview

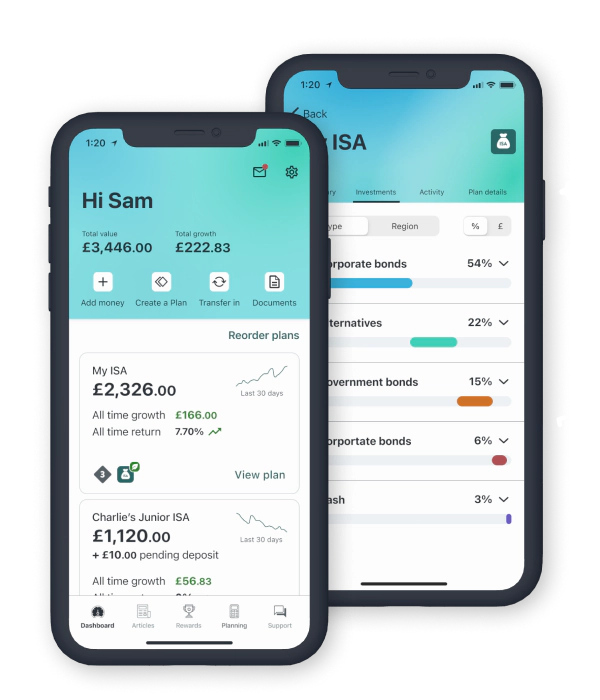

Wealthify is an easy to use Robo-advisor app with some of the cheapest platform fees for small portfolios. They have a sleak modern platform which is easy to use for new investors. However, if I had to pick any robo-advisor to use it would be Moneyfarm.

Wealthify is a popular robo-advisor investing platform offering a simple way to invest for people who don't want to manage their own portfolios. They have a team of expert investors managing your portfolio so you don't have to. Wealthify has some of the cheapest robo-advisor fees in the market for small portfolios.

- Cheap consistent fees for small portfolios

- Easy to use platform

- Offers General Investment, ISAs and Pensions

- Portfolio performance is worse than competitors in the market

Who Are Wealthify?

Wealthify is a distinguished name in the UK’s growing robo-advisory sector. This digital wealth management platform offers a refreshing and accessible approach to investing. Catering to both the seasoned investor and those taking their first steps, Wealthify provides a range of investment plans, including ISAs, general investment accounts, and junior ISAs.

Founded in 2016 and headquartered in Cardiff, Wealthify represents the new age of financial tech innovation. Even in its relative youth, the platform has been rapidly adopted, in part due to its simplicity, user-focused design, and commitment to making investment more accessible to the general public.

Reliability: Wealthify’s growing reputation is anchored in several key attributes:

Modern Approach: While newer to the scene compared to some stalwarts, Wealthify’s modern approach, harnessing the latest in technology and financial theory, has resonated with a new generation of investors.

Regulation: Like many of its peers, Wealthify is regulated by the Financial Conduct Authority (FCA) in the UK. This ensures that its practices and operations adhere to the high standards set by regulatory bodies, instilling confidence in its users.

Steadily Growing Client Base: The platform’s emphasis on demystifying the world of investing has garnered it a substantial and loyal user base. Their straightforward approach has won the trust of a segment of the market looking for both ease and reliability.

Transparency: Wealthify is noted for its clear pricing and open communication. With no hidden charges and a commitment to keeping clients informed, they epitomise the standards expected in the age of digital finance.

In summary, Wealthify’s rise in the robo-advisory domain is a testament to its commitment to simplifying investing, backed by technological prowess and a transparent ethos.

What Products Does Wealthify Offer?

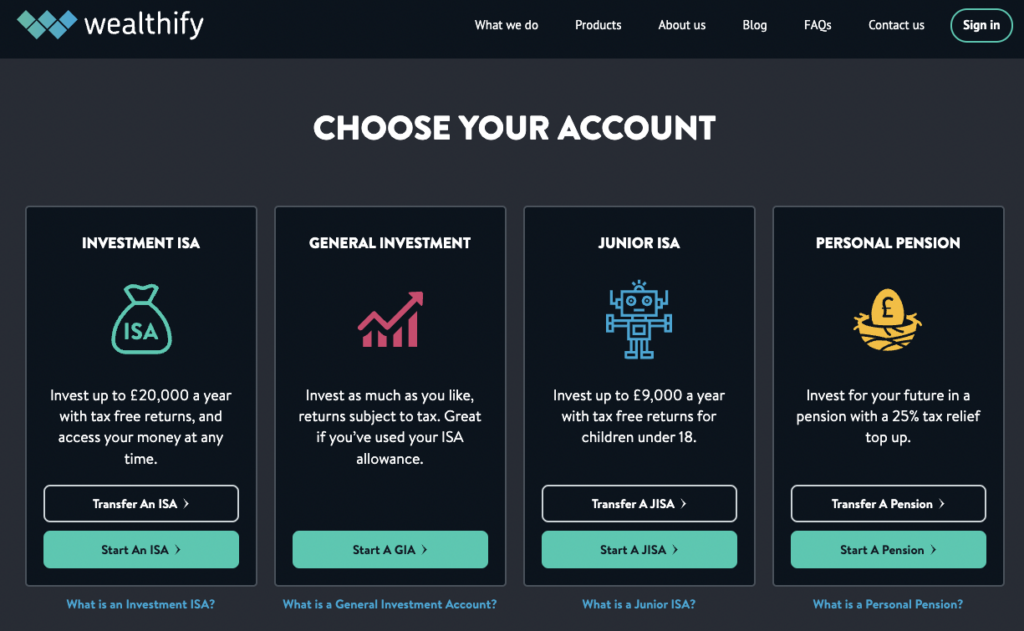

Wealthify has 4 account types available on their platform. They offer a General Investment Account, ISA, Junior ISA and a Pension.

General Investment Account

This is a general investment account with no tax benefits. Any gains over your £6,000 capital gains allowance will be taxed.

ISA

This account allows you to invest up to £20,000 per year without paying any tax on your profits, even when you withdraw. You pay no tax on capital gains, income, or dividends. Remember you can only have £20,000 spread across multiple ISAs in a single year.

Pension

You can manage your personal pension within Wealthify through a SIPP (Self Invested Personal Pension). Any money added to your pension will get a 25% bonus from the government, potentially more if you’re a higher-rate taxpayer. You can then manage your own pension investments.

Junior ISA

A junior ISA allows you to invest up to £9,000 for your child. Once they turn 18 they can access this money. It’s a great way to put money away for their first car, house deposit or university.

How Wealthify Investment Management Works

Wealthify is one of the newer robo-advisor financial platforms to hit the market. Rather than investing yourself, Wealthify will do it for you. This is great for people who know they should be investing but really don’t know where to get started

With Wealthify you can get started for as little as £1 (Except for their SIPP which has a minimum investment of £50). This is great in comparison to Nutmeg and Moneyfarm which require a minimum investment of £500.

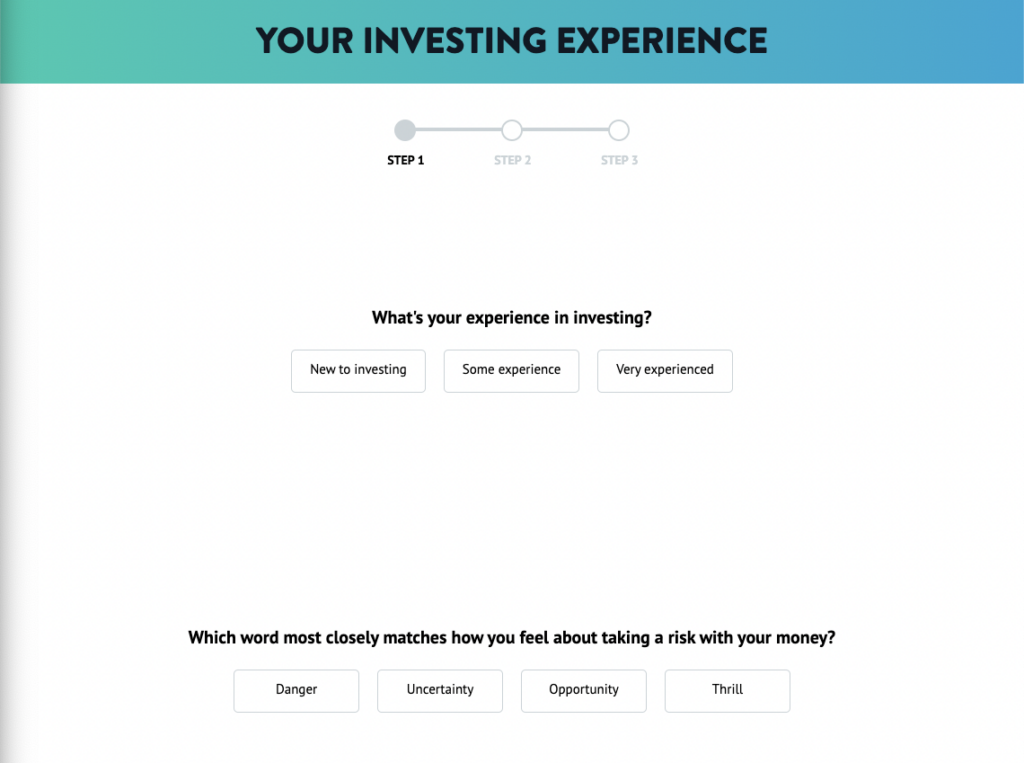

The Wealthify team of investment experts has developed an investment process that uses algorithms to select the best funds for each portfolio based on the client’s risk tolerance. When you sign up Wealthify will determine your appetite for risk and place you in one of 5 portfolios. These portfolios are continuously monitored by the investment team to ensure the allocations stay in line with the portfolio’s level of risk.

This is a simple way to start investing as it’s very passive. Simply choose your risk level, invest and let Wealthify do the rest.

Wealthify Onboarding Process

Wealthify has a quick and easy signup process. Here’s how it works.

The first step is choosing which type of account you want to set up. If you haven’t already opened an ISA in this tax year, you can open an ISA and invest up to £20,000 tax-free. Alternatively, you can open a general investment account, Junior ISA or Personal Pension.

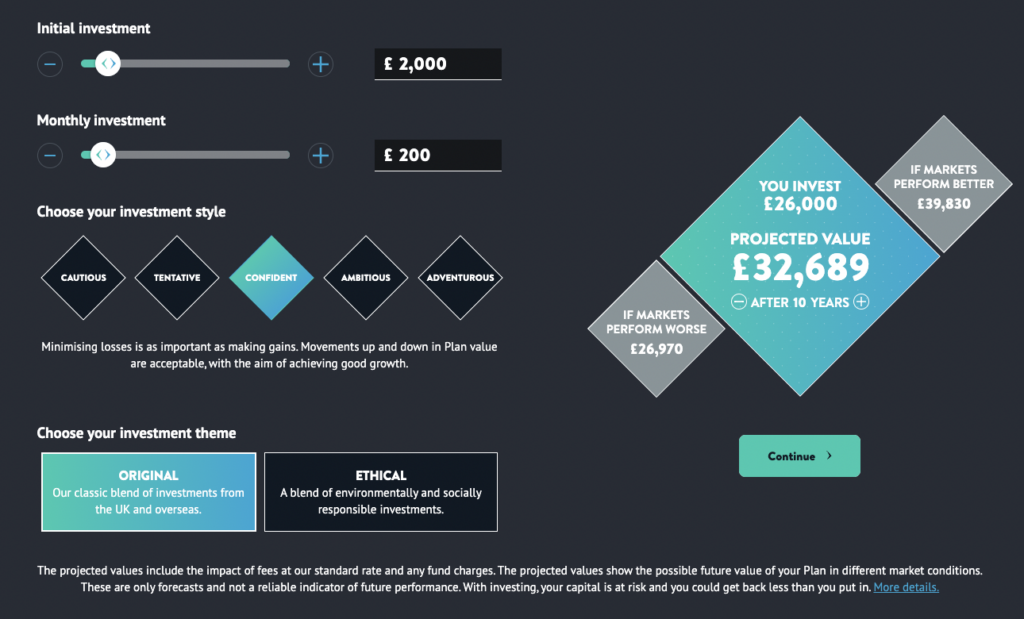

Once you have selected an account, you will be presented with the screen below. Here you can pick your initial investment and add a regular monthly investment if you intend to invest regularly.

Next, we have your investment style. This will determine the level of risk your portfolio takes on. Wealthify has 5 options to choose from; Cautious, Tentative, Confident, Ambitious and Adventurous. I chose Confident for this example.

Then you can choose your investment theme. Wealthify only has two to choose from at this stage, Orginal and Ethical. Most people will likely choose the original option but if you want to invest Ethically, you can go with the Ethical option.

You can then see on the right-hand side a projected view of your portfolio after X number of years based on three different market performance scenarios.

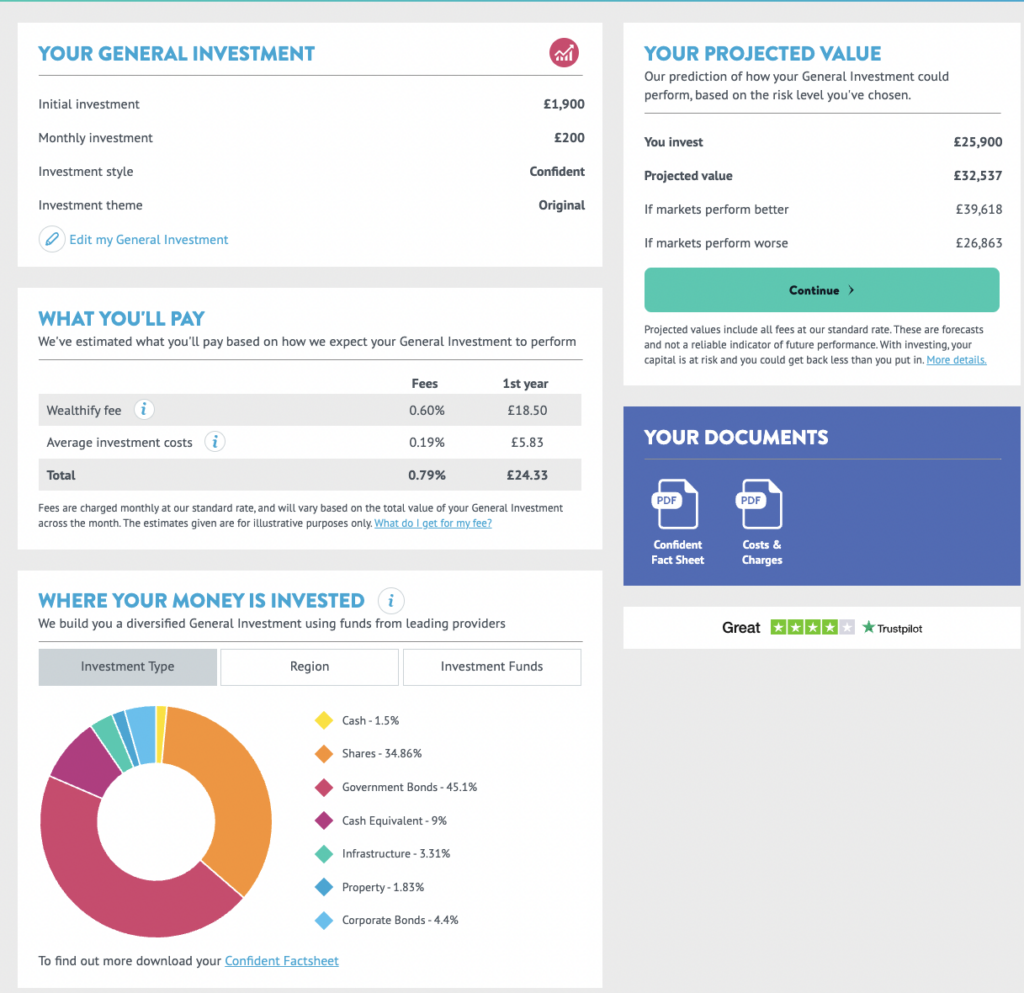

Once you have chosen all of your options, you will get an overview of your investment, fees, projected value and most importantly where your money is invested. I really like this overview screen before creating your account. It shows Wealthify’s dedication to transparency.

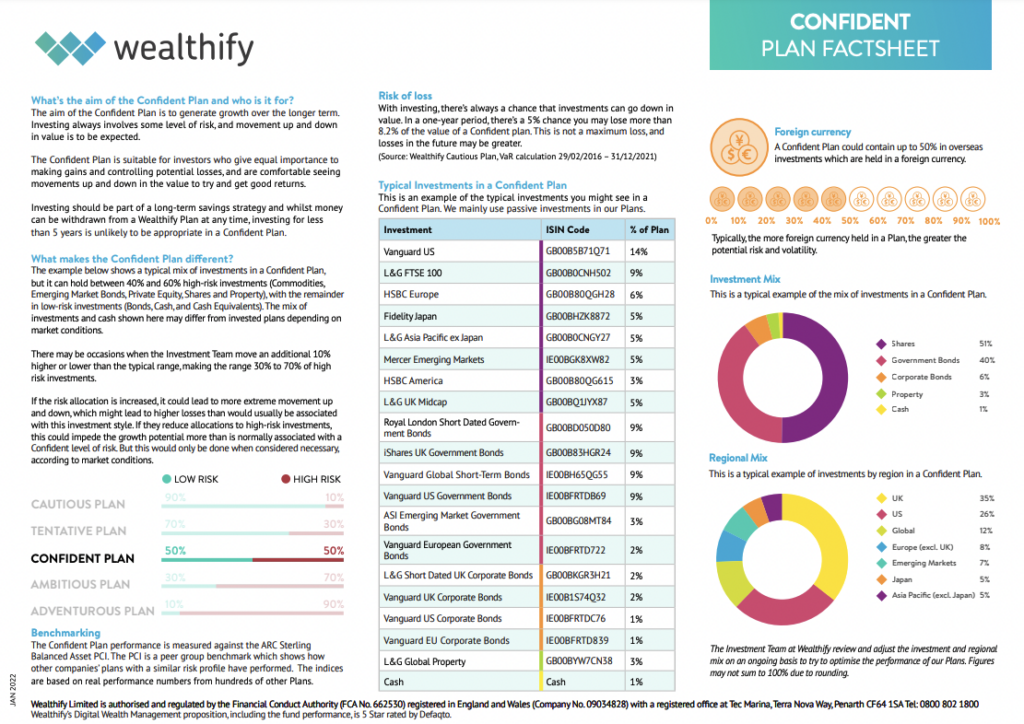

I have chosen the confident portfolio and can see an exact breakdown of where my money will be invested. We can see a breakdown of the asset classes we’re investing in as well as region and specific funds. Some similar platforms don’t reveal the funds you’re invested in, so it’s good to see Wealthify revealing this information.

They even provide a full fact sheet breaking down your investments with more information.

Once you have completed these steps, you are ready to officially sign up. Wealthify requires you to complete a suitability review before you can sign up with the platform. This ensures that you are in a financially viable place to start investing. For example, if you’re in a lot of consumer debt right now, you should pay that off before starting to invest. While Wealthify might lose customers by having this in place, it’s a good feature for customer safety.

If you complete this survey and are financially viable you will be able to join the platform and make your first deposit.

Wealthify Fees

When investing with Wealthify there are two fees to take into account. You have the Wealthify platform fee as well as fund fees to pay. This is similar to most other robo-advisory brokers.

| Original Portfolio | Ethical Portfolio | |

|---|---|---|

| Wealthify Fee | 0.6% | 0.6% |

| Average Investment Costs (Fund Fees) | 0.16% | 0.7% |

| Total Fees | 0.76% | 1.3% |

0.6% is reasonably good compared to the other digital wealth advisor platforms however Wealthify doesn’t offer any fee discounts at specific portfolio values. For example, Moneyfarm has a 0.75% fee up to £10k but at £100k the fee drops to 0.45% which would make Moneyfarm significantly cheaper for someone with a larger portfolio.

The Fund Fees are similar across all platforms as these fees come from the underlying funds held in your portfolio rather than from Wealthify.

Wealthify Investment Styles

Wealthify only has two selections when it comes to investment styles. While some might feel like there’s a lack of choice, I actually think that accomplishes the goal of these platforms. Keeping things as simple as possible for new investors is the best choice in my eyes. You can choose from their original portfolios or ethical portfolios.

Original Portfolios

Wealthify has 5 original portfolios to choose from which we mentioned above. These portfolios are built with low-cost pass investments such as Index funds and mutual funds. These plans are built with funds from leading providers such as Vanguard, Blackrock and more.

Ethical Portfolios

Wealthify also has 5 Ethical portfolios. Ethical portfolios allow you to invest while staying true to your values. Wealthify has partnered with best-in-class ethical fund providers allowing you to only invest in companies committed to having a positive impact on society and the environment.

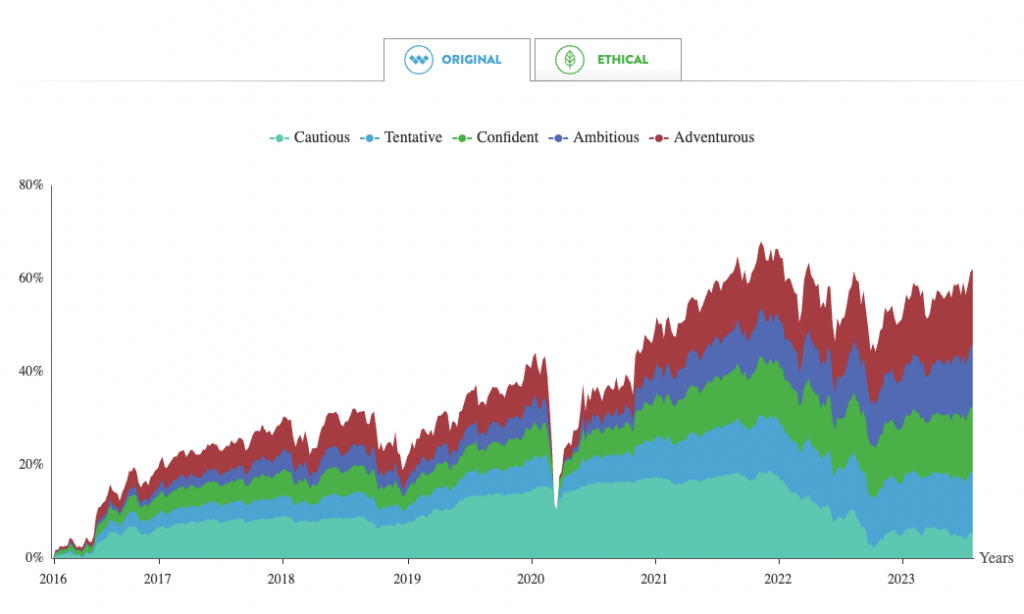

Wealthify Portfolio Performance

So, how are these portfolios created by experts performing? If we take a look at the data from the past five years we can see that the Lowest-risk portfolio actually lost money with returns of -2.9%, the medium-risk portfolio had returns of 10.7% and the high-risk portfolio had returns of 23.2%.

| Risk Level | Wealthify 5 Year Returns | Wealthify 5 Year Returns (Yearly Avg) | Fidelity World Index 5 Year Returns | Fidelity World Index (Yearly Avg) |

|---|---|---|---|---|

| Low | -2.9% | -0.59% | ||

| Medium | 10.7% | 2.05% | 54% | 9.02% |

| High | 23.2% | 4.26% |

We have benchmarked these portfolios against the Fidelity Index World Fund which is a low-cost broad index of companies from all around the world. It has significantly outperformed the Wealthify portfolios generating a return of 9.02% per year over the past 5 years compared to Wealthify’s high-risk fund which generated only 4.26% in the same time period.

If you’re not comfortable investing in your own funds utilising platforms like Wealthify can be a good option and is better than not investing at all but I believe better returns can be found simply investing in broad-based index funds yourself, even though there is more risk involved.

Using low-risk investing strategies allows you to protect the downside in a bear market however you also miss the gains when the market runs up as you can see from the results above. The low-risk fund actually lost money over the past 5 years.

Wealthify Portfolio Breakdown

Let’s take a look at a breakdown of Wealthify’s medium-risk and high-risk funds.

Medium Risk (Confident) Portfolio Breakdown

The medium-risk portfolio is very risk-averse with only 35% of the portfolio being invested in shares. 45% of your investment is into government bonds and the rest in other low-risk assets. While Wealthify calls this a “Confident” portfolio, in my opinion, it’s n a very low-risk portfolio.

| Asset | % Allocation |

|---|---|

| Cash | 1.5% |

| Shares | 34.86% |

| Government Bonds | 45.1% |

| Cash Equivalent | 9% |

| Infrastructure | 3.31% |

| Property | 1.83% |

| Corporate Bonds | 4.4% |

High Risk (Adventurous) Portfolio

Even though this is a “High Risk” portfolio the allocation is pretty conservative. Only 69% of the portfolio is allocated toward shares whereas the rest of the portfolio is allocated toward more risk-averse assets.

Personally, as I’m early in my investing career, I would want more allocated towards shares than this. As we showed above, the Fidelity All World Index massively outperformed this portfolio, in part due to this portfolio’s risk-averse allocations.

| Asset | % Allocation |

|---|---|

| Cash | 1.5% |

| Shares | 69.74% |

| Government Bonds | 12.5% |

| Cash Equivalent | 6% |

| Infrastructure | 6.61% |

| Property | 3.65% |

Wealthify Reviews

Wealthify has over 2,000 reviews on Trustpilot with a rating of 4 stars. For a financial platform, this is a fairly good rating.

The reviews are made up of 74% 5-star and 10% 4-star reviews with only 9% of reviews coming in at 1-star.

The majority of positive reviews talk about great customer service and the simplicity of the platform for new investors.

Most negative reviews talk about poor returns on their investment. Many investors who have been in their low-risk fund for the past 5 years would have lost money while the rest of the market grew significantly.

Wealthify vs. The Competition

Some of the biggest Wealthify competitors are Moneyfarm and Nutmeg. Moneyfarm is our preferred robo-advisor so let’s take a look at their returns vs Moneyfarm.

As you can see below, Moneyfarm has better performance than Wealthify in medium and high-risk funds. Wealthify beats Moneyfarm on the low-risk fund but both still lost money over the past 5 years.

| Risk Level | Wealthify 5 Year Returns | Wealthify 5 Year Returns (Yearly Avg) | Moneyfarm 5 Year Returns | Moneyfarm 5 Year Returns (Yearly Avg) |

|---|---|---|---|---|

| Low | -2.9% | -0.59% | -6.9% | -1.4% |

| Medium | 10.7% | 2.05% | 12.2% | 2.3% |

| High | 23.2% | 4.26% | 28% | 5.1% |

In terms, of fees, Wealthify has some of the best in the Robo-advisor market for lower-value portfolios at 0.6%. The Wealthify fee is flat for everyone, no matter what your portfolio size is whereas other platforms offer discounts on larger portfolios.

If I had to pick any Robo-advisor platform to use, it would be Moneyfarm.

Who Should Use Wealthify

Wealthify is an amazing platform for new investors with small portfolios. If you’re looking to passively invest with the help of expert investment advisors it’s a good choice. The app is simple to use and keeping track of how you’re portfolio is doing is easy.

However, I do feel like all of the portfolios on offer are quite conservative. If you are early in your investing career and want to allocate most of your portfolio to equities, that’s not an option with Wealthify. If you want to do that, you should build your own portfolio on Hargreaves Lansdown or Trading 212.

If you have a larger portfolio and want to benefit from cheaper fees and still use a passive investing platform, I would recommend Moneyfarm.

Final Thoughts

Ultimately Wealthify is a simple easy-to-use platform for investors who are new to the market and don’t want to deal with buying their own stocks and funds. However, if you really want to go with a robo-advisor platform that manages a portfolio for you, I would recommend going with Moneyfarm.

Moneyfarms medium and high-risk portfolios have also performed better over the past 5 years. While their fees are slightly more expensive in the early days of your portfolio, it doesn’t take long to reach the same fees as Wealthify and it eventually gets cheaper.

Read More From Money Sprout: