If you’re looking to work out your current net worth you’ve come to the right place. Simply add your assets and liabilities to the calculator below and it will automatically calculate your current net worth.

How To Use The Net Worth Calculator

To use the calculator, simply fill in the fields above with your assets and liabilities. Below is a brief explanation of each of the calculator fields.

Assets

Property – This includes your house or any rentals/other properties you own. This is the value these properties would be worth if you were to sell them today.

Cash Accounts – This includes any cash you have in current accounts, savings accounts and cash.

Investment Accounts – This includes your investment accounts such as Stocks and Shares ISAs, Lifetime ISAs, General Investment Accounts etc.

Pension – This includes your pension value. This may be a personal pension or your workplace pension.

Vehicle Value – If you have a vehicle add the value that it could be sold at today into this field.

Other Assets – If you have any other valuable assets you can put a value on add it here. I would include items such as luxury watches, precious metals, and expensive jewelry. Be conservative with resale prices on these items.

Liabilities

Mortgage Balance – If you have mortgages on your properties, add the remaining mortgage balance to this field.

Credit Card Debt – If you have credit card debt, add the total balances of all your cards here.

Personal Loans – If you have any personal loans add the remaining balance to this field.

Student Loans – If you have any student loans add the remaining balance to this field.

Car Loan – If you have a loan on your car, add the remaining balance to this field.

Other Liabilities – If you have any other liabilities please add them to this field.

When you fill this information in, the calculator will automatically calculate your net worth.

Easily track your net worth in google sheets with these easy to use template. Add all of your banks accounts, stock accounts, properties and liabilities. Track how your net worth trends month over month so you can keep on top of your finances.

What Is Net Worth?

Net worth is like a financial score that tells you how much money you would have if you sold everything you own and paid off all your debts. Think of it as a way to see how you’re doing money-wise at a certain point in time.

Here’s a simpler explanation:

- What you own (Assets): This includes the money in your savings account, your car, your house, and anything else of value. Add up the value of all these things.

- What you owe (Liabilities): This includes any debts like your credit card balance, car loans, or mortgage. Add up all the money you owe.

- How to Find Your Net Worth: Subtract what you owe from what you own. If the number is positive, great! You own more than you owe. If it’s negative, it means you owe more than you own.

Example:

- What you own: £10,000 in the bank + £15,000 car + £5,000 in other belongings = £30,000

- What you owe: £2,000 on credit cards + £10,000 car loan = £12,000

- Your net worth: £30,000 – £12,000 = £18,000

In this easy example, if you have £30,000 worth of stuff and money but owe £12,000, your net worth is £18,000. It’s good to know your net worth so you can make smart money choices and plan better for the future!

Keep in mind, that having more assets and fewer liabilities is the key to achieving a positive net worth and financial stability. Keep an eye on this number to know how you’re doing financially!

You can track your net worth over time to see how it fluctuates. On a yearly basis, you should aim to increase your net worth. Some years your net worth may take a hit but over time it should grow year over year.

If you are utilising a budget and saving/investing at least 20% of your income your net worth will automatically grow in the long term.

Net Worth Statistics UK

- The mean net worth of someone in their early career (25-34) is £68,000 in the UK.

- People who are about to retire or have just retired (65 to 74) have a mean net worth of £552,300.

- People in the South East have the highest median net worth in the UK coming in at £235,900.

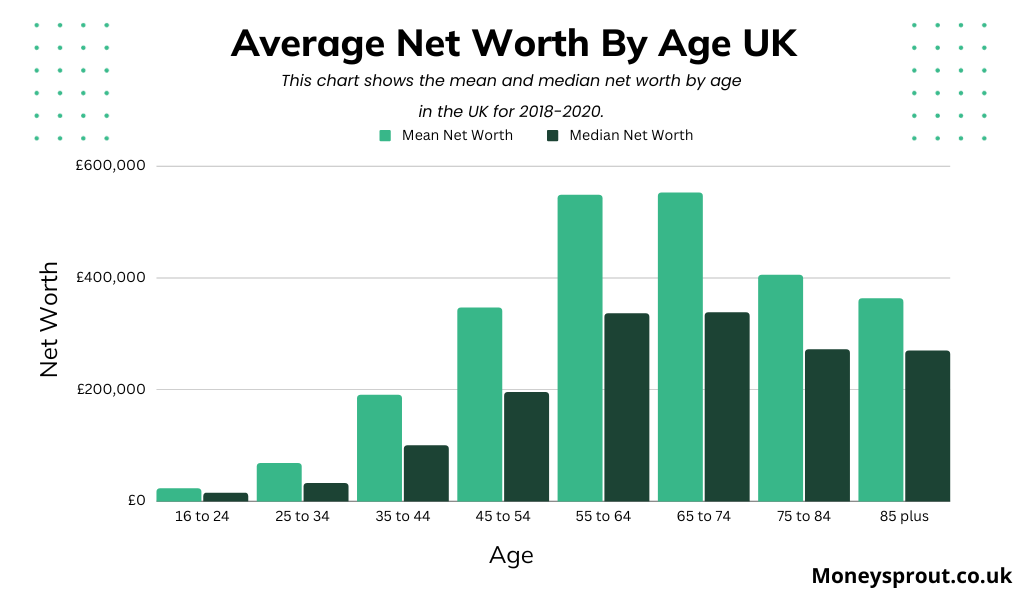

Average Net Worth By Age In The UK

Now you know your net worth, you can see how you compare to the average for your age group in the UK. This is based on the most recent data for 2018 to 2020 from the ONS. We will update for 2023 once the data is released.

| Age | Mean Net Worth | Median Net Worth |

|---|---|---|

| 16 to 24 | 22,500 | 15,100 |

| 25 to 34 | 68,000 | 32,400 |

| 35 to 44 | 190,000 | 100,200 |

| 45 to 54 | 346,300 | 195,200 |

| 55 to 64 | 548,100 | 336,300 |

| 65 to 74 | 552,300 | 338,100 |

| 75 to 84 | 405,100 | 271,900 |

| 85 plus | 362,800 | 269,600 |

When analyzing net worth data, the mean is the average wealth, calculated by dividing the total wealth by the number of individuals, which can be skewed by extremely wealthy individuals; the median, however, is the middle value of sorted net worths, presenting a more accurate representation of the typical individual’s wealth in uneven distributions.

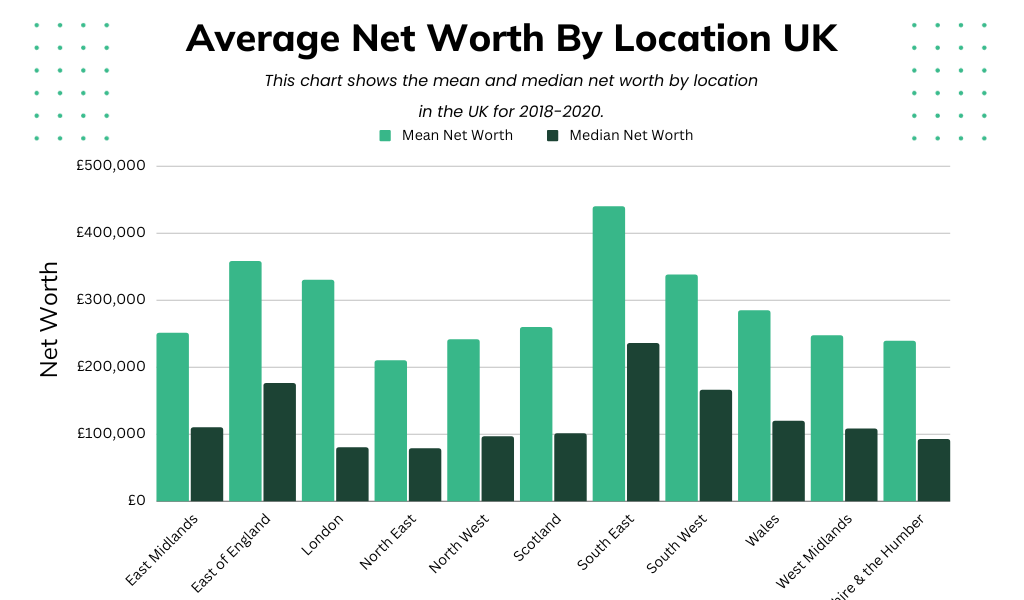

Average Net Worth By Region In The UK

Below you can see the average net worth by region in the UK. You can see how you stack up compared to the region you live.

| Region | Mean Net Worth | Median Net Worth |

|---|---|---|

| East Midlands | 250,800 | 110,300 |

| East of England | 358,000 | 176,200 |

| London | 330,100 | 80,400 |

| North East | 209,800 | 78,800 |

| North West | 241,200 | 96,700 |

| Scotland | 259,500 | 101,200 |

| South East | 439,500 | 235,900 |

| South West | 337,700 | 166,100 |

| Wales | 284,300 | 119,800 |

| West Midlands | 247,000 | 108,500 |

| Yorkshire & the Humber | 239,100 | 92,800 |

When analyzing net worth data, the mean is the average wealth, calculated by dividing the total wealth by the number of individuals, which can be skewed by extremely wealthy individuals; the median, however, is the middle value of sorted net worths, presenting a more accurate representation of the typical individual’s wealth in uneven distributions.

Easily track your net worth in google sheets with these easy to use template. Add all of your banks accounts, stock accounts, properties and liabilities. Track how your net worth trends month over month so you can keep on top of your finances.

Read More From Money Sprout: