Barista FIRE Calculator

How To Use The Barista FIRE Calculator

Using the Barista FIRE Calculator is easy. Simply fill in the 10 inputs with your information and the calculator will automatically calculate your Full FIRE age and Full FIRE age if you stayed in your normal job.

Confused about some of the inputs/outputs? Here’s what they mean:

Inputs

Age – This is your current age or the age you plan to start saving towards Barista FIRE

Current Annual Income – How much you are currently making in income after taxes.

Current Annual Spending – How much you are currently spending on an annual basis.

Current Savings/Investments – How much you currently have saved and invested in your brokerage accounts.

Barista FIRE Income – This is how much you think you will make in your part-time job when you move into semi-retirement.

Annual Spending When Retired – How much you plan to spend each year when you go into sem-retirement.

Annual Return On Investment – This is the average return you expect to get on your investments.

Safe Withdrawal Rate – This is the % of funds you can expect to safely withdraw from your portfolio each year without them running out. Most people will use 3 or 4% for this calculation. You can view the study on the 4% rule here.

Planned Retirement Age: This is the age you plan to transition into Barista FIRE/Semi-retirement. During this period you will draw a portion of your income from your portfolio and the rest from your part-time job.

Inflation: Inflation will reduce your spending power as you age. Adjusting this number will adjust your results into inflation-adjusted £’s with the same spending power as today.

Once you have input all of this information, you will see the age you will reach full FIRE as well as your Full FIRE age if you just stayed at your job. Sometimes it’s worth staying at your job for an extra couple of years as that is all it would take to reach Full FIRE where you could retire completely.

Outputs

Full FIRE Age – This is the age you will reach Full FIRE after you move into semi-retirement. This is only possible if your portfolio is large enough to sustain the withdrawals from your portfolio and grow at the same time.

FIRE Age If You Stayed At Your Job – This is the age you would reach full FIRE if you just stayed at your job and didn’t go into semi-retirement.

Required Portfolio For FIRE – This is how much you need in your portfolio to go Full FIRE.

Chart

Dotted Line – The dotted line shows you your portfolio if you continue contributing to it instead of going Barista FIRE.

Green Line – This shows your portfolio value over time based on your contributions and withdrawals.

Yellow Line – This is the FIRE number you need to reach to hit full FIRE.

Check out our full guide to Barista FIRE and how you can get there as fast as possible.

What Is Barista FIRE?

Barista FIRE refers to a lifestyle and financial strategy where individuals achieve a level of financial independence that allows them to leave their traditional full-time jobs. However, instead of fully retiring, they take on part-time or more flexible work (often likened to a barista’s job at a coffee shop) to cover their ongoing expenses, maintain social interactions, or just get free healthcare.

With Barista FIRE you will cover a portion of your expenses with withdrawals from your portfolio while making up the shortfall with your part-time job.

In essence, Barista FIRE is a middle ground between working full-time and fully retiring, allowing people to enjoy some benefits of retirement without completely stopping work.

How Barista FIRE Works

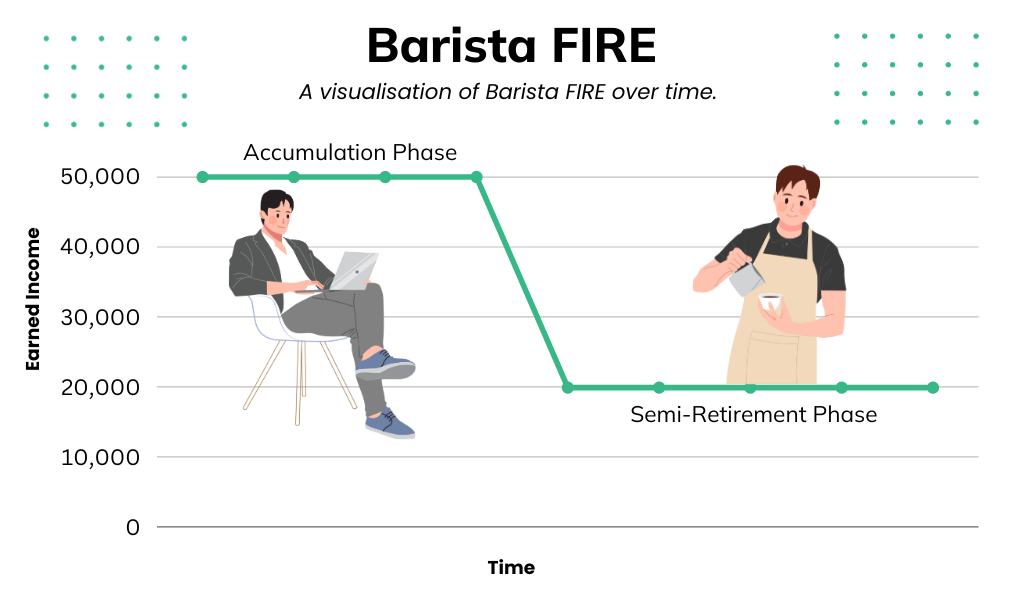

There are two main steps to the Barista FIRE method, the accumulation phase and the semi-retirement phase.

Accumulation Phase

During the Accumulation phase, you will be working full-time, saving and investing as much of your income as possible to reach your Barista FIRE number. This part of the process follows all the same principles as FIRE. You are living a frugal lifestyle to reach your goal as fast as possible.

Semi-Retirement Phase

Once you reach your Barista fire number you can leave your full-time job and start working part-time. Most people will withdraw 3-4% of their portfolio each year while supplementing the remaining income with a part-time job.

The main problem with Barista FIRE is that you will never reach full FIRE. As your portfolio is only big enough to provide you with a portion of your required income, you will always need a second source of income. The only other option is to downsize your lifestyle when you fully retire. This could be an option if you have paid off your mortgage and have no other debts.

How To Calculate Your Barista FIRE Number

Calculating your Barista FIRE number is simple. The formula is similar to the traditional FIRE calculation with a slight modification to account for your part-time work.

To calculate your traditional FIRE number you simply multiply your annual expenses by 25.

FIRE = Annual Expenses x 25

Example: £50,000 x 25 = £1,250,000 <– FIRE Number

To calculate your Barista FIRE number we take our annual expenses and deduct the salary from our part-time job. Ensure you know the salary you can expect to earn as a part-time employee.

Barista FIRE = (Annual Expenses – Part-Time Income) x 25

Example: (£50,000 – £20,000) x 25 = £750,000 <– Barista FIRE Number

In the example above you need £50,000 per year for expenses and will earn £20,000 from your part-time job. Therefore your Barista FIRE number is £30,000 x 25 which is £750,000 invested. You can safely withdraw 4% a year from your £750,000 portfolio while earning the extra £20k from your job.

Final Thoughts

This calculator should have helped you to figure out how much you need in your portfolio before you can transition into semi-retirement. We would only recommend going Barista FIRE when your portfolio is large enough that it still grows, even when you are withdrawing from it every year. That way you should still eventually hit Full FIRE.

Read More From Money Sprout: