FIRE Calculator

How To Use This FIRE Age Calculator

To use this calculator fill in the 9 inputs and the calculations will automatically run to give you your FIRE age and number. Here’s exactly what everything on the calculator means:

Inputs

Age: The age you are currently or the age you plan to start working towards FIRE

Current Annual Income: This is your current after-tax annual income. You can figure this out by multiplying the monthly salary you receive in your bank by 12 or looking at your P60 for your yearly net income. You can also add any income you get from side hustles etc here.

Current Annual Spending: This is how much you are spending on a yearly basis. You can take your monthly expenses and multiply them by 12 but also remember to think about those one-off purchases such as holidays that may only happen once a year.

The difference between current annual income and annual spending is how much you are saving in your portfolio each year. You can see this figure calculated under “Current Annual Savings”.

Current Savings/Investments: This is the current value of your investment portfolio/savings.

Annual Spending When FIRE’d: This is how much you plan to spend each year when you retire.

Annual Return On Investment: This is the average return you expect to get on your investments.

Safe Withdrawal Rate: This is the % of funds you can expect to safely withdraw from your portfolio each year without them running out. Most people will use 3 or 4% for this calculation. You can view the study on the 4% rule here.

Planned Retirement Age: This is the age you plan to retire at. At your planned retirement age, the calculator assumes you stop earning income. You can set this to the traditional retirement age of 65 if you are unsure when you will retire.

Inflation: Inflation will reduce your spending power as you age. Adjusting this number will adjust your results into inflation-adjusted £’s with the same spending power as today.

Once you have input all of this information, you will receive the age you can expect to reach your FIRE number and the Year you will reach it.

Outputs

Age to FI/RE: This is the age you are expected to reach your FIRE number.

FI/RE In Year: This is the year you will reach your FIRE number.

Current Annual Savings: This is how much you are saving yearly.

Current Savings Rate: % Of Your Income that you are currently saving.

Required Saving For FI/RE: This is your FIRE number. How much you will need to safely retire early.

Check out our complete guide to reaching FIRE as fast as possible.

What Is FIRE?

FIRE, an acronym for “Financially Independent, Retire Early,” is a modern philosophy in personal finance that champions the ideals of living frugally, saving aggressively, and investing wisely to achieve the dream of early retirement.

Drawing inspiration from the foundational concepts in the 1992 book “Your Money or Your Life” by Vicki Robin and Joe Dominguez, the FIRE movement pushes individuals to reevaluate their relationship with money.

By living well below their means and channeling a significant portion of their income—often more than 50%—into investments, proponents aim to build a nest egg that allows them to step away from traditional employment years, if not decades, earlier than the norm.

While the allure of financial freedom and a reimagined retirement resonates with many, the FIRE approach is not without its challenges. Critics point to potential hurdles like healthcare costs, market volatility, and the extreme frugality required, suggesting that the movement may not be feasible for everyone.

How FIRE Works

Now we know exactly what FIRE is, let’s take a look at the numbers behind it and how it actually works.

Rule Of 25

The Rule of 25 is based on the 4% Safe Withdrawal Rate (SWR), a widely recognized principle in retirement planning. The 4% SWR suggests that if you withdraw 4% of your retirement savings in the first year and adjust for inflation in subsequent years, there’s a high probability your savings will last for 30 years or more.

To determine how much you need to save to safely withdraw your annual expenses without depleting your nest egg, you take your annual expenses and multiply them by 25 (the inverse of 4%).

If you want to be more conservative with your calculations, you can adjust to a safe withdrawal rate of say 3%. This would require you to have a nest egg of 33x Annual Expenses rather than the traditional 25.

The Magic Of Compound Interest

Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.

Albert Einstein

At first glance, you may think it’s impossible to save 25x your annual income in any reasonable amount of time. That’s where investing and the power of compound interest come in. You will be putting your money to work for you.

Generally, we assume a rate of 7% growth in the Stock Market. Over the past 50 years, the S&P 500 has grown by approximately 10% per year. We use 7% to be conservative and account for inflation. It’s important to note that past results don’t guarantee future results however it’s a rough indicator of what we can expect.

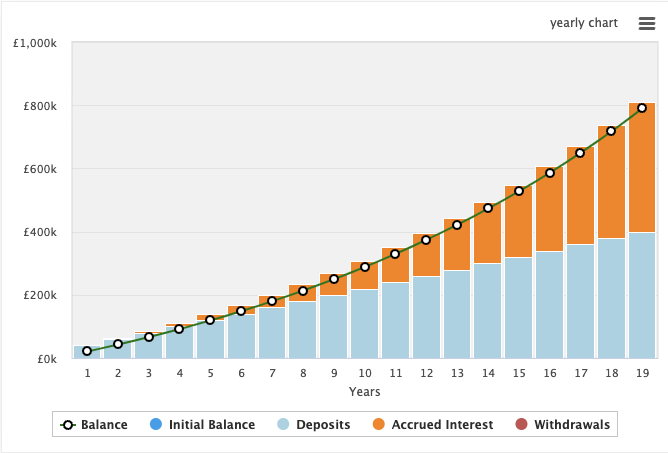

Let’s say you earn £50,000 per year after tax and want to retire with a £30,000 per year income. You currently spend £30,000 per year and save the other £20,000.

Following the FIRE calculation, you would need £750,000 invested to hit FIRE and retire.

Investing £20,000 a year would take you 19 years to reach a nest egg of £790k. Approximately £380,000 of that would be from your contributions and the other £410,000 would come from portfolio growth in the market.

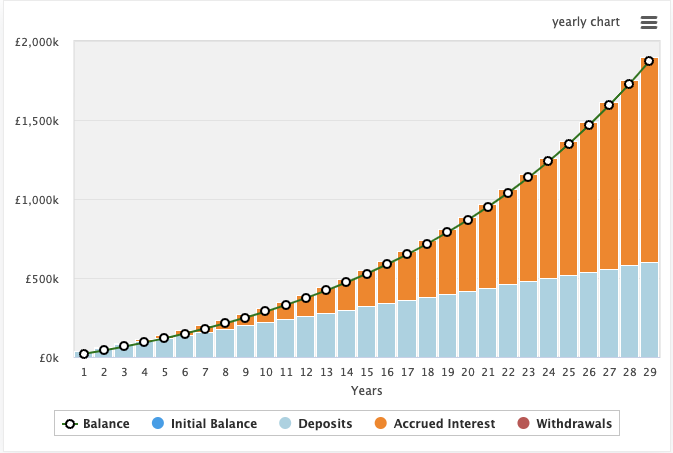

If decided once you reached this level you wanted to work for another 10 years and continue investing your portfolio would reach a massive £1,876,195 at a 7% rate of growth. If you started at. 25 and invested to 54, you could retire with a massive nest egg.

The longer you leave your money to compound the crazier the returns get. This is the chart for investing £20,000 per year for 29 years.

This is the secret to building large amounts of wealth over long periods of time. It’s not exciting, it’s not going to make you rich overnight but it is a tried and tested process to generate wealth over a long period of time.

How To Get Started Working Towards FIRE

The steps to reach FIRE are simple to understand but take discipline to execute over long periods of time.

- Create a budget for yourself and dedicate a large portion of it towards your investment account each month.

- Work out how much you need to invest each month to reach your FIRE number by your desired age. You can do this using our compound interest calculator.

- Consistently invest this amount monthly into an investment account. We have a full guide on the best investment accounts in the UK. Most FIRE investors take a simple approach to investing by buying broad-market, low-cost index funds. You should use tax-advantaged accounts such as your pension and ISAs so you can invest tax-free.

- The last step is simply to wait until you reach your target FIRE number. How aggressively you’re investing now will determine how long it will take to reach FIRE.

Final Thoughts

Hopefully, you have found this FIRE Age calculator useful. I would love to hear some of your FIRE numbers in the comments to get an idea of how much different people need to go FULL FIRE.

If you want to see our full guides to each type of FIRE check them out below: