Do you want to retire early and live a life of luxury in retirement? Fat FIRE could be the route for you. People in the FIRE movement aim to retire earlier than the traditional age of 65 with a nest egg large enough to sustain themselves without working.

Fat FIRE aims to do the same but with a significantly larger nest egg than traditional FIRE. Most are aiming for at least £100,000 in yearly income during retirement, which means you need a portfolio of £2.5 Million or more.

What Is Fat FIRE?

In the context of the FIRE movement, “Fat FIRE” represents a luxurious version of early retirement. The basic principle of FIRE revolves around saving aggressively and investing wisely to retire earlier than the traditional age.

Fat FIRE takes it a step further by targeting not just early retirement, but a retirement filled with more financial comforts and extravagances.

Those aiming for Fat FIRE seek to accumulate a larger nest egg, enabling them to maintain or even elevate their current standard of living in retirement.

Instead of cutting costs to the bone and living frugally, Fat FIRE adherents prioritize building a significant wealth portfolio that allows for regular vacations, dining out, and other indulgences that might be curtailed in a more traditional FIRE approach.

As we mentioned earlier, most people aiming at “Fat FIRE” are aiming for £100,000 or more in income per year from their portfolio. However, it all depends on the lifestyle you desire when you get to retirement.

How Fat FIRE Works

Fat FIRE operates under the core principles of the traditional FIRE framework. The goal remains to amass a financial portfolio, but rather than aiming for a portfolio that would cover basic expenses and a simple life, Fat FIRE aims for a portfolio that can sustain a luxurious lifestyle.

The distinction between Fat FIRE and Traditional FIRE centers on the journey and the envisioned post-retirement lifestyle. Fat FIRE enthusiasts, while still value-conscious, do not adhere to the extreme frugality that characterizes Lean FIRE. They might choose to live in costlier areas, indulge in finer dining, or travel more extensively.

Opting for Fat FIRE ensures not just coverage of basic expenses like housing, food, and transport, but also a buffer for additional luxuries and comforts. It’s the choice for those who wish to retire early without compromising the lifestyle they’re accustomed to.

If you’re someone who wants to maintain or even enhance your current way of life in retirement, then Fat FIRE might be your ideal path. Now, let’s delve into strategies to achieve your Fat FIRE number.

How To Calculate Your Fat FIRE Number

Calculating your Fat FIRE number uses the same formula as traditional FIRE. 25 times your yearly expenses. However, with Fat FIRE a lot of people will aim to spend more in retirement than they do while working.

First, you will need to calculate your expected yearly spending in retirement. This should include everything you plan to spend on:

- Housing costs

- Eating out

- Traveling

- Cars and Transport

- etc

You should be able to envision your life in retirement and work backward from there. Fat FIRE allows for a much higher standard of living than other FIRE types. Once you have your annual spending number you can use the FIRE calculation to work out your required portfolio size.

Fat FIRE Number = Annual Spending In Retirement x 25

If you need £100k per year to live a life without sacrifices you would need a portfolio of £2.5 Million.

£100,000 x 25 = £2,500,000 portfolio value

If you are currently in a reasonably high-income job and are early in your career reaching this size of a portfolio is doable but will require some sacrifice in the accumulation phase.

Some people who go after Fat FIRE are already high achievers and have a very large income which allows them to live to a high standard while also saving for a Fat FIRE retirement. Many people also aim to Fat FIRE through the sale of a business. We’ll talk more about this later.

Fat FIRE Calculator

First, calculate how much you will need yearly to live a “Fat” lifestyle and then add it to the calculator below.

How To Reach Fat FIRE

Reaching Fat FIRE is going to require you to use the same principles on would to reach any level of fire. You should be diligent with a budget and invest consistently each month.

The big difference in reaching a Fat FIRE portfolio is that you need to invest more. Anyone pursuing £100k per year in retirement income will need a strong income throughout their career.

Many people in the Fat FIRE community work in high-paying fields such as Finance, Law or own their own businesses. This allows many of them to live a good lifestyle while still investing enough to reach a Fat FIRE portfolio at retirement.

If you haven’t got a high-paying career this should be your first move. Whether it’s working your way into a field that can eventually pay you enough or starting your own business. Income is important.

Below are the basic steps you need to follow to reach Fat FIRE:

- Create a budget for yourself and dedicate a large portion of it towards your investment account each month.

- Work out how much you need to invest each month to reach your FIRE number by your desired age. You can do this using our compound interest calculator.

- Consistently invest this amount monthly into an investment account. We have a full guide on the best investment accounts in the UK. Most FIRE investors take a simple approach to investing by buying broad-market, low-cost index funds. You should use tax-advantaged accounts such as your pension and ISAs so you can invest tax-free.

- The last step is simply to wait until you reach your target FIRE number. How aggressively you’re investing now will determine how long it will take to reach FIRE.

Selling A Business To Reach Fat FIRE

Another route many people take to reach Fat FIRE is selling their business. While building their business they may not make a huge income that they can invest monthly but they end up selling the business for a lump sum.

If you can exit your business close to your Fat FIRE number this goes a long way to allowing you to retire.

I’m essentially running a hybrid strategy of investing with my monthly salary but also hoping I can exit my business at some stage down the line which will allow me to FIRE much quicker.

Benefits Of Fat FIRE

- Increased Financial Security: One of the main appeals of Fat FIRE is the higher level of financial security it offers. By amassing a larger portfolio than what’s typically aimed for in traditional FIRE strategies, Fat FIRE followers have a bigger financial cushion. This can help in counteracting the effects of inflation, unexpected expenses, or downturns in the market.

- Lavish Lifestyle: Fat FIRE allows retirees to maintain or even enhance their current standard of living post-retirement. Whether it’s luxury travel, high-end hobbies, or gourmet dining, those who achieve Fat FIRE are not as constrained by budgets compared to their Lean FIRE counterparts.

- Flexibility in Spending: With a larger financial reserve, those who achieve Fat FIRE have the freedom to make choices without the constant need to track every penny. This could be in the form of spontaneous trips, philanthropic endeavors, or significant purchases without derailing their financial well-being.

- Healthcare and Other Essentials: A substantial retirement fund ensures that one can afford quality healthcare, which becomes more crucial as we age. Whether it’s routine medical check-ups, specialized treatments, or long-term care, being Fat FIRE provides peace of mind knowing that funds are available.

- Legacy and Generational Wealth: Those who achieve Fat FIRE have the potential to leave a substantial inheritance for their heirs, ensuring financial security for subsequent generations. Moreover, they can also take up philanthropic causes, donate generously to charities or set up trust funds.

Drawbacks Of Fat FIRE

- Extended Working Years: To achieve the financial milestones of Fat FIRE, one might need to stay in the workforce longer than they would with a traditional or Lean FIRE approach. This could mean sacrificing earlier years of potential retirement or dealing with job-related stress for an extended period.

- Increased Risk of Lifestyle Inflation: With more wealth comes the temptation to upgrade one’s lifestyle continually. This could lead to continuously moving the goalpost, as increasing expenses might require even more substantial funds to maintain the same lifestyle in retirement.

- Mental and Emotional Strain: The pressure to achieve the lofty financial goals associated with Fat FIRE can be overwhelming. This could lead to burnout, increased stress, and anxiety, affecting one’s mental health and overall well-being.

- Overemphasis on Financial Goals: While financial independence is a worthy goal, focusing too much on achieving Fat FIRE might lead some to neglect other essential aspects of life, like relationships, health, or personal growth.

- Potential for Complacency: With a significant nest egg, there might be less motivation to stay financially educated or aware. This complacency could be detrimental, especially if economic conditions change or if unforeseen expenses arise.

Other Types Of FIRE

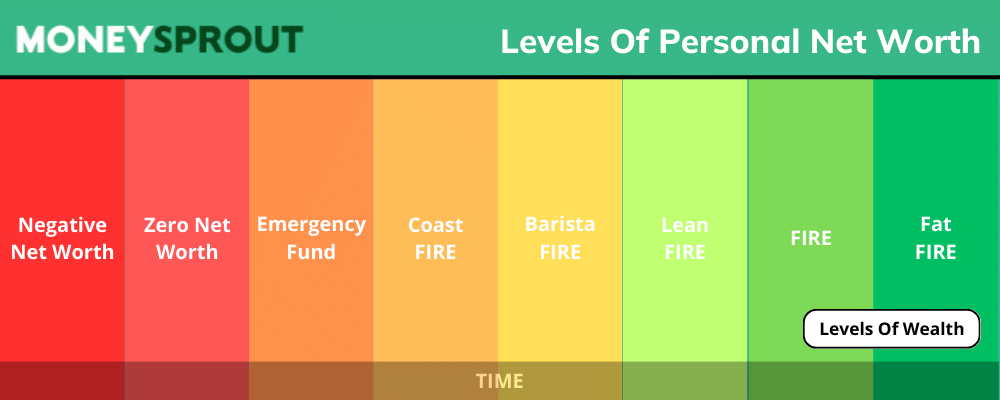

There are multiple different levels of Financially Independent Retire Early. Coast FIRE is the first level of financial independence. You then have the following levels:

Coast FIRE – Coast FIRE is when you save and invest enough early on in life, so that your portfolio will eventually reach your FIRE number by retirement. Once you reach Coast FIRE, you can stop contributing to your portfolio and let compound interest do the work for you. Once you reach Coast FIRE you can spend less time focusing on saving and investing and simply enjoy the money you earn.

Barista FIRE – This is for individuals who have saved enough to mostly retire, but they still work in low-stress, part-time jobs (like a barista at a coffee shop) to cover some living expenses and maybe benefits like health insurance. The idea is that the investment returns from their savings cover most of their expenses, but they work a bit to ensure they don’t fully deplete their savings.

Lean FIRE – Individuals or families pursuing Lean FIRE aim to retire as soon as possible, often living a minimalist lifestyle both before and after retirement. They carefully watch their expenses and typically live on a budget that’s lower than the average person. The goal is to accumulate enough savings to cover these basic living expenses for the rest of their life.

FIRE – This is the “standard” level of the movement. Those who achieve FIRE have saved and invested enough to live off their investments indefinitely without working and can maintain a comfortable (but not luxurious) lifestyle. The typical guideline for FIRE is to have saved up 25 times your annual expenses, based on the 4% safe withdrawal rate.

What Is The Difference Between Fat FIRE and Traditional FIRE

The FIRE (Financial Independence, Retire Early) movement promotes financial freedom through aggressive saving and investing to enable early retirement. Within this movement, a subset known as FAT FIRE emerges, aiming for a more luxurious retirement.

Goal

- FIRE: Achieve early retirement by living frugally, both pre and post-retirement.

- FAT FIRE: Retire early while maintaining or elevating your current lifestyle, with no significant compromises.

Budget

- FIRE: Target assets worth 25 times annual expenses, often aiming for yearly expenses of $40,000 or less.

- FAT FIRE: Aim for larger retirement budgets, potentially over $100,000 annually.

Lifestyle

- FIRE: Embrace minimalism, possibly downsizing homes or relocating to cheaper areas.

- FAT FIRE: Prioritize luxury, from upscale living to extravagant travel.

Risk Tolerance

- FIRE: A frugal lifestyle might offer more flexibility during economic challenges.

- FAT FIRE: Higher expenditures mean potentially less financial wiggle room, necessitating conservative investments or larger emergency funds.

Both FIRE and FAT FIRE aim for financial independence, but with different visions of retirement. The choice between them depends on individual financial goals and desired lifestyle.

Final Thoughts

Personally, I am aiming for Fat FIRE in retirement. If I don’t reach it, I’ll still land in the middle between FIRE and Fat FIRE and adjust accordingly. I currently invest monthly and should reach Fat FIRE around age 55 if I stick to my current rate of investment. However, I’m also building businesses such as this one right here, which if I’m lucky enough, I can potentially exit and expedite my route to Fat FIRE.

Read More From Money Sprout: