Are you sick and tired of living a life you don’t enjoy? Does it feel like you simply work to pay bills, repeat? Unlocking financial freedom through Coast FIRE may be a great option for you. Coast FIRE allows you to lead a more intentional lifestyle, allowing you to spend more time working on something you love.

I reached Coast FIRE a few years ago and since then have had the freedom to solely work on projects I enjoy. While I probably work more than ever, it doesn’t feel like work to me. I get to wake up every day and work on the projects I truly enjoy.

For you, Coast FIRE might just be cutting back hours at your current job so you can spend more time with your kids. Let’s take a look at how you can get started with Coast FIRE today.

Quick Overview

Coast FIRE is the easiest version of FIRE to reach. It involves reaching a portfolio value large enough that you don’t have to contribute to your portfolio anymore. This means you only have to invest early on in your career and once you reach your Coast number, let compound interest work it’s magic to hit your full FIRE number at retirement.

What Is Coast FIRE?

Coast FIRE (Financial Independence, Retire Early) is a variation of the increasingly popular FIRE movement. This Coast strategy involves contributing enough to your investment portfolio early in life so that you no longer need to make additional contributions to your retirement. Once your investment portfolio gets large enough, it will grow on its own without you having to make any more contributions.

The objective of Coast FIRE is to have the flexibility to pursue a lower-paying job, passion project or simply work fewer hours knowing that your retirement is already secure. Rather than focusing solely on retiring early, you’re focusing on securing your retirement as fast as possible so you can pursue a lifestyle that you enjoy waking up to every day.

It is named “Coast FIRE” because you can just “Coast” with retirement after reaching your Coast FIRE figure.

How Coast FIRE Works

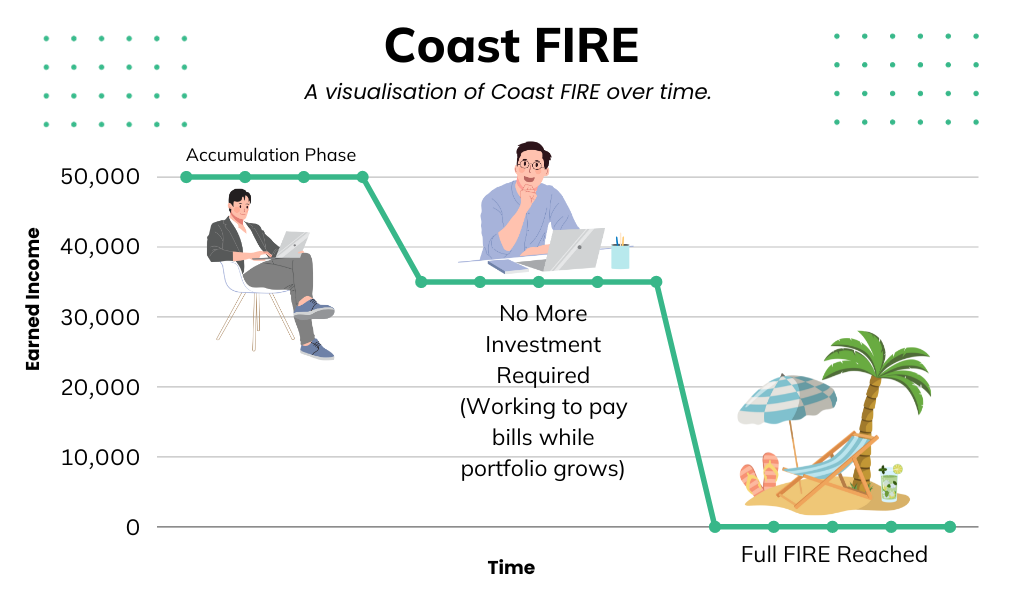

With Traditional FIRE you are trying to build a large enough portfolio that will allow you to completely retire without working. With Coast FIRE you are attempting to build a portfolio large enough that it will grow without making any more contributions. Coast FIRE is about using your investments to unlock freedom before hitting your full FIRE number.

1 – Invest Enough So Investing Becomes Optional

The goal of Coast FIRE is to reach a portfolio value large enough that you don’t have to contribute anymore. With traditional FIRE you would be aiming to save at least 50% of your salary until you reach your full FIRE Number. With Coast, however, you would do the same but only until your portfolio reaches a critical mass where it will compound enough by itself to reach enough money for retirement.

Most FIRE investors, invest in broad market index funds so they can passively manage their portfolio and spend more time doing what they love.

2 – Work While Your Portfolio Grows

Once you reach your target goal (I’ll show you how to work it out below) you can start to think about changing your life. You don’t have to continue investing 50% of your income anymore as your portfolio is growing by itself through the power of compounding. This means you finally have options to start spending more freely.

You can continue with your existing job but have a large portion of your income freed up to spend on your hobbies, travel, cars, etc. You may also think about changing to a lower-paying job that you enjoy more or working fewer hours at your existing job so you can spend more time with your kids.

3 – Full Retirement

The great thing about Coast FIRE is that your portfolio will still reach your full FIRE number, just at traditional retirement age. This third stage is when you can leave your job and completely live off your portfolio returns.

My Experience With Coast FIRE

Reaching Coast FIRE was a massive moment of Financial Freedom in my life. For me, it allowed me to pursue businesses that I enjoy rather than simply working solely for the money. In fact, it’s why you’re reading this post right here.

I started my investing journey when I reached 18 and finally reached my Coast FIRE number at 26. I started young, which meant I didn’t need to have a huge portfolio before reaching Coast FIRE as my portfolio has another 40 years to compound before I actually need to retire.

Now, I plan on continuing to work and invest to reach my Full FIRE number. The difference is, that I can now take more risks and work on projects I care about because I know my retirement is secure.

How To Calculate Your Coast FIRE Number

Now we know what Coast FIRE is, let’s work out how you can calculate your Coast FIRE number.

Coast FIRE is simple in theory but the formula you use to implement it requires multiple estimates. Here’s the two biggest assumptions we make in the formula:

- Rate Of Growth – We obviously can’t predict our portfolio returns in the future so we have to make an estimate based on historical returns. The higher your return, the less time it will take to reach your retirement number. In general, people will use an estimate of 5-7% after accounting for inflation.

- Rate Of Withdrawal – The second assumption we make is the rate of withdrawal. This is how much we can safely withdraw each year after reaching retirement. 4% is the common number we hear mentioned. This comes from a 1998 Trinity study where three finance professors make their argument that a portfolio of 50% equities and 50% fixed-income securities should allow the owner to withdraw 3-4% of the principal per year and still maintain a reliable source of passive income for decades.

Coast FIRE Formula

The Coast FIRE formula starts with the standard fire formula (25 x Annual Spending) and then divides it by your annual growth to the power of the number of years you have to reach retirement.

(25 x [Annual Spending]) / (1 + [Annual Growth Rate][Years To Retirement] )

Coast FIRE Example

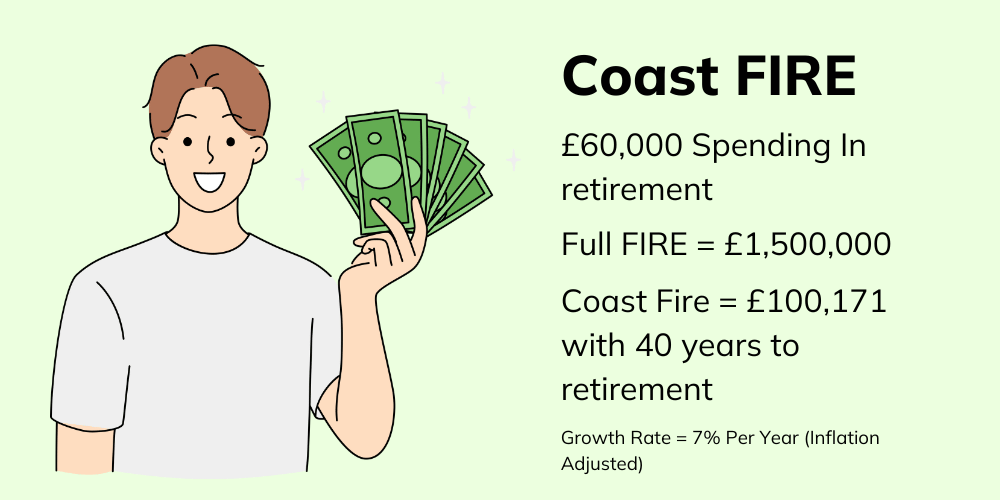

Let’s take a look at my example. I want to retire with a minimum of £60,000 per year in annual income upon retirement. To get my full fire number we do 25 x Annual Income/Spending.

25 x £60,000 = £1,500,000

£1,500,000 is my full FIRE number. From here we can work out our coast fire number. I plan to retire in 40 years when I am 66 and I using a growth rate of 7% after inflation.

£1,500,000 / (1+0.0740) = £100,171

In this example, my Coast FIRE number is £100,171, which would grow over the next 40 years to the target figure (Regular FIRE Number) of £1,500,000.

Coast FIRE Calculator

If you don’t want to do the maths yourself, simply enter your numbers below and let the calculator do the work for you.

Why It’s So Important To Start Saving And Investing Early

When saving and investing towards Coast FIRE age makes a huge difference. The earlier you start investing, the less you have to contribute.

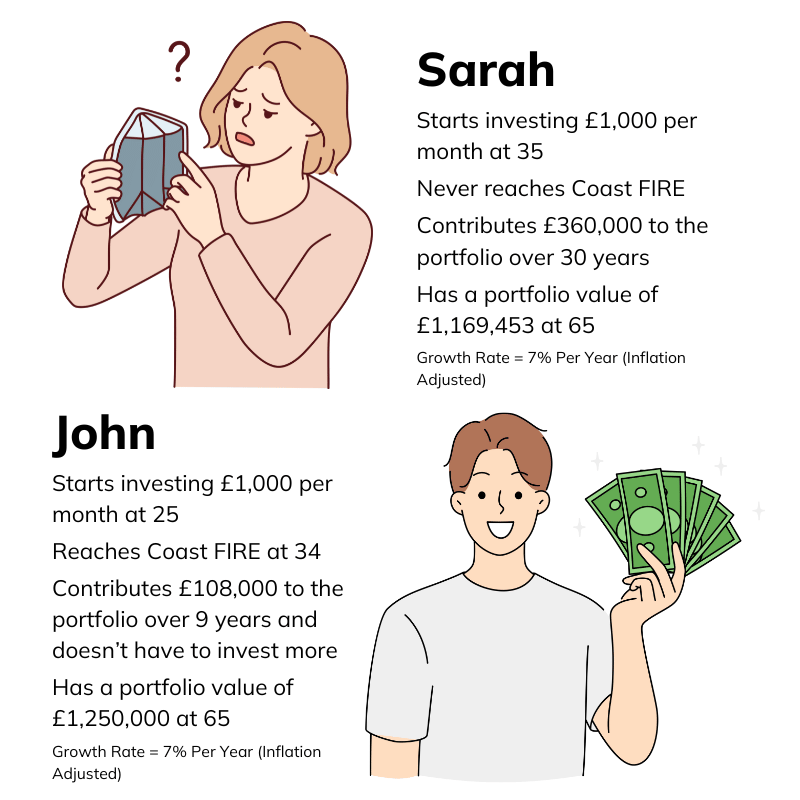

Let’s take the example of two people, John and Sarah. Both want to reach Coast FIRE and retire at 65 however John is starting at 25 and Sarah is starting at 35. Both want to withdraw £50,000 annually in retirement. Both start by investing £1,000 per month.

John will reach Coast FIRE at age 34 whereas Sarah won’t reach Coast FIRE before she retires at 65. John will have a portfolio value of £1,250,000 at 65 and doesn’t have to invest any more money after 34. Sarah has to contribute £1,000 per month for 30 years and still hasn’t reached her FIRE number at 65. She has a portfolio value of £1,169,453 at retirement.

By investing early on John sets himself up for life and doesn’t have to invest anymore after age 34 whereas Sarah’s late start means she has to invest for the rest of her life and still won’t reach her FIRE target. Sarah has to invest £1,100 per month to reach her FIRE target at age 65.

All of the numbers above are calculated with a 7% growth rate accounting for inflation and a safe withdrawal rate of 4%.

Benefits Of Coast FIRE

- Reduced Financial Stress – Reaching the Coast FIRE milestone means that you’ve saved enough to secure your future retirement, even without further contributions. This achievement can significantly diminish anxieties related to job security, market fluctuations, and other financial uncertainties. It offers the assurance that thanks to compound interest, your investments will grow over time without additional aggressive saving.

- Increased Job Flexibility – With the primary savings goal met, the pressure to maintain a high-paying or demanding job diminishes. This flexibility allows individuals to consider roles that align more with their passions or values, even if these positions offer lower compensation. It opens doors to more meaningful or fulfilling work experiences.

- Enhanced Work-Life Balance – As the compulsion to maximize income wanes, individuals can prioritize their well-being, family, or personal pursuits. This might mean transitioning to part-time work, taking extended vacations, or even sabbaticals. This balance can lead to a richer, more diverse life experience and reduced burnout.

- Pursue Passions and Personal Growth – Financial security provides the freedom to explore interests that were previously sidelined due to time constraints or the need to prioritize income. Whether it’s furthering education, delving into a hobby, starting a side business, or engaging in community service, Coast FIRE offers the luxury of time and means to grow personally and professionally.

- Continued Investment – If you reach Coast FIRE and find that you still want to work and maximise your investments, you can. Coast FIRE can simply be a stepping stone on your way to FIRE. Once you reach this milestone, you know you are now significantly more financially secure than you used to be.

Risks Of Coast FIRE

- Market Volatility – The Coast FIRE approach heavily relies on the principle of compound interest and the assumption that investments will grow consistently over time. However, markets are inherently unpredictable. Extended periods of stagnation or downturn can adversely affect the expected growth, jeopardizing the projected retirement nest egg.

- Inflation and Rising Costs – While one might calculate their future needs based on today’s costs, inflation can erode the purchasing power of money over time. If not accounted for properly, what seems like a sufficient amount today might fall short of covering future expenses, especially in economies with high inflation rates.

- Unexpected Life Events or Emergencies – Even with a considerable nest egg, life can throw unforeseen challenges—health issues, accidents, family emergencies, or global crises. These events might necessitate dipping into the saved funds, which would disrupt the Coast FIRE plan.

- Lifestyle Inflation – As one progresses in their career or as family dynamics change (like having children), there’s a tendency for expenses to rise. Living below one’s means is essential for the FIRE approach. However, succumbing to lifestyle inflation can quickly offset the benefits of early aggressive saving, making the end goal harder to reach.

- Psychological Impact of Reduced Earning – Transitioning to a job that pays less or reducing working hours might sound appealing, but it can sometimes bring unforeseen psychological challenges. Feelings of decreased self-worth, concerns about societal judgment, or fears of missing out on career opportunities can emerge. Moreover, if one’s identity is closely tied to their profession or income, adjusting to a different work-life balance might be harder than anticipated.

Other Types Of FIRE

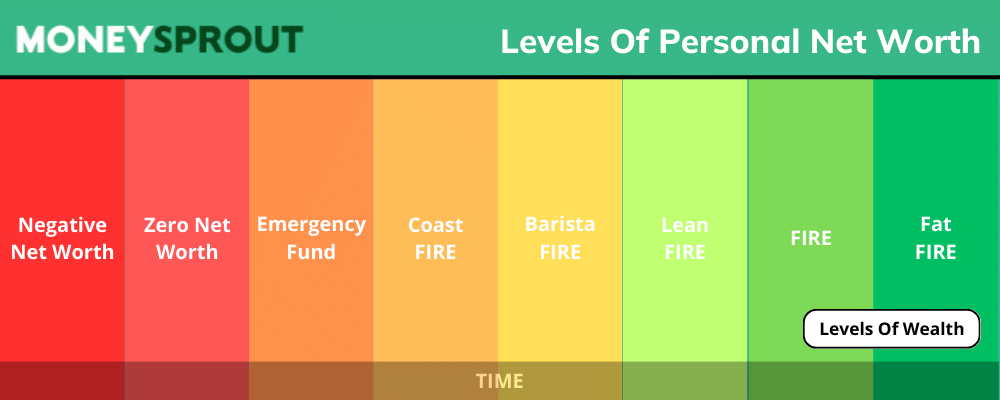

There are multiple different levels of Financially Independent Retire Early. Coast FIRE is the first level of financial independence. You then have the following levels:

Barista FIRE – This is for individuals who have saved enough to mostly retire, but they still work in low-stress, part-time jobs (like a barista at a coffee shop) to cover some living expenses and maybe benefits like health insurance. The idea is that the investment returns from their savings cover most of their expenses, but they work a bit to ensure they don’t fully deplete their savings.

Lean FIRE – Individuals or families pursuing Lean FIRE aim to retire as soon as possible, often living a minimalist lifestyle both before and after retirement. They carefully watch their expenses and typically live on a budget that’s lower than the average person. The goal is to accumulate enough savings to cover these basic living expenses for the rest of their life.

FIRE – This is the “standard” level of the movement. Those who achieve FIRE have saved and invested enough to live off their investments indefinitely without working, and they can maintain a comfortable (but not luxurious) lifestyle. The typical guideline for FIRE is to have saved up 25 times your annual expenses, based on the 4% safe withdrawal rate.

Fat FIRE – People who pursue Fat FIRE want to retire early but maintain a more luxurious or affluent lifestyle in retirement. They save and invest more than those aiming for traditional FIRE, allowing for higher spending in retirement. This might include more travel, fine dining, or living in a high-cost area. They have saved well beyond the 25 times annual expenses guideline.s

What Is The Difference Between Barista FIRE and Coast FIRE

Coast FIRE and Barista FIRE are the first two levels of FIRE. Both of them are very achievable for most people especially if you start at a young age.

With both Coast and Barista FIRE, you will still be employed in the workforce in some shape or form.

The main difference between Coast FIRE and Barista FIRE is the amount of time you will have to work. With Coast FIRE you will still likely be working full-time (40+ hours) whereas with Barista Fire you may work part-time for 10-20 hours per week.

In the US many people will opt for Barista FIRE as a lot of part-time jobs offer medical benefits. However, in the UK we are lucky enough to have public healthcare so don’t have to worry about this as much. You may just opt to take a job you enjoy for a few hours per week.

To take on Barista FIRE you will need a much larger portfolio than Coast FIRE.

With Barista FIRE you will pay for a portion of your living expenses with your portfolio returns and use your part-time job to fund any shortfall you have.

With Coast FIRE you aren’t touching your portfolio as it grows for retirement so you will still need a full-time job to cover your living expenses.

With Coast FI you will eventually reach your FIRE number and be fully retired however, with Barista FIRE, you will likely never reach full retirement as you start withdrawing from your portfolio too early and it doesn’t have a chance to grow into a full retirement pot.

Final Thoughts

Coast FIRE is a great financial target to hit. Even if you aren’t intentionally trying to be part of the “FIRE” movement, coast FIRE is a good number to track. Reaching a point in your financial life where you know you are secure for your retirement is very freeing. It’s a level of security that allows you to pursue a more enjoyable path in life if you choose to do so.

Read More From Money Sprout: