FIRE stands for Financially Independent, Retire Early. This movement to retire earlier than the traditional retirement age started back in 1992 in the United States but has since become popular in the UK.

Working to 65 and enjoying yourself in retirement is the traditional path but is it really the best way to live? Work through the years when you are in your prime physically and mentally only to retire when you’re likely not even able to do the thing you wanted to.

Some people who are adopting the FIRE movement don’t believe that’s the best way to go about things. If you are smart with your money, you can retire a whole lot earlier and live a life you can really enjoy.

What Is FIRE (Financially Independent, Retire Early)

FIRE, an acronym for “Financially Independent, Retire Early,” is a modern philosophy in personal finance that champions the ideals of living frugally, saving aggressively, and investing wisely to achieve the dream of early retirement.

Drawing inspiration from the foundational concepts in the 1992 book “Your Money or Your Life” by Vicki Robin and Joe Dominguez, the FIRE movement pushes individuals to reevaluate their relationship with money.

By living well below their means and channeling a significant portion of their income—often more than 50%—into investments, proponents aim to build a nest egg that allows them to step away from traditional employment years, if not decades, earlier than the norm.

While the allure of financial freedom and a reimagined retirement resonates with many, the FIRE approach is not without its challenges. Critics point to potential hurdles like healthcare costs, market volatility, and the extreme frugality required, suggesting that the movement may not be feasible for everyone.

How FIRE Works

Now we know exactly what FIRE is, let’s take a look at the numbers behind it and how it actually works.

Rule Of 25

The Rule of 25 is based on the 4% Safe Withdrawal Rate (SWR), a widely recognized principle in retirement planning. The 4% SWR suggests that if you withdraw 4% of your retirement savings in the first year and adjust for inflation in subsequent years, there’s a high probability your savings will last for 30 years or more.

To determine how much you need to save to safely withdraw your annual expenses without depleting your nest egg, you take your annual expenses and multiply them by 25 (the inverse of 4%).

If you want to be more conservative with your calculations, you can adjust to a safe withdrawal rate of say 3%. This would require you to have a nest egg of 33x Annual Expenses rather than the traditional 25.

The Magic Of Compound Interest

Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.

Albert Einstein

At first glance, you may think it’s impossible to save 25x your annual income in any reasonable amount of time. That’s where investing and the power of compound interest come in. You will be putting your money to work for you.

Generally, we assume a rate of 7% growth in the Stock Market. Over the past 50 years, the S&P 500 has grown by approximately 10% per year. We use 7% to be conservative and account for inflation. It’s important to note that past results don’t guarantee future results however it’s a rough indicator of what we can expect.

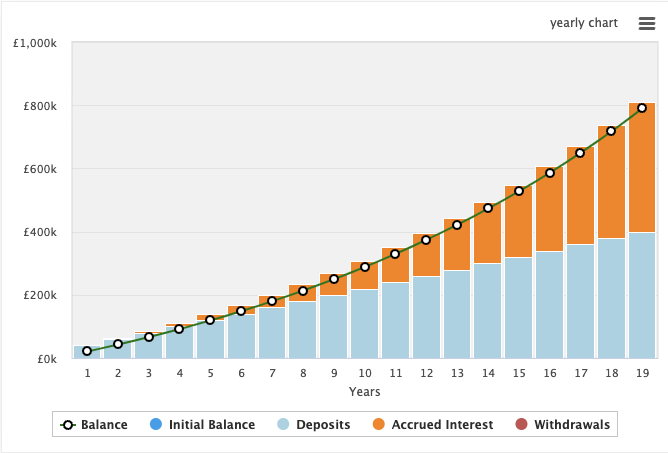

Let’s say you earn £50,000 per year after tax and want to retire with a £30,000 per year income. You currently spend £30,000 per year and save the other £20,000.

Following the FIRE calculation, you would need £750,000 invested to hit FIRE and retire.

Investing £20,000 a year would take you 19 years to reach a nest egg of £790k. Approximately £380,000 of that would be from your contributions and the other £410,000 would come from portfolio growth in the market.

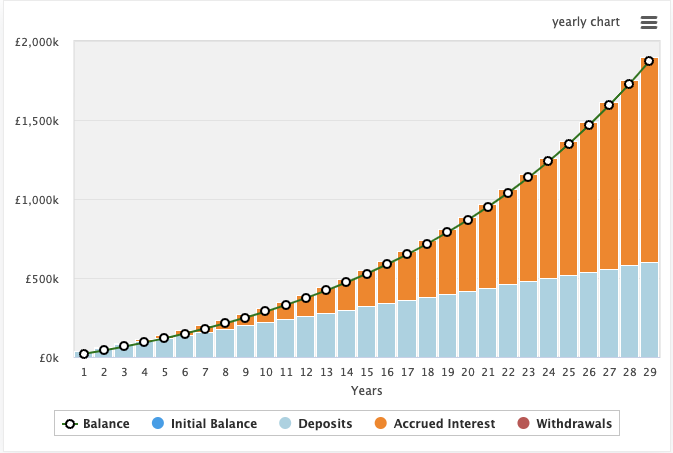

If decided once you reached this level you wanted to work for another 10 years and continue investing your portfolio would reach a massive £1,876,195 at a 7% rate of growth. If you started at. 25 and invested to 54, you could retire with a massive nest egg.

The longer you leave your money to compound the crazier the returns get. This is the chart for investing £20,000 per year for 29 years.

This is the secret to building large amounts of wealth over long periods of time. It’s not exciting, it’s not going to make you rich overnight but it is a tried and tested process to generate wealth over a long period of time.

Use our FIRE calculator to work out your FIRE number and estimated retirement age.

How To Save & Invest Tax Efficiently In The UK

In the UK we have some great tax advantages with investing accounts. There are a few notable things you should be aware of:

Employer Pension Match – If your employer matches your pension contributions take advantage of this up to the max they offer. Just be aware that you can’t take your pension until the official pension age, so if you plan on retiring before that, plan accordingly.

ISA Accounts – ISA accounts are amazing for FIRE investors. You can currently invest up to £20,000 per year into your ISA. Any gains or dividends in the account are tax-free. You can also withdraw the money from the account completely tax-free. For example, if you invested £20,000 into a stock that went up 50x to £1 Million you would be able to withdraw that £1 MIllion tax free.

Private Pensions – If you invest in your own private pension, you get 20% tax relief from the government. This means that for every £5,000 you invest in your pension, you will get £1,000 free added to your investment account. Again, you need to be careful around the pension rules if you plan to retire early.

At a minimum, you should be investing in an ISA where your gains are tax-free. You can check out the best investing apps here.

Now you know how the numbers work, let’s take a look at how you can start.

How To Get Started Working Towards FIRE

The steps to reach FIRE are simple to understand but take discipline to execute over long periods of time.

- Create a budget for yourself and dedicate a large portion of it towards your investment account each month.

- Work out how much you need to invest each month to reach your FIRE number by your desired age. You can do this using our compound interest calculator.

- Consistently invest this amount monthly into an investment account. We have a full guide on the best investment accounts in the UK. Most FIRE investors take a simple approach to investing by buying broad-market, low-cost index funds. You should use tax-advantaged accounts such as your pension and ISAs so you can invest tax-free.

- The last step is simply to wait until you reach your target FIRE number. How aggressively you’re investing now will determine how long it will take to reach FIRE.

How Many Years It Will Take To FIRE

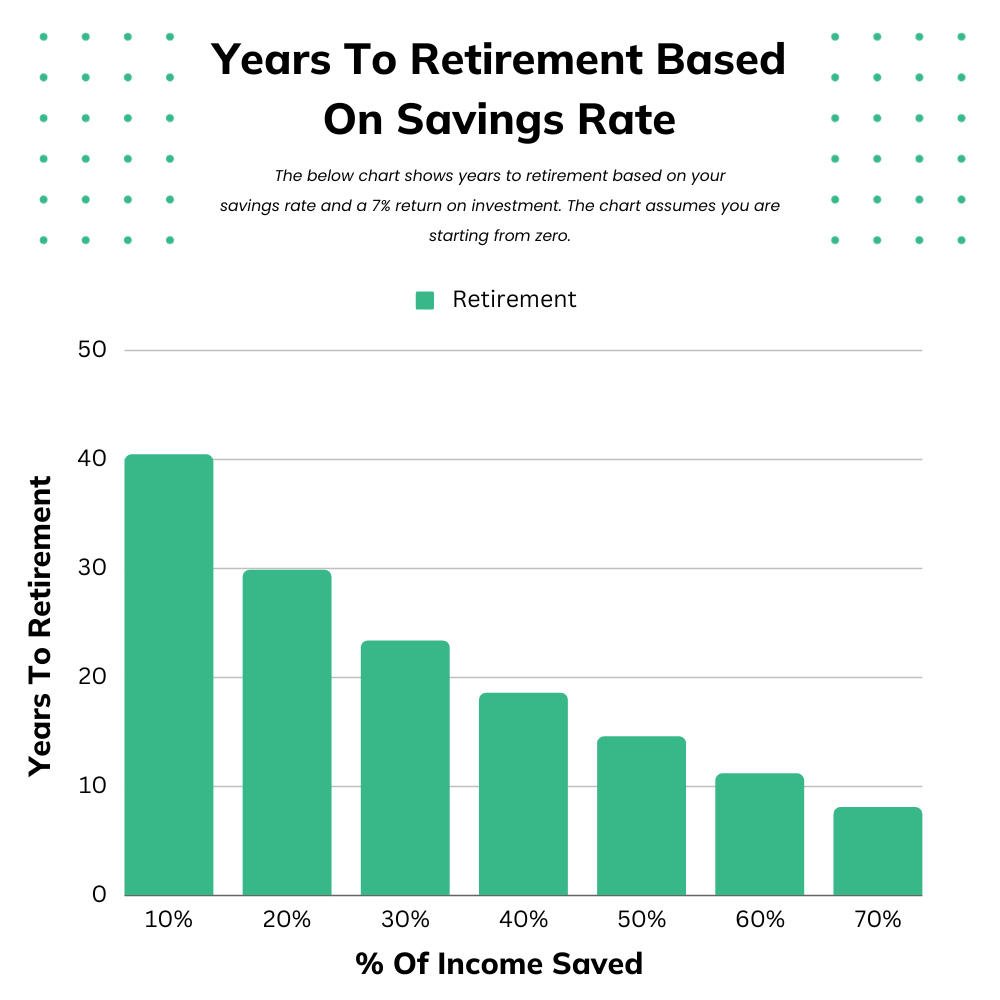

The length of time it will take you to retire comes down to two things; How much you can save and how much you need to spend in retirement. You don’t necessarily need to earn your full income from your portfolio.

For example, if you earn £50,000 per year but only spend £25,000 per year and save the rest, you only need to earn £25,000 per year in retirement to maintain the same lifestyle.

If you plan to maintain the same lifestyle in retirement as you have right now, you can use the chart below to see how long it will take you to retire.

The data below uses a 7% rate of growth to calculate your years to retirement. This chart will only work if you plan to retire and spend the same amount as you do now.

| Savings Rate | Years To Retirement |

|---|---|

| 10% | 40 |

| 20% | 30 |

| 30% | 23 |

| 40% | 19 |

| 50% | 15 |

| 60% | 11 |

| 70% | 8 |

Tips For Reaching Fire Fast

Reaching FIRE is a tough goal to strive for. Here are some ways you can get there faster:

Maximise Your Income

Most people who partake in FIRE think about cutting expenses rather than increasing income. If you can increase your income significantly without increasing your lifestyle, you can hit your FIRE goal much faster.

- Primary Job: Always be on the lookout for opportunities to advance in your career, whether that means seeking promotions, negotiating raises, or acquiring new skills that make you more marketable.

- Side Hustles: Consider taking on side gigs or freelance work to supplement your primary income. Over time, these additional earnings can significantly boost your savings rate.

- Passive Income: Explore opportunities for passive income, such as real estate investments, dividend stocks, or creating digital products that can be sold repeatedly with minimal ongoing effort.

Live Well Below Your Means

Adopt a minimalist lifestyle, focusing on needs over wants. This doesn’t mean depriving yourself but rather prioritizing spending on what truly brings value and happiness to your life.

Consider downsizing your living space, opting for a used car over a new one, or cooking at home more frequently to reduce expenses.

Invest Aggressively and Wisely

Investing is a huge part of being able to reach FIRE. Most people will never be able to save their way there.

- Diversify: Ensure your investments are diversified across different asset classes to mitigate risks.

- Low-Cost Index Funds: Consider investing in low-cost index funds or ETFs, which often outperform actively managed funds over the long term and come with lower fees.

- Automate: Set up automatic transfers to your investment accounts to ensure consistency in your investing strategy.

Avoid Lifestyle Inflation

As your income increases, it’s tempting to upgrade your lifestyle proportionally. However, if you maintain your current standard of living (or only increase it modestly) while earning more, you can save and invest the surplus, accelerating your path to FIRE.

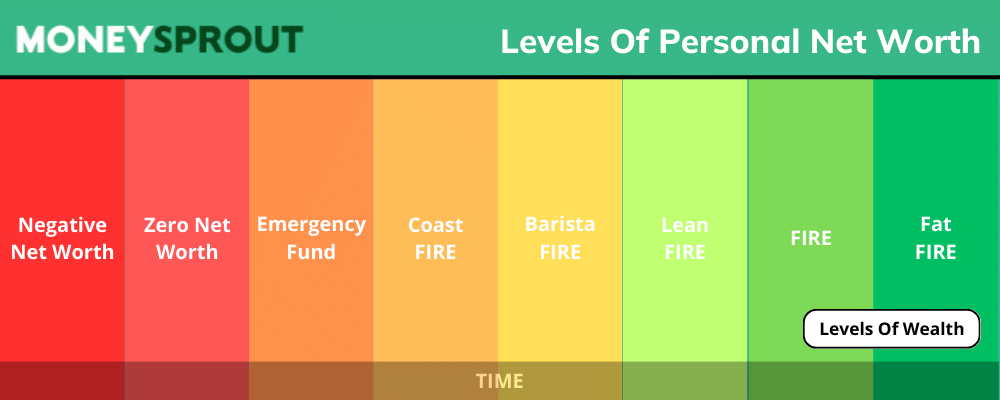

Other Types Of FIRE

The traditional method of reaching FIRE doesn’t work for everyone. As the FIRE community has grown over the past decade more variations of the movement have popped up. Some focus on securing their retirement while still working jobs they actually enjoy while others focus on retiring with a large nest egg big enough to afford them a luxury lifestyle.

I have put together an article on each variation if you feel that traditional FIRE isn’t quite right for you.

Coast FIRE

Coast FIRE is when you save and invest enough early on in life, so that your portfolio will eventually reach your FIRE number by retirement. Once you reach Coast FIRE, you can stop contributing to your portfolio and let compound interest do the work for you.

Barista FIRE

This is for individuals who have saved enough to mostly retire, but they still work in low-stress, part-time jobs (like a barista at a coffee shop) to cover some living expenses and maybe benefits like health insurance.

Lean FIRE

Individuals or families pursuing Lean FIRE aim to retire as soon as possible, often living a minimalist lifestyle both before and after retirement. They carefully watch their expenses and typically live on a budget that’s lower than the average person.

Fat FIRE

People who pursue Fat FIRE want to retire early but maintain a more luxurious or affluent lifestyle in retirement. They save and invest more than those aiming for traditional FIRE, allowing for higher spending in retirement.

Benefits & Drawbacks Of FIRE

Like anything in life, FIRE comes with its benefits and drawbacks. Let’s take a look at the good and bad of trying to retire early. You can then make a decision on whether or not this is for you.

Benefits

- Early Retirement: The most obvious benefit is the ability to retire early, often decades before the traditional retirement age. This can provide individuals with the freedom to pursue passions, hobbies, or even new career paths without the pressure of a regular 9-to-5 job.

- Financial Security: By focusing on saving and investing aggressively, those pursuing FIRE often amass a significant nest egg. This can provide a sense of security and peace of mind, knowing that they have a cushion to fall back on in times of financial uncertainty.

- Flexibility and Freedom: Achieving financial independence means having the flexibility to make choices based on desires rather than financial necessity. This could mean traveling the world, taking up volunteer work, or simply enjoying more leisure time with loved ones.

- Enhanced Financial Literacy: The journey to FIRE requires individuals to become well-versed in personal finance, budgeting, and investing. This enhanced financial literacy can benefit them in various aspects of life, even beyond retirement planning.

- Reduced Financial Stress: With a clear plan in place and a focus on living below one’s means, many FIRE enthusiasts report reduced financial stress and anxiety, leading to improved overall well-being.

Drawbacks

- Sacrifices and Frugality: To save a significant portion of one’s income, it often requires making sacrifices, such as forgoing certain luxuries or experiences. This level of frugality can sometimes lead to feelings of deprivation or missing out.

- Market Dependence: FIRE strategies often rely on investment returns to fund early retirement. Market downturns or prolonged periods of low returns can jeopardize one’s ability to maintain their desired lifestyle in retirement.

- Potential for Regret: Some individuals who achieve FIRE may later regret retiring so early, missing the camaraderie of the workplace or feeling a lack of purpose once their primary goal is achieved.

- Healthcare Concerns: In countries like the U.S., where healthcare is often tied to employment, retiring early can pose challenges in securing affordable healthcare coverage until one is eligible for programs like Medicare.

- Social Isolation: Retiring early can sometimes lead to feelings of isolation, especially if peers are still engaged in the workforce. This can require additional effort to maintain social connections and find new communities of like-minded individuals.

FIRE Success Stories

Personally, I love reading other people’s success stories when it comes to FIRE. It always helps to keep me motivated and see what’s actually possible if you stay the course. Here’s some interesting FIRE Stories from Reddit.

Comment

byu/throwawayyyyoway from discussion

inFire

Comment

byu/throwawayyyyoway from discussion

inFire

Comment

byu/boringFI from discussion

infinancialindependence

Final Thoughts

Personally, I love the FIRE movement. It makes a lot of sense for a lot of people. Even if you aren’t going as aggressive as saving 50% of your income, saving 20-25% from an early age can make a huge difference in the age you can retire.

I don’t want to live an extremely frugal lifestyle so I have opted to aim for Fat FIRE through consistent investing and building businesses. While traditional FIRE may not be for you, one of the other FIRE variants could potentially fit your lifestyle and help you secure a solid retirement.

Read More From Money Sprout: