The Lean FIRE movement is a variation of FIRE which stands for Financially Independent Retire Early. The goal of FIRE is to save and invest enough money early in life, so you can retire in your 30s, 40s or 50s rather than the traditional retirement age.

The Lean variation of FIRE takes an even more minimalist and frugal approach. Lean FIRE will allow you to retire earlier but you will be living a lean lifestyle without a lot of life luxuries.

What Is Lean FIRE?

Lean FIRE stands for “Financial Independence, Retire Early” with an emphasis on “lean” living. It’s a personal finance movement that encourages individuals to achieve financial independence and retire early by living frugally and saving a significant portion of their income. The primary goal of Lean FIRE is to accumulate enough savings and investments to cover one’s basic living expenses without needing to work for money again.

Those who pursue Lean FIRE typically aim to minimize their expenses and maintain a minimalist, low-cost lifestyle both before and after retirement. This allows them to retire with less money than someone following a more traditional retirement path or even other FIRE methodologies like traditional FIRE or Fat FIRE, which accommodates a more luxurious post-retirement lifestyle.

The idea behind Lean FIRE is not merely about early retirement, but about achieving the freedom to live on one’s own terms, free from financial constraints, albeit with a more frugal approach.

How Lean FIRE Works

Lean FIRE works the same way that traditional FIRE works. You are attempting to save and invest into a nest egg which is 25 times your annual expenses. Having a portfolio this size theoretically allows you to draw 4% per year from your portfolio without your portfolio losing value.

The difference between Lean FIRE and Traditional FIRE is how you get there and what your lifestyle will look like after retirement. People who follow a Lean FIRE plan typically live a very minimalist and frugal lifestyle. They likely live in a very cheap part of the country and don’t treat themselves to luxuries very often.

Lean FIRE gives you enough money each year to cover your basic living expenses such as housing costs, food and transport but does not allow for much more.

Many pursue Lean FIRE to pursue a life they are passionate about rather than work a job they hate each day. While living this frugally all your life is not something I’m interested in, it may be for you. Let’s take a look at how you can reach your Lean FIRE Number.

How To Get To Lean FIRE Fast

- Evaluate Current Expenses and Budget: Start by tracking all expenses to understand where money is going. This provides clarity on potential areas to cut back. You will have to adopt a minimalist lifestyle by cutting back on things like holidays, subscriptions, designer goods, etc. You can use our guide to budgeting to get started.

- Increase Savings Rate: The goal for many in the Lean FIRE community is to save 50% or more of their income. The higher the savings rate, the sooner one can retire.

- Invest Aggressively: Money saved is typically invested in a mix of stock and bond index funds, real estate, or other income-producing assets. The objective is to grow wealth rapidly.

- Avoid Debt: Minimize or eliminate all debt, especially high-interest debt like credit card balances. Some even pay off their mortgages early to reduce monthly obligations.

- Establish a Safe Withdrawal Rate: Determine how much money can be safely withdrawn from investments each year without depleting the principal. A common guideline is the 4% rule, although some Lean FIRE adherents might adopt a more conservative rate.

- Achieve the FIRE Number: This is the amount of savings needed to support oneself in retirement based on the projected annual expenses and the safe withdrawal rate. For instance, if someone expects to live on £30,000 a year, and they’re using the 4% withdrawal rule, they’d need a nest egg of £750,000 (£30,000 is 4% of £750,000).

- Continuous Review: Regularly review and adjust budgets, investments, and withdrawal rates based on changing personal circumstances and market conditions.

- Retire or Pivot: Once the FIRE number is achieved, individuals can choose to retire early or pivot to work that they’re more passionate about without the pressure of needing a high income.

- Live Frugally in Retirement: Even after achieving financial independence, the Lean FIRE approach requires adherents to continue living a relatively frugal lifestyle to ensure they don’t outlive their savings.

How To Calculate Your Lean FIRE Number

Calculating your Lean FIRE number works the same way as calculating a traditional fire number. Take your annual expenses and multiply them by 25. Once you reach this number you can withdraw 4% per year relatively safely without your portfolio value dropping.

Lean FIRE = Annual Expenses In Retirement x 25

For example, if you spend £25,000 a year and plan to keep it that way during retirement you would need £625,000 to FIRE.

Example: £25,000 x 25 = £625,000 <– Lean FIRE Number

If you reached this number and decided you actually wanted to live a more luxurious lifestyle in retirement you could continue to invest and increase your yearly withdrawal amount.

If you want to calculate your FIRE Number you can use the calculator below.

Lean FIRE Calculator

Lean FIRE Example

Sarah decides that she wants to retire before the traditional retirement age of 65. She’s okay living a simple life and doesn’t need to spend a lot of money on luxuries. She’s currently 30 and has £100,000 in investments. She’s earning £40k per year after tax and is currently spending £20k living a frugal lifestyle.

She knows she will need at least £20k per year when she retires. To reach her Lean FIRE target she needs to hit £625,000 in her portfolio. At a 7% return, investing £1666 per month she will reach her Lean FIRE Target in 13 years at 43 years old.

At this point she could decide to retire and live extremely frugally on £20k per year at the safe withdrawal rate of 4% or she could continue to invest for a few more years and give herself a larger yearly withdrawal.

Benefits Of Lean FIRE

- Earlier Retirement: The primary benefity of Lean FIRE is the ability to retire significantly earlier than the traditional retirement age. By drastically reducing expenses and saving a significant portion of income, proponents can achieve financial independence in their 30s or 40s, rather than their 60s.

- Simplified Lifestyle: Lean FIRE often necessitates (and celebrates) a minimalist lifestyle. This means less clutter, fewer possessions, and often a reduced environmental footprint. Many find this lifestyle shift leads to greater happiness and reduced stress.

- Resilience to Economic Downturns: With a streamlined budget and low monthly expenses, those who achieve Lean FIRE may be better equipped to weather economic downturns. Without the pressures of hefty financial obligations, a recession may be less threatening.

- Flexibility and Freedom: Achieving financial independence means being able to prioritize what truly matters to you. Whether it’s traveling, pursuing a passion project, or spending more time with family, Lean FIRE offers a degree of autonomy that’s difficult to achieve in a traditional 9-to-5 setting.

- Personal Growth: The journey to Lean FIRE requires discipline, financial literacy, and a significant amount of self-reflection. The skills and mindset cultivated during this process can be valuable, leading to personal growth and greater life satisfaction.

Drawbacks Of Lean FIRE

- Strict Budgeting: To achieve Lean FIRE, one often has to live on an extremely tight budget. This could mean forgoing certain comforts or luxuries that many people take for granted. For some, this level of frugality can feel restrictive or even burdensome.

- Potential for Financial Strain: While the idea is to save enough to cover basic expenses, unforeseen financial challenges (like major health issues or global economic crises) could strain a Lean FIRE budget. Since the budget is already tight, there’s little room for unexpected costs.

- Social Pressures and Perception: Pursuing Lean FIRE might lead to misunderstanding or skepticism from peers or family. The societal norm leans towards traditional careers and retirement timelines, and deviations can sometimes lead to feelings of isolation or judgment.

- Potential for Lifestyle Rigidity: To maintain a Lean FIRE lifestyle, one might need to avoid potential opportunities or experiences that come with added costs. This could lead to missing out on certain life experiences or feeling constrained in one’s choices.

- Mental and Emotional Challenges: The discipline required for Lean FIRE can, for some, lead to burnout or feelings of deprivation. It’s essential to balance the pursuit of financial goals with mental and emotional well-being. Some might find the constant focus on frugality mentally exhausting over time.

Other Types Of FIRE

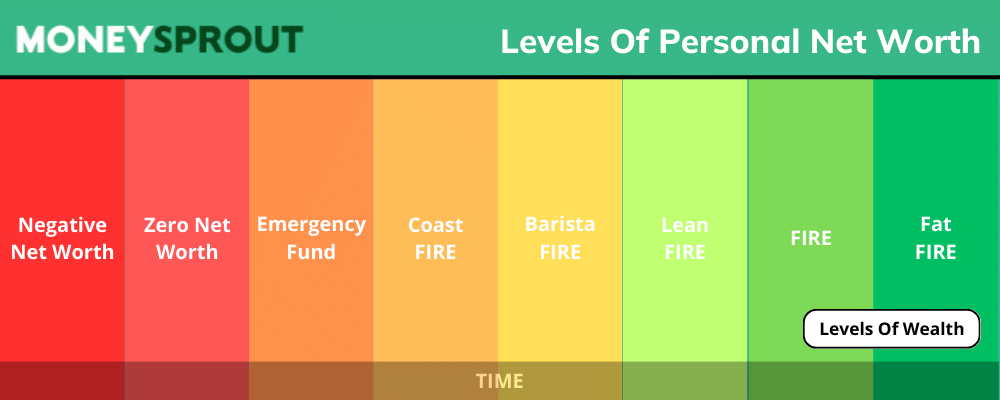

There are multiple different levels of Financially Independent Retire Early. Coast FIRE is the first level of financial independence. You then have the following levels:

Barista FIRE – This is for individuals who have saved enough to mostly retire, but they still work in low-stress, part-time jobs (like a barista at a coffee shop) to cover some living expenses and maybe benefits like health insurance. The idea is that the investment returns from their savings cover most of their expenses, but they work a bit to ensure they don’t fully deplete their savings.

Coast FIRE – Coast FIRE is when you save and invest enough early on in life, so that your portfolio will eventually reach your FIRE number by retirement. Once you reach Coast FIRE, you can stop contributing to your portfolio and let compound interest do the work for you. Once you reach Coast FIRE you can spend less time focusing on saving and investing and simply enjoy the money you earn.

FIRE – This is the “standard” level of the movement. Those who achieve FIRE have saved and invested enough to live off their investments indefinitely without working, and they can maintain a comfortable (but not luxurious) lifestyle. The typical guideline for FIRE is to have saved up 25 times your annual expenses, based on the 4% safe withdrawal rate.

Fat FIRE – People who pursue Fat FIRE want to retire early but maintain a more luxurious or affluent lifestyle in retirement. They save and invest more than those aiming for traditional FIRE, allowing for higher spending in retirement. This might include more travel, fine dining, or living in a high-cost area. They have saved well beyond the 25 times annual expenses guideline.

Difference Between Lean FIRE and FIRE

Traditional FIRE (Financial Independence, Retire Early) focuses on achieving financial independence and retiring earlier than the conventional age, but with a comfortable or even luxurious lifestyle.

Individuals pursuing this path typically aim to accumulate a nest egg that allows them to sustain their current standard of living indefinitely, without compromising on comforts.

This might mean a retirement budget that allows for frequent travel, dining out, and other discretionary spending. The savings goal for traditional FIRE is often calculated based on maintaining or slightly improving one’s pre-retirement lifestyle.

Lean FIRE, on the other hand, emphasizes extreme frugality and simplicity. The goal is still early retirement, but with a minimalist lifestyle that significantly reduces expenses.

Lean FIRE enthusiasts might live in smaller homes, adopt sustainable practices to save on utilities, or even forgo certain modern conveniences to keep their costs low.

The nest egg required for Lean FIRE is considerably smaller than traditional FIRE due to the reduced monthly expenses. However, it demands greater discipline in budgeting and often involves making sacrifices in terms of lifestyle comforts.

Final Thoughts

Personally, Lean FIRE isn’t for me as I don’t want to live a life without any luxuries at all. While I’m pretty conservative and invest a large portion of my income, I still want to enjoy life right now. I know I’m set for the future without cutting back on my holidays and occasional Starbucks latte. For me I would rather focus on making more money than pinching the pennies.

If you are happy living a frugal lifestyle then Lean FIRE may be a great choice for you. You may even reach Lean FIRE level and just work at a job that pays less but you enjoy much more.

Read More From Money Sprout: