Coast FIRE Calculator

How To Use The Coast FIRE Calculator

To use this calculator fill in the 9 inputs and the calculations will automatically run to calculate your Coast FIRE number at your current age. This is how much you would need to Coast FI today. The calculator will also show you how many years you are away from Coast FIRE at your current contribution rate and the age you will get there.

Here’s what everything on the calculator means:

Inputs

Age – This is how old you are currently or how old you will be when you plan to start Coast FIRE.

Yearly Contribution – This is how much you plan to contribute towards your portfolio each year. If you invest £500 per month, times it by 12 to get your yearly contribution.

Current Savings/Investments – This is how much you currently have saved and invested in your brokerage accounts.

Annual Spending When FIRE’d – This is how much you plan to spend per year when you do eventually retire.

Annual Return On Investment – This is the average return you expect to get on your investments.

Safe Withdrawal Rate – This is the % of funds you can expect to safely withdraw from your portfolio each year without them running out. Most people will use 3 or 4% for this calculation. You can view the study on the 4% rule here.

Planned Retirement Age: This is the age you plan to retire at. At your planned retirement age, the calculator assumes you stop earning income. You can set this to the traditional retirement age of 65 if you are unsure when you will retire.

Inflation: Inflation will reduce your spending power as you age. Adjusting this number will adjust your results into inflation-adjusted £’s with the same spending power as today.

Once you have input all of this information, you will receive your Coast FIRE number at your current age as well as the age you can expect to reach your Coast FIRE number.

Outputs

Coast FIRE Number At Current Age – This is the amount you need invested today if you want to stop investing and coast.

Years From Coast FIRE – This is how many years it will take you to reach Coast FIRE with your current rate of contribution and expected spending in retirement.

Age You Can Coast FIRE – This is the age you will reach Coast FIRE and be able to stop investing if you wish.

Check out our complete guide to Coast FIRE and How to reach it as fast as possible.

What Is Coast FIRE?

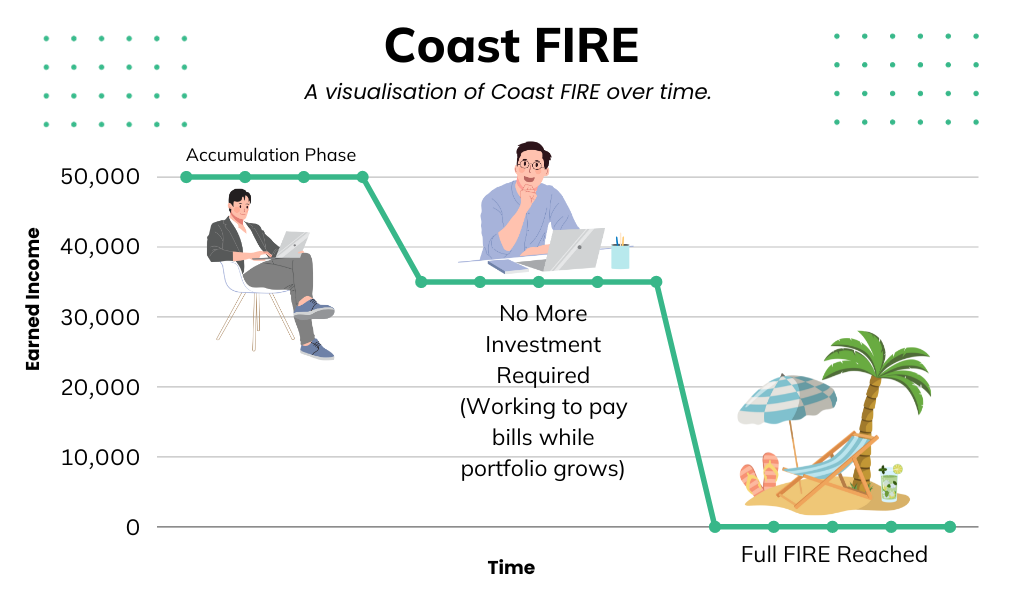

Coast FIRE (Financial Independence, Retire Early) is a variation of the increasingly popular FIRE movement. This Coast strategy involves contributing enough to your investment portfolio early in life so that you no longer need to make additional contributions to your retirement. Once your investment portfolio gets large enough, it will grow on its own without you having to make any more contributions.

The objective of Coast FIRE is to have the flexibility to pursue a lower-paying job, passion project or simply work fewer hours knowing that your retirement is already secure. Rather than focusing solely on retiring early, you’re focusing on securing your retirement as fast as possible so you can pursue a lifestyle that you enjoy waking up to every day.

It is named “Coast FIRE” because you can just “Coast” with retirement after reaching your Coast FIRE figure.

How Coast FIRE Works

With Traditional FIRE you are trying to build a large enough portfolio that will allow you to completely retire without working. With Coast FIRE you are attempting to build a portfolio large enough that it will grow without making any more contributions. Coast FIRE is about using your investments to unlock freedom before hitting your full FIRE number.

1 – Invest Enough So Investing Becomes Optional

The goal of Coast FIRE is to reach a portfolio value large enough that you don’t have to contribute anymore. With traditional FIRE you would be aiming to save at least 50% of your salary until you reach your full FIRE Number. With Coast, however, you would do the same but only until your portfolio reaches a critical mass where it will compound enough by itself to reach enough money for retirement.

Most FIRE investors, invest in broad market index funds so they can passively manage their portfolio and spend more time doing what they love.

2 – Work While Your Portfolio Grows

Once you reach your target goal (I’ll show you how to work it out below) you can start to think about changing your life. You don’t have to continue investing 50% of your income anymore as your portfolio is growing by itself through the power of compounding. This means you finally have options to start spending more freely.

You can continue with your existing job but have a large portion of your income freed up to spend on your hobbies, travel, cars, etc. You may also think about changing to a lower-paying job that you enjoy more or working fewer hours at your existing job so you can spend more time with your kids.

3 – Full Retirement

The great thing about Coast FIRE is that your portfolio will still reach your full FIRE number, just at traditional retirement age. This third stage is when you can leave your job and completely live off your portfolio returns.

How To Calculate Your Coast FIRE Number

Now we know what Coast FIRE is, let’s work out how you can calculate your Coast FIRE number.

Coast FIRE is simple in theory but the formula you use to implement it requires multiple estimates. Here’s the two biggest assumptions we make in the formula:

- Rate Of Growth – We obviously can’t predict our portfolio returns in the future so we have to make an estimate based on historical returns. The higher your return, the less time it will take to reach your retirement number. In general, people will use an estimate of 5-7% after accounting for inflation.

- Rate Of Withdrawal – The second assumption we make is the rate of withdrawal. This is how much we can safely withdraw each year after reaching retirement. 4% is the common number we hear mentioned. This comes from a 1998 Trinity study where three finance professors make their argument that a portfolio of 50% equities and 50% fixed-income securities should allow the owner to withdraw 3-4% of the principal per year and still maintain a reliable source of passive income for decades.

Coast FIRE Formula

The Coast FIRE formula starts with the standard fire formula (25 x Annual Spending) and then divides it by your annual growth to the power of the number of years you have to reach retirement.

(25 x [Annual Spending]) / (1 + [Annual Growth Rate][Years To Retirement] )

Final Thoughts

Coast FIRE is a great financial target to hit. Even if you aren’t intentionally trying to be part of the “FIRE” movement, coast FIRE is a good number to track. Reaching a point in your financial life where you know you are secure for your retirement is very freeing. It’s a level of security that allows you to pursue a more enjoyable path in life if you choose to do so.

Read More From Money Sprout: