In this review, we are going to take an honest look at Moneyfarm and the products they offer on their platform. We take a look at fees, fund performance, and customer reviews for their service. As with any financial platform, Moneyfarm comes with its own strengths and weaknesses. After reading this, you should be able to make a decision on whether or not Moneyfarm is for you.

Moneyfarm is one of the UK's premier digital wealth managers, dedicated to simplifying investments and helping individuals grow their assets. Providing innovative investment solutions, Moneyfarm focuses on delivering tailor-made portfolios based on individual risk appetites and financial goals.

- Slick easy to use app

- Great for passive investors

- High fees on certain products

- Poor returns on low risk funds

Who Are Moneyfarm?

Moneyfarm is one of the UK’s premier digital wealth managers, dedicated to simplifying investments and helping individuals grow their assets. Providing innovative investment solutions, Moneyfarm focuses on delivering tailor-made portfolios based on individual risk appetites and financial goals.

Established in 2011 by Paolo Galvani and Giovanni Daprà in Italy, before expanding its operations to the UK, Moneyfarm has experienced significant growth in a relatively short span of time. Emerging from the digital revolution’s intersection with financial services, it has rapidly secured its position as a favoured choice among tech-savvy investors seeking modern investment approaches.

Reliability: Moneyfarm’s credibility can be attributed to several facets:

- Experience and Innovation: Although a younger entrant in the financial world, Moneyfarm leverages technology to provide efficient investment solutions, combining modern methods with traditional investment principles.

- Regulation: Operating in the UK, Moneyfarm is regulated by the Financial Conduct Authority (FCA), ensuring a high standard of compliance and security for its clientele.

- Engaged Clientele: With its user-friendly platform, the company has garnered a vast number of users, receiving consistent appreciation for its intuitive design and transparent investment strategies.

- Transparency: Renowned for its clear fee structures and a commitment to keeping costs low, Moneyfarm champions transparency, ensuring clients are always informed about where and how their money is invested.

What Products Does Moneyfarm Offer?

Moneyfarm offers 4 simple investing vehicles on their platform. Let’s take a look at what they have to offer.

General Investment Account

This is a general investment account with no tax benefits. You can buy and sell shares as you please but will have to pay capital gains tax on any profit over your yearly allowance of £6,000.

ISA

This account allows you to invest up to £20,000 per year without paying any tax on your profits, even when you withdraw. You pay no tax on capital gains, income, or dividends. Remember you can only have £20,000 spread across multiple ISAs in a single year.

Pension

You can manage your personal pension within Moneyfarm through a SIPP (Self Invested Personal Pension). Any money added to your pension will get a 25% bonus from the government, potentially more if you’re a higher-rate taxpayer. You can then manage your own pension investments.

Junior ISA

A junior ISA allows you to invest up to £9,000 for your child. Once they turn 18 they can access this money. It’s a great way to put money away for their first car, house deposit or university.

How Moneyfarm Investment Management Works

Moneyfarm helps you find an investment strategy that works with your lifestyle. While some people want to have a high-risk, high-growth strategy, others want to lower their risk and have more consistent returns over time.

Moneyfarm will help you decide on the level of risk you want to take. The higher the risk. the more chance there is to lose big and also win big.

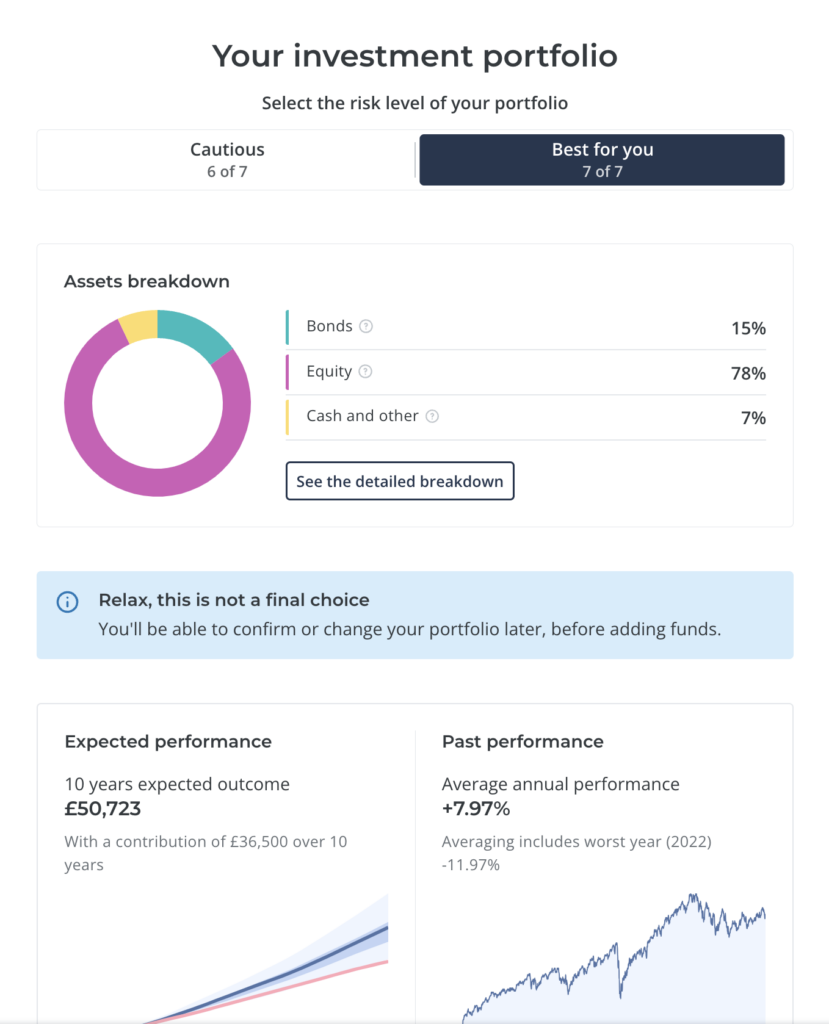

Guided by the decisions you have made in your risk assessment, they will build out a diversified portfolio for you, spreading your risk. You can see the breakdown of their high-risk portfolio below.

Once your money is invested Moneyfarm will aim to maximize your returns by strategically investing your money. They will continue to review your portfolio based on macro or micro trends in the market.

When you use Moneyfarm, you will not be able to invest in individual companies or even funds. The platform is created to take the stress out of investing. They have created base portfolios for set-and-forget investors who want to invest broadly in the markets.

They offer 7 different funds in total based on the level of risk you wish to take and your previous experience with the markets. Later in the review, we take a look at how each of these funds has performed over the past few years.

Moneyfarm is regulated by the FCA so has to adhere to strict guidelines when giving you portfolio recommendations. Unlike some other robo-advisor firms, Moneyfarm is actually providing you with regulated advice. Many other firms operate on an execution-only basis, meaning you make the decision to invest in a fund and the risk ultimately lies with you. As Moneyfarm is offering regulated advice and has to adhere to strict FCA guidelines they have to review the suitability of your portfolio each year to see if it remains suitable for you or not.

Moneyfarm Management Styles

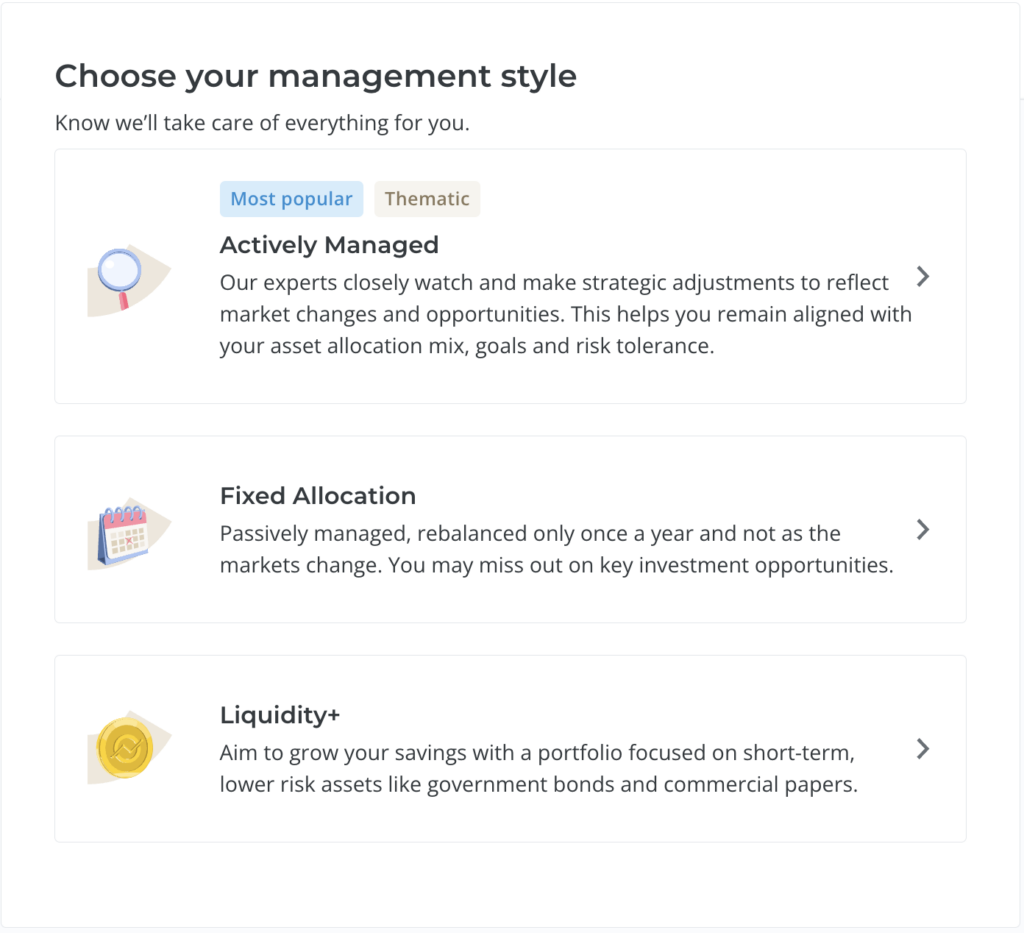

When choosing your portfolio from Moneyfarm you will be asked to choose from 2 different management styles. Here’s what they mean.

Fixed Allocation

Moneyfarm’s fixed allocation is a passive investment approach, where portfolios are initially set up by experts and then allowed to move with the market. With only one rebalance annually, this method minimizes intervention, making it cost-effective for investors. These portfolios are expertly constructed, emphasizing passive growth without continuous tweaks.

Not only are they aligned with market movements, but they can also be tailored to investors’ personal values. Additionally, investors enjoy flexibility; they can access, withdraw, or reinvest their funds during the tax year without penalties.

Active Management

Active management at Moneyfarm provides a dynamic investment experience, with portfolios constantly supervised and adjusted to capitalize on market shifts and counter risks. The objective is to ensure portfolios align with investors’ evolving goals and market dynamics. From the moment of funding, Moneyfarm’s state-of-the-art technology, together with the expertise of Chief Investment Officer Richard Flax and his team, handles the entire process.

Unlike the once-a-year rebalancing in fixed allocation, active portfolios are frequently adjusted, maximizing market opportunities. For any queries or guidance, a dedicated Moneyfarm consultant is always ready to assist, whether online, via the app, or through direct communication channels.

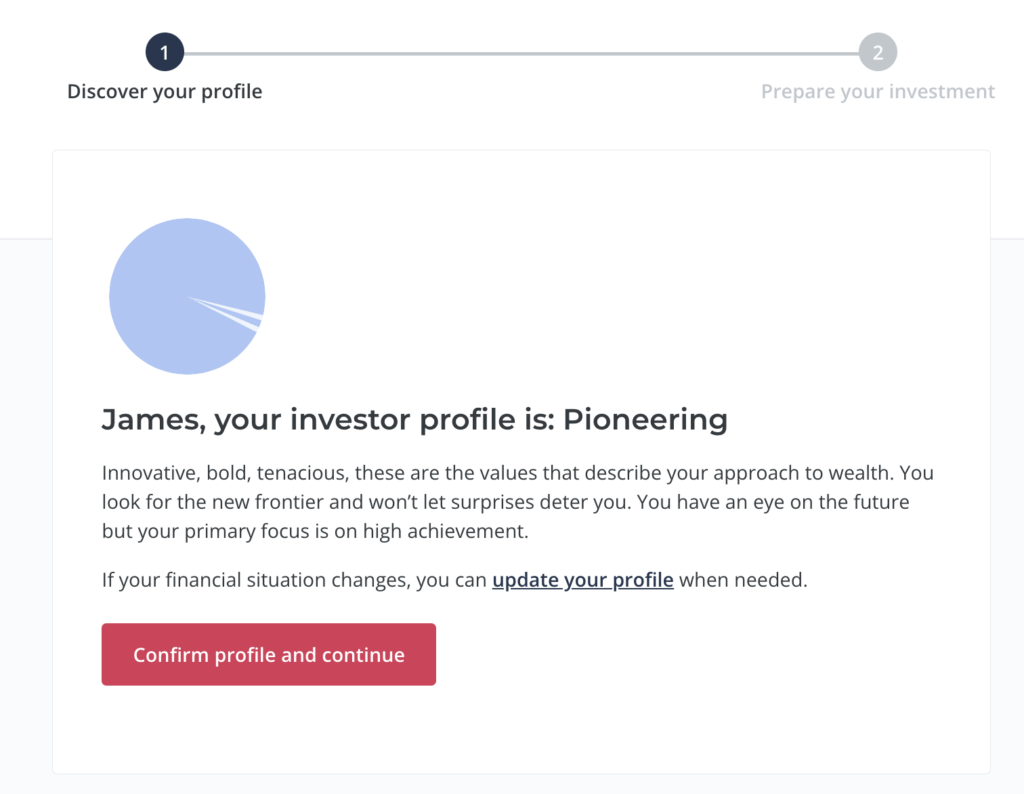

Moneyfarm Onboarding Process

When signing up, you will have to fill out a questionnaire that will determine their portfolio recommendation for you. The signup process takes approximately 10 minutes.

Once you complete this survey you will get assigned a “level” on your investor profile.

Next, I was offered to book a call with an investment advisor who could help me get my portfolio set up. This is a neat feature that many other robo-advisors don’t have and is great for new investors who aren’t confident making their first investments. If you’re confident doing it yourself, you can move to the next stage.

Here you can choose your management style which we have already discussed above. Once that’s complete you have the option of whether or not you want to have a socially responsible portfolio or not.

Finally, before they start putting your portfolio together, you can decide if there’s an area you want to focus on in your portfolio such as sustainability, Technology, society, or multi-trend. Honestly, I would avoid these. If you want to start making your own specific investment decisions use a legacy broker such as Hargreaves Lansdown where you have full control.

Once you have gone through all of this, Moneyfarm will recommend one of their 7 portfolios. You can view all of these portfolios on their site without signing up. I was recommended their 7 of 7 risk level portfolio. Even though I chose high-risk answers in the signup process, the asset allocation is still quite conservative with 15% allocated to bonds and 7% to cash.

That’s you set and ready to start investing in the portfolio chosen for you. Now you simply give them the required personal information to get your account set up.

Moneyfarm Fees

When investing with Moneyfarm there are 3 different fees you will face. This consists of platform fees, investment fund fees and Market Spread fees.

Platform Fee

These are the fees Moneyfarm charges to be on their platform.

| From | Actively Managed | Fixed Allocation |

|---|---|---|

| £500 | 0.75% | 0.45% |

| £10k | 0.70% | |

| £20k | 0.65% | |

| £50k | 0.60% | |

| £100k | 0.45% | 0.35% |

| £250k | 0.40% | 0.30% |

| £500k | 0.35% | 0.25% |

Investment Fund Fees

As well as the platform fees, you will have to pay underlying fund fees. These are the fees charged by the funds Moneyfarm is investing in.

The average fee for underlying funds on Moneyfarm is 0.2% for actively managed and 0.15% for fixed allocation. Expect to pay that on top of your platform fee.

If you opt for the Thematic portfolio (The themes we looked at earlier) your fund fees will range from 0.4% to 0.45%. Another reason to avoid the Thematic portfolio.

Underlying fund fees will also be slightly higher if you choose a socially responsible portfolio vs. the classic portfolio. It’s 0.05% more expensive for fixed allocation and 0.01% more expensive for actively managed.

Market Spread Fees

Another fee you will have to pay is the market spread fee. These are essentially transaction costs. It’s the difference between what someone is looking to sell an asset for and what someone else is willing to pay for it.

For actively managed accounts this fee is up to 0.9% whereas with fixed allocation accounts it is only 0.02%.

Total Fees

So you will be paying the below fees when investing with Moneyfarm.

Moneyfarm Platform Fee + Underlying Fund Fee + Market Spread

The cheapest option to go with is a fixed allocation fund not focused on being socially responsible. With £10,000 invested you would pay a 0.62% fee.

In the most expensive scenario where you choose actively managed with socially responsible funds, you would be paying a 1% fee. This is quite expensive compared to a DIY option but you paying for the simplicity of the service.

Personally, I would stick with the fixed allocation funds and get the cheaper fees.

Moneyfarm Portfolio Performance

Below, you can see the performance of all 7 Moneyfarm funds over the past 7 years. Both of the low-risk funds have performed poorly over the period with one of them delivering negative returns.

| Fund | Risk Level | All Time | Annual Average Return |

|---|---|---|---|

| One | Low | -2.4% | -0.3% |

| Two | Low | 12.2% | 1.6% |

| Three | Medium | 29.6% | 3.5% |

| Four | Medium | 38.7% | 4.5% |

| Five | Medium | 47.5% | 5.3% |

| Six | High | 59.6% | 6.4% |

| Seven | High | 77.5% | 7.9% |

Considering the S&P 500 has returned 13.84% in the same time period these returns are lackluster. However, as I mentioned during the signup process, even the highest-risk portfolio is quite conservative with 22% in bonds and cash. These funds are invested in a broader range of assets than just the S&P 500 so returns are expected to be slightly lower.

If you’re looking for a passive way to invest and don’t want to think too much about your investments one of the higher-risk funds may be a good option for you returning 6-7% per year.

For me, the funds on the lower end are simply too conservative, and currently, you would be better off putting your money in a high-interest savings account offering 4.84%. I use Chip.

Chip is an award-winning savings and investment app. They became popular with their high-interest savings account but also offer investment services and automatic saving.

Moneyfarm Portfolio Breakdown

When investing your money, it’s important to know where your money is being invested. Let’s take a look at a breakdown of a medium-risk and high-risk fund from Moneyfarm.

Medium Risk Portfolio 4

The medium-risk portfolio is very conservative, made up of 51% bonds and cash. If you are early in your investing career this is a very conservative allocation and is unlikely to beat the market. 38.5% is invested in Developed Markets. 5.5% is invested in emerging markets and 5% is invested in Commodities and Real Estate.

| Allocation | Percentage |

|---|---|

| Cash & short-term Gov. Bonds | 9.80% |

| Developed Markets Gov. Bonds | 12.50% |

| Inflation Linked Bonds | 5% |

| Investment Grade Corporate Bonds | 11.70% |

| High-Yield & Emerging Markets Bonds | 10% |

| Developed Markets Equity | 38.50% |

| Emerging Markets Equity | 5.50% |

| Commodities and Real Estate | 5% |

| Cash | 2% |

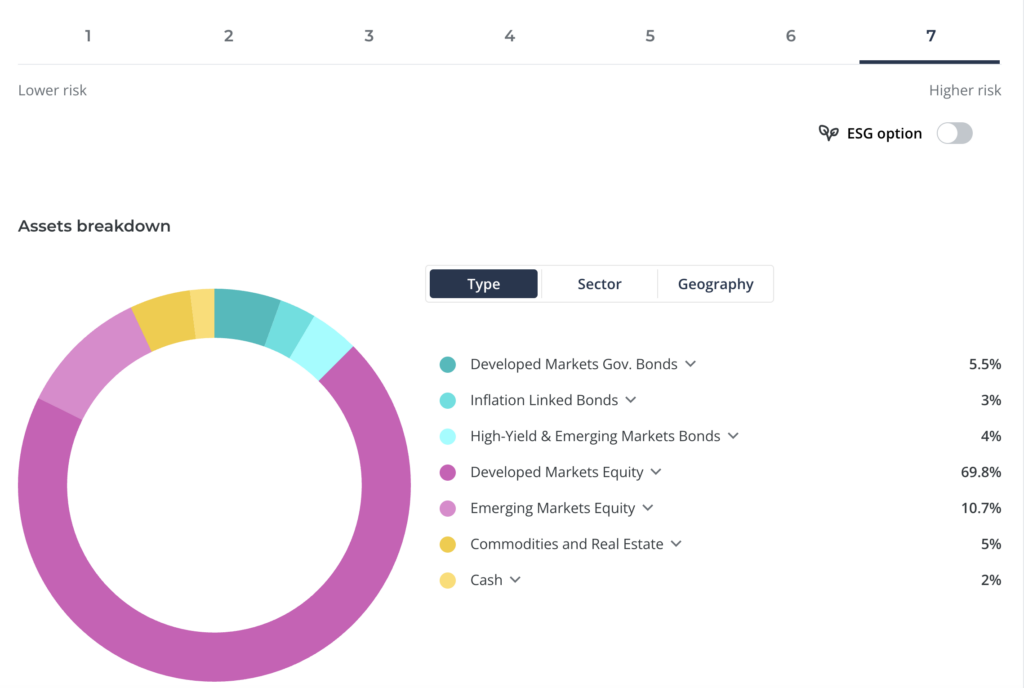

High Risk Portfolio 7

The high-risk portfolio is made up of 14.5% bond and cash with the remaining allocation towards equities and a small 5% in commodities and real estate.

| Allocation | Percentage |

|---|---|

| Developed Markets Gov. Bonds | 5.50% |

| Inflation Linked Bonds | 3% |

| High-Yield & Emerging Markets Bonds | 4% |

| Developed Markets Equity | 69.80% |

| Emerging Markets Equity | 10.70% |

| Commodities and Real Estate | 5% |

| Cash | 2% |

Moneyfarm Reviews

Moneyfarm has 3.8 stars on Trustpilot which is reasonably good for a financial website. 68% of the reviews are 5-star with only 6% of them being 1-star.

The main complaints are about the returns people are receiving from the funds. As we saw earlier in the review the lower-risk funds haven’t performed very well over the past few years so that explains those complaints. I also noticed quite a few of the negative reviews are a company trying to advertise their service so they can be discounted.

Many of the positive reviews have great things to say about how easy the app is to use.

Moneyfarm vs The Competition

The biggest competitor to Moneyfarm right now is Nutmeg. Let’s see how they stack up when it comes to fees and performance. If you want to go deeper, we have a full comparison of Nutmeg vs Moneyfarm.

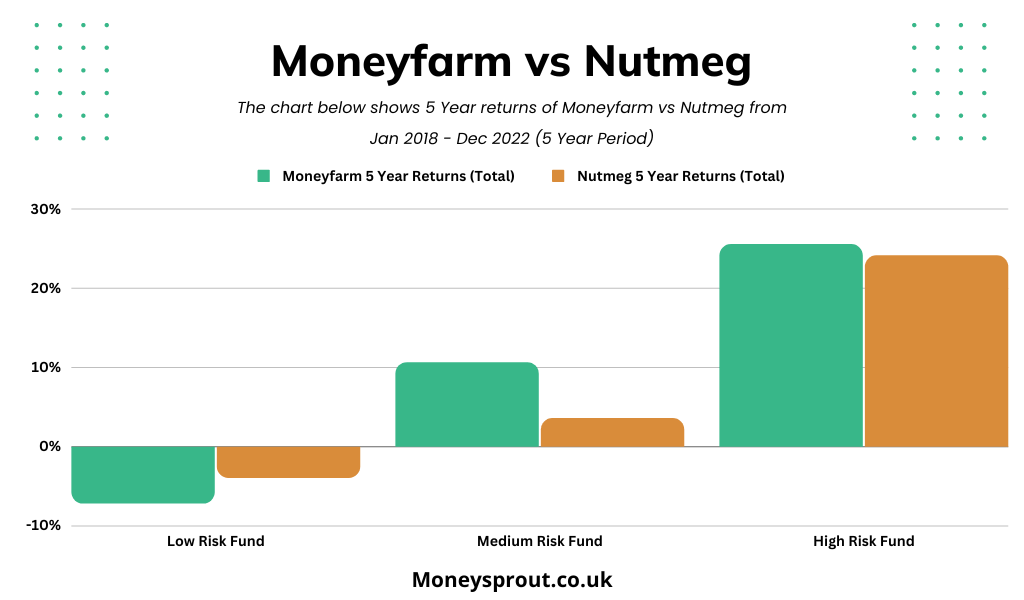

Performance

While past performance is not a guarantee of future performance it’s a good indicator of successful funds over long periods of time. Let’s take a look at how both of these funds have performed over the past few years.

These numbers are based on the actively managed funds at both providers.

| Risk Level | Moneyfarm 5 Year Returns (Total) | Moneyfarm 5 Year Return (Yearly Avg) | Nutmeg 5 Year Returns (Total) | Nutmeg 5 Year Returns (Yearly Avg) |

|---|---|---|---|---|

| Low | -7.1% | -1.5% | -3.9% | -0.8% |

| Medium | 10.6% | 2.1% | 3.6% | 0.72% |

| High | 25.5% | 4.7% | 24.09% | 4.49% |

Low risk relates to each provider’s lowest-risk fund. Medium relates to their middle fund and high relates to their highest risk fund.

Moneyfarm outperforms Nutmeg in both the medium and high-risk funds but lost more in the low-risk fund. Both companies’ low-risk funds performed horribly over the 5 year period losing money.

Moneyfarm performed significantly better with their medium-risk fund (10.6% vs 3.6%) and only marginally better with the high-risk fund (25.5% vs 24.09%).

Overall Moneyfarm has performed better than Nutmeg based on returns over the past 5 years.

Fees

Both Moneyfarm and Nutmeg have similar fee structures. Just like we broke down above, there will be a platform fee, fund fee and spread fee. On both platforms, the fund fees are very similar. The main difference is with the platform fees on both platforms. Let’s look at them side by side.

Actively Managed Fees

| From | Moneyfarm | Nutmeg |

|---|---|---|

| £500 | 0.75% | 0.75% |

| £10k | 0.70% | 0.75% |

| £20k | 0.65% | 0.75% |

| £50k | 0.60% | 0.75% |

| £100k | 0.45% | 0.35% |

| £250k | 0.40% | 0.35% |

| £500k | 0.35% | 0.35% |

Fees are much cheaper on Moneyfarm than Nutmeg. With Moneyfarm, you will be charged a fee based on your total balance. For example, if you have £100k in your account, you would be charged 0.45% of the total amount. However, with Nutmeg you are charged on a tier basis. Everything in your account up to £100k will be charged at 0.75% and everything after £100k will be charged at 0.35%.

For most people, Moneyfarm will work out much cheaper than Nutmeg.

Fixed Allocation Funds

Both platforms have fixed allocation products which means the portfolio is not actively managed and only gets rebalanced once a year. The fees on these are cheaper than actively managed products.

| From | Moneyfarm | From | Nutmeg |

|---|---|---|---|

| Up To £100k | 0.45% | Up to £100k | 0.45% |

| £100k to £250k | 0.35% | £100k+ | 0.25% |

| £250k to £500k | 0.30% | ||

| £500k+ | 0.25% |

Up to £100k both platforms have the same fee. Nutmeg is 0.1% cheaper for users who have a balance of £100k to £500k.

Overall

Overall we think Moneyfarm is a better choice for most people. They have significantly better performance in their medium and high-risk funds. They also have better fees on their actively managed portfolios and very similar fees on Fixed allocation funds.

Who Should Use Moneyfarm?

Moneyfarm is a great choice for someone who knows they should be investing for their future and retirement but doesn’t want to spend hours choosing stocks. If you simply want to invest in a diverse range of assets with very little hassle Moneyfarm is perfect.

Moneyfarm is one of the UK's premier digital wealth managers, dedicated to simplifying investments and helping individuals grow their assets. Providing innovative investment solutions, Moneyfarm focuses on delivering tailor-made portfolios based on individual risk appetites and financial goals.

Final Thoughts

Overall, we think Moneyfarm is a great product for set-and-forget investors. If you don’t want to go to an expensive in-person financial advisor but also don’t want to spend hours picking your own funds and stock, Moneyfarm is perfect. Their fees are reasonably inexpensive for their classic fixed allocation funds and the platform is very simple to use for beginners.

Read More From Money Sprout: