Webull has been a popular broker in the United States since it hit the market in 2017. They became popular through their influencer marketing strategy onboarding thousands of users. Many have stuck around because of their user-friendly app with low-cost trading and useful features.

Recently, Webull has launched their app in the UK market. In this review, we will look at the app’s features, products, fees and customer reviews to see how it compares to the US version of the app.

Webull is a stock trading platform that has had a lot of success in the US since 2017. They have now released a UK version of the app offering after-hours trading, access to the US market and cheap fees.

- Low commission on trades

- Great stock analysis and app

- After Hours trading available

- No ISA account available

- Only has US stocks

- High FX Fees

Quick Overview

While Webull UK has some great features such as fractional shares, after-hours trading and low fees, they are lacking in some key areas for UK investors. They currently only offer access to the US market, meaning you are unable to invest in UK and global shares. They also don’t offer an ISA account which is a huge letdown.

The main selling point of Webull right now is their after-hours trading which most other platforms don’t offer. If they can eventually get access to the UK and global markets, they could become a strong competitor to other investment platforms.

Who Are Webull?

Webull UK is an emerging player in the UK’s financial services landscape, providing an innovative platform for trading and investment. A subsidiary of the globally recognized Webull Financial LLC, Webull UK builds upon the legacy of its parent company by offering a range of products and services, including advanced trading tools, real-time market data, and in-depth analysis resources.

Originating from Webull Financial LLC, which was founded in 2017, Webull UK may be newer to the scene compared to other financial giants, but it is rapidly gaining traction due to its technological advancements and user-friendly interface. The main ethos behind Webull is to democratize finance for all by providing powerful tools and resources.

Is Webull Good For Beginners?

Webull has some features that make it good for beginners such as low fees and fractional shares. However, they only offer a General Investment account and don’t have any ISA options. Any gains you make over your capital gains allowance will be taxed. This alone makes it hard to recommend Webull against some of its competitors for beginners.

What Products Does Webull UK Offer?

Most UK trading platforms will offer a range of investment vehicles to their customers, including ISA accounts, Pensions and General investment accounts. Unfortunately, Webull is only offering access to a General Investment Account (GIA).

This means that UK investors are unable to benefit from the tax advantages of a Stocks and Shares ISA. Without having an ISA available, it is hard to recommend the platform. For most people, maxing out their ISA allowance should be the focus before opening a general investment account. You can open an ISA on platforms like Hargreaves Lansdown or Trading 212.

If you have maxed out your ISA and want to open a General Investment account to invest in US Stock, Webull could be a good choice. It’s also one of the only platforms to offer after-hours trading which may be advantageous to some traders.

Hopefully, in the near future, we will see Webull release an ISA account as this would open up the market to a much wider range of investors. It’s likely that they wanted to get to market with a minimally viable version of the product and will continue to expand their offering as time goes on.

What Investments Does Webull UK Offer?

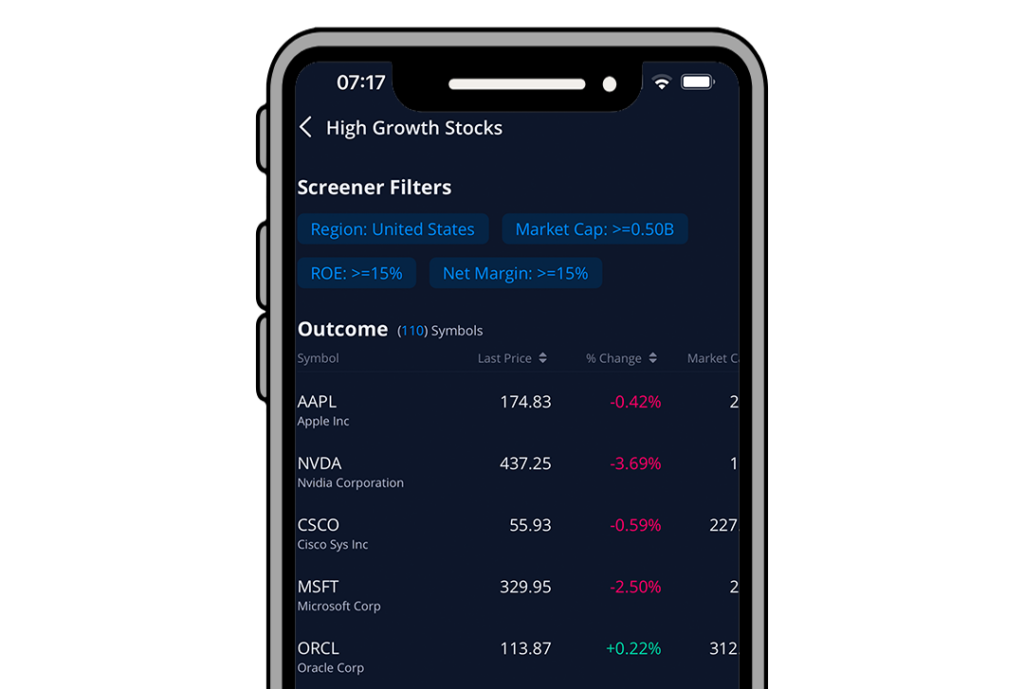

Currently, Webull only gives UK investors access to the United States market. There are over 10,000 stocks available to trade on the app which is a lot more than some UK competitors such as Wombat offer.

They have access to exchanges such as the Nasdaq, NYSE, AEMX and more.

Investors with small portfolios will be happy to know fractional shares are available. This means you can purchase a fraction of a share. On certain brokerages, you are only able to purchase a minimum of 1 whole share.

Many popular stocks cost hundreds of dollars making it hard for small investors to purchase individual shares. Fractional shares allow you to purchase a portion of a share. For example, if a share is $100, you can purchase 0.1 shares for $10.

Hopefully, in the near future, we will see them add more UK and global exchanges to the platform.

Webull After Hours Trading

As you probably know, the stock market opens and closes at set times each day. On most investing platforms you can only invest during “trading hours”. While it has been a popular feature on some platforms in the United States, not many brokers offer this feature in the UK.

Webull has brought after-hours trading to the UK at launch. This means you can trade stocks in the pre-market as well as the post-market. This used to be a service only available to institutional investors but technology has allowed the masses to play on a level playing field.

Why Would You Want To Trade After Hours

There are a number of reasons you may want to trade after hours:

Respond To Breaking News First – Not all company news is delivered during trading hours. If a breaking story goes live, having access to after-hours trading can allow you to act first.

Convenience – Not everyone can trade during normal market hours. Having access to after-hours may allow you to trade where you otherwise couldn’t.

Pre-market Insights – Having access to the market after hours can give you insights into trading volumes and the direction the market may take during the next trading day.

Potentially Better Prices – On certain occasions, you may find that certain stocks are trading at favorable prices in the after-hours, allowing savvy traders to pick up shares at a discount.

Risks Of Trading In The After Hours

While trading after hours comes with a range of benefits, it also comes with added risk. Here are a few things to be aware of when trading after hours:

Liquidity Concerns – As there are fewer market participants in the after-hours, there may be less liquidity, which can lead to larger bid-ask spreads. This could make it harder to execute orders at favorable prices.

Increased Volatility – Trading volumes are lower in the after-hours which can lead stocks to be more volatile, causing significant price swings.

Limited Participation – Not all stocks will have after-hours trading available.

Competition with Institutional Investors – Trading after hours means you will be competing against professional and institutional traders who have access to more resources.

If you’re a day trader, Webulls after-hours feature could be very beneficial to you. For buy-and-hold investors like myself, it’s unlikely to make much difference to my investing strategy.

Webull Advanced Charts

Webull has been on the American market for years now. Unlike other platforms released in the UK, they are not brand new. They can take everything they learned from building the US platform and add it to the UK version.

The app is one of the best we have used. They have comprehensive charting features, allowing you to analyse a wide range of technical indicators as well as draw your own lines on the charts.

One of my favorite charting features on the platform is the VS feature allowing you to quickly compare two stocks of your choice.

You can use these charting features on both the computer and the mobile app. When you’re trading it’s much easier to look at indicators and detect patterns on a computer however I was surprised at how well the mobile app worked for charting lines and showing a range of different preset indicators.

Another feature I enjoyed was the ability to add multiple stocks to a grid. If you’re a trader and want to keep an eye on multiple stocks during the trading day, you can.

Webull Company Analysis

One of the places Webull shines is their company analysis. They have an amazing overview page of each stock providing a wide range of information.

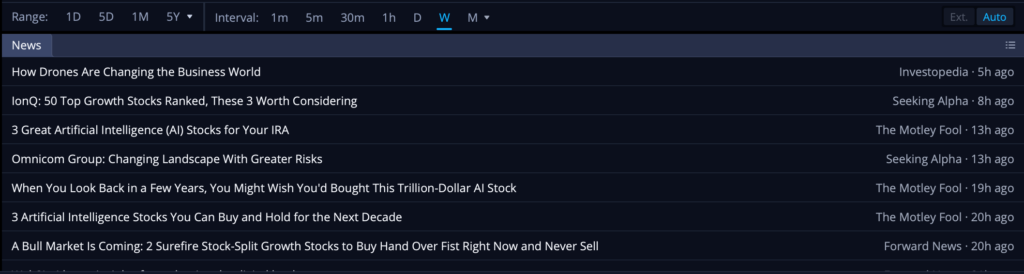

First off is the news section. Each stock has a news feed that showcases any recent news articles published about the stock. This is a great way to keep an eye on what is going on with each company you invest in.

You also have the charting and trend line features which we have already discussed above.

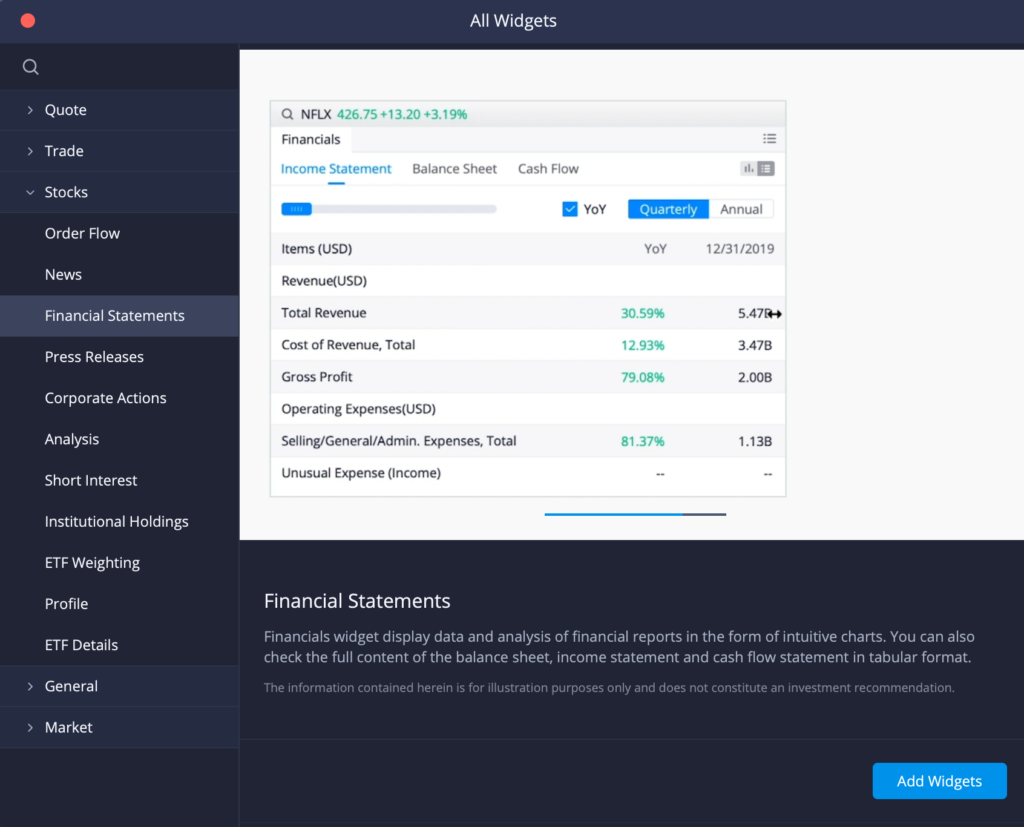

You can then dive deeper into the Webull Widgets section. Here they have a wide range of informative widgets you can add to your dashboard making it easy to analyse stocks.

These widgets include:

- Order flow

- Financial Statements

- Press Releases

- Corporate Actions

- Analysis

- Short Interest

- WTF Weighting

- Many more

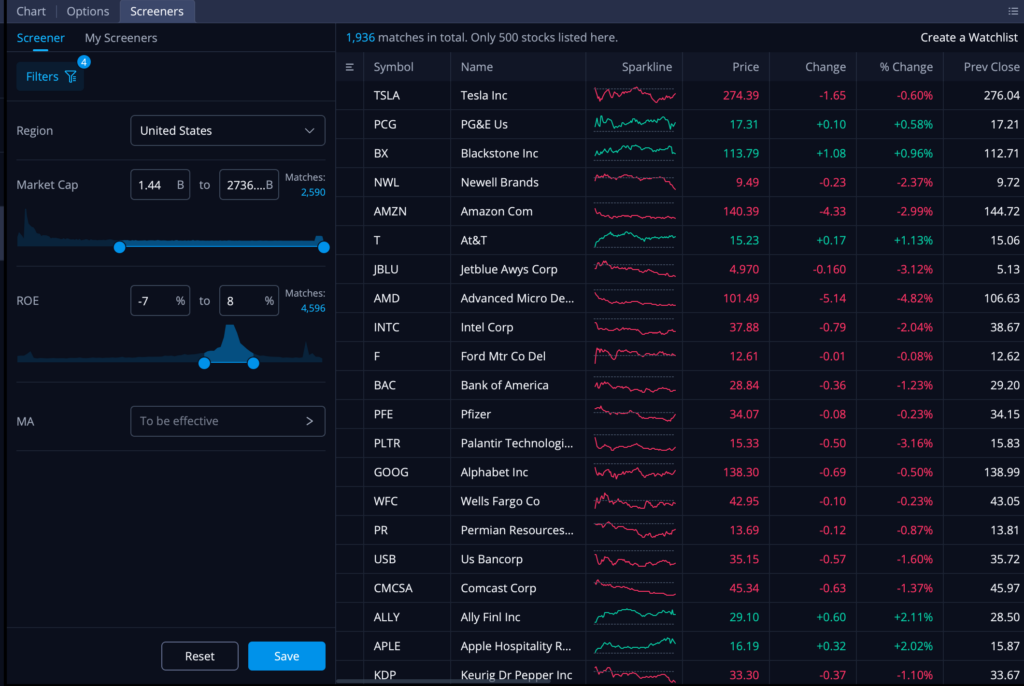

As well as these individual stock analysis tools, you can set up a stock screener to find stocks that meet your investing criteria.

When it comes to having an all-in-one, trading and analysis platform Webull does an amazing job. Even if I didn’t actually execute my trades on the platform, I will likely continue to use this app solely for the simple free analysis features.

Webull Paper Trading

If you’re not ready to invest real money in stocks just yet, you can “Paper Trade”. When paper trading you can learn how to use the app and test your trading strategies without putting any real money on the line.

Webull UK Fees

Many UK platforms now offer commission-free trading, unfortunately, Webull has not followed. They currently charge a 0.025% fee on each trade you make. While they do charge a fee, this is relatively inexpensive, especially if you are trading in small quantities.

For example, if you bought £1,000 worth of stock, you would pay £0.25 in commission. Not bad compared to some legacy platforms which charge £10+ per trade.

You can also currently get 90 days of free trading when you sign up.

| Items | Charges | Charged by |

|---|---|---|

| Commission | 2.5 basis points (0.025%) Currently offering commission-free trading for 90 days) | Webull |

| Platform Fee | 0 | Webull |

| Regulatory Transaction Fee (Sell Trades Only) | USD 0.000008 * Total Trade Amount (Min. USD 0.01) | US Securities and Exchange Commission (SEC) |

| Trading Activity Fee (Sell Trades Only) | USD 0.000145 * Total Trade Volume (Min. USD 0.01 and Max. USD 7.27 per trade.) | US Financial Industry Regulatory Authority (FINRA) |

| Foreign Exchange Conversion (Min USD10 or equivalent per conversion) | 35 basis points (0.35%) | Webull |

Fortunately, there are no platform fees, so you can access their amazing analysis and dashboards for free.

The biggest place you need to watch for fees is the FX Fees. These fees are charged at the time of execution. The fee is based on the rate offered by Webulls banking partners plus Webulls own 0.35% fee on top. This can add up if you are making a lot of trades on a daily basis.

Does Webull UK Offer Options Trading?

While the US version of Webull offers options trading, the UK version does not. It only offers cash account trading via its general investment account. If you want to trade options in the UK, check out Interactive brokers or Degiro.

Webull Reviews

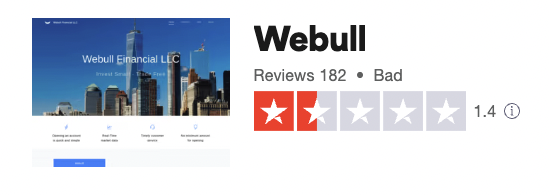

Webull has some of the worst reviews of any investment platform we have reviewed on Money Sprout. It’s worth noting these reviews also include people from the US platform.

They have a 1.4-star rating on Trustpilot with 182 total reviews. Only 4% of reviewers gave the app 5 stars while 85% of them left a 1-star rating.

They haven’t claimed their trust pilot page so supposedly don’t ask their customers for reviews. This is potentially why there is an overwhelmingly large amount of negative reviews vs positive reviews.

There are many complaints but the main ones are from poor customer service and people struggling to use the app. I can understand how new traders would be struggling with the app as there is a lot going on. If you’re brand new to trading it would be overwhelming to use. Others have stated it takes a long time to get in contact or get a reply from customer service.

Is Webull UK Safe?

Yes, Webull is safe. They are authorised by the Financial Conduct Authority (FCA) and are also a part of the Financial Services Compensation Scheme (FSCS).

The FCA ensures that Webull follows strict financial regulations to keep your money safe.

These FSCS covers you up to £85,000 if Webull was ever to go out of business.

Webull also has the financial backing of Webull US, which has been around since 2017. The US version of the app is a member of the Financial Industry Regulatory Authority (FINRA) as well as the US Securities and Exchange Commission.

Who Should Use Webull?

Personally, I do not think most new investors should use Webull. Not having an ISA available for investors is a huge letdown. Also not offering UK stocks to UK investors is also not great. If they eventually release these two things, it would change my thoughts on the app.

If you’re a day trader who primarily trades the US market, Webull could be a good platform option. They offer one of the best software platforms I have seen on the market. Webull essentially has trading view built into their software and you can use it for free.

Final Thoughts

Ultimately, for most people, I wouldn’t recommend Webull UK right now. The fact they don’t have ISA accounts available and the complicated interface doesn’t make it a great choice for beginners. With that said, if you know your way around a brokerage app, Webull has a lot of great features. Day traders may benefit from the charts, analysis and after-hours trading available on the app.

Read More From Money Sprout: