If you’re considering setting up a new private or self-employed pension, you might consider using Pensionbee or Penfold. These are two of the best modern pension platforms on the market. Both are a great choice but one is just slightly better in our opinion.

In this article, we are going to break down both of these platforms to see which has the best investment options, fees and performance. Let’s jump in.

|

5.0

|

4.5

|

|

Pros:

|

Pros:

|

|

Cons:

|

Cons:

|

- Easy to move existing pensions into the platform

- 0.5% Annual Management Fee

- 8 Investment plans available

- Great customer support

- Automatic 25% Government Bonus on contributions

- Can withdraw your pension via a drawdown or annuity

- Supports self-employed people

- Low control over your investments

- No financial advice

- Easily find and add old pensions to your account

- 0.75% Annual Management Fee

- Good range of investment plans

- 25% government bonus

- A great for self employed people

- Fees more expensive than Pensionbee

- Low control over investments

Pensionbee vs Penfold Overview

Pensions can be a complicated topic. Most people know they should be investing for their future but put it off because it seems so far in the future. Pension apps like Pensionbee and Penfold are making it much easier to invest in your pension. They also make it easy to find any old pensions you have and consolidate them in a single place.

Pensionbee

Pensionbee is a pioneering digital retirement platform in the UK, dedicated to streamlining the pension management process for its users. They put a lot of marketing focus around their ability to find your old pensions and consolidate them into one single platform.

The platform was founded in 2014 and has since seen impressive growth due to the easy-to-use nature of its app. While it’s not as old as some other pension providers, they are certainly impressing the early users they have on board.

When it comes to investing your money there are over 8 investment plans to choose from depending on your personal circumstances. We’ll look at this in more detail soon.

Penfold

Penfold is an even newer platform in the UK, founded in 2017. Penfold put a large focus on giving small employers a place to create a pension scheme for their employees. However, they also offer private pensions for individual savers, the self-employed and directors of limited companies.

All in all, their service is very similar to Pensionbee. They have 10 different plans to invest in depending on your personal circumstances. The app is simple to use and allows anyone to get started saving for retirement.

The main difference between these two platforms comes in the fine print. Things like fees, investment performance and customer support set these companies apart. Let’s dive a little deeper.

Pensionbee vs Penfold Comparison

| Platform | Pensionbee | Penfold |

|---|---|---|

| Rating | 5 | 4.5 |

| Minimum Investment | £0 | £0 |

| Investment Plan Types Available | – Tracker – Tailored – Fossil Fuel Free – Impact – 4Plus – Shariah – Preserve – Pre-Annuity | – Standard – Lifetime – Sustainable – Shariah |

| Plans Available | 8 | 10 |

| Fees | 0.5% for Tracker plan up to £100k, 0.25% on balance over £100k Other more focused plans have slightly higher fees but most people would be better suited for the tracker fund. | 0.75% for pension pots under £100k and 0.4% for pension pots over £100k The Shariah plan has slightly higher fees at 0.88% and 0.53% for pots over £100k. |

| Can add old Pensions? | ✅ | ✅ |

| Pension Withdrawal Fees | Free | Free |

| Pension Withdrawal Options | – Lump Sum – Drawdown – Annuity | – Lump Sum – Drawdown – Annuity |

Pensionbee vs Penfold: Investment Plans

Both platforms have a range of different portfolios to choose from when setting up your pension. Each company offers a standard plan as well as plans focused on other beliefs or interests such as socially responsible investing or Sharia law.

Penfold

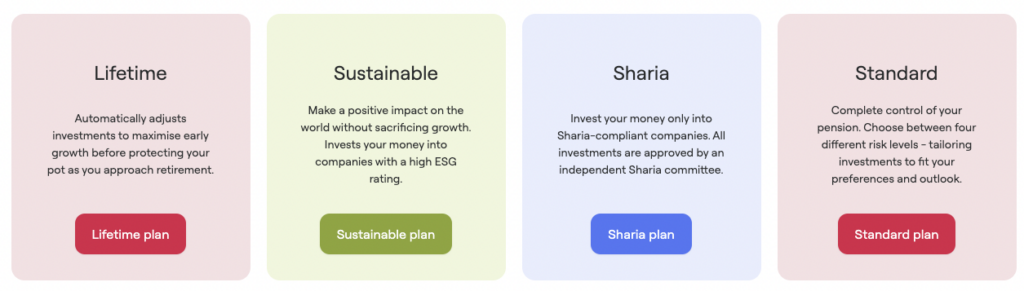

Penfold has 4 main plan options to choose from:

- Standard

- Lifetime

- Sustainability

- Shariah

These “plans” are essentially just wrappers for Blackrock funds which invest in a range of different iShares ETFs. You could in theory invest in these yourself outside of Penfold. The underlying fund of the Shariah plan is with HSBC.

Within the standard and sustainability plans, you can choose a risk level that suits you. If you are young and have 20+ years to invest, you can choose a higher-risk plan that may be more volatile but should produce better returns in the long term. Those closer to retirement can choose a lower risk plan allowing them to protect and preserve their wealth as they approach retirement age.

The lifetime plan works like a target retirement fund and will lower your exposure to risky assets such as stocks the closer you get to retirement. This is a great choice for more passive investors who don’t want to manage their portfolios themselves. You can choose from a standard or sustainable lifetime plan.

The Shariah plan invests in Shariah-compliant companies so Muslims can also invest in their financial future. This fund is managed by HSBC and sits at 5 of 7 on the risk scale.

Pensionbee

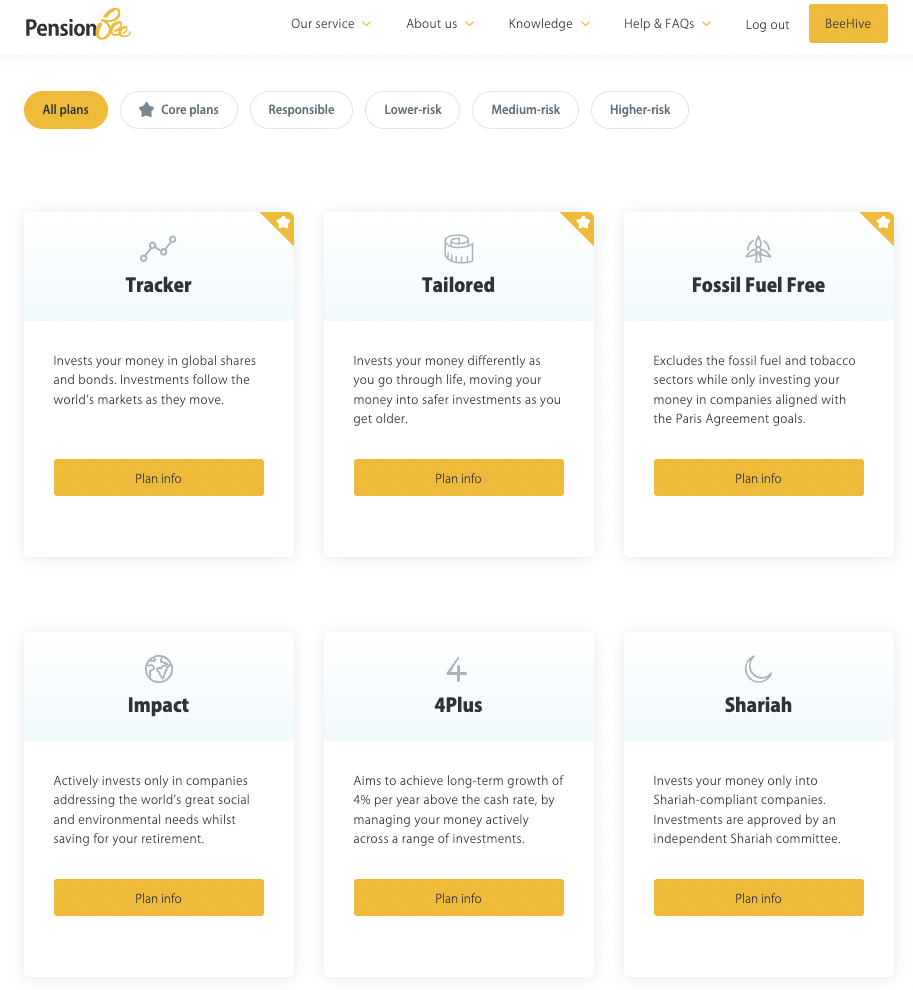

Pensionbee has 8 plans to choose from:

- Tracker

- Tailored

- Fossil Fuel Free

- Impact

- 4Plus

- Shariah

- Preserve

- Pre-annuity

Pensionbee has 3 main core plans; Tracker, Tailored and Fossil Fuel Free. These are the most popular plans on their platform.

Pensionbee doesn’t have risk-based options on each plan like Penfold. They have one core tracker portfolio that tracks the broad market and then have other plans such as Preserve and Pre-annuity when you start to reach retirement age and want to lower your risk.

The tailored plan operates in a similar fashion to Penfolds Lifetime plan. You choose the date when you plan to retire and it will automatically re-balance your portfolio towards less risky assets as you approach retirement. This is likely the best strategy for most passive investors who don’t want to overthink their investing strategy.

Pensionbee also has some focused plans such as its Impact plan which focuses on investing in companies that are addressing the world’s great social and environmental needs. It also has a Fossil Fuel Free plan that excludes the fossil fuel and tobacco sectors while only investing in companies that align with the Paris Agreement goals.

Plans Compared

Both platforms essentially have the same offerings available when it comes to the type of plans they offer. For most people, you will be going with a simple tracker fund to start your portfolio anyway. The main question is, which has higher performance? That’s what we’re going to look at next.

Pensionbee vs Penfold: Portfolio Performance

Below I have taken the Level 4 Penfold plan and put it against the Pensionbee tracker fund. Unfortunately, we can only get 3-year returns from Penfold.

| Fund | 1 Year Returns | 3 Year Total Returns | 5 Year Total Returns |

|---|---|---|---|

| Penfold Standard Level 4 | 3.3% | 15.93% | – |

| Pensionbee Tracker | 6% | 16.5% | 20.1% |

As you can see above the Pensionbee tracker fund has outperformed in the past year by 2.7% and just slightly outperformed over the past 3 years by 0.57%.

The Pensionbee plan is invested in 80% equities and 20% fixed income. The Penfold Level 4 Plan holds 85.37% in equities and 11.93% in fixed income with the remaining in alternatives and cash.

The funds have roughly the same balance when it comes to asset classes. Penfold has a slightly more aggressive approach which brings a little more volatility.

Ultimately, both of these choices use a very similar investing style to provide clients with a diversified portfolio.

Pensionbee vs Penfold: Transparency

Both platforms are transparent about their fees and the holdings in your portfolio. I personally would like to see them showcase each investing plan’s yearly returns on the site. This would be valuable for potential users to compare each investing option against each other.

The performance returns can be found but you have to dig into the actual funds that the plan holds. For most beginner investors, this isn’t going to be easy to navigate.

Most of the funds only have a 3-year track record so far, so we may see these published with comparisons at a later date.

Both platforms are transparent when it comes to their fees. Let’s take a deeper look.

Pensionbee vs Penfold: Fees

When it comes to fees, both platforms charge one single yearly management fee. This is much easier to navigate than many other platforms and advisors who are charging multiple different fees.

Pensionbee Fees

| Investment Plan | Fee Up To £100k | Fee on Balance Over £100k |

|---|---|---|

| Tracker | 0.5% | 0.25% |

| Tailored | 0.7% | 0.35% |

| Fossil Fuel Free | 0.75% | 0.375% |

| Impact | 0.95% | 0.475% |

| 4Plus | 0.95% | 0.475% |

| Shariah | 0.95% | 0.475% |

| Preserve | 0.5% | 0.25% |

| Pre-Annuity | 0.7% | 0.35% |

Penfold Fees

| Plan | Fee | Fee For Pots Over £100k |

|---|---|---|

| Standard | 0.75% | 0.4% |

| Sustainable | 0.75% | 0.4% |

| Lifetime | 0.75% | 0.4% |

| Sharia | 0.88% | 0.53% |

Pensionbee is significantly cheaper on their tracker plan which is the plan I would use myself. If we compare it to Penfold’s standard plan you are saving 0.25% on a portfolio under £100k.

Penfold is cheaper for the Sharia plan and Sustainable plan.

For the impact and 4Plus funds with Pensionbee they are getting pretty expensive at 0.95%. Personally, I would avoid these high-fee funds as they will eat into your returns.

So if you’re looking to invest in broad market indexes, Pensionbee is the cheapest option with their Tracker plan and Preserve plan. If you want to invest in a Sustainable or Sharia plan, Penfold is the cheaper option.

Pensionbee vs Penfold: Old Pensions

Pensoinbee and Penfold offer great pension transfer services for free. Any old pensions you have can be transferred into either of their platforms and invested in their investment plans.

I love this feature as it allows you to consolidate your pensions in one single place so you can keep an eye on your money and ensure it’s working for you for retirement. If you have worked multiple jobs in the past, you may have a few pensions to transfer in.

It seems like these providers have good relationships with some pension funds which allows them to transfer pensions from those companies quickly while others can take up to 12 weeks for the transfers to complete.

Pensionbee vs Penfold: Withdrawals

Both platforms offer the same withdrawal options and don’t charge any fees to draw down from the platform.

On Pensionbee and Penfold, you can withdraw your pension through:

- Lump sum

- Pension Drawdown

- Annuity

Pensionbee vs Penfold: Reviews

Both platforms have great reviews on Trustpilot and the App store. Pensionbee just slightly beats Penfold with 4.6 vs 4.3 stars on Trustpilot.

| Platform | Trustpilot | App Store | Money Sprout Rating |

|---|---|---|---|

| Pensionbee | 4.6 ⭐️ | 4.8 ⭐️ | 5 ⭐️ |

| Penfold | 4.3 ⭐️ | 4.8 ⭐️ | 4.5 ⭐️ |

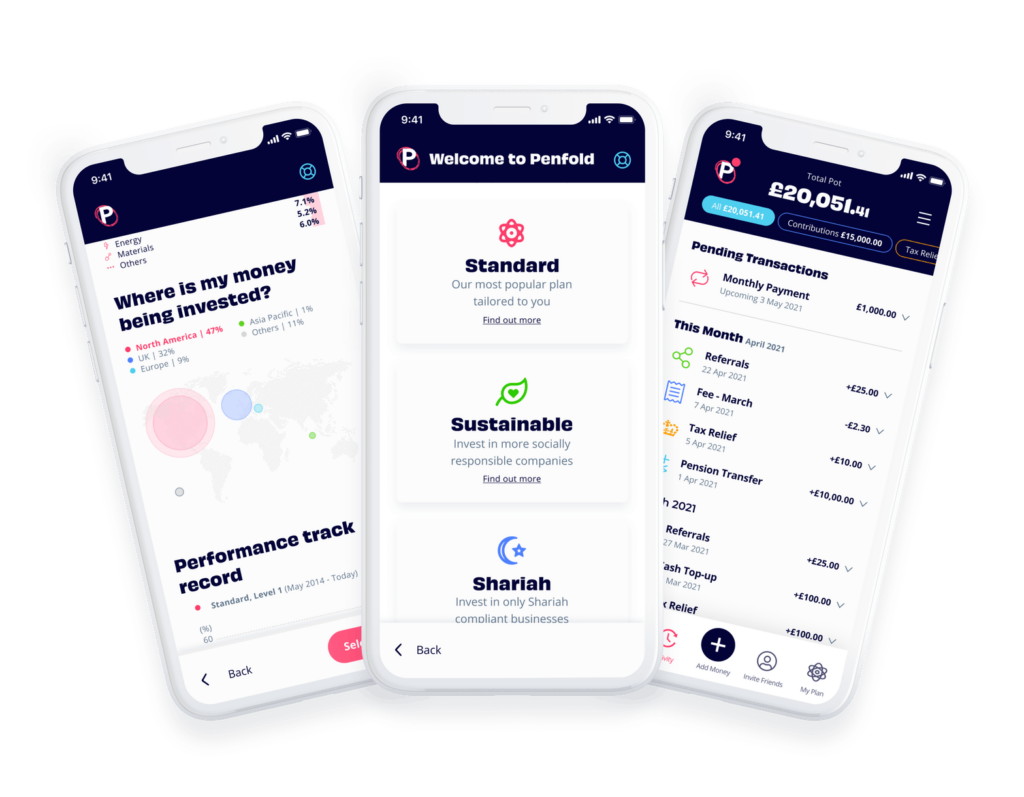

Pensionbee vs Penfold: App & Interface

As these are modern apps their goal is to make investing for your future as easy as possible. Both of their apps are simple to use and allow you to get a great overview of how your pension is performing.

Pensionbee vs Penfold: Safety

Both apps are on par when it comes to safety. They are both Authorised by the Financial Conduct Authority (FCA) and also covered by the Financial Services Compensation Scheme (FSCS).

The FCA ensures that platforms are following strict financial regulations to keep your money safe.

The FSCS covers you up to £85,000 if they ever went out of business.

You can be confident that your money is safe when opening a pension with Pensionbee or Penfold.

Who Should You Start A Pension With?

When you break down the numbers, for most people Pensionbee will be a better option. If you want to simply invest in broad market indexes with low management fees, Pensionbee offers that. They also outperformed Penfold with their equivalent plan.

Some of the other investment options like Sustainability and Sharia are cheaper with Penfold. If you’re looking to go down this route Penfold might be the move for you.

Pensionbee seems to edge out Penfold when it comes to customer support. They have their “Beekeepers” to help you along with the pension process which is a nice touch.

Other than that, both platforms really have the same features and services. For that reason, I would choose Pensionbee as my pension provider of choice.

Read More From Money Sprout: