In this review, we are going to take an honest look at Pensionbee, one of the most popular modern pension platforms in the UK. We’re going to take a look at their fees, investment options and customer reviews for the platform.

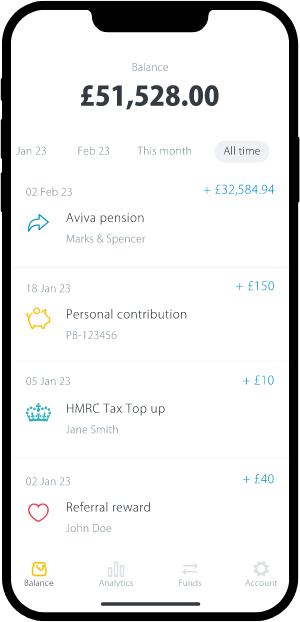

Most people have workplace pensions but don’t really know where their money is invested. Pensionbee allows you to take control of your pension and track your investments to ensure the most growth out of your portfolio.

Pensionbee is a pioneer in the digital retirement space in the UK. This platform allows you to quickly combine all of your pensions into one easy-to-manage place and they do all the hard work for you. You can then continue to invest for retirement in one of Pensionbee's 8 Investment plans depending on your investment style.

- Easy to move existing pensions into the platform

- 8 Investment plans available

- Great customer support

- Automatic 25% Government Bonus on contributions

- Can withdraw your pension via a drawdown or annuity

- Supports self-employed people

- Low control over your investments

- No financial advice

Who Are Pensionbee?

PensionBee is a pioneering digital retirement platform in the UK, dedicated to streamlining the pension management process for its users. The platform allows individuals to consolidate their old pension pots into a single, easily accessible online plan, making pension management simpler and more transparent.

Founded in 2014 by Romi Savova and Jonathan Lister Parsons, PensionBee emerged out of a genuine need to address the complexities and opacities of traditional pension schemes. From its inception as a disruptive fintech startup, the company has seen impressive growth, earning the trust and patronage of numerous users across the UK. While not as old as some of its contemporaries, PensionBee’s innovative approach to retirement savings sets it apart in the financial services landscape.

How Pensionbee Works

Pensionbee allows you to quickly find any old pensions you have and pull them all into one single platform, so you can manage your money in one place. If you are self-employed and don’t currently have any pensions, you can set up a new account and start contributing towards one.

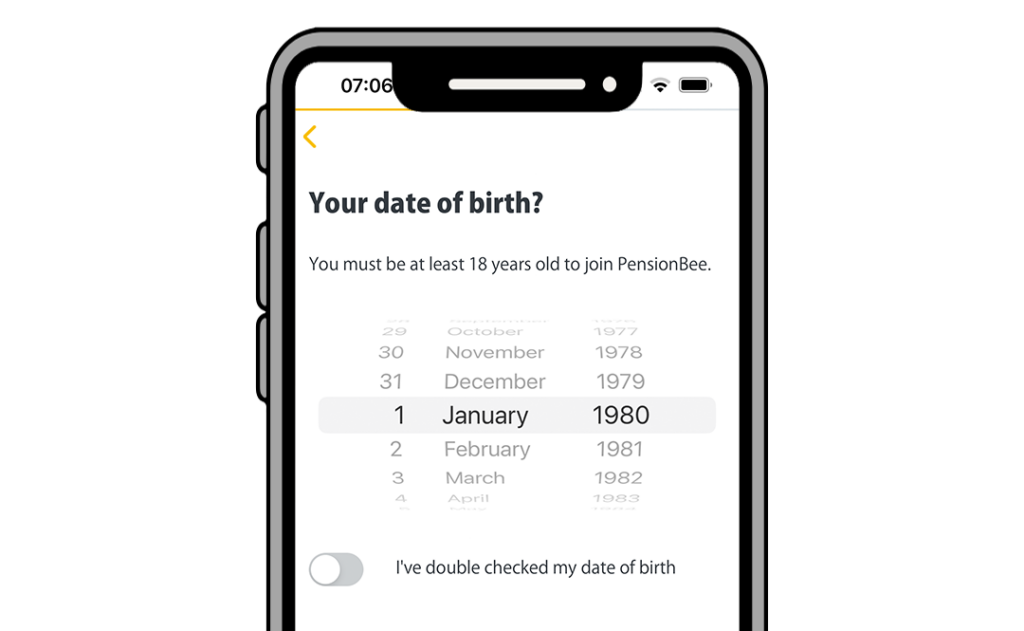

To get started you will need to sign up to Pensionbee. You can sign up on the mobile app or online. You’ll need to have your Name, Current Address, Date of Birth and National Insurance Number to create an account.

Once you have signed up and verified your identity you’re ready to choose an investment plan. Pensionbee has multiple plans to choose from based on your needs. We are going to take a deeper look at them in the next section.

Now your account is ready to go, it’s time to fund it. You can do this in two ways. You can start transferring in any of your old pensions or you can start making new contributions to your account.

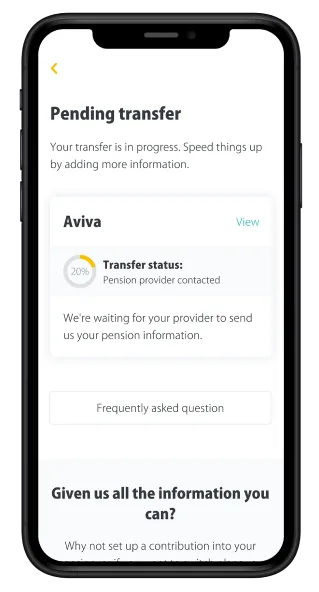

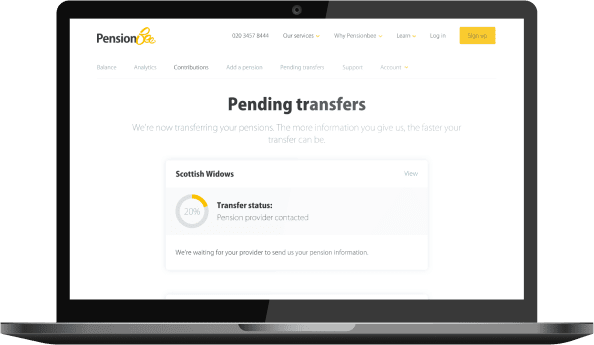

When transferring in old pensions, it takes around 12 weeks for the pensions to show in your account. If your old pension provider charges an exit fee of more than £10 or the pension comes with special benefits or guarantees, Pensionbee will reach out for your permission before they make the transfer.

During this process, you will have access to a personal account manager (BeeKeeper) who will help you with any problems and provide you with regular updates every step of the way.

While waiting for your old pension plans to get transferred you can make contributions to your account via a Bank Transfer. Once the money hits your Pensionbee account (typically same day), it will get invested in the plan you have chosen.

So, there you have it. That’s how Pensionbee works… Let’s take a look at the range of investment plans they have available on the platform.

Pensionbees Investment Plans

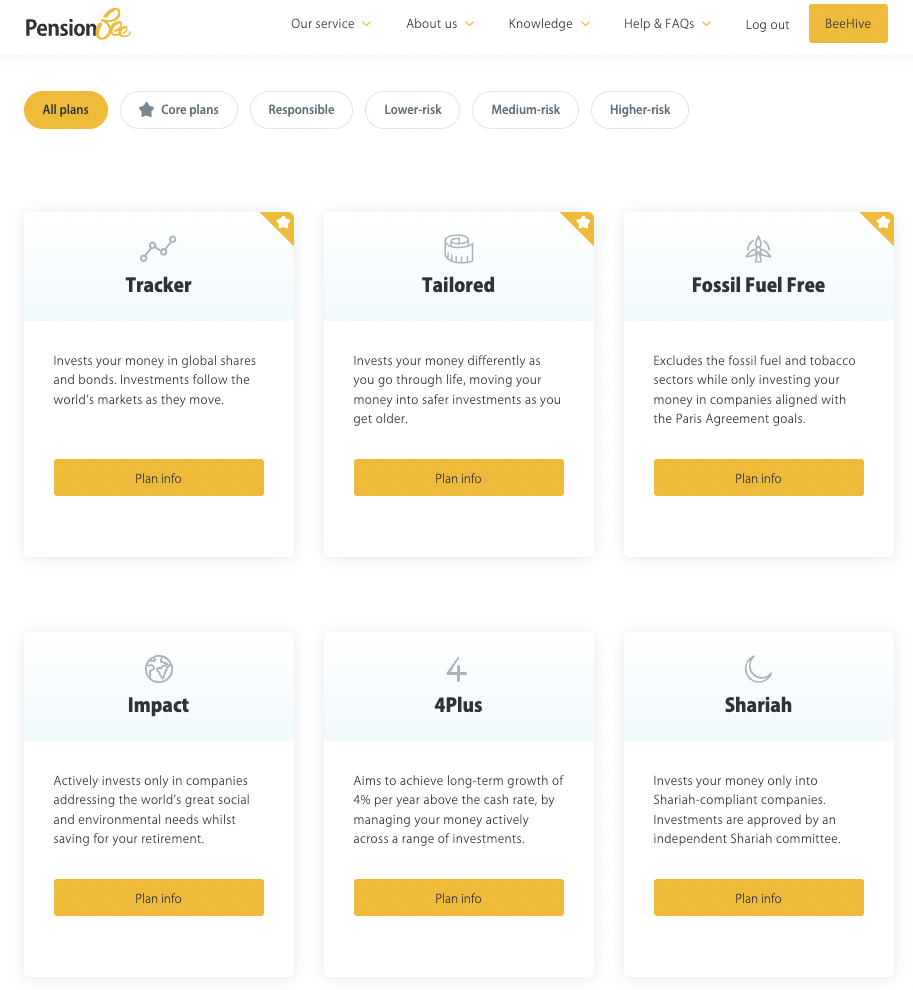

Pensionbee has a range of 8 different investing plans available. These plans are tailored towards different risk levels as well as environmental impact and shariah-compliant companies.

They have 3 “Core Plans” which 95% of Pensionbee users choose to go with.

Plans Available On Pensionbee

Tracker (Core Plan) – Invests your money in global shares and bonds. Investments follow the world’s markets as they move.

Tailored (Core Plan) – Invests your money differently as you go through life, moving your money into safer investments as you get older.

Fossil Fuel Free (Core Plan) – Excludes the fossil fuel and tobacco sectors while only investing your money in companies aligned with the Paris Agreement goals.

Impact – Actively invests only in companies addressing the world’s great social and environmental needs whilst saving for your retirement.

4Plus – Aims to achieve long-term growth of 4% per year above the cash rate, by managing your money actively across a range of investments.

Shariah – Invests your money only into Shariah-compliant companies. Investments are approved by an independent Shariah committee.

Preserve – Makes short-term investments into creditworthy companies. This reduces risk and preserves your money.

Pre-Annuity – Invests your money in bonds to provide you with returns that broadly correspond to the cost of purchasing an annuity.

For most people, the Tracker or Tailored plans will be the best option allowing them to have a simple diversified portfolio.

Asset Mix Of Each Pensionbee Plan

Below you can see the asset mix of each of the portfolios on Pensionbee. Most are fairly heavily weighted towards equities.

If you want a completely passive investment strategy for retirement, a tailored plan is likely the best way to go. It allocates your portfolio based on your current age. The younger you are the higher the exposure to equities you will have, to focus on growing your money. As you approach retirement, more of your portfolio will be allocated towards fixed income and cash to preserve your wealth rather than grow it in those retirement years.

| Assets | Tracker | Fossil Fuel Free | Impact | 4Plus | Shariah | Preserve | Pre-Annuity | Tailored |

|---|---|---|---|---|---|---|---|---|

| Equity | 80% | 100% | 100% | 69% | 100% | 0% | 0% | Changes based on your birth year |

| Fixed Income | 20% | 0% | 0% | 16% | 0% | 100% | 99% | Changes based on your birth year |

| Cash | 0% | 0% | 0% | 10% | 0% | 0% | 1% | Changes based on your birth year |

| Other | 0% | 0% | 0% | 5% | 0% | 0% | 0% | Changes based on your birth year |

Pensionbee Portfolio Performance

Unfortunately, Pensionbee offers limited performance history for their plans which means we can’t dive deep into each plan’s returns. However, each plan comes with a factsheet, sharing the underlying funds that your plan is invested in.

Below I have tried to highlight as much performance returns as we possibly could from the data we have.

For the tailored plan we are unable to provide performance returns as it differs depending on your age. Each age range has a different asset mix depending on how close to retirement they are.

| Plan | 1 Year Returns | 3 Year Total Returns | 5 Year Total Returns |

|---|---|---|---|

| Pensionbee Tracker | 6% | 16.5% | 20.1% |

| Fossil Fuel Free | -1.59% | – | – |

| Impact | – | – | – |

| 4Plus Plan | 2.08% | 18.57% | 19.22% |

| Shariah | 17.17% | 40.92% | 95.69% |

| Preserve | 3.43% | – | – |

| Pre-Annuity | -13.38% | -34.14% | -18.32% |

When comparing these plans I like to compare them to a couple of different index funds I personally invest in myself. Let’s take a look at the Pensionbee Tracker fund and compare it against 2 different diversified index funds.

| Fund | 1 Year Returns | 3 Year Total Returns | 5 Year Total Returns |

|---|---|---|---|

| Pensionbee Tracker | 6% | 16.5% | 20.1% |

| Fidelity Index World Fund P Accumulation | 5.6% | 35.5% | 56.8% |

| Vanguard Lifestrategy 80% Equity | 2.8% | 20.2% | 30.7% |

Over the past year, the Pensionbee Tracker has performed marginally better than both the Vanguard Fund and Fidelity fund however over a longer time frame of 3 and 5 years, both the Vanguard and Fidelity fund significantly outperform the Pensionbee Tracker fund.

If you want to set up a pension yourself and invest in these specific funds you can do so through Hargreaves Lansdown.

Pensionbee Fees

Pensionbee has a very simple fee structure for using their platform. They charge a single annual fee on the balance of your pension.

Depending on the investment plan you choose, you will be charged between 0.5% and 0.95%. On any balance over £100,000 your fee will be cut in half.

| Investment Plan | Fee Up To £100k | Fee on Balance Over £100k |

|---|---|---|

| Tracker | 0.5% | 0.25% |

| Tailored | 0.7% | 0.35% |

| Fossil Fuel Free | 0.75% | 0.375% |

| Impact | 0.95% | 0.475% |

| 4Plus | 0.95% | 0.475% |

| Shariah | 0.95% | 0.475% |

| Preserve | 0.5% | 0.25% |

| Pre-Annuity | 0.7% | 0.35% |

Pensionbee has a simple structure compared to most other competitors. With most pension plans you will pay a platform fee as well as underlying fund fees. These are both included in Pensionbee’s one single fee.

The only other fee you may incur is a small amount of transaction fees. These are costs incurred when transactions are made such as buying or selling shares. The weighted average cost is 0.05% per year and can range from 0.00% to 0.31% per year. These fees are separate from the annual Pensionbee management fee, so they won’t make any money from them.

Will I get charged for transferring my old pensions to Pensionbee?

No, you will not get charged any fees from Pensionbee to move your old pensions into your account. There is a chance that your old pension provider will charge an exit fee when you are leaving their platform. If this fee is more than £10, Pensionbee will reach out to ensure you want to make the transfer.

If you have a pension with certain special benefits worth more than £30,000, you’ll have to seek independent financial advice before you can transfer it to another provider.

Tranferring Old Pensions To Pensionbee

One of the best features of Pensionbee, is the ability to find and transfer all of your old pension funds into one single place. If you have worked in multiple jobs over the past 10, 20, or even 30 years you could have any number of workplace pensions. Keeping track of all of these is a nightmare. Transferring them all to a single platform allows you to stay on top of your money and ensure it’s being invested correctly.

Simply tell Pensionbee as much information about your old pensions as you can. The more information you provide, the easier it will be to find them. This usually includes the name of the provider and your pension number.

Once you have added this information, Pensionbee will start contacting your old pension providers to initiate the transfer process. It will usually take around 12 weeks to start seeing your pensions appear in your account. During this time you can see updates on your pending transfers.

If there are any exit fees over £10 from your old Pension providers, Pensionbee will let you know before moving ahead with the transfer.

Pensionbee is not charging any fees to you for transferring your pensions into their platform.

Once your pensions are moved over, your money will go into the plan you chose when signing up to the platform.

Withdrawing Your Pension

When it comes time to withdraw your pension, you may be wondering exactly how it works.

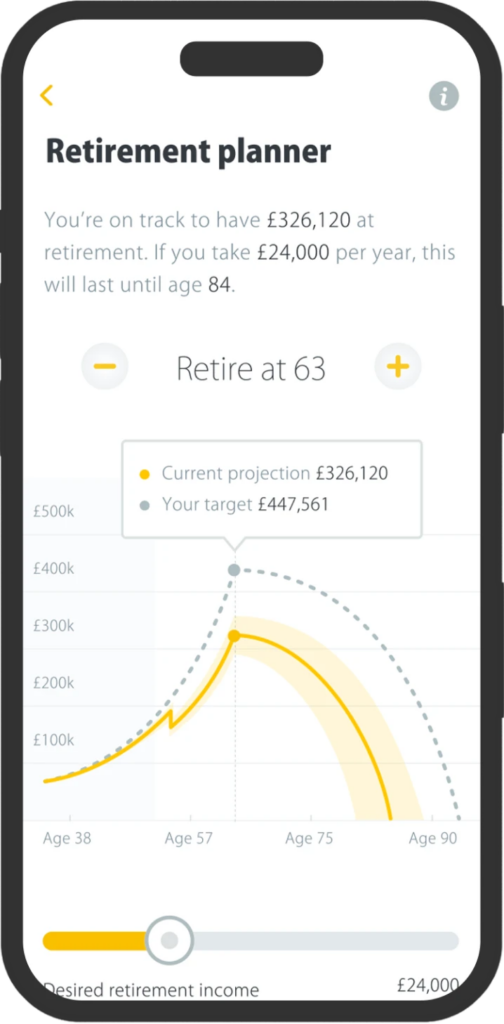

You can access your pension online from the age of 55 (57 from 2028). Once you reach this age there are two ways to withdraw money from Pensionbee. You can either take your pension flexibly through Pensionbee drawdown or you can buy a pension annuity through Pensionbees partner, Legal and General.

Pension Drawdown

A pension drawdown is a flexible way to take cash from your pension. You are able to take up to 25% of your pension pot tax-free and leave the rest invested to withdraw when you need it, rather than taking your whole pension as a lump sum. You will have to pay income tax on anything you withdraw over the 25%.

At Pensionbee withdrawals are 100% free. There are no drawdown costs unless you transfer to them and take your whole pot out within 12 months.

You can use Pensionbees Drawdown calculator to see what your pension drawdown would look like.

Buying An Annuity

An annuity allows you to get a guaranteed regular income for your retirement. Pensionbee is partnered with Legal & General to provide customers with Pension Annuities. The amount you receive is determined by your annuity rate.

You can still choose to take your 25% tax-free lump sum and take the remaining as an annuity. The amount you get from an annuity will depend on your personal circumstances such as age, health and where you live. The older you are, the higher the annuity rates you will be offered. You can use Legal and Generals calculator to see what your annuity rate might be.

The main reason to take an annuity is the guaranteed income aspect. This gives people a lot of people peace of mind that they will have enough money to live in retirement, no matter how long they live. With a pension drawdown, your money can run out.

Government Bonus

When making a personal contribution to your pension you are eligible for a 25% bonus from the government. Pensionbee will automatically claim this 25% top-up from HMRC and add it to your balance if you are eligible for pension tax relief.

When your work makes contributions for you, it comes out of your salary pre-tax. When contributing money after you have been paid you are contributing post-tax. Therefore the government will give you tax relief on any of your contributions to your personal pension as pensions are intended to be tax-free saving.

This is essentially “free money” added to your pension for you.

It’s important to note you will only get the bonus on contributions you make and not on old pensions you transfer into your account.

Also, if you are a higher rate (40%) or an additional rate (45%), you can claim back tax at these higher rates. However, you will have to do this yourself via your self-assessment tax return which can be completed online.

Pensionbee For The Self-Employed

As someone who is self-employed, I know a pension is the last thing on your mind. Most of us are so busy being focused on our business that we forget to invest for our retirement in the future.

Pensionbee makes investing for the self-employed easy. Whether you are a sole trader or a director of a Limited Company you can open a Pensionbee account with a small cash deposit initially and then consistently contribute more over time. It’s a good idea to set up an automatic direct debit so you consistently invest towards your retirement without having to think about it.

As a sole trader, you will get a 25% government bonus when you make deposits. For every £100 you contribute, the government adds £25. This happens automatically in Pensionbee.

For Directors of Limited Companies, company contributions may be considered an allowable business expense and could be offset against your company’s corporation tax.

Pensionbee Beneficiaries

Pensionbee makes it easy to add beneficiaries to your account. If you die before age 75, your pension can usually be passed on to your beneficiaries as a lump sum without tax deductions. Simply add your beneficiaries to your dashboard and you can rest easy knowing your loved ones will inherit your pension.

Is Pensionbee Safe?

Yes, Pensionbee is a completely safe pension platform. They are authorised by the Financial Conduct Authority (FCA) and are also a part of the Financial Services Compensation Scheme (FSCS).

The FCA ensures that Pensionbee is following strict financial regulations to keep your money safe.

The FSCS covers you up to £85,000 if Pensionbee ever went out of business.

You can be confident that your money is safe when opening a pension with Pensionbee.

Pensionbee Customer Support

Pensionbee has great customer support available on their platform. They have three ways to contact them.

- Phone – 020 3457 8444 – Monday to Friday 9:30am – 5pm

- Email – contact@pensionbee.com – Will reply as soon as possible

- Live Chat – Speak to someone on live chat immediately

When using a financial company, I like to be able to get on the phone with them if there is ever any issues. It’s great that Pensionbee offer a phone support service as many competitors don’t.

Pensionbee Customer Reviews

Pensionbee has a rating of 4.6 stars on Trust Pilot with over 9,000 reviews. This is an impressive score for a financial app. 81% of reviews are 5 stars, 10% are 4 stars and only 5% are 1 star.

Many of the positive reviews talk about how easy it is to move your existing pensions into the app. People like that Pensionbee keeps them updated on the progress of each of the pensions that are moving over to their account. People also like being able to get on the phone with someone from Pensionbee (Beekeepers) to help them with any problems they have.

The main complaints are around returns from their pensions however, this has more to do with the plan they picked and the stock market’s general performance over the past few years.

Pensionbee Pros & Cons

Pros

- Easy to move existing pensions into the platform

- 8 Investment Plans Available

- Great customer support

- Automatic 25% Government Bonus on contributions

- Can withdraw your pension via a drawdown or annuity

- Supports self-employed people

Cons

- Low control over your investments

- No financial advice

Who Should Use Pensionbee?

Pensionbee is a great pension platform for a wide range of people. If you have multiple pension plans from previous jobs this is hands down one of the best platforms to consolidate them and keep them all in one place. Having all of your money in one place allows you to better control where it is being invested and you’re more likely to make greater returns if you know where your money is and what it is invested in.

The platform also supports self-employed people who a lot of the time have no pension. Pensionbee allows them to easily get started investing in their pension using one of their funds.

Pensionbee is our recommended pension platform for those who want a passive retirement strategy with a solid company.

Pensionbee is a pioneer in the digital retirement space in the UK. This platform allows you to quickly combine all of your pensions into one easy-to-manage place and they do all the hard work for you. You can then continue to invest for retirement in one of Pensionbee's 8 Investment plans depending on your investment style.

Read More From Money Sprout: