It’s always good to know where you are in relation to the average. Today we will dive into the UK’s pension pot data and crunch the numbers. We’ll look at what the average UK pension pot looks like at different stages of life and what percentage of people invest in a pension at all.

The data comes from the Office of National Statistics “Pension Wealth: Wealth in Great Britain” report released in 2022. The numbers are honestly pretty shocking.

This report looks at private pensions but we’ll also touch on state pensions later in the article. Private pensions refer to defined contribution (DC), defined benefit (DB), and personal pensions. DC and DB pensions are employer pensions you receive through work and personal pensions are self-invested personal pensions (SIPPS).

Quick Overview

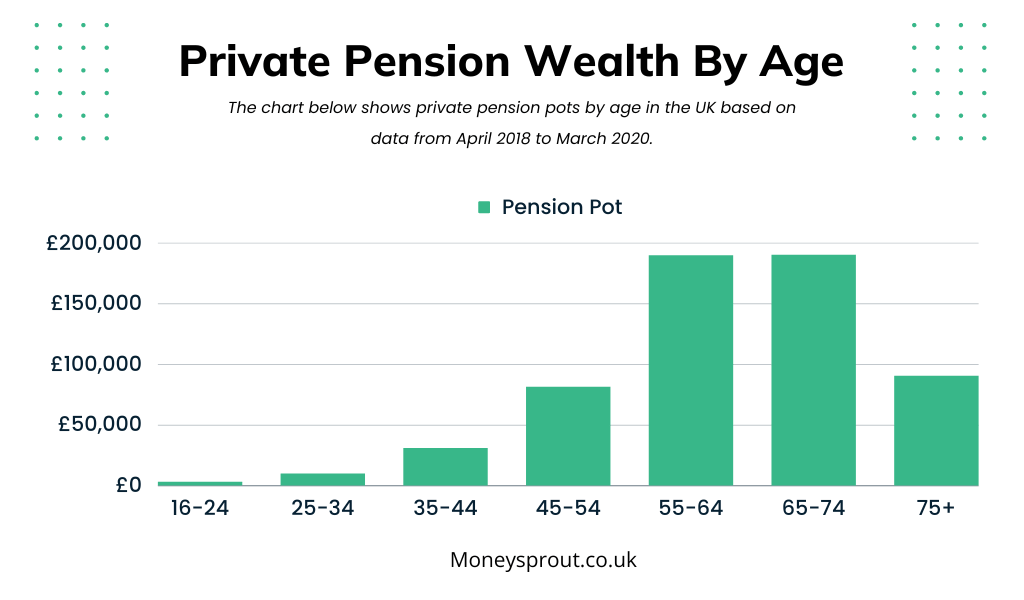

The average pension pot in the UK for people aged 55 – 64 is £189,700 and for 35 – 44, it is £30,600. These figures are significantly lower than what is recommended for these age ranges.

Average Pension Pot In The UK By Age

Here are the average pension pot numbers based on age in the UK. These numbers use the median average. If you lined up everyone 25-34 who has a private pension in the UK from smallest to largest, the person in the middle has a pot size of £9,500. This is the median average. If your pension is above average for your age range, you are in the top 50% of people in that age range, who have a pension.

| Age | Average Pension Pot |

|---|---|

| 16-24 | £2,700 |

| 25-34 | £9,500 |

| 35-44 | £30,600 |

| 45-54 | £81,200 |

| 55-64 | £189,700 |

| 65-74 | £190,000 |

| 75+ | £90,300 |

Looking at these numbers I was pretty shocked. I have been investing for my retirement since I turned 18 and always operated on the basis of a 4% safe withdrawal rate.

If I wanted to withdraw £40,000 per year at retirement, I would need £1 Million invested to do it.

Looking at the average pension pot of £189,700, drawing 4% per year only gives you £7,588 per year. That’s not a lot to live on, especially in these high inflationary times.

While these numbers are low, we have to realise that they don’t take into account ISAs, standard investment accounts, or property that people may own. However, these numbers also don’t take into consideration people who don’t pay into a pension at all.

In fact 1 in 6 people aged 55+ admit to having no private pension at all.

Personally, I have very little in my private pension as I’m self-employed but I max out my ISA every year. This gives me some more flexibility with the money if an opportunity arises.

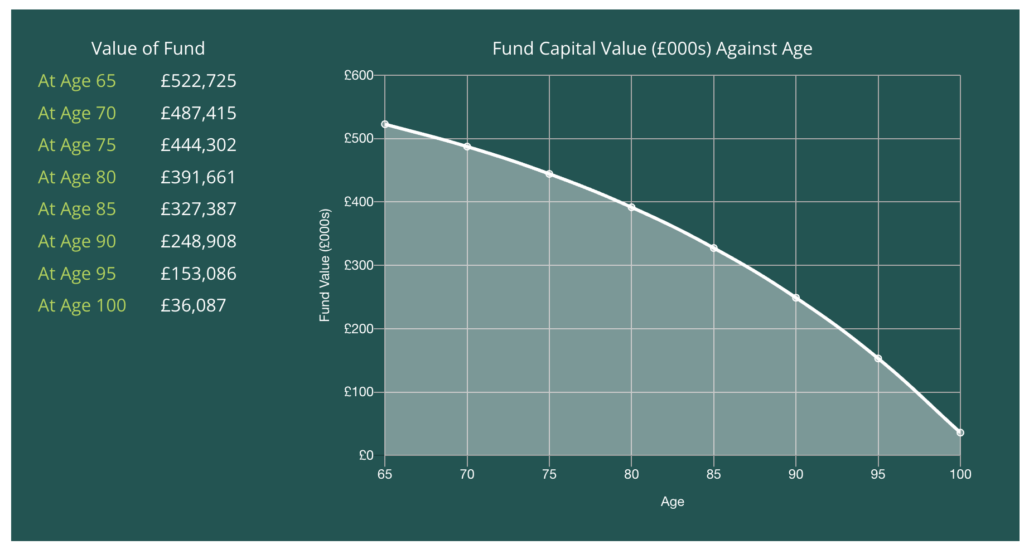

What A £190,000 Pension Pot Pays At Retirement

Let’s take a look at how much a £190,000 pension would pay you each year. With a pension pot this size you can expect to withdraw £6,840 per year from 65 to 88 (The average life expectancy).

How the markets perform in your years after retirement significantly affects how long your pension will last.

In poor market conditions, you will run out of money by 88. If the market has average returns you will be able to withdraw until you’re 96 years old. If conditions are good, your retirement account could even be worth more at 100 years old, with a balance of £194,475.

When you reach retirement age, you will want to get less aggressive with your portfolio as as it doesn’t have as much time to recover from bad years. It’s a good idea to make plans based on the worst-case scenario and anything better than that is a bonus.

The problem here is the extremely low withdrawal amount. If you want your money to last, you will only be able to withdraw £6,840 per year. That won’t provide a comfortable retirement, even with an added state pension.

Retirement Living Standards

The Retirement Living Standards have put together a report on how much you will need in retirement for 3 different lifestyles. This will give you an idea of how much money you will need in retirement depending on the life you want to live.

These numbers are based on living outside London. The figures also assume that you have aren’t paying rent and have already paid off your mortgage. If you’re still paying down your mortgage or renting, you will need to add these figures on top.

How Much You Need As A Single Person

As a single person, you will need a minimum of £12,800 per year to live a very basic lifestyle.

Let’s look at some numbers based on the average private pension plus a state pension.

Average Private Pension (£190,000) = £6,840 Per Year

State Pension = £10,600 Per Year

Yearly Income = £17,440 Per Year

With an average private pension and a state pension combined, you will be earning £17,440 per year. This puts you in between a minimum and moderate lifestyle. It’s also a long way away from a comfortable lifestyle.

The shocking thing is, 50% of people with a private pension have less than the average of £190,000 in their pension pot. 21% of people at retirement age don’t even have a private pension.

These numbers are also based on taking your pension at 65. If you want to retire earlier, your private pension has less time to grow and will be worth significantly less at retirement.

| MINIMUM | MODERATE | COMFORTABLE | |

|---|---|---|---|

| SINGLE | £12,800 a year | £23,300 a year | £37,300 a year |

| WHAT STANDARD OF LIVING COULD YOU HAVE? | Covers all your needs, with some left over for fun | More financial security and flexibility | More financial freedom and some luxuries |

| HOUSE | DIY maintenance and decorating one room a year. | Some help with maintenance and decorating each year. | Replace kitchen and bathroom every 10/15 years. |

| FOOD | £54 a week on food (including food away from the home). | £74 a week on food (including food away from the home). | £144 a week on food (including food away from the home). |

| TRANSPORT | No car. | 3-year old car replaced every 10 years. | 2-year old car replaced every five years. |

| HOLIDAYS & LEISURE | A week and a long weekend in the UK every year. | 2 weeks in Europe and a long weekend in the UK every year. | 3 weeks in Europe every year. |

| CLOTHING & PERSONAL | Up to £580 for clothing and footwear each year. | Up to £791 for clothing and footwear each year. | Up to £1,500 for clothing and footwear each year. |

| HELPING OTHERS | £20 for each birthday present. | £34 for each birthday present. | £56 for each birthday present. |

How Much You Need As A Couple

If you are still with your significant other at retirement you won’t need just as much. Both of you will hopefully get a state pension as well as a private pension. Housing costs and food costs will be shared, meaning you need less to live comfortably, on a per-person basis.

As a couple, you will both receive a state pension. If you both have a private pension, close to the average, living a moderate lifestyle is within reach.

State Pension = £10,600 x 2 = £21,200

Private Pension = £6,840 x 2 = £13,680

Total As A Couple = £34,880

If you both have a state pension and a private pension which you can withdraw £6,840 per year from, you can live a moderate lifestyle in retirement.

However, if one partner has stayed at home for extended periods to raise the children, they might not have as large of a pension. This is where you might slip closer to a minimum lifestyle at these numbers.

| MINIMUM | MODERATE | COMFORTABLE | |

|---|---|---|---|

| COUPLE | £19,900 a year | £34,000 a year | £54,500 a year |

| WHAT STANDARD OF LIVING COULD YOU HAVE? | Covers all your needs, with some left over for fun | More financial security and flexibility | More financial freedom and some luxuries |

| HOUSE | DIY maintenance and decorating one room a year. | Some help with maintenance and decorating each year. | Replace kitchen and bathroom every 10/15 years. |

| FOOD | £96 a week on food (including food away from the home). | £127 a week on food (including food away from the home). | £238 a week on food (including food away from the home). |

| TRANSPORT | No car. | 3-year old car replaced every 10 years. | Two cars, each replaced every five years. |

| HOLIDAYS & LEISURE | A week and a long weekend in the UK every year. | 2 weeks in Europe and a long weekend in the UK every year. | 3 weeks in Europe every year. |

| CLOTHING & PERSONAL | £460 per person for clothing and footwear each year. | £791 per person for clothing and footwear each year. | Up to £1,300 per person for clothing and footwear each year. |

| HELPING OTHERS | £20 for each birthday present. | £34 for each birthday present. | £56 for each birthday present. |

Recommended Pension Pot At Retirement

Below are two ways to determine how much money you will need for your retirement.

Simple Way To Determine How Much You Will Need In Your Retirement Pot

If you want an easy way to get an idea of how much you will need you can use the method below.

Most financial advisors would recommend you have 10 times your average working-life salary by the time you retire.

For example, if you earned on average £40,000 per year over your working life, you would need a private pension of £400,000 in retirement.

Generally, in retirement, most people need 50-70% of what they lived on while working.

If you live to 88 (the average life expectancy) you can expect to withdraw about £16,000 from your £400,000 pot each year safely. This combined with your £10,600 state pension gives you an income of £26,600 per year. This is 66.5% of your £40,000 salary, likely giving you enough to live on without many lifestyle changes.

This is assuming your house is paid off and you do not pay rent.

Using Investment Calculator To Determine How Much You Will Need

Let’s take a look at how much you would need in private pensions to live the comfortable lifestyles portrayed above.

As a single person, you will need approximately £37,300 per year in retirement. £10,600 of that should come from the state pension, so we need to find the other £26,700 from our private pensions or other investments.

To earn an income of £26,700 from your pension you will need £525,500 invested. Based on a conservative portfolio growth of 4% per year, this retirement pot should last you over 35 years.

You can see below what that withdrawal looks like over the years. It’s important to note that poor market returns in the early years of withdrawal could significantly affect how long your portfolio lasts.

£525,000 is significantly more than the average retirement pot of £190,000. If you’re reading this, you probably want to live a comfortable lifestyle rather than one where you are scraping by.

You’ll likely also want to grow that portfolio even larger before retirement to be able to weather any bad years in early retirement.

Rather than looking at the average retirement pots in the UK, it’s better to ask yourself what sort of lifestyle you want in retirement. When you determine that, you can then determine a target pension pot size you will need to hit to retire comfortably.

Let’s take an example. If I’m retiring at 65 and I want to earn an income of £50,000 per year for at least 35 years, I would need to withdraw £39,400 from my pension each year. We would receive the other £10,600 from our state pension.

If we use this calculator we can see how much we will need to have in our pension pot and the statistical likelihood of it lasting 35 years.

If we want a 90% chance of our portfolio lasting 35 years with a balanced portfolio of 55/45 Stocks to Bonds ratio, then we will need £1,300,000 in our pension pot by 65.

If you are planning a 25-year retirement that portfolio value needed comes down to around £1,000,000.

You can use the calculator to determine how much money you will need for a specific amount of income in retirement.

How Much Should You Contribute To Your Pension

Now we know how much we are going to need in retirement, we can figure out how much we need to contribute each month to get there.

In the UK the average pension fund has grown at approximately 7% over the past 35-40 years. If we plug these numbers into our compound interest calculator below you can calculate how much you need to save each month.

Principal Amount – Your current pension balance.

Annual Interest Rate – 7% is the average for UK Pensions

Investment Period – Number of years until retirement

Monthly Contribution – How much you plan to contribute each month

By adjusting the monthly contribution number you can see how much you will need to invest to hit your pension pot target at retirement. This is highlighted below as “The future value of the investment”.

If you are 25, with no pension and want to hit £525,000 before you retire here’s how much you will need to invest monthly.

You would need to invest £450 per month over the next 30 years at a 7% interest rate, to reach your target of £550,000 (£548,986.95) before retirement.

Now, £450 probably seems like quite a lot of money. However, if you are investing through a workplace pension, you will benefit from an employer contribution as well as tax relief.

Your employer is required to contribute a minimum of 3% of your salary but may contribute more. It’s worth asking HR about this. You should contribute the maximum they will match.

The employer match, as well as the tax relief significantly lowers how much you have to pay out of your own pocket.

If the maximum employee match does not meet your contribution target, you should invest the remaining in your own personal pension outside of work. This will give you much more control over your money with that portion of your pension.

How Does The Government Bonus Work With Pensions

When you contribute money to your pension, you will get a 25% top-up from the government.

This is because pension contributions are intended to be tax free. However, when you are contributing money, you’ve already paid tax on that money, so the government remburses you.

They do this as they want to incentivise people to put money into their pensions. They realise that the state pension is no longer large enough to live on and people will need their own private pension to live comfortably in retirement.

If you pay higher rate or additional rate tax you will be able to claim back 40% or 45%. You can do this each year on your tax return based on contributions throughout the year. You can do this on your self assesment tax return.

With the 25% government bonus, most pension providers will automatically claim this bonus from the government and add it to your account when you contribute. This can take 2 to 3 months to process.

In a workplace pension your pension contribution is taken out of your salary before is taxed. This means you are already receiving the government bonus when contributing as you are not paying tax on your contribution.

How To Grow Your Pension Pot

There are two main ways to grow your pension pot. Contribute more monthly and contribute over a longer period of time.

Contributing More

One way you can grow your pension is by contributing more monthly. If your employer offers a match for pension contributions you should take the max. Your employer’s contribution is essentially extra free money.

If you have completely maxed out your match but still want to contribute more, we would recommend investing through your own SIPP (Self Invested Personal Pension). This gives you full control over your money.

The more you contribute early in life, the less you will need to contribute on average.

Benefiting From Time

You may be concerned if you are in your 30s or 40s and think that your pension pot is a long way off your target for retirement. However, your pension benefits from compound interest which grows over time. The longer your money is invested, the more aggressively it will grow.

Your pension will be invested in a mixture of stocks, bonds, property etc. Unlike a savings account, this can go down as well as up. However, on average over the past 35-40 years pension funds have gone up 7% per year in the UK.

Over time you benefit from compounding. When you invest £100 within a year it’s worth £107. The next year you get interest on the £107 rather than the initial £100, leaving you with £114.49 in Year 2.

Over time this compounding effect starts to produce some really big gains. If you invest £450 per month over 7 years, you will contribute £162,000 of your own money. However, your portfolio will be worth £548,986.95. The extra £386,986.95 comes from investment gains over time. That’s the power of compound interest.

The money you invest early in life can grow massively over 30 years. The more you can contribute early on, the better off you will be when it comes to retirement.

Choose More Aggressive Funds

When you are enrolled in a pension your employer will usually enrol you in a default fund. You may have the option to select from multiple different funds. These funds will have different investment strategies. Some low risk conservative fund and some higher risk aggressive funds.

If you are decades away from retirement a more aggressive investment strategy may work for you as you have longer to recover from any downturns in the market.

Ultimately growing your pension pot comes down to these three things. How much you invest, how long its invested and where it’s invested. If you can invest aggressively in your early years you can benefit massively over time.

Types Of Pensions

When it comes to Pensions there are multiple different types out there. Most people will get a state pension if they have worked 35 years throughout their lifetime. If you have worked jobs most of your life, you will also likely have a workplace pension. Those who work for themselves will have to set up their own pension in a Personal Pension or SIPP.

Here’s a deeper dive into each of these Pension types.

State Pension

What is it?

The State Pension is a regular payment made by the UK government to individuals who have reached State Pension age.

Key Points:

- Eligibility is based on your National Insurance (NI) record.

- The amount you receive depends on the number of qualifying years on your NI record.

- There are two versions: the “basic” State Pension and the “new” State Pension. Which one you’ll get depends on when you were born.

Workplace Pensions

What is it?

This is a pension set up by your employer where both you and your employer contribute towards your retirement savings.

Key Points:

- Automatically enrolled if you’re between 22 and State Pension age, earn more than a certain amount, and work in the UK.

- Your contributions get tax relief, meaning the government also effectively contributes.

- There’s typically a default investment strategy, but you might have some choice in how your money is invested.

- Your workplace is requireed to contribute 3% of your salary but may match more.

Personal Pension

What is it?

A personal pension is a type of defined contribution pension that you set up for yourself. You choose the provider and make arrangements for your contributions.

Key Points:

- Suitable for those who are self-employed or want to boost existing pensions.

- Like workplace pensions, your contributions get tax relief.

- You choose where your money gets invested from a range of funds offered by your provider.

Self-Invested Personal Pension

What is it?

A SIPP is a type of personal pension but offers a wider choice of investments.

Key Points:

- Ideal for experienced investors who want more control over where their money goes.

- You can invest in a broader range of assets, including individual stocks and shares, commercial property, and more.

- Comes with greater responsibility; you need to actively manage and monitor your investments or hire someone to do so.

How Does Pension Interest Work

Pension interest does not work in the same way interest in a savings account does. In a savings account you get a set interest rate determined by your bank.

With a pension fund your money is invested in stocks, property, bonds and more. Pension funds are investing your money with the goal of growing it consistently over time. The average return on pension funds is 7% over the past 35-40 years.

One year your pension portfolio may grow by 15% and the next it might decline by 3%. The goal is to get a consistent rate of return over time and the best way to do this, is invest the money.

Your interest on a pension fund compounds over time. You start to earn money on the money you earned. This snowball affect over time create massive returns.

Best Personal Pensions

If you are considering investing in your own pension but don’t know where to start, we have picked a few of our favourite options below. Remember to max out any employee match availble to you before starting a personal pension.

PensionBee

- Modern platform making it easy to grow pension pot

- Combine pensions online in minutes

- Add to your pension in a few clicks

- Withdraw your money quickly (Typically 7-10 Days)

- 4.6 ⭐️ On Trustpilot – 9,290 Reviews

Moneyfarm

- Modern platform offering pensions, investing, ISAs and more

- Tax relief at source

- Target retirement funds available

- Talk with a personal investment consultant via phone, email or even in person

- Monitor your investing progress all in one place

Penfold

- All pensions in one place. Easily combine old pensions

- Easily adjust contributions

- Choose from a range of pension funds

- They will help onboard you and switch from previous providers

What Are The Pension Limits

Investing as much money as you can in your pension can be a good idea however there are some limits.

You are only allowed to pay the equivalent of your total salary, or £60,000 each year, whichever is lower.

Extra money can be saved within a stocks and shares ISA which allows your money to grow tax-free.

Final Thoughts

Now you know how bad the average pension pot looks in the UK. Hopefully, this article has inspired you to think more about how much you will need during your retirement. Using our tips and recommended providers, hopefully, you can meet your retirement goals!

Read More From Money Sprout: