If you’re thinking about finally leaving your parent’s house or potentially making a move to the UK you may be wondering what the average cost of living looks like. Here we are going to take a look at how much it will take to live comfortably in the UK in 2023.

Currently, inflation is at record highs, housing costs are skyrocketing and it doesn’t seem to be slowing any time soon. According to Living Cost, the UK is the 16th most expensive country to live out of 197.

So, let’s jump in and take a look at how much money it will take to live a comfortable life in the UK.

What Is A Comfortable Lifestyle?

To give you an idea of how much you need to live comfortably, we first need to determine what a comfortable lifestyle actually looks like. What I determine to be comfortable and what you think is comfortable may be two very different things.

We are going to use the Minimum Income Calculator to determine what a decent standard of living is. This calculator is based on public views about a minimum standard that nobody should fall below. Everyone’s circumstances will be different but this gives us a place to start.

The calculator essentially calculates how much you will need to live in a safe housing environment, eat well, pay your bills, use public transport or a car, buy a few treats for yourself, and go out once or twice a month.

It does not take into consideration holidays and traveling, buying new cars or savings and investing. Some people may deem these as essential but ultimately they are not needed for a comfortable life.

Now we know what a comfortable life looks like, let’s take a look at the numbers.

What Salary Do You Need To Live Comfortably In The UK

In the UK you will need £24,876 as an individual, £34,494 per year as a couple and £39,678 as a couple with two young children to live a comfortable lifestyle in the UK.

Finance is never one size fits all but the below can give you a good estimate of how much you will need to earn in the UK for a comfortable lifestyle. We have broken it down based on individuals, couples, and a family with two kids.

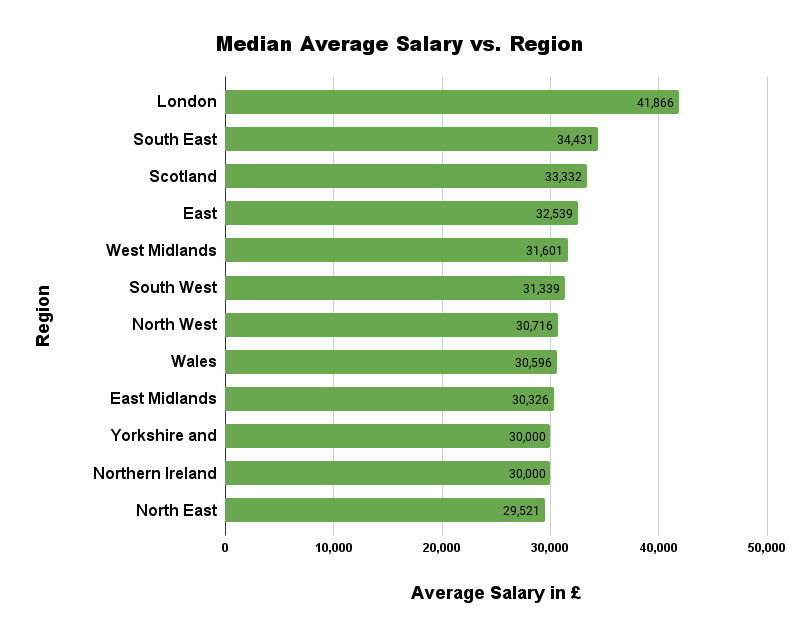

Currently, the average median salary in the UK is £33,280 per year. However, this also factors in London which has a much higher cost of living. In London, the median average salary is £41,866 per year.

In most parts of the country, the average salary is between £30k and £32k.

Now we know the average salaries in the UK, let’s take a look at how much you will actually need to live a comfortable lifestyle.

As An Individual

As an individual you will need to earn £24,876 pre-tax to live a comfortable life in the UK. This equates to £391.98 per week after Tax and National insurance.

On this income you will be much better off finding a room mate to live with cutting rent and utility costs in half. If you can do this you may have enough money to go on a yearly holiday or invest some money each month.

As A Couple

As a couple, you will need to earn £34,494 per year between you. This will allow for a comfortable lifestyle in the UK. It equates to £592.66 weekly after Tax and National insurance.

Most couples should be able to bring in significantly more than £34,494 per year in the UK if they both work full-time, which shouldn’t be a problem if you don’t have kids. Even if you work full time (40 Hours/Week), earning minimum wage, you should be able to earn over £20,000 per year with a few weeks off throughout the year.

So, if you’re a couple with no kids and both are working you should be able to live comfortably in the UK.

As A Family (2 Kids)

As a family with two young kids, you will need to earn £39,678 per year between you to live a comfortable lifestyle in the UK. This gives you a net income of £936.56 per week after Tax and National Insurance.

Most couples should be able to bring this amount in working full time however a large chunk of your salary may go to childcare depending on your own circumstances. It’s wise to weigh up your options to make sure it is worthwhile for both of you to work full-time at this stage in your family life.

Many couples will have one person work full time and the other work part-time to save on childcare costs.

The age of your kids will greatly affect how much they are costing on a yearly basis. Secondary school children are significantly more expensive than babies and primary school children.

How Much Is Housing In The UK?

In the UK the average rent is currently £1,243 but if we exclude London that comes down to £1,037 per month.

Looking at the table below we can see the cheapest and most expensive places to rent in the UK. Keep in mind these are averages, so much cheaper housing can be found in each of these areas.

| Region | Jul-23 | Jun-23 | Jul-22 | Monthly var | Annual var |

|---|---|---|---|---|---|

| Scotland | £973 | £940 | £840 | 3.5% | 15.8% |

| Greater London | £2,109 | £2,077 | £1,868 | 1.5% | 12.9% |

| West Midlands | £927 | £915 | £835 | 1.3% | 11.0% |

| South East | £1,323 | £1,306 | £1,205 | 1.3% | 9.8% |

| North West | £976 | £967 | £890 | 0.9% | 9.7% |

| Wales | £838 | £828 | £768 | 1.2% | 9.1% |

| Yorkshire & Humber | £836 | £828 | £769 | 1.0% | 8.7% |

| East of England | £1,169 | £1,166 | £1,081 | 0.3% | 8.1% |

| East Midlands | £840 | £832 | £781 | 1.0% | 7.6% |

| North East | £636 | £625 | £591 | 1.8% | 7.6% |

| South West | £1,130 | £1,128 | £1,061 | 0.2% | 6.5% |

| Northern Ireland | £826 | £810 | £776 | 2.0% | 6.4% |

| UK | £1,243 | £1,229 | £1,127 | 1.1% | 10.3% |

| UK Excluding Greater London | £1,037 | £1,027 | £948 | 1.0% | 9.4% |

Currently, in the UK the cheapest place to rent is in the North East coming in at £636 per calendar month.

The most efficient way to save money on housing is to get a roommate or eventually move in with your partner. This will significantly decrease your living costs.

What Is The Cost Of Having Children In The UK?

Kids are not cheap. According to Child Poverty Action Group, the cost of raising a child to 18 years old now stands at £157,562 for a couple or £208,735 for a lone parent.

For a couple that equates to £8,753 per year or £729 per month on average.

For a lone parent, it’s even worse. You’re looking at £11,596 per year or £966 per month on average.

In the UK it costs on average £966 per month for a couple to raise a child from birth to 18 years old.

When thinking about having a child these costs should be considered. They are definitely not insignificant. Planning and ensuring you have a good financial base before jumping into parenthood is a wise decision.

If you do have a child, you can claim child benefits from the government. This equates to £24 per week for the eldest or only child £15.90 per child for additional children. It’s not much but everything counts when you need the help.

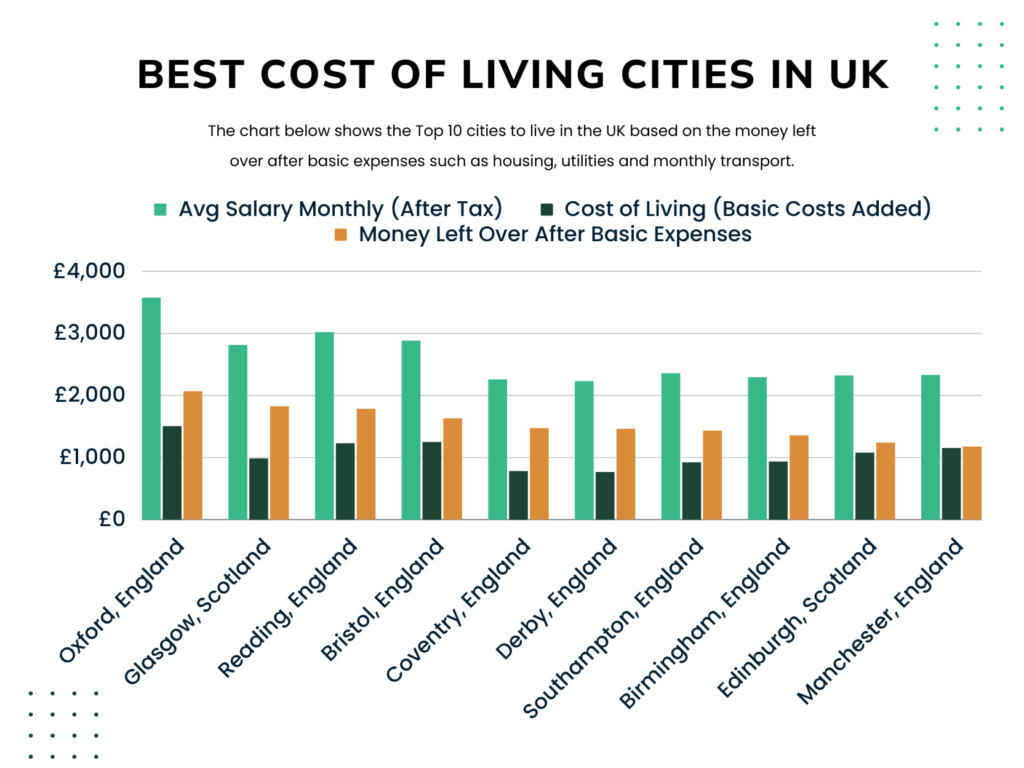

Best Cost Of Living Cities To Live In The UK

The table below shows us the best cities to live in based on the average salaries and average cost of living. By taking the average salary and taking away the average cost of living we can see which cities leave you with the most money at the end of the month.

Currently, Oxford is the best city to live in the UK based on the amount of income you have left over. It is important to note that these are averages and that can skew the data. Depending on the sector you work in, opportunities may be better in other cities.

| Best Place To Live | City | Avg Salary Monthly (After Tax) | Rent 1 Bed Inner-City | Utilities (Elec, Heat, Water for 85m2 apartment) | Monthly Pass Transport | Cost of Living (Basic Costs Added) | Income Left Over |

|---|---|---|---|---|---|---|---|

| 1 | Oxford, England | £3,566.67 | £1,300.00 | £143.51 | £60.00 | £1,503.51 | £2,063.16 |

| 2 | Glasgow, Scotland | £2,805.67 | £776.92 | £141.90 | £65.00 | £983.82 | £1,821.85 |

| 3 | Reading, England | £3,010.76 | £996.51 | £172.72 | £60.00 | £1,229.23 | £1,781.53 |

| 4 | Bristol, England | £2,874.21 | £998.33 | £174.53 | £73.91 | £1,246.77 | £1,627.44 |

| 5 | Coventry, England | £2,250.00 | £550.00 | £180.04 | £50.90 | £780.94 | £1,469.06 |

| 6 | Derby, England | £2,225.00 | £500.00 | £209.95 | £56.00 | £765.95 | £1,459.05 |

| 7 | Southampton, England | £2,350.00 | £729.00 | £137.16 | £55.00 | £921.16 | £1,428.84 |

| 8 | Birmingham, England | £2,285.83 | £709.46 | £159.41 | £65.00 | £933.87 | £1,351.96 |

| 9 | Edinburgh, Scotland | £2,312.50 | £869.58 | £146.84 | £60.00 | £1,076.42 | £1,236.08 |

| 10 | Manchester, England | £2,324.11 | £916.36 | £162.30 | £71.74 | £1,150.40 | £1,173.71 |

How Much Money Do You Need To Live Comfortably In London

London has a much higher cost of living than the rest of the UK. A good portion of that increase comes from the expensive housing costs in the city center.

Currently, the average salary in London is £41,866 per year while the average living costs for a single person are £38,000 per year. The average salary is pre-tax so even earning the average wage, you would be struggling to live a comfortable life in London.

The average rent price in London for a 1-bedroom apartment in the city centre is £2,081 which eats into a massive chunk of your wages. If you want to lower living costs, get a roommate or move outside the city centre and commute into town.

You will need to be earning roughly £50,000 to £60,000 in London as an individual to live a comfortable lifestyle. For a family of four, you will need to be earning more than £63,000 annually.

How To Live A More Comfortable Life In The UK

If you currently feel like you are unable to live in the UK comfortably there are some changes you can make. Times are tough for a lot of people right now due to high inflation pushing the price of everything up. Let’s take a look at some ways you can improve your finances.

Ensure Savings Are In A High-Interest Account

If you do have any extra money lying around this should go into a high-interest savings account. With Bank of England base rates rising due to inflation, savings accounts are now offering some good returns.

If your money isn’t earning interest it is losing purchasing power due to inflation. This essentially means your money can’t buy as much as it used to.

By putting savings into a high-interest savings account you can try and earn more than the rate of inflation or at least keep up with it.

We have created a full guide on the best high-interest savings accounts in the UK this month.

Create a Budget & Audit Your Finances Monthly

Budgeting may seem boring but it’s important if you want to get in control of your finances. Laying out your finances and determining where you are going to spend your money each month allows you to have predictable cash flow and ensure you are not spending more than you are earning.

Check out this guide and select your salary for a rough budget for your specific salary.

Cut Back On Spending

While none of us like to hear this, sometimes we simply have to cut back. Maybe it’s buying off-brand items, ditching designer clothes, or downgrading your car. The most important thing is ensuring you’re not spending money you don’t have, to impress people you don’t even know.

There is no better feeling than being financially free. Don’t buy items you can’t afford with money you don’t have. This completely traps you into needing a job and having to work on things you’re not passionate about.

Make More Money

There are many ways you can make more money. Personally, I have been making a full-time income online for the past 6 years. I have done a lot of side hustles which earn a few £100 extra each month as well as starting fully fledged 7 figure online businesses from my laptop.

Freelancing is probably the easiest way to get started. If you already have skills such as coding, writing, design etc you can sell your services on marketplaces like Fiverr or Upwork. This is a great way to bring in some extra side income.

Final Thoughts

Now you know roughly how much it costs to live in the UK in 2023. These numbers should only be taken as a guideline. When it comes to personal circumstances things can vary wildly. However, this is a good place to start so you can understand how much you will need to live comfortably in the UK on your own or with a partner and family.

Read More From Money Sprout: