In this review, we are going to take an honest look at Wombat Invest and the products they offer. We will take a look at their fees, platform experience and customer reviews to see if it’s worth your time signing up for this app. Remember, as with all investing, your capital is at risk.

After reading this, you should be able to make an informed decision on whether or not Wombat is for you.

Wombat is an investment app designed with new investors in mind. The app is easy to use and makes starting an investment portfolio easy for anyone. However, they only have a small selection of stocks and funds to invest in.

- - Easy to use, modern app

- - 0.1% platform fees on Standard Accounts

- - Free £10 on sign up (T&Cs apply)

- - 0.65% FX Rates fee isn’t as competitive as some other providers

- - Range of stocks and funds could be better

Quick Overview

Wombat is a new investment app in the UK aimed at new investors. The app is simple to use for beginners and has low fees to get started. However, it lacks a broad range of stocks and requires a £1 monthly fee to access its range of 30+ ETFs. While the app is a solid product, there are better apps out there with cheaper fees and more stocks and funds available.

Who Are Wombat Invest?

Wombat Invest is an emerging fintech platform catering to modern-day investors. Designed to simplify the world of investing, Wombat provides a platform for individuals to begin their investment journey with as little as a pound. With a focus on thematic investing, users can choose from a range of portfolios based on their personal interests or causes they care about.

Founded in 2017, the platform was born out of a vision to make investing more accessible and relatable for the younger generation. The London-based startup has since garnered a substantial user base, aiming to educate and empower its community to grow their wealth over time. With a user-friendly interface and commitment to transparency, Wombat Invest represents the next wave of investment platforms that cater to the evolving needs of 21st-century investors.

What Products Does Wombat Invest Offer?

Wombat Invest offers four account types on their platform; Stocks and Shares ISA, Standard General Investment Account, Instant General Investment Account and Junior ISA. Let’s take a look at these products in detail.

Stocks and Shares ISA

This account allows you to invest up to £20,000 per year without paying any tax on your profits, even when you withdraw. You pay no tax on capital gains, income, or dividends. Remember you can only have £20,000 spread across multiple ISAs in a single year and tax treatment depends on individual circumstances and is subject to change.

To open a Stocks and Shares ISA on Wombat, you will have to pay £1/month and 0.1% annual platform fee.

General Investment Account

Wombat has two GIAs available on their platform which is quite confusing. There are a few differences between the accounts but in my opinion, it would be a much simpler process to just offer one single account. Especially when your target market is new investors. This only makes it more confusing.

The standard account costs £1/month whereas you can invest for free with the instant account (FX fees apply).

Standard General Investment Account

- Trade fractional shares from £10

- Trade US, UK & EU Shares

- Themed Funds (ETFs)

- Instant Deposits

- Round Ups

- Auto Invest

Instant General Investment Account

- Trade fractional shares from £10

- Trade US Shares

- Instant Investing

- Instant Deposits

- Cashback

Junior ISA

A junior ISA allows you to invest up to £9,000 for your child. Once they turn 18 they can access this money. It’s a great way to put money away for their first car, house deposit or university.

To open a Junior ISA you will have to pay a £1 per month fee.

Wombat Invest Fees

All of Wombat’s accounts offer commission-free trading but Wombat’s free instant investment account offers only US shares. Their other accounts have access to UK, EU & US stocks and ETFs but come with a 0.10% yearly platform fee and a £1/month.

| Instant General Investment Account (GIA) | Standard General Investment Account (GIA) | Stocks & Shares ISA | Junior Stocks & Shares ISA (JISA) | |

|---|---|---|---|---|

| Subscription Fee | Free | £1 | £1 | £1 |

| Platform Fee | Free | 0.10% | 0.10% | 0.10% |

| Commission Fees | Free | Free | Free | Free |

| FX Fee | 0.65% | 0.75% | 0.75% | 0.75% |

| Fund Provider Fee | – | 0.07-0.75% | 0.07-0.75% | 0.07-0.75% |

| Deposits & Withdrawals | Free | Free | Free | Free |

| Electronic Statements & Contract Notes | Free | Free | Free | Free |

| Account Closure | Free | Free | Free | Free |

| ISA Transfer Fee | – | – | Free | Free |

FX Fees

When you buy and sell international stocks on Wombat, you will be charged FX fees at a rate of 0.65%. For example, Trading 212 offers FX Fees at 0.15% so the 0.65% is huge especially as you are charged on the buy and the selling of a stock.

Fund Fees

Purchasing funds on Wombat also comes with a fee however this is unavoidable and will be the same as buying that fund on any other platform. These fees are charged by the fund manager rather than Wombat.

Is The Wombat Invest App Easy To Use?

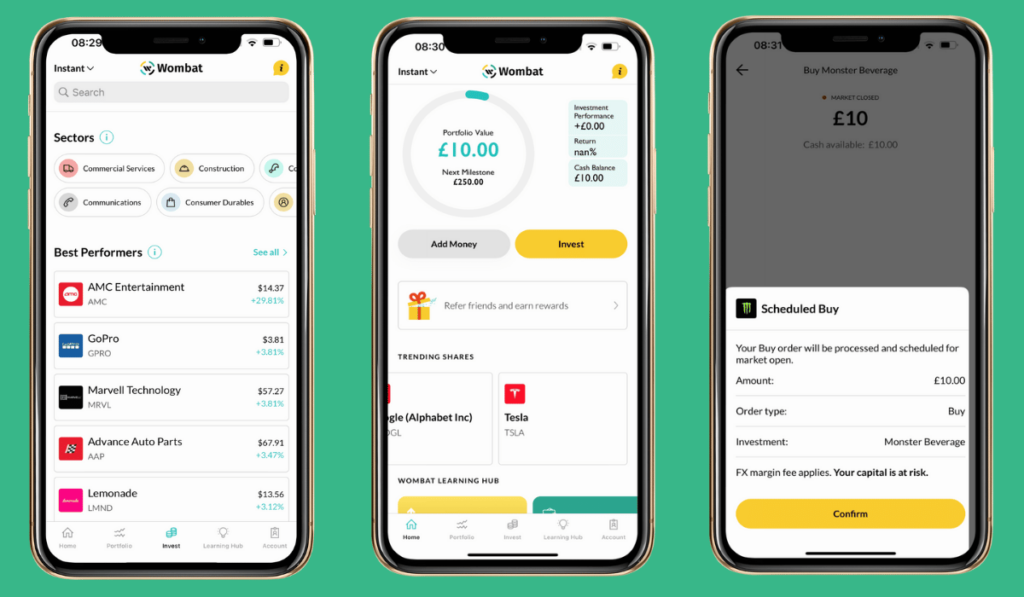

I signed up to the Wombat app for this review and the process was quick and easy. I had to give my information such as name, address, and bank details so they could verify my identity. It took a couple of minutes to confirm my identity and I was ready to invest.

When you sign up to Wombat you get a free £10 credited to your account. This appeared after a few minutes of using the app and was added without me having to make a deposit myself.

Once I was in the app, I signed up to both the Instant Investment account and the General Investment account.

The instant account has a hundreds of stocks to choose from and has a handy search feature to find what you are looking for. The paid plan only has 42 stocks to invest in but also has access to Wombats 32 Thematic funds.

Overall the user experience is simple and easy to understand. I had no problems finding what I needed to. Just to test the app out, I went ahead and scheduled a purchase of Monster Beverage company. The process was smooth and easy to execute. It took no more than 5 minutes from starting to sign up, to purchasing my first shares.

On the paid account you also have access to features such as Auto Invest and Round Ups. If you plan on investing a consistent amount monthly, I would recommend using the auto-invest feature to keep you disciplined. If your investments come out at the start of the month before you have the chance to spend that money, you’re much more likely to stay on track.

The spare change feature debits your account every two weeks. It calculates how much spare change you had during that two-week period and takes it on a single day. In my opinion, that defeats the purpose of round-ups, as it takes a lump sum of your round-ups every two weeks rather than taking the money for every transaction where it’s hard to notice.

What Investments Does Wombat Invest Offer

Wombat offers stocks and shares as well as Exchange-Traded Funds on their platform. On their free instant plan, you can trade a wide range of popular US stocks. As far as I could tell when using the app, on the paid plan you can only invest in around 42 popular stocks.

Fractional shares are only available in General Investment accounts. If you are using the ISAs, you will have to purchase full shares.

Stocks & Shares

You can invest in shares on the Wombat app on both their free Instant plan and their paid plan. The free plan actually has a wider range of shares to invest in but doesn’t include UK or EU shares.

When investing in Stocks and shares on the Instant plan, there will be no platform fees. However, if you are investing with the standard account you will pay a 0.1% platform fee on your account balance.

ETFs

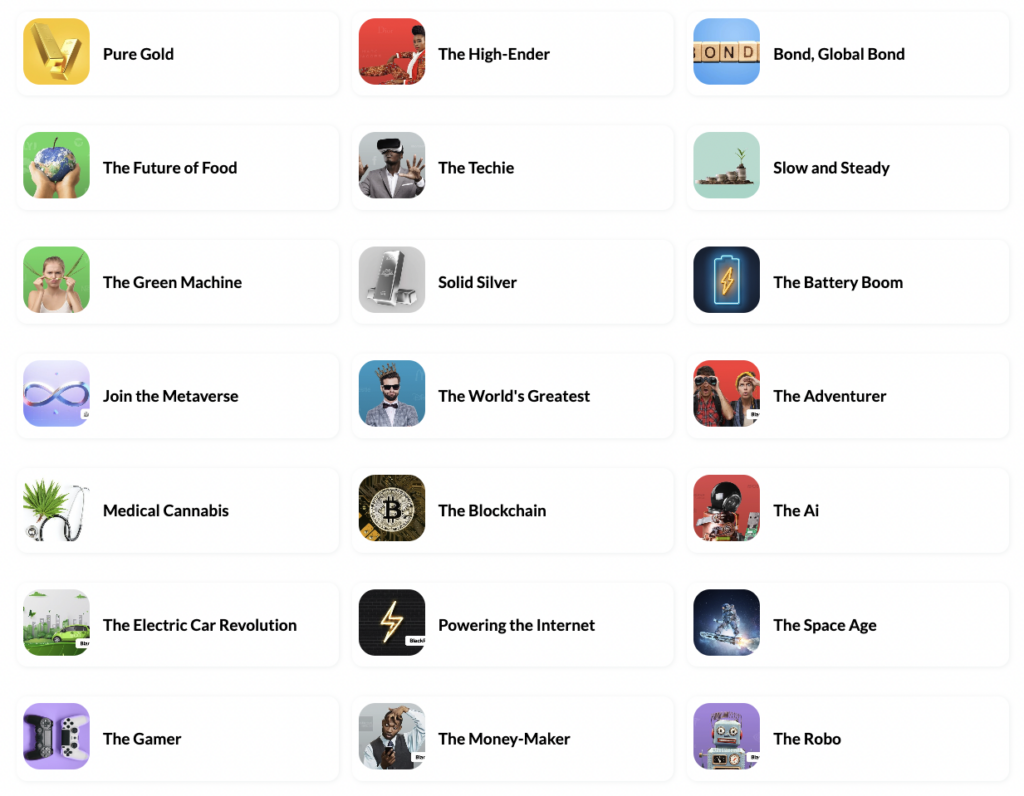

If you don’t want to pick individual stocks and would rather take a more diversified approach to investing, Wombat offers access to ETFs.

Wombat offers 32 ETFs to invest in at the time of writing this article. Honestly, this isn’t a very wide range of ETFs. They give each of the ETFs an interesting name such as “The lifestyler”, “The British Bull Dog” etc. This is seemingly to try and appeal to new investors by simplifying the names.

They have a range of different themes available:

- Technologies – The Techie, The Battery Room, Join the Metaverse, The Blockchain, The Ai, Powering the Internet, The Space Age, The Gamer, The Robo, The Innovator

- Ethical Investing – The Future of Food, The Green Machine, Medical Cannabis, The Electric Car Revolution, The Goodies, The Innovator, Women In Power

- Diversification – Bond, Global Bond, Slow and Steady, Solid Silver, The Adventurer, The Balanced, The Lifestyler, Women In Power

- Commodities – Pure Gold, Solid Silver, The Money-Maker

- Global Brands – The High-Ender, The Worlds Greatest, Fly the Flag, All American, The British Bulldog

- Model Portfolios – Slow and Steady, The Adventurer

- Scientific Investing – The Health Care innovators

- Food & Drinks – The Future of Food, The Foodiem The Snack Attack

Each of these ETFs is simply an existing fund re-skinned. For example “The Techie” fund is simply just the iShares NASDAQ 100 UCITS ETF which is available on most other brokerages.

Honestly, I am disappointed with the ETFs available right now. As someone who likes to invest in very low-fee global index funds, that’s not an option right now on Wombat. The closest ETF to that is “The Worlds Greatest”.

Is Wombat Invest Safe?

Yes, Wombat invest is safe and is regulated by the FCA. Any un-invested cash you hold on your account is held in a segregated account provided by Seccl or Currency Cloud (depending on account type). Money held in this account is protected in accordance with the FCA’s client money rules. If they were to become insolvent you may be entitled to a claim from the Financial Services Compensation Scheme (FSCS). You are protected up to the maximum of £85,000.

If you have money invested in a fund and the fund provider has been declared in default, you may also be entitled to a claim up to £85,000 through the Financial Services Compensation Scheme (FSCS).

Wombat Customer Service

Wombat is passionate about helping new investors get started on their investing journey and therefore has a great support system in place. They have a UK customer service team in place 7 days a week, 365 days a year.

Wombat Invest Reviews

Wombat Invest has 4.1 stars on the independent review platform Trustpilot. This is great for a financial platform. 67% of the reviews are 5-star with 9% of them coming in at 1-star.

There are many positive reviews around the app and the sign-up process is simple and easy to do. Lots of people also mention the free £10 they receive when signing up.

A lot of reviews in general are based on the user’s returns, both positive and negative. Ultimately, this doesn’t really have anything to do with the app. As the market has been running up lately there are many more positive reviews than negative around returns.

The main negative reviews are around how long it takes to get money into and out of your account as well as people complaining about the fee structure. Personally, I think the fee complaint is unfair as the fees are clearly stated on the website and app when signing up.

On the Apple App store, Wombat has a 4.6-star rating with over 700 reviews.

Wombat Invest Learning Hub

As Wombat is targeting new investors they have a section on their site dedicated to helping investors. They explain basic investing principles, capital gains tax, how to choose stocks and more.

While I don’t think this is necessary for a brokerage it’s nice to have on a platform tailored towards new investors. Helping their customers make better investing decisions is always a win in my eyes.

Who Should Use Wombat Invest

Wombat Invest is definitely tailored towards beginner investors. The app is modern and easy to use. There is only a small selection of popular stocks to invest in which could be good for new investors who feel overwhelmed with the massive amount of choice on other platforms.

Most advanced investors will have no reason to use Wombat as they don’t offer a comprehensive range of shares and funds to invest in.

Alternatives To Wombat

If Wombat isn’t cutting it for your investing needs, what app should you use to invest? Personally, if you are looking for an easy-to-use app that has cheap fees and a much larger range of stocks and funds to choose from I would go with Trading 212.

If you want a full passive investing experience I would check out Moneyfarm who put together a set portfolio depending on your risk tolerance.

If you’re investing large sums of money and want a reliable, tried and tested legacy broker, I would recommend Hargreaves Lansdown.

Final Thoughts

Overall I think Wombat Invest is a good simple-to-use app. Those who are already using the app are having a great experience with it. While it’s great for beginners in the investing space, I’m not sure it’s actually solving any problems in the marketplace.

Many other popular apps such as Trading 212 have much more comprehensive offerings and features at cheaper prices. For most people, I would recommend using them rather than using Wombat. As you progress further into your investing journey, you will likely want access to a broader range of ETFs as well as stocks. I would recommend starting with a platform you can grow on.

Wombat may add more in the future however right now they have some catching up to do compared to other market leading investing apps.

Read More From Money Sprout: