In this review, we are going to take an honest look at Trading 212, a platform I have used extensively for over two years now. We’re going to take a look at fees, fund performance and customer reviews for the platform.

Trading 212 is undoubtedly one of the most popular trading platforms in the UK and for good reason. The platform is great. However, is still worth signing up for in 2023? Let’s find out.

Trading212 is a zero-commission trading platform offering general investment accounts, ISAs and CFD accounts. They are a trusted broker who has been around for almost 2 decades now. They have a range of features such as pies and multi-currency accounts which aren't offered by other brokerages.

- Commission Free Trading

- Access to over 12,000 Stocks and Funds

- Impressive features such as Pies and Multi-currency

- No phone support

Who Are Trading 212?

Trading 212 is a prominent player in the European digital trading platform scene. Catering to investors from across the globe, they offer a modern interface for stock trading, forex, commodities, and more, setting themselves apart with a user-friendly approach and zero-commission trades.

Originating from Bulgaria, the company was founded in 2004 by Ivan Ashminov and Borislav Nedialkov. What began as a humble venture has burgeoned into a favorite among novice and experienced traders alike. Through continuous innovation and a deep commitment to democratising finance, Trading 212 has expanded its presence to a global audience.

Trading 212’s trustworthiness is underscored by several pivotal elements:

- Experience and Expansion: Approaching two decades in the industry, Trading 212 has not only witnessed the dynamic fluctuations of the financial markets but has also adapted and evolved, ensuring that users get the best tools for their trading needs.

- Regulation: Trading 212 operates under the stringent regulations of the Financial Conduct Authority (FCA) in the UK and the Financial Supervision Commission in Bulgaria. Such dual regulation instills confidence and provides a robust framework ensuring the safety and security of its users’ assets.

- Growing User Base: With over 2,000,000 accounts on their app the platform’s popularity is a testament to its reliability and user satisfaction.

- Zero Commission Trading: Trading 212 prides itself on being upfront about its operations. With a clear zero-commission stance and an intuitive interface, users always know what they’re getting. Their dedication to transparency extends to their educational resources, guiding beginners and experts alike.

In a rapidly evolving trading landscape, Trading 212 has managed to cement its position through a blend of technology, transparency, and tenacity. If you’ve read enough and want to get started, you can sign up to Trading 212.

Is Trading 212 Good For Beginners?

In my opinion, Trading 212 is an amazing platform for beginners. There are a number of reasons I would recommend it to a new investor:

Low Fees – Trading 212 is a big advocator for zero-commission trading. Being able to buy and sell stocks for free is huge, especially if you only have a small portfolio to start with. For example, Hargreaves Lansdown charges £11.95 per trade. If you buy £100 worth of a stock, you’ll be down 11.95% before you have even started. With Trading 212 you can trade in and out of stock for free.

Fractional Shares – Many platforms require you to buy a full share of a company. Trading 212 allows you to trade fractional shares which means you can purchase a piece of a share. For example, if a stock is trading at £200/share, you have the ability to buy £50 worth of that stock. This is great for beginners as it allows you to build a diversified portfolio without having a large portfolio.

Easy To Use – Trading 212 has a very modern, easy-to-use interface. Signing up to the platform and purchasing your first shares or ETFs is a very easy process.

Room To Grow – Unlike digital wealth advisor platforms, Trading 212 is a fully-fledged brokerage. Beginner investors can start by purchasing some ETFs to kick-start their portfolio, but as they start to get into investing more they may want to invest in individual stocks or leveraged shares. Trading 212 offers all of the above, while still having an easy-to-use interface.

What Products Do Trading 212 Offer?

Trading 212 offers 3 different accounts on its platform. This consists of a General Investment account, an ISA and a CFD account. Currently, they do not offer any form of pension.

Trading 212 Invest

This account is a general investment account with no tax benefits. You can trade in this account commission-free to purchase shares & ETFs from 13 stock exchanges around the world.

If you earn more than your capital gains allowance for the year you will have to pay tax on your profits.

Trading 212 Stocks & Shares ISA

The trading 212 ISA account allows you to invest in a tax-free, zero-commission ISA.

This means you will not be taxed on any capital gains, dividends or interest on the account. You can contribute up to £20,000 each year to an ISA.

This account allows you to purchase stocks, shares and funds just like the general investment account.

Trading 212 CFD

Trading 212’s CFD account offers users the opportunity to trade Contracts for Difference, a type of derivative that allows traders to speculate on the price movement of various financial instruments without owning the underlying asset.

With this account, users can gain exposure to stocks, forex, indices, commodities, and more. The platform boasts intuitive interfaces, a range of analytical tools, and competitive spreads.

However, it’s important to note that trading CFDs carries significant risk, with the potential to lose more than the initial investment, so it’s essential for traders to be well-informed and cautious.

Pension

Currently, Trading 212 does not offer a pension account on their platform. If you are looking to open a SIPP we would recommend checking out Hargreaves Lansdown or Moneyfarm.

What Investments Does Trading 212 Offer?

Trading 212 offers one of the most comprehensive ranges of investments in the UK market. This includes access to Stocks and Shares on 13 Major Stock exchanges, ETFs, Commodities and Forex markets.

Stocks & Shares

Trading 212 allows you to instantly purchase Stocks and Shares from 13 exchanges around the world.

They offer a massive 12,000 global stocks & ETFs ensuring you’ll be sure to find the companies and funds you are looking to invest in. This is a huge offering compared to competitors and is great if you are looking to invest in some lesser-known stocks.

You can view everything that trades on Trading 212 here.

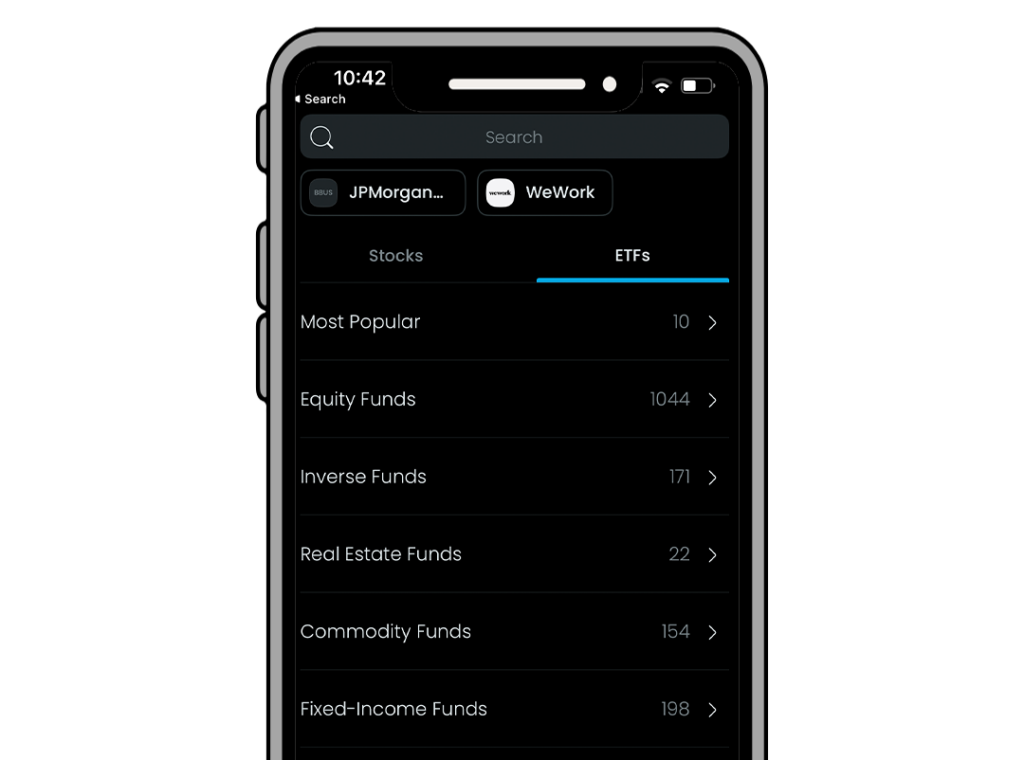

ETFs (Exchange Traded Funds)

ETFs (Exchange Traded Funds) are investment funds that are traded on stock exchanges, similar to individual stocks. They typically track an index, commodity, bonds, or a basket of assets and offer a way for investors to diversify their portfolios without buying each individual security.

This is a simple way to diversify your investments without having to pick your own individual stocks. Trading 212 offers 1000+ different ETFs to invest in.

Some funds will focus on certain markets, while others will focus on a specific sector or theme such as AI or Ethical Investing.

Commodities

Commodities refer to raw materials such as gold, oil or wheat. Traders can speculate on the price of these commodities going up or down with a Trading 212 CFD account.

Forex (Currencies)

The Trading 212 CFD account also allows you to speculate on the price movement of currencies. When trading forex you are essentially trading one currency for another.

For example, you may trade GBP to EUR. This is known as a currency pair. Trading 212 offers a comprehensive list of currency pairs for most makor currencies.

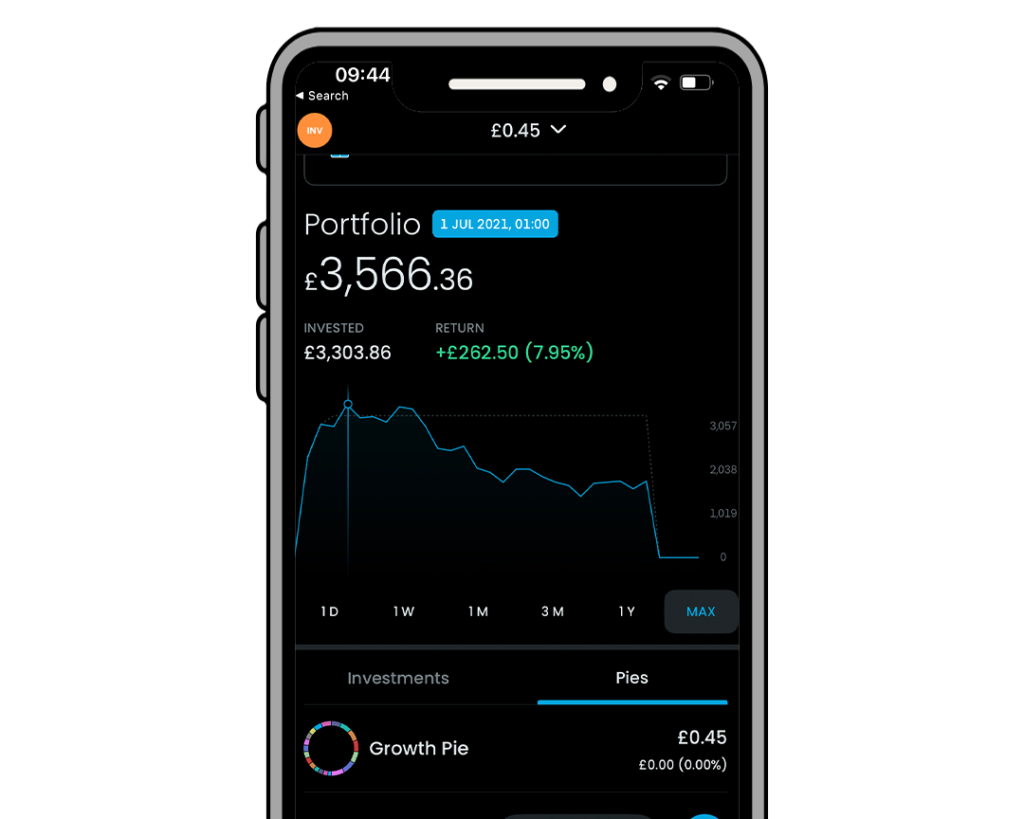

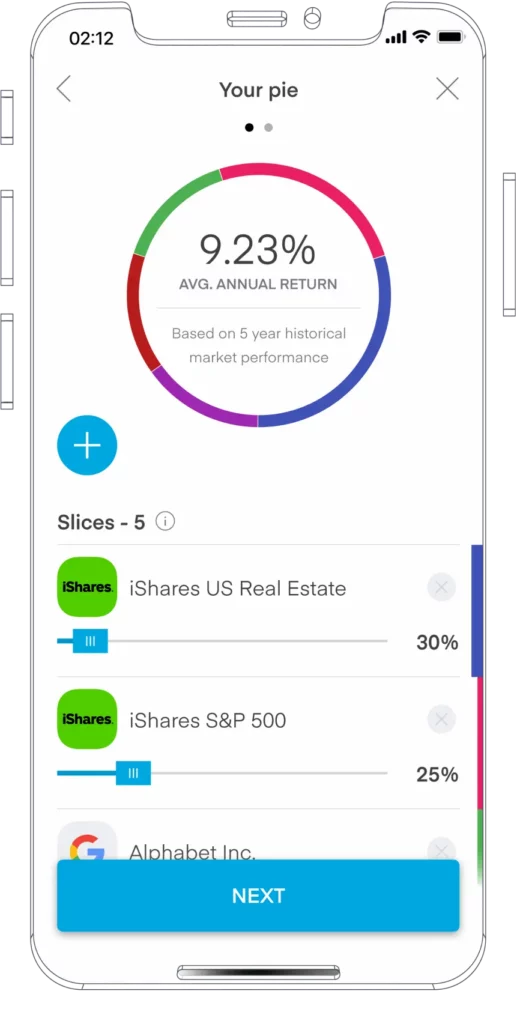

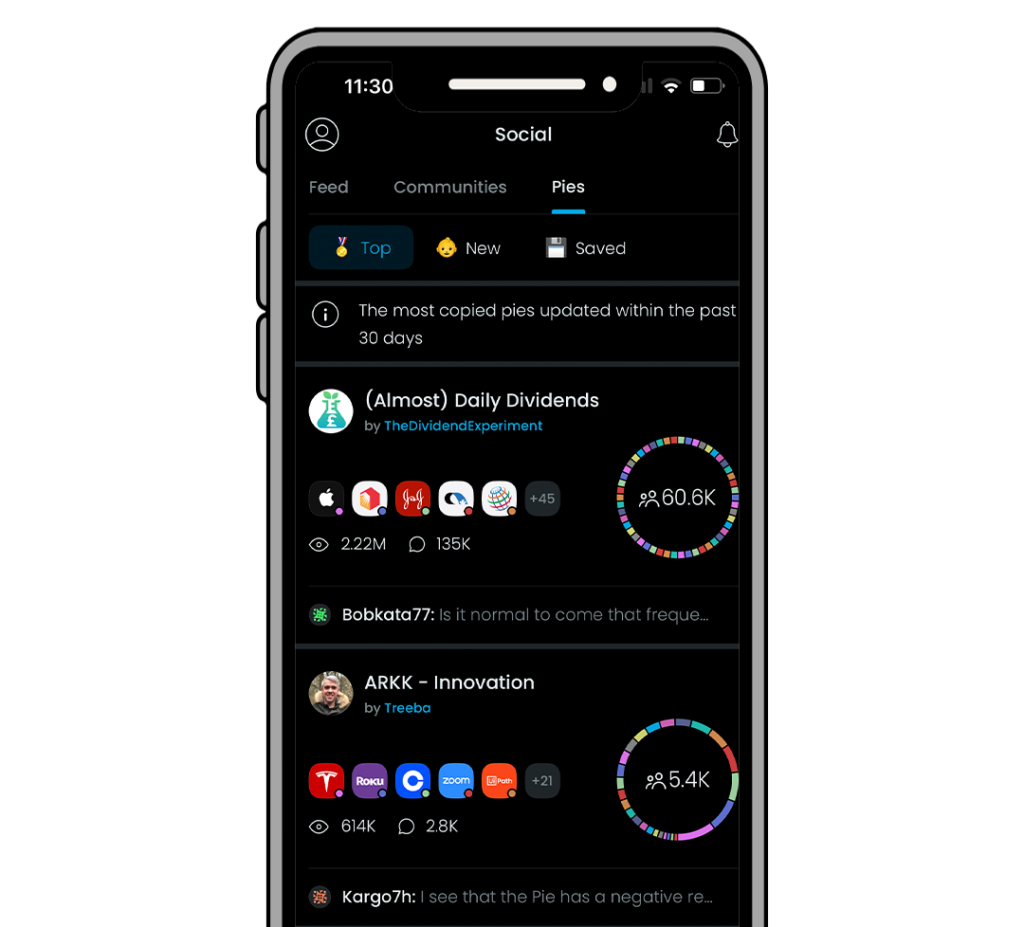

Trading 212 Pies

This is one of my favorite Trading 212 features that not many other platforms offer. In their Invest and ISA accounts, you can create a portfolio of specific stocks called pies. Once you have created a pie, you have the ability to invest money across your whole pie in one go.

For example, if you are investing £1,000 it will split it across all of the stocks in your pie based on the % allocation you give each stock.

This makes it easy to create and manage your portfolio. On other brokerages where you have fees for each trade and aren’t able to purchase fractional shares, this feature just isn’t possible.

Set up your portfolio once and then fully automate your investing. You can even have dividends re-invested automatically into your pie to ensure you are maximising your returns.

At any time you can adjust your pie. Simply adjust the proportion of your pie you want dedicated to specific assets. As you deposit more money, Trading 212 will automatically re-balance the portfolio by allocating your funds towards slices that are below their target percentage.

If you aren’t confident enough with creating your own pie, you can check out Pies made by the Trading 212 community and start investing in them.

There are hundreds of interesting pies people have created to invest in with different goals in mind. One of the most popular pies on the platform is the “Almost Daily Dividends” pie which pays dividends almost every day. While this may not be the best way to invest, it’s definitely an interesting experiment.

Unique Trading 212 Features

Trading 212 has some amazing unique features on its platform that not many other brokerages offer. Let’s take a look.

Share Lending

Trading 212 has recently released a feature allowing you to lend your shares out in return for interest.

This is an interesting way to make some extra money from your portfolio. Trading 212 lends shares from your portfolio to borrowers and receives interest in exchange. They then split all interest equally with you. This is all fully automatic and will not cause any delays if you are selling your position.

Your lent shares are protected by receiving collateral of at least 102% of the value of the lent shares. This is in the form of US Treasuries and will be adjusted daily to match the value of the shares.

You can enable or disable share lending in your as you please.

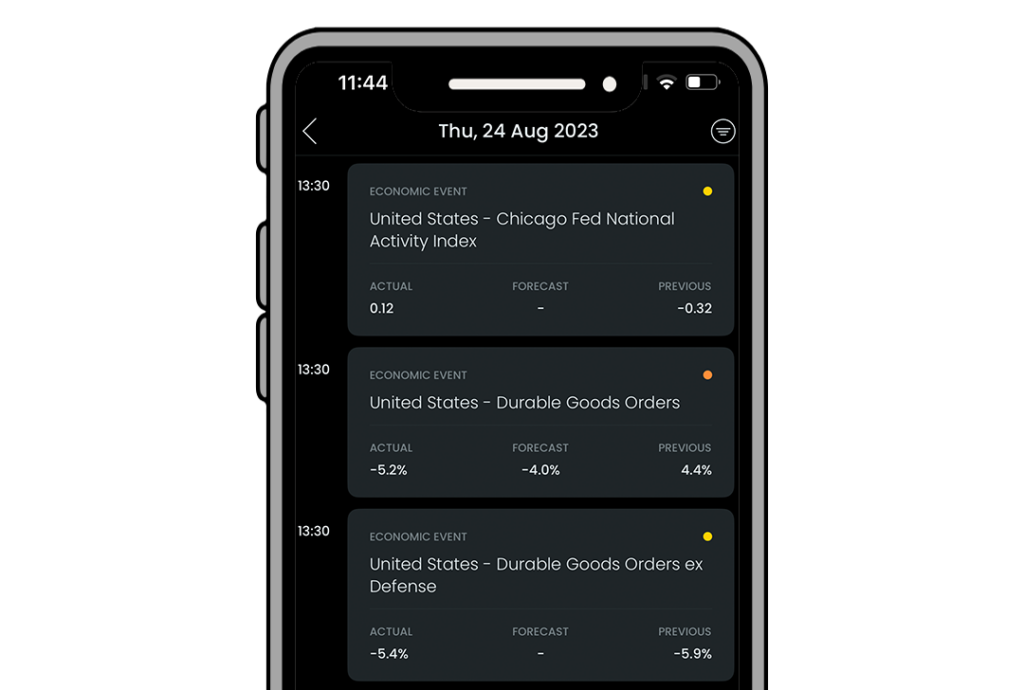

Economic Calendar

There is a lot going on in the world of finance and it can be hard to keep up with all the latest news. The economic calendar in the app shows you all of the upcoming important economic events.

Here you will find surveys, CPI releases, etc. This stuff can be hard to keep up with, so it’s great to have it all in one place. If you are someone who likes to trade based on these reports, then you’ll love the feature.

Trading 212 Fees

When it comes to low fees, Trading 212 is one of the leaders. They pioneered zero commission trading and also have zero platform fees. That’s hard to beat. Let’s take a look at the fees they have on all three of their accounts.

Invest & ISA Fees

The fees on the Invest and ISA accounts with Trading 212 are some of the best around. Having no Platform fees, trading fees and low FX Fees can make a huge difference in your returns over time.

| Invest Account | ISA Account | |

|---|---|---|

| Trading Commission | Free | Free |

| Custody Fee | Free | Free |

| FX Fee | 0.15% | 0.15% |

| Deposits via Bank Transfer | Free | Free |

| Deposits via Cards, Google Pay, Apple Pay& Others | – Up to £2,000: Free – After £2,000: 0.7% | – Up to £2,000: Free – After £2,000: 0.7% |

| Withdrawals | Free | Free |

| Min Deposit | £1, €1, $1 | £1 |

| Min Withdrawal | £1, €1, $1 | £1 |

| Min Buy/Sell order | £1, €1, $1 | £1 |

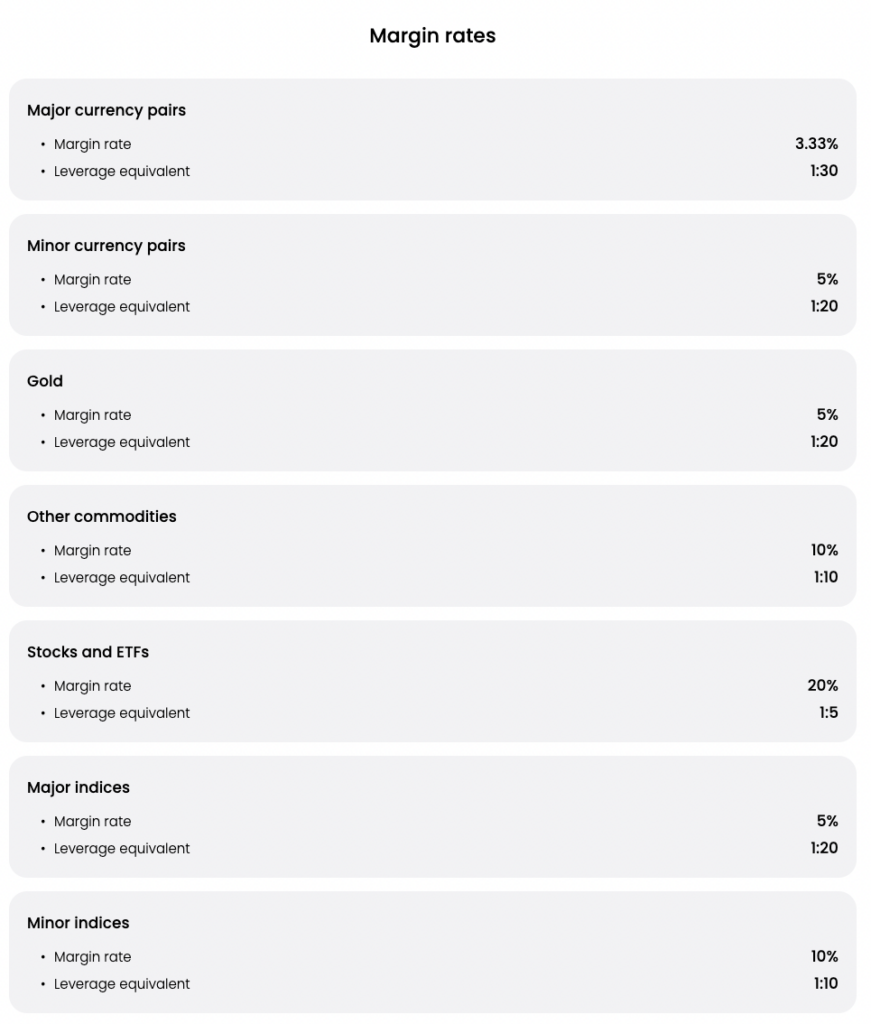

CFD Account Fees

| CFD Account | |

|---|---|

| Trading commission | Free |

| Custody Fee | Free |

| Spread | Spreads are dynamic and change depending on the underlying market conditions. Check the average spread for each instrument here. |

| Overnight Holding Fee | Positions held in your account past 22:00 GMT will incur an overnight holding fee. The fee can be positive or negative, depending on the direction of the trade and the product. Find the fees for each instrument in the app, listed on its ‘Instrument details’ page. |

| FX Fee | 0.5% (On Results Only) |

| Min Deposit | £10, €10, $10 |

| Min Withdrawal | £10, €10, $10 |

You can view the full list of Margin rates for the CFD account here or in the image below.

Trading 212 Multi-Currency Accounts

Recently. Trading 212 rolled out multi-currency accounts on the platform. This is a huge benefit for those of us investing internationally.

If you’re in the UK and buy and sell US Stocks in GBP you’re subject to FX fees on every transaction. You are also subjected to exchange rate risk. If the value of the pound strengthens while you’re invested in US stocks this will result in an FX loss. Even if the stock price didn’t move, you would lose money. The reverse can happen where you also profit from changes in FX.

However, now that Trading 212 has multi-currency accounts, you can hold cash in different currencies such as GBP, USD, EUR and 9 other major currencies.

This means you can trade in the asset’s currency without being subjected to FX fees. You can then also hold the cash in that currency until you feel like it’s a good time to convert it back into your home currency.

If you hold one of the supported currencies in a bank account, you can now deposit this directly into your Trading 212 account without having to pay any conversion fees.

This really is a game-changing feature and is one that many brokerages don’t offer.

Trading 212 Interest On Uninvested Cash

With interest rates rising in savings accounts, it’s important to be getting a return on un-invested cash. Trading 212 offers interest on your un-invested cash.

At the time of writing Trading 212 is offering the following rates:

- USD – 2.25% APY

- GBP – 2% APY

- EUR – 1.5% APY

Even when your money’s not invested, it’s still making something. If you do plan to be out of the market for a long period of time and the money isn’t in an ISA, you may be better off putting your cash in a high-interest savings account such as Chip.

Is Trading 212 Safe?

Yes, Trading 212 is safe. They are authorised by the Financial Conduct Authority (FCA) and are also a part of the Financial Services Compensation Scheme (FSCS).

The FCA ensures that Trading 212 is following financial regulations and is fit to look after your money.

The FSCS covers you up to £85,000 if Trading 212 ever went out of business.

Trading 212 Support

Trading 212 has an amazing support system that runs 24/7. If you ever have a problem with you’re account you will be able to get in touch with a human within seconds. They state that their average response time is currently 29 seconds.

Unfortunately, they do not have a telephone number to call should you need to speak to someone. This is actually one of the main reasons I use Hargreaves Lansdown over Trading 212 even though they are slightly more expensive.

Trading 212 Reviews

Trading 212 has amazing reviews on Trust Pilot with a score of 4.6 Stars from almost 22,000 reviews. 4.6 is impressively good for a brokerage app.

75% of the reviews are 5-star with only 8% of them being 1-star. The majority of positive reviews talk about free commissions and how simple the platform is to use.

The main negative reviews come from people unhappy about having to provide the information required for withdrawals. This isn’t really a fault of Trading 212 as they are required to ask for this information in line with regulations. Personally, I have had no issues withdrawing my money off the platform when I needed to.

Does Trading 212 Offer Options Trading?

Trading 212 does not offer options Trading on their platform. Alternative brokers such as Plus500 and Degiro do offer this as an option.

Who Should Use Trading 212?

Trading 212 is a great brokerage for anyone. It’s simple and easy to use for beginners and has all the features required to keep experienced investors happy. Features like their Pies and Multi-currency accounts, help to set them apart from the competition.

The only real downside to the platform is that they don’t have a phone support service. I know that when my portfolio got to a certain point, I wanted to be able to chat to someone on the phone, should I need to. That’s why my portfolio is now with Hargreaves Lansdown.

If you are happy having access to chat support and want to benefit massively from commission-free trading then Trading 212 is a great choice.

Final Thoughts

Overall, Trading 212 is one of the best brokerage apps in the UK. It’s easy to use for beginners and has everything an experienced investor requires to build a large portfolio. If you’re looking to start investing with low fees and the ability to have full control over your portfolio, there’s really no better place to do it than Trading 212.

Read More From Money Sprout: