So, you’re starting out on your journey to becoming a millionaire! In the UK, we have a unique blend of opportunities and challenges. While it’s true that no place is perfect, the UK offers great opportunities for those aiming to build a seven-figure net worth.

From property investments to thriving start-ups, the avenues to amass wealth are varied and rewarding. In this guide, we’ll explore the most effective strategies to reach that coveted millionaire status. Whether you’re starting from scratch or already on your way, our step-by-step plan aims to navigate you from where you are to where you wish to be: in the millionaire’s club. Join me as we unlock the blueprint for financial success in the UK.

How To Become A Millionaire In The UK

Some people work all their lives to become a millionaire while other people seemingly get it handed to them. Here are the most popular methods of becoming one in the UK.

Investing

Investing your way to a 7 figure net worth is one of the most reliable ways to become a millionaire over a long period of time. You’re not going to get rich overnight, but historically investing small amounts in the market from an early age will allow you to reach millionaire status. Let’s break down the numbers.

Since 1957 the S&P 500 has produced an average return of 10.15% per year.

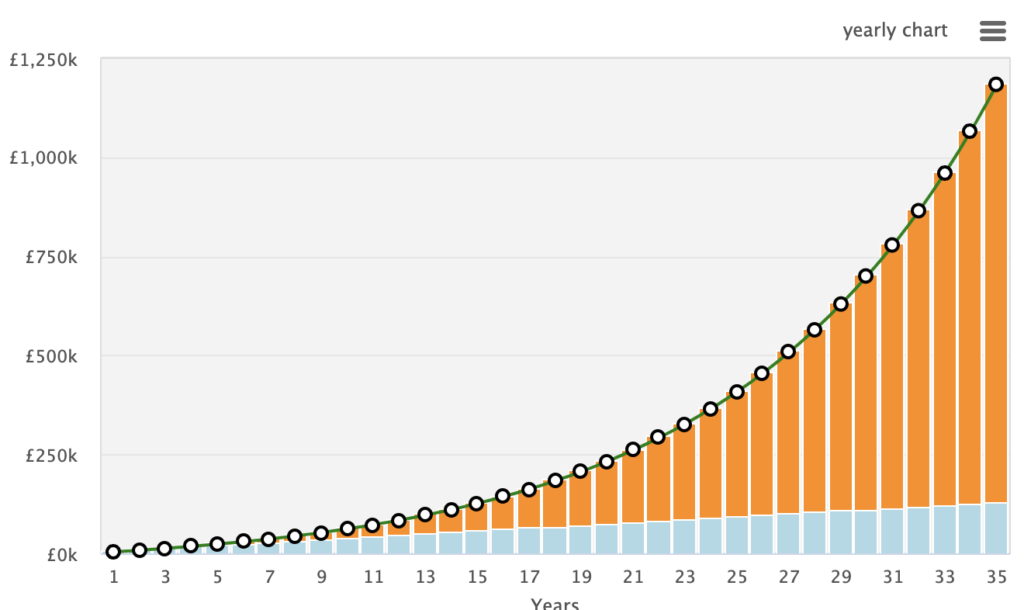

If you invested £300 per month from 25 years old to 60 years at 10.15%, by the time you’re 60, you would have a portfolio value of £1,184,024.

It may seem like a long time to get there but utilising this strategy is one of the most tried and tested ways to become a millionaire in your lifetime. The beauty of this is, pretty much anyone can do it. You don’t need a fancy job or a huge business exit. Simply budget well, invest £300 a month and watch the magic of compounding work for you, over long periods of time.

Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it

Albert Einstein

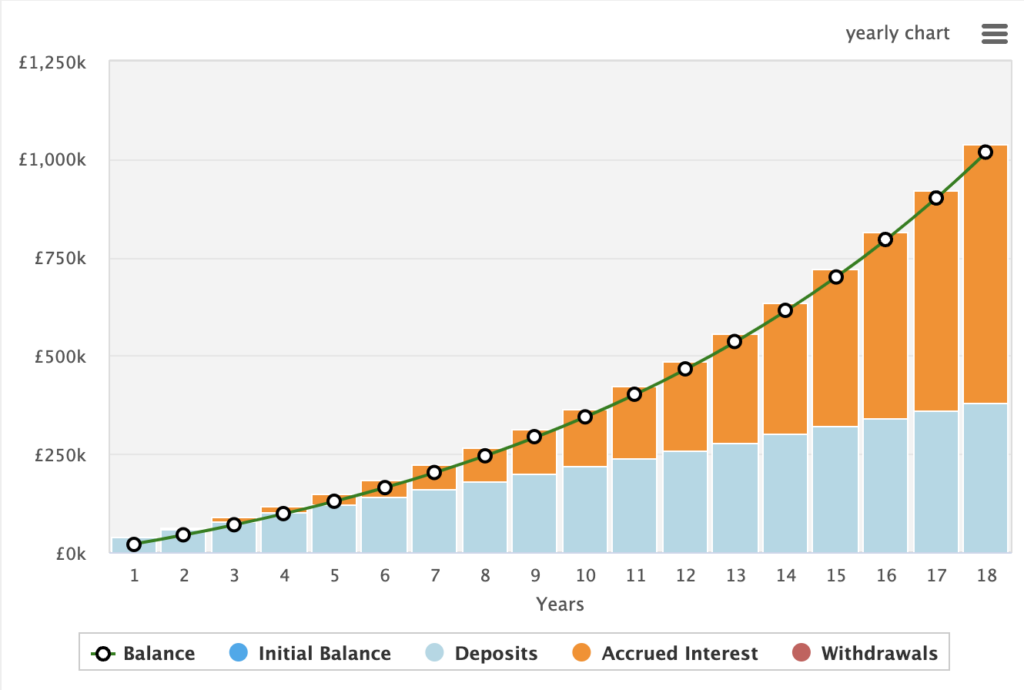

If you’re aggressive like me, you may want to try and max out your ISA allowance each year. This equates to around £1,666 per month. With a £1,666 contribution each month at a 10.15% interest rate, you would reach millionaire status in just 18 years.

£1,666 is a big ask for most people but you should try your best to maximise your contributions as early in life as you can. The longer your money has to compound, the more you will have at retirement. If you want to run some projections, check out our compound interest calculator.

If you want to start investing I would highly recommend checking out Hargreaves Lansdown as a brokerage. I personally use it myself.

Hargreaves Lansdown is one of the most trusted investment platforms in the UK. They offer amazing customer service with access to someone on the phone at any time. However, these come at a high price in terms of fees.

Property

In the UK, bricks and mortar have long been regarded as a secure and tangible investment avenue. As a nation with a deep-rooted culture of property ownership and a history of rising house prices, leveraging property can fast-track your journey to millionaire status. Let’s delve into the specifics.

Historically, UK house prices have appreciated at an average of around 2.7% per year. Though this rate may not match the highs of the stock market, the advantage lies in property’s leverage potential and consistent growth.

For instance, if you were to purchase a property worth £200,000 with a 25% deposit (£50,000) and the property value appreciates by 2.7% annually, after 10 years, your property would be worth approximately £256,000. But here’s the catch – your equity wouldn’t have just grown by £56,000. Thanks to leverage, your initial £50,000 investment would have doubled, excluding the mortgage repayments you’ve made.

This doesn’t even account for the potential rental income, which can act as a steady cash flow and offset mortgage costs. If you could rent out this property for, say, £800 per month, that’s a consistent income of £9,600 annually – or £96,000 over a decade, minus expenses.

Furthermore, savvy investors often “flip” properties – buying, refurbishing, and selling at a higher price. With the right research and approach, this strategy can yield significant returns in shorter durations.

For those with an entrepreneurial spirit, there’s the route of establishing a property portfolio, utilising the ‘buy-to-let’ strategy across multiple properties. As the portfolio grows, so does your wealth, often at an exponential rate.

Don’t wait to buy real estate; buy real estate and wait.

Will Rogers.

It’s essential, however, to be aware of the risks and responsibilities associated with property investment. From property maintenance to understanding tenant rights, there’s more to it than just collecting rent or waiting for prices to appreciate. But with dedication, research, and a bit of luck, property investment remains one of the most lucrative paths to millionaire status in the UK.

If you’re considering embarking on the property ladder, I’d suggest liaising with local estate agents or researching platforms like Rightmove to gauge market trends. It’s also wise to engage a financial advisor who specialises in property investments to navigate the intricacies.

Business

Building a business is one of the best routes to millionaire status in the UK. There are two ways to become a millionaire from your business.

The first is to take cash flow from the business in the form of salary or dividends and invest it just like you would a job. Having a successful business will likely allow you to grow your portfolio at a much faster rate.

The second way is through the sale of the business. Otherwise known as an exit. If you have created a successful business, it may be attractive to buyers looking to purchase a quality asset. Many sales of businesses are based on a multiple of profit. If your business makes £250,000 per year, you may be able to sell the business for 6-8x profit, maybe even more depending on the business type. This means you could exit for £1.5 – £2m making you a millionaire if you are the sole owner.

For example, I recently sold one of my websites. While websites are valued slightly differently, I was able to sell the site for 36x monthly revenue which got me a 6 figure payday. While it wasn’t quite the 7 figure exit I’m aiming for now, it was definitely an eye-opener into how a business sale can generate a lot of real wealth.

I truly believe that a combination of building a business and consistently investing monthly is the fastest way to become a millionaire in the UK.

Lottery

While it’s extremely unlikely, there’s a small chance you could win the lottery. However, around here we call that a suckers tax. There are much better ways to build wealth than gambling the money you do have.

Even the people who do end up winning the lottery often end up miserable and end up going broke not too far down the line.

In short, forget about this and get to work on building your investments and increasing your income.

Inheritance

For some, the route to becoming a millionaire is not built over decades of investment or property ladder climbing; it comes in the form of an inheritance. While this path is less about the sweat of your brow, it offers its own complexities and responsibilities. Here’s how to navigate them.

In the UK, it’s not uncommon to inherit substantial assets, especially given the high value of property in many parts of the country. However, inheriting wealth doesn’t mean you automatically retain it; it’s crucial to understand the taxation aspects. Currently, the Inheritance Tax rate in the UK is 40% on estates valued over £325,000, although there are several exemptions and reliefs available that can substantially reduce this liability.

The key is to not let the sudden influx of wealth change your financial habits for the worse. It might be tempting to make lavish purchases or risky investments. Remember that even inherited wealth can be fleeting if not managed properly.

Another aspect to consider is the emotional weight that often comes with inheritance. Money received from a loved one’s passing comes with psychological dimensions that make it different from earning it yourself. Handling it wisely is a way to honor their legacy while also securing your financial future.

In summary, inheriting your way to millionaire status may seem like “easy money,” but the complexities of tax laws, potential emotional baggage, and the responsibilities of sudden wealth make it a path that should be trodden carefully.

For those who find themselves on this unique route to wealth, it’s not so much about how you acquired it, but how you manage and grow it that counts.

Saving

While not impossible to save your way to a 7 figure net worth it’s very unlikely. Unless you have an extremely high-paying job in the 6 figure range, it’s going to be hard to save that much money, in a reasonable time frame.

However, if you did live extremely frugally and save £50k per year of your income it’s possible to reach millionaire status in 20 years. Right now you can also get some pretty good interest rates on savings accounts that will certainly help you on your way to your goal. Chip is my current go-to savings account offering almost 5% rates.

Chip is an award-winning savings and investment app. They became popular with their high-interest savings account but also offer investment services and automatic saving.

Roadmap To £1 Million Net Worth

We have now seen some of the best ways to become a millionaire but how do you actually start putting a plan into action? Below I have outlined a few simple steps that will highly increase the chances of you having a 7 figure net worth in your lifetime.

Step 1 – Master The Basics Of Personal Finance

If you want to become a millionaire you need to master good financial habits. This means mastering the personal finance basics. Most of personal finance can be summed up in one line “Live below your means”.

If you live below your means and invest the rest, this will set you up for a great financial future.

Now, let’s dive a little deeper into what that actually means.

- Career Path – Secure a good job with the potential for career progression. Always be on the lookout for jobs in the same field with better pay.

- Budget – Set up a budget and understand where your money goes each month. Make sure your bills are paid and you are setting aside money to invest each month before buying things you “want”. I recommend following the 50/30/20 budgeting system as a rough guide.

- Live Below Your Means – Ensure you are never spending more than you make. If you can follow this rule your likelihood of getting into financial difficulty is so much smaller. Stay away from expensive luxury items that you don’t need. Stop trying to impress people by buying stuff you can’t afford. They’re not even thinking about you anyway.

- Have an Emergency Fund – You should have a 6-month emergency fund for your essential expenses. Unexpected problems pop up all the time and can put a stop to your financial plans. However, if you have an emergency fund in place that covers the unexpected you’re much less likely to go off track.

- Avoid Bad Debt – You should avoid high-interest debt at all costs. If you’re not paying off your credit card in full every month, get rid of it. Avoid high-interest car loans. Avoid buy now pay later services. All of these kill your potential to invest and keep you in a debt trap where you simply work to pay off your debts in a never-ending cycle.

While there’s a lot more I could add to this section, these are a few of the core basics. If you stick to these, you should end up in a reasonably good place financially. This makes for a great base to take the next.

Once you have a fully funded emergency fund in place, it’s time to start investing.

Step 2 – Invest

The first place you should start investing is through your workplace pension if you have one. Your employer will usually match up to a certain amount. If they offer this, invest the maximum that they will match. The match is essentially free money and helps to contribute towards your investments.

Once you have maxed that out, the next best place to invest is through a Stocks & Shares ISA. I use Hargreaves Lansdown for this, but most brokers offer one. It allows you to invest up to £20,000 per year tax-free. This means you won’t pay any tax on capital gains, dividends or income when you start withdrawing money from this account.

As I showed you above, If you invested £300 per month from 25 years old to 60 years at 10.15%, by the time you’re 60, you would have a portfolio value of £1,184,024.

You can follow this path and reach a 7 figure net worth without much effort. You can work a fairly normal job. Contribute most of the money through your workplace pension and top up the rest from your income. If you start early, you’re not required to invest a huge portion of your monthly income. This is a great way to reach your goal of becoming a millionaire.

However, if you’re an overachiever, you might want more. That’s where the next step comes in and it’s not for everyone.

Step 3 – Start A Business/Accelerate Your Income

Now that you are investing and have got the snowball rolling, you can start thinking about ways to accelerate the growth of your portfolio. One of the best ways to do this is starting a business.

Personally, I don’t like taking huge risks in business. There are numerous online businesses you can start with very little upfront capital and huge upside. I would start one of these businesses at night and on the weekend while keeping your main job. Keep the safety net of your job until your income from your business has passed your income from your job and you have at least one year of salary in the bank. This gives you a lot of buffer room.

As your income grows in your business, you can contribute more money towards your portfolio and grow it rapidly. You also have the chance to potentially exit your business at some point if you choose to do so. This alone could help you reach the million-pound mark in a much shorter space of time.

Step 4 – Patience

Once you have all of this in motion, it’s simply about being patient. Stay disciplined throughout the process and don’t ever get too carried away with your lifestyle. Don’t get me wrong, you should still set aside money for fun and experiences but it should never come at the expense of financial freedom. If you want to live a more extravagant lifestyle, you simply need to make more money.

Over time as you fund your portfolio and start to contribute more, the snowball starts to grow rapidly. I’m now starting to see this as my personal portfolio is about to tip over the £100,000 mark at 26 years old.

Tips To Become A Millionaire Faster

Below are 5 simple tips to remember on your journey to becoming a millionaire in the UK:

- Live Below Your Means: Keep your expenses in check. The more you save, the more you can invest. Over time, those savings will compound, getting you closer to your millionaire goal.

- Diversify Your Income: Don’t rely on just one source of income. Consider side hustles, freelance opportunities, or investments that generate passive income to boost your earning potential.

- Educate Yourself: Commit to continuous learning. Whether it’s about investments, market trends, or new business opportunities, being knowledgeable will allow you to spot and act on lucrative opportunities faster.

- Avoid High Debt: While some debt can be beneficial, especially if it’s for investments that grow in value (like property), avoid accumulating high-interest debt, which can impede your financial growth.

- Network Wisely: Surround yourself with successful and like-minded individuals. Networking can open doors to investment opportunities, partnerships, or insights that you might not have come across on your own.

Want to track your Net Worth every month to see how it’s trending over time? Check out our Net Worth tracking google sheet.

Easily track your net worth in google sheets with these easy to use template. Add all of your banks accounts, stock accounts, properties and liabilities. Track how your net worth trends month over month so you can keep on top of your finances.

How Many Millionaires Are In The UK

2.85 Million people in the UK are millionaires. That’s approximately 4.2% of the population with a net worth in the 7 figure range. This data comes from the latest Credit Suisse report that classifies someone as a millionaire if they have assets worth more than $1 Million rather than pounds.

Being a millionaire does not mean they have £1 Million in the bank. Many people’s wealth is generated through property or investments. Many of these millionaires live in London and the South East. With property values rising rapidly over the past decade in these locations, property is likely a large contributor to many of these millionaire’s wealth.

Final Thoughts

You now know how many of the UK’s millionaires reached that level of wealth. It’s time for you to go out there and execute. Let me know in the comments how you plan to become a millionaire in your lifetime.

Read More From Money Sprout: