In this review, we are going to take a comprehensive look at Invest Engine and the products it offers on its platform. We will look at their unique model compared to other investment platforms in the UK as well as fees, investment options, customer experience and more. After reading this, you should be able to make an informed decision on whether or not Invest Engine is for you.

Quick Overview

Invest Engine is a low-cost investing platform that allows you to build your own DIY funds made up of ETFs or invest in one of their own managed funds. DIY funds come with zero platform or trading fees and the managed portfolios have cheap 0.25% platform fees. Invest engine is one of the cheapest platforms around right now and is a great choice for new investors who are not looking to invest in individual shares. The minimum deposit to open an account is £100.

Invest Engine is a zero-fee investing platform for ETFs as well as offering managed funds for more passive investors. They have a sleek, easy-to-use platform which makes building your portfolio a breeze. With no platform fees and over 550 ETFs on offer, we highly recommend Invest Engine.

- Fee free investing for DIY portfolios

- 0.25% Managed Portfolio Fees

- 550+ ETFs Available

- Auto-investing with savings plans

- Easy to use

- No pension plan

- Only offers ETFs

Who Are Invest Engine

Invest Engine is a dynamic player in the UK’s financial technology space, specializing in providing robust investment management solutions. The firm offers a comprehensive suite of services, including tailored investment portfolios, ISAs, and user-friendly digital tools, appealing to both novice and seasoned investors alike.

Founded with a vision to revolutionize the investment landscape, Invest Engine has made a name for itself through its innovative technology-driven approach. Unlike traditional asset management firms, it employs cutting-edge algorithms alongside financial expertise to craft personalized investment strategies for its clients.

Invest Engine’s dependability is underpinned by several key facets:

- Innovation and Modern Approach: Invest Engine’s embrace of technological advancements ensures that its strategies and services are always at the forefront of the industry, meeting the evolving needs of investors.

- Regulation: Being domiciled in the UK, Invest Engine operates under the vigilant oversight of the Financial Conduct Authority (FCA), ensuring that its clients’ interests are always safeguarded.

- Growing Client Base: The platform’s user-friendly interface, coupled with its commitment to transparency, has enabled it to rapidly amass a loyal customer base. Transparency: Invest Engine prides itself on its straightforward fee structures, its commitment to keeping clients informed, and its focus on delivering transparent, data-driven results.

In the fast-paced world of financial technology, Invest Engine stands out as a reliable and forward-thinking choice for those seeking an edge in their investment endeavors.

What Products Does Invest Engine Offer

Invest engine offers three different types of accounts for investing; ISA, a General Investment Account and a Business account.

Stocks And Shares ISA

This account allows you to invest up to £20,000 per year without paying any tax on your profits, even when you withdraw. You pay no tax on capital gains, income, or dividends. Remember you can only have £20,000 spread across multiple ISAs in a single year. With Invest engine, you pay no ISA account fees, only fees related to the portfolio type you choose.

General Investment Account

This is a general investment account with no tax benefits. You can buy and sell ETFs as you please but will have to pay capital gains tax on any profit over your yearly allowance of £6,000. Invest Engine offers commission-free trading and a choice of over 550 ETFs to invest in.

Business

If you have a small business you can open a Business account with Invest Engine and start investing surplus cash sitting in your business. You can withdraw your cash at any time from this account without paying any exit fees, so you don’t need to worry about getting locked in if you need the funds for your business.

Pension

Unfortunately, right now Invest Engine is not offering a pension service on their platform. If you are looking for a pension provider in the robo-advisor space, we would recommend Moneyfarm.

How Invest Engine Works

Invest Engine offers two different services on its platform.

Managed Portfolios

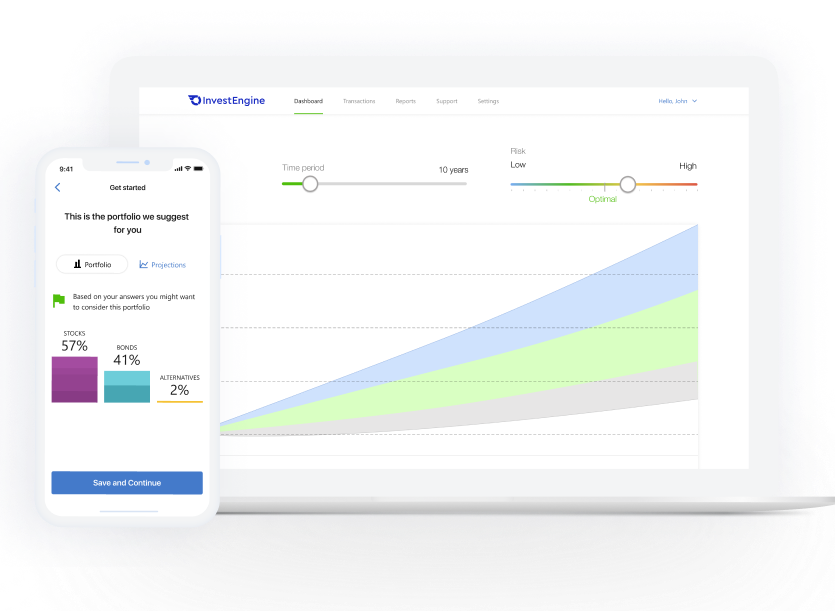

Invest Engine has a managed portfolio service similar to Moneyfarm or Nutmeg. They will provide you with one of their pre-built portfolios based on your risk level.

These portfolios are designed for people who don’t want to choose their own investments and want an easy, passive way to invest their money. Here’s how it works:

- Sign up to Invest Engine and select your account type (ISA, General or Business).

- Complete a questionnaire about your investment goals and the amount of risk you’re comfortable with.

- Invest Engine will then match you to a portfolio that is designed to maximise returns for your risk level made up of low-cost index funds.

- The invest engine team will then manage your investments and ensure they remain on track based on your goals.

When investing with Invest Engine, you can see exactly what you are invested in with their portfolio look-through feature allowing you to see where your money is being invested.

The minimum initial investment is £100 when investing in Invest Engines managed funds.

DIY Portfolios

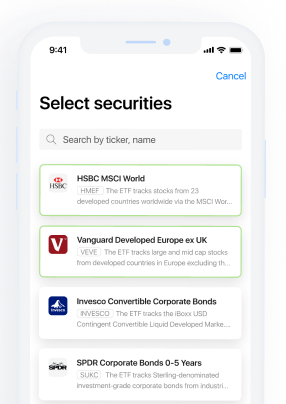

Invest Engine also allows you to build your own portfolio and choose your own ETFs. This gives you a lot more control over where your money is allocated. Here’s how it works:

- Sign up to Invest Engine and choose your account type (ISA, General or Business).

- You can then select investments for your portfolio from Invest Engines’ range of handpicked ETFs. They have over 550 ETFs to choose from which is a much larger selection than some of their competitors.

- Once you have chosen the ETFs you are going to invest in you can customise the percentage of your portfolio you want to allocate toward each of them.

- Invest Engine has a “One Click” balancing system that allows you to easily rebalance your portfolio if a certain allocation becomes too heavily weighted.

- Thats it. You can now manage your portfolio by buying and selling certain ETFs in your portfolio if you choose to do so.

The best part about Invest Engines DIY investing is the fact there are no dealing fees and no account fees. This is a huge saving compared to other platforms offering similar services.

Our Thoughts

We really like that Invest Engine offers managed services as well as DIY services. This gives new investors the opportunity to get into the markets without much knowledge. Once they start to learn more about investing they can start to experiment with building their own portfolio of ETFs without having to sign up to a new platform.

Invest Engine Investment Options

Invest Engine focuses on giving its customers the ability to invest in ETFs as well as having their own managed portfolios.

ETFs

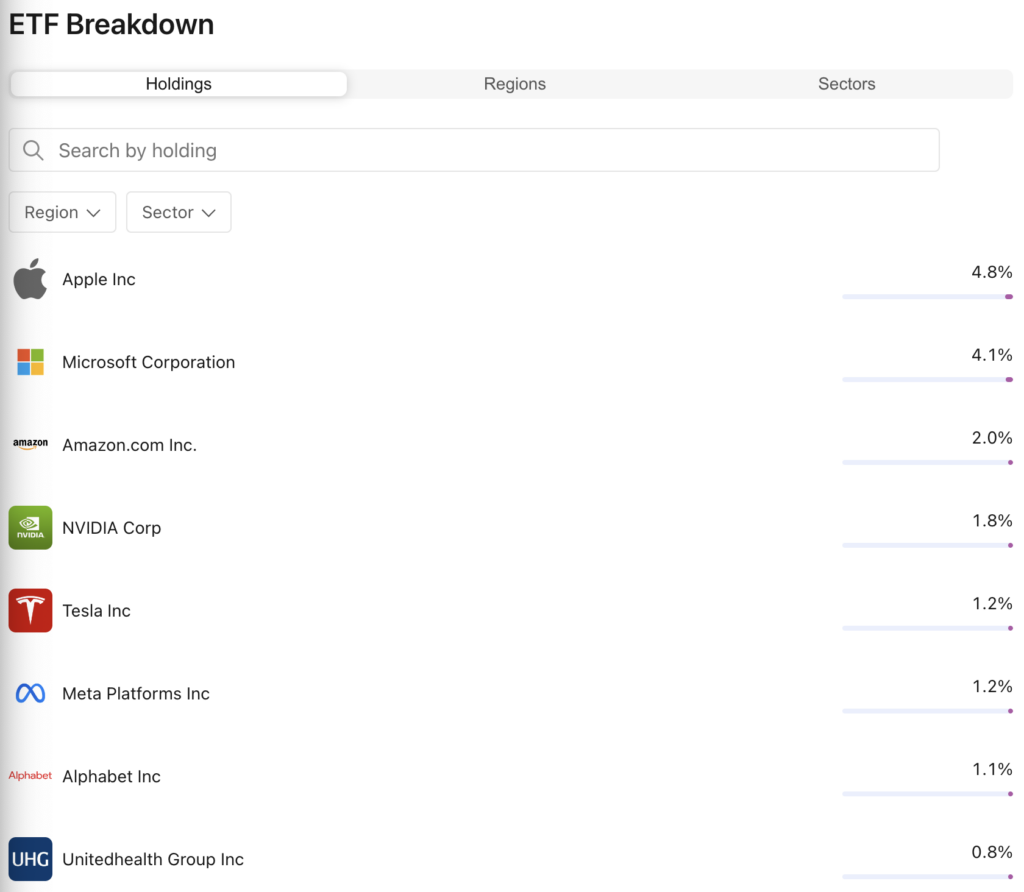

With Invest Engine you can invest in over 550 ETFs that have been hand-selected by the Invest Engine team.

An ETF, or Exchange Traded Fund, is like a basket of different stocks or assets that you can buy or sell through a stock exchange. Instead of picking individual stocks, buying an ETF lets you invest in a broad section of the market all at once, offering a mix of diversification and simplicity. Think of it as a mini-portfolio that trades just like a single stock.

You may choose to invest in a single ETF or have a range of ETFs with different focuses included in your portfolio.

The ETFs available on the platform include standard equity ETFs, Bond ETFs as well as some alternative assets ETFs (Gold, Platinum and more).

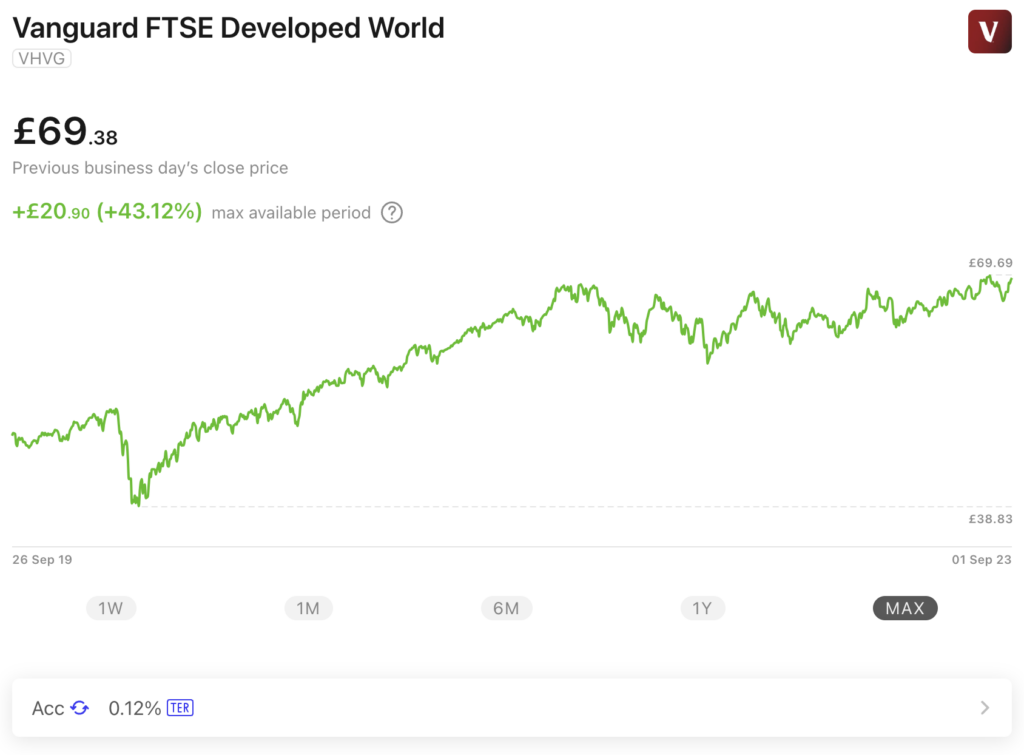

For example, you can invest in the Vanguard FTSE Developed world fund which invests in a range of companies from developed countries.

Invest Engine gives a full breakdown of the companies held in each fund as well as a breakdown of the regions and sectors the fund is based.

Managed Portfolios

Managed portfolios as we discussed above are managed by the Invest Engine team. When you sign up, you take a questionnaire to determine your risk level which will allow them to decide which of their pre-built portfolios you should invest in.

Invest Engine Portfolio Performance

Unfortunately, Invest Engine does not publish its portfolio results publicly right now. This is likely due to them being a new company and not having a massive history. Hopefully, they will start to publish these in the near future as their portfolios mature.

The only way to currently track the history of their portfolios is to look at the performance of the underlying funds each portfolio purchases. Obviously, this is not a very user-friendly way to track performance and would take an individual quite a while to work out for each portfolio.

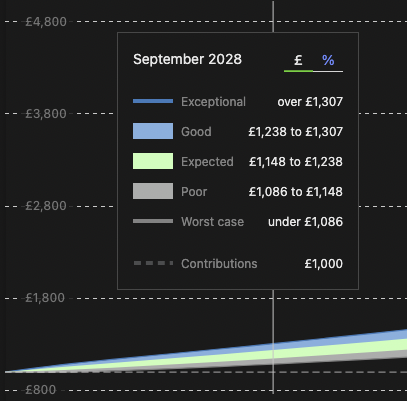

When you are choosing a portfolio inside Invest Engine you can see a projection forecast for each portfolio. These are the results Invest Engine expects to get with each portfolio.

They project 5 different scenarios for the projections; Worst case, Poor, Expected, Good, and Exceptional. These should be taken with a grain of salt as they are simply projections.

Invest Engine Fees

Fees on Invest Engine are some of the best in the industry for both their DIY portfolios and their managed portfolios. Let’s take a look at what they look like.

Do It Yourself Fees

If you go with Invest Engine’s DIY portfolio you will pay no platform fees whatsoever.

- No set-up fees

- No Withdrawal fees

- No dealing fees

- No ISA fees

Most platforms will charge a platform fee of 0.5-0.75% so having no platform or dealing fees is a huge advantage of going with InvestEngine.

Note: You will still have to pay fees on the ETFs you choose. These fees are charged by the funds themselves and not Invest Engine. I would recommend investing in low-cost index funds rather than expensive managed funds. The average portfolio charge on the platform is 0.16% plus 0.07% ETF spread costs.

In total, you will pay a fund fee and spread fee when investing in ETFs. This will be on average 0.23% when investing with Invest Engine. However, some funds cost significantly more to invest in than others.

Managed Portfolio Fees

If you decide to go down the route of a managed portfolio you will have to pay an annual fee. Invest Engine charges 0.25% on their managed portfolios which is considerably better than a lot of the competition. You still won’t have to pay the fees below:

- No set-up fees

- No Withdrawal fees

- No dealing fees

- No ISA fees

You can see a comparison of Invest Engine compared to some of the most popular competitors in the robo-advisor space.

In total, you will pay a management fee + fund fee + spread fee. On average this works out to around 0.48% when investing with Invest Engine.

In the table below Average total Fund costs include fund fees and spread fees.

| Platform | InvestEngine | Wealthify | Moneyfarm | Nutmeg | Hargreaves Lansdown |

|---|---|---|---|---|---|

| Provider fee | 0.25% | 0.60% | 0.65% | 0.75% | 0.45% |

| Average total Fund costs | 0.23% | 0.16% | 0.30% | 0.25% | 1.29%* |

| Total | 0.48% | 0.76% | 0.95% | 1% | 1.74% |

| £20,000 annual cost | £96 | £152 | £190 | £200 | £348 |

As you can see, Invest Engine is the cheapest platform for investing in ETFs. Their total fees come in at 0.76% with the closest competitor Wealthify having 0.76% fees.

Invest Engine Unique Features

Invest Engine has some unique features on the their platform which makes it easier to manage your investments. Let’s take a look at what they have to offer.

Savings Plans

Recently Invest Engine released their Savings plan feature allowing you to set up regular payments to your account and automatically invest in the funds you are already invested in.

First, build your own custom portfolio or use one of the managed portfolios that are already available. You can then set up regular payments weekly, fortnightly or monthly. Using the Autoinvest feature Invest Engine will automatically allocate your funds towards your chosen investments.

We like this feature as setting up automatic payments takes the decision making out of your investing strategy. When the money is automatically taken from your account, you’re more likely to stick to your investing plan.

Fractional Investing

Invest Engine allows you to invest in ETFs from as little as £1 by utilising fractional shares. This means you can spread your money across multiple ETFs for diversification even if you have a small portfolio.

Education

Invest engine has a blog on their site where the release educational content on investing. They also release monthly market round ups allowing you to get a broad overview of what is going on in the market.

It’s definitely not the most comprehensive education section we have seen on an investment platform but it’s clear to see they are trying to grow this and provide their customers with more information and educational resources on investing.

Transferring To Invest Engine

Invest Engine offers the option to transfer existing ISAs to their platform. Simply sign up and fill out their online form and they will do the rest. You are able to transfer any existing ETFs you already own without having to sell them first (In-specie Transfers).

This service is completely free and is available when you sign up to Invest Engine.

Invest Engine Reviews

Invest Engine has an amazing score of 4.5 Stars on Trust Pilot. This is one of the highest scores out of all the financial platforms we have reviewed. It has 78% 5-star reviews, 11% 4-star reviews and only 5% 1-star reviews.

Many of the positive reviews talk about the fast, helpful customer support team who work at Invest Engine which is important when dealing with customers’ finances. People also mention how simple it is to use the platform and start investing.

The negative reviews are mostly made up of people complaining about the KYC verification process when signing up which happens on every platform. A few others also complained of poor returns but this really comes down to the market and funds you decide to invest in rather than Invest Engine. One point that they could improve on is having phone support. As an investor, I like being able to get on the phone and contact the people who are managing my money.

Invest Engine Customer Support

Many people on Trust Pilot have praised Invest Engines’ great customer support. Currently, you can contact them via the contact form on their website and also through social media.

Unfortunately, they are not currently offering any phone support. I know as my portfolio grew I wanted to be able to get in touch with the people managing my money and actually speak to someone. This is currently one of the biggest downsides of Invest Engine.

They do mention on their support page that they may add phone support in the future.

Is Invest Engine Safe

Yes, Invest Engine is a safe platform to invest your money. They are authorised and regulated by the Financial Conduct Authority (FCA). These are the people who ensure that Invest Engine is following strict rules and regulations to keep your money safe.

Your money is also protected by the Financial Services Compensation Scheme (FSCS), which means that if Invest Engine went out of business, your money would be covered up to £85,000.

As well as the protections outlined above, your money is also held in a separate protected trust account. This account is completely separate from Invest Engine’s own business accounts. This means if Invest Engine ceased trading, your money would be returned.

How Does Invest Engine Make Money?

Invest Engine is currently making money through the 0.25% fee it charges on its managed portfolios. Currently, the DIY service is completely free and is one of the cheapest platforms to invest in ETFs. As Invest Engine is a fairly new company, they are likely trying to bring in new customers with these extremely cheap fees. In the future, we may see additional features added to the platform at an extra cost or even an increase in their base fees.

Who Should Use Invest Engine

Invest Engine is great for a wide range of investors. If you do not have a need to invest in individual stocks then Invest Engine may be the best platform to onboard with right now. If you’re new to investing or simply want someone else to manage your portfolio, the managed plans on the platform are great and come with some of the lowest fees in the industry. If you want to build your own portfolio with low-cost ETFs and have zero platform fees Invest Engine is also a great choice.

Invest Engine is a platform where you can grow from having a managed portfolio to building your own portfolio all under one roof. They have created a great path for new investors to get started and retain them as clients as they grow.

If you don’t plan on investing in individual stocks anytime soon, this is the platform to use.

Final Thoughts

Here at Moneysprout we think that Invest Engine is one of the best places to Invest your money right now. If you are looking for a low-fee broker, where you can purchase ETF’s or invest in a managed portfolio Invest Engine is hands down, one of the best platforms to do it.

If you feel like you will eventually want to start investing in individual stocks, I would personally set up an account with Trading 212 or Hargreaves Lansdown instead.

Read More From Money Sprout: