Saving money and eventually becoming wealthy doesn’t just happen by luck. It happens by putting a system or routine in place to ensure you are moving towards your goals every single month. If you follow a sensible system over a long enough period of time, you will eventually reach financial freedom.

Payday is a make or break for your finances. When that paycheck lands there are two types of people. One is paying off debt from last month, buying more stuff they don’t need and heading out to party immediately. The other has an automated system in place that invests a portion of their paycheck, pays their bills and saves for important goals they have in the future. The money remaining can be spent guilt-free on whatever they want.

If you’re the former, you’ll never get ahead financially. If you set up a payday routine and stick to your budget, you’ll eventually build significant wealth. In this article, I’m going to show you a simple payday routine that will allow you to build significant wealth and become financially free.

Payday Routine Video Guide

PayDay Routine For Financial Success

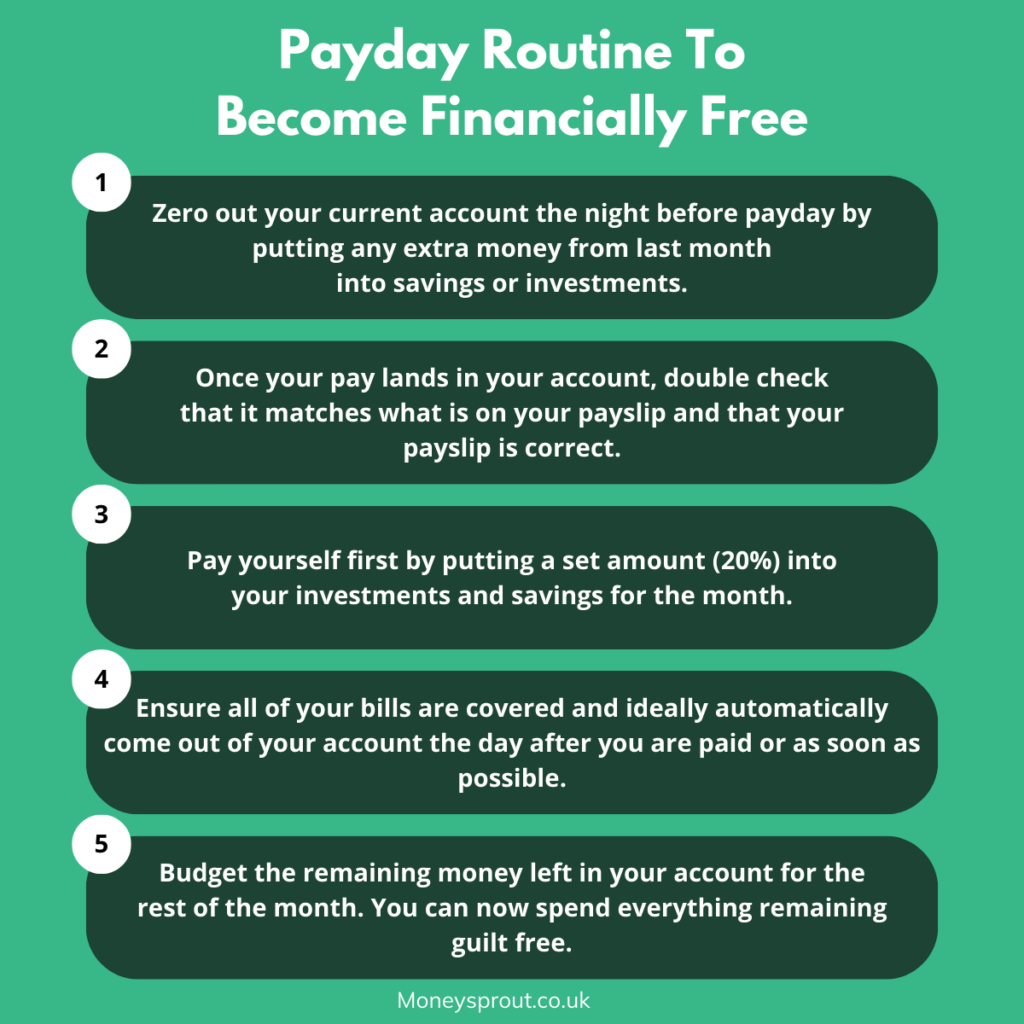

Below is a cheat sheet that outlines the steps you should take when you get your paycheck every month.

Step 1 – Review Your Accounts The Night Before Payday

The night before payday it’s a great idea to check your accounts and see how much money you have left from last month. I recommend keeping a £500 – £1000 buffer in your current account just in case any unexpected bills come through, you’ll have them covered.

At the end of the month if you have anything above that set £500 – £1000 number move it into your savings or investments. If you keep it in your current account, you’ll probably end up spending it on something you didn’t need.

This means you are essentially starting off the new month at zero (Or your “buffer number”). When you start from zero it makes budgeting for the next month much easier and anything you had left over last month is extra savings. You don’t necessarily have to invest this “extra money”. You could put it in a savings account for holidays or a treat you are saving up for.

Step 2 – Check Your Payslip

Once your paycheck lands in your account, it’s a good idea to check that the amount on your payslip matches the amount you got paid in your account as well as checking that the amount on your payslip is actually correct.

Payroll mistakes affect 47% of employees so over your career there is a good chance that you will eventually make a mistake with your salary.

If there is a problem, get in touch with your company or payroll department and have the mistake rectified. If your salary is correct, you can move on to the next step, paying yourself first.

Step 3 – Pay Yourself First – Savings & Investments

Paying yourself first means that you set money aside for your savings and investments before paying your bills or making other generic purchases. By doing this you are investing a set portion of your income for your future self. You may also be setting money aside for other savings goals such as a house, wedding or car.

A lot of people state that they will save and invest what they have left over at the end of the month. When the end of the month rolls around, there’s usually nothing left. As humans, if we have money in our current account, we tend to spend it.

By putting a set amount of money into savings and investments before we do anything else we remove the temptation of spending that money. We also learn to adapt and live on the remaining money we have left. Our lifestyle and spending usually expands to the amount of money we have in our account.

Treat these payments like bills. Once that money is gone to your investments, it’s not available anymore for spending.

By utilising the pay-yourself-first method, you get wealthier every month. Your investments grow and your savings pots start to build.

How Much Should You Invest Each Month?

The amount you need to invest each month for retirement will depend on your current age and future goals. Personally, I like to invest a minimum of 20% of my post-tax income and then I will also save for things like holidays on top of that.

By investing 20% of my income each month I know that I will have a healthy retirement portfolio when I’m ready to retire.

If you invest through your workplace pension and get an employer match you can count this towards your 20%. You should at least invest as much as your employer is willing to match. This is an instant 100% return on your money. You also get to invest this money before tax comes out lowering the amount of tax you pay.

If you’re investing after you have received your paycheck an ISA or SIPP is a better place to invest your money.

With an ISA you can avoid any tax on your capital gains and dividends up to £20,000 per year as of the 2023/2024 tax year. You an also withdraw your money at any time without penalties, making it a great option if you plan on potentially needing the money before retirement.

You can open an ISA with our partner Trading 212 and receive up to £100 in free shares while doing it. Capital is at risk when investing.

Trading212 is a zero-commission trading platform offering general investment accounts, ISAs and CFD accounts. They are a trusted broker who has been around for almost 2 decades now. They have a range of features such as pies and multi-currency accounts which aren't offered by other brokerages.

- Commission Free Trading

- Access to over 12,000 Stocks and Funds

- Impressive features such as Pies and Multi-currency

- No phone support

You can also invest in a SIPP where the government will give you 20% tax relief which means on a £1000 deposit you would get £1250 in your account. If you’re a higher-rate taxpayer, you can get even more. However, with a SIPP there is penalties for taking money out before the retirement age and you will also have to pay income tax on withdrawals.

If you’re unsure why you should be investing for your future, I would recommend checking out our beginners guide to investing.

Saving For Things Outside Of Retirement

You may also want to save for things outside of retirement such as Holidays, Weddings or a car. I like to use Sinking Funds to do this. A sinking fund is a separate savings account where you put money away monthly towards larger expenses in the future.

If you are saving for any larger purchases I would recommend also putting this money away on payday.

We have a full guide on Sinking Funds if you want to learn more about them.

Step 4 – Ensure Your Bills Are Covered

Once you have invested a set portion of your income, you will want to ensure your bills are covered for the month. This is expenses such as your rent/mortage, utility bills, phone bills, subscriptions etc.

I would highly recommend having these bills come out of your account on the day after you get paid or as close to it as possible. This makes it much easier to know how much you have to spend the rest of the month.

Once all your monthly bills have been paid, the remaining money in your account can be spent 100% guilt-free.

Step 5 – Budget Your Remaining Money

Now we have covered your retirement, your savings goals and your bills all on the first day of the month. This puts you in a great position moving forward for the rest of the month.

Any money you have in your current account can be spent guilt-free. I would recommend using our free budget sheet to create a monthly budget and decide where you want to spend that remaining money each month.

You will naturally adjust your lifestyle towards the amount you have left over after everything is paid for. Using this system has made managing my finances extremely easy and allowed me to build a 6 figure investment portfolio at 26 years old.

Payday Routine Example

Let’s take a look at an example payday routine for someone on £33,000:

Pre-tax Salary Monthly – £2,750

Pension Deduction – £100 + £100 Employer match

Take Home After Tax & National Insurance – £2,125

You are paying £200 into your pension already through your workplace pension so we will invest another £210 from our take home for our investments. Here’s what your payday routine might look like.

Investments & Savings

Investments ISA – £210 (£410 invested between workplace pension and ISA investments)

Holiday Savings – £100

Wedding Savings – £100

Total – £410

Remaining Balance – £1715

Bills

Housing – £600

Utilities – £125

Phone – £50

Subscriptions – £75

Insurances – £125

Total – £775

Remaining Balance – £740

You now have £740 left over for food, transport and entertainment/wants. You can spend this money how you please knowing that you have already invested and saved for the other things you want.

Your budget may look significantly different than this depending on your current living circumstances. If you struggle with budgeting and want to make it easier, I would recommend checking out our 50/30/20 budgeting guide.

Final Thoughts

Hopefully, this guide has helped you to outline a payday routine that will work well for you. Once you get a routine in place, it makes it much easier to save and invest for the future while living within your means and not feeling guilty about the money you do end up spending.

Read More From Money Sprout: