When you create a monthly budget it can be hard to account for larger one-off expenses. For example, if you go on a holiday once per year and you pay for it all in a single month, that can really put a dent in your budget, making it hard to stick to for the rest of the month.

That is where sinking funds come in. They allow you to save for larger expenses over time and have the money ready for them when it’s needed. In this article, we’re going to look at what a sinking fund is and how you can use it to your advantage when budgeting.

What Is A Sinking Fund?

A sinking fund is a strategic way to save money by setting aside a small amount regularly into a separate account for a specific future expense. In personal finance, this method is often used to prepare for large, predictable expenses like a down payment on a house, a car purchase, a vacation, or even Christmas.

The idea is to break down a large expense into manageable chunks, saving a bit each month over time, so when the bill comes due or the purchase is made, the money is available without the need to incur debt. It differs from an emergency fund, which is intended for unforeseen expenses. A sinking fund is proactive and focused on a known upcoming expense.

Rather than taking on debt to pay for an expense and paying it off with added interest after you make the payment, you pro-actively save for the thing you are purchasing ahead of time. Therefore you don’t go into debt or incur interest charges which can leave you in a bad place financially.

Benefits Of A Sinking Fund

1. Stress Reduction

Sinking funds help alleviate financial stress by providing a clear plan for large purchases or bills. When you know you’re saving specifically for a purpose, it reduces anxiety about how you’ll cover these costs when they arise.

2. Debt Avoidance

Using a sinking fund can help you avoid taking on debt, since you’re planning ahead and saving incrementally for big expenses. This means you won’t have to rely on credit cards or loans when it’s time to make a payment.

3. Budget Stability

Your budget remains stable because sinking funds smooth out your cash flow over time. Rather than facing a large expense all at once, you spread the cost over several months, which makes managing your monthly budget easier.

4. Goal Achievement

Sinking funds are excellent for goal-oriented savings. Whether you’re saving for a vacation, a new gadget, or home repairs, having a dedicated fund for each goal keeps you focused and on track financially.

5. No Sacrifice Surprises

There’s no need for last-minute sacrifices. Without a sinking fund, you might have to cut back on your spending abruptly to afford a big expense. With a sinking fund, you plan your savings in advance, so there’s less impact on your daily life when the expense comes due.

How To Create A Sinking Fund

You will want to keep your sinking funds separate from your main savings account and also separate from each other if you have more than one. If you just lump everything into one single savings account, it can get complicated to figure out what money is actually allocated to what expenses. This can lead you to spend more than you would have liked on certain expenses.

Let’s take a look at how you can set up sinking funds.

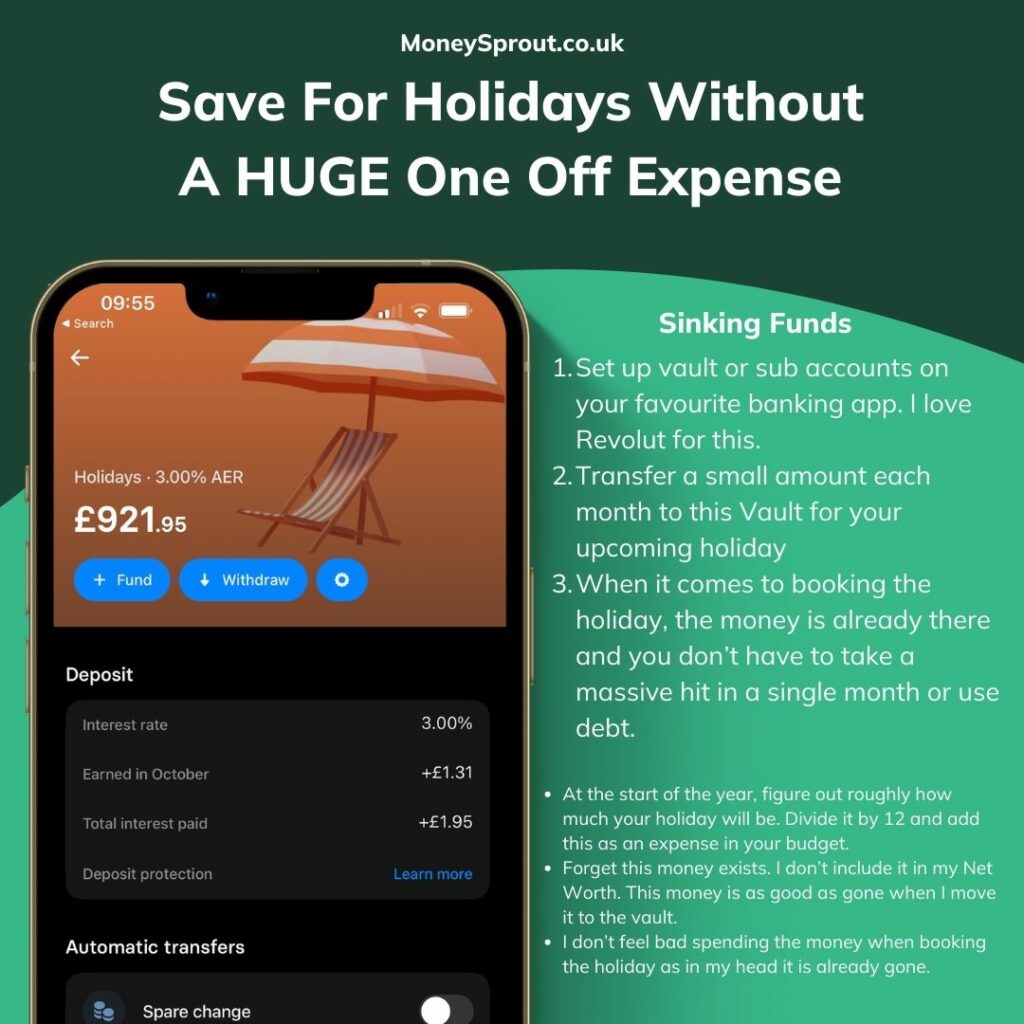

Step 1 – Get A Bank or Savings Account That Allows Sub Accounts

You will need to utilise a banking or savings account that allows you to create sub-accounts. Most modern banking apps will allow you to do this. Personally, I use Revolut for mine but Monzo is also another great choice.

If your existing bank doesn’t offer these features, I would recommend setting up an account with one of these providers. You can easily transfer the money for sinking funds into this account from your main account.

Step 2 – Figure Out How Much You Need To Save In Each Sinking Fund

Now you need to decide the specific funds you need to create and how much you need to save in them. For example, you may estimate that a holiday 1 year from now will cost you £1200. Therefore you would want to add £100 per month to your sinking fund.

If you have multiple things you want to save towards, work out how much you will need to put towards them each month. Some goals may only require you to save for a few months, while others could take multiple years.

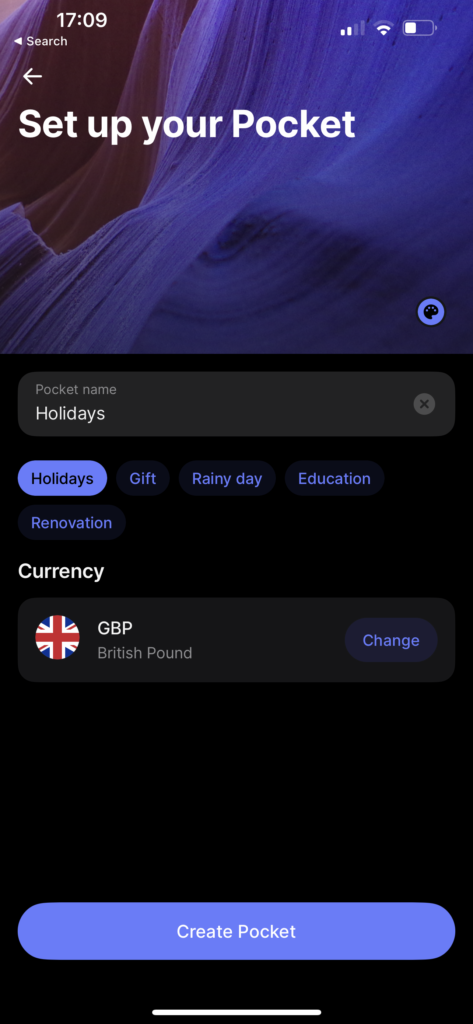

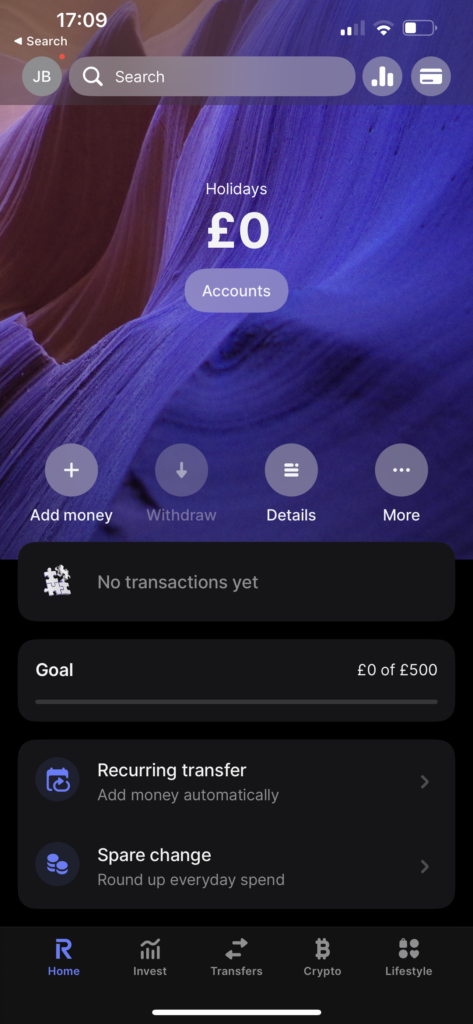

Step 3 – Create Your Sub-Accounts On Your Banking App

In your app of choice create sub-accounts for each of the sinking funds you want to create.

If you are using Revolut you can select Accounts –> Add New –> Pockets –> Personal –> Name Your Pocket and select “Create pocket”. Set your target goal for the pocket.

Step 4 – Set Up A Recurring Transfer

You can either transfer money to each of your pockets manually each month or you can set up a recurring transfer for each of your sinking funds. I would personally recommend setting up recurring transfers as it takes any thought out of it. Automating your finances is one of the best ways to become financially responsible.

Step 5 – Fill Your Funds

Over time you will fill up your funds. You can then go ahead and purchase whatever it is you are saving for. As you have saved for it beforehand, you won’t have to use any debt to pay for it. Buying something you have worked hard for in cash feels a lot better than the anxiety of putting it on a credit card only to have it cripple you financially for months or years to come.

Sinking Fund vs A Savings Account

Sinking funds and savings accounts are a match made in heaven. Sinking funds are just a way to use savings accounts to help you save more efficiently. By using separate “Savings Accounts” in modern finance apps, you can keep your savings for different goals separate.

If you keep everything in a single account, you will eventually end up overspending for something causing you to fall behind on your other goals.

Sinking Funds vs Emergency Funds

Sinking funds should be completely separate from your Emergency fund.

An emergency fund is there for when you have unexpected expenses that you can’t plan for. This could be your car breaking or getting laid off from your job. Sinking funds on the other hand are expenses in the future that you are planning for. For example, holidays, weddings or a house deposit.

Your emergency fund and sinking funds should be two completely separate accounts and your emergency fund should never be used to pay for “Wants” such as holidays. It should be reserved only for emergencies.

A sinking fund is used for large expenses that you know about in advance. An emergency fund is for the unknown expenses that will eventually appear but you don’t know what they will be or how much they are.

I would recommend building a full emergency fund before starting to save for things like holidays and new cars.

How Many Sinking Funds Should You Have

The amount of sinking funds you have will depend on the things you are saving for. I would try and keep it to a fairly tight list of things that mean a lot to you. There’s no point in having 20 sinking funds if you can only pay a very small amount of money into them each month.

The money that goes towards your sinking funds should be coming out of your 30% Wants budget. Even though you are saving towards these things, this is not the same as saving and investing for retirement, which approximately 20% of your income should be going to.

If you earn £30,000 per year after tax, 10% of your income may go towards your sinking funds.

Over the course of a year, it might look something like this:

£1200 – Holiday (£100/Month)

£500 – Home Maintenance (£42/Month)

£1000 – Future Car (Save over multiple Years) (£84/Month)

£300 – New Golf Club (£25/Month)

Having any more than this would mean you don’t have much money to spend each month on just enjoying life. It’s best to keep it to things that are really important to you.

Best Apps For Sinking Funds UK

Many bank accounts in the UK now give you the ability to create sub-accounts where you can separate your savings into individual accounts for specific expenses. However, the more modern ‘Banking Apps’ such as Revolut and Monzo do this much better than traditional accounts.

Personally, I use Revolut for my sinking funds. They have a feature that allows you to create as many “Pockets” inside your account as you like. I mainly use this for my holiday fund, which I pay into monthly based on a rough estimate of how much I plan to spend on travel throughout the year.

When it comes time to pay for your expenses you can just withdraw from these sub-accounts and pay for whatever it is you were saving for. In Revolut these accounts are also out of sight. The balance in these accounts doesn’t show in your main account. I like this because if I don’t see the money without looking for it, I’m much less likely to spend it impulsively.

These accounts also pay interest. It’s not quite as high as my main savings account with Chip which pays 4.84% but it’s something. As there’s usually not a huge amount of money in these sinking funds I’m not worried about missing out on a few points of interest. The bulk of my money is in my investments and emergency fund.

Another great option for your sinking funds is Monzo. They allow you to create “pots” which essentially act the exact same way as the “Pockets” on Revolut.

Final Thoughts

Sinking funds are one of the best ways to save for larger future expenses. At the start of each month, set aside a small amount towards the large purchases you plan to make. This should be in individual accounts, dedicated towards a specific expense.

Once you put that money into those individual accounts, mark it as ‘spent’ in your head and forget about it until you need to pay for that expense.

Read More From Money Sprout: