In this review, we are going to take an honest look at eToro, one of the largest investment platforms in the UK. eToro is a brokerage and social trading platform that allows you to follow investors and copy their portfolios. We’re going to take a look at the fees, products, and investments they offer as well as customer reviews on the platform.

There’s no doubt eToro is one of the most popular trading platforms around with over 30M users worldwide. The platform has its benefits but is it still worth signing up for with all the competition in the market? Let’s find out.

eToro is a popular global trading and investing platform for new and experienced investors. They offer zero-commission trading and have over 3,000 stocks available on the platform.

One of their most unique features "Copytrader" allows you to copy other high-performing traders portfolios.

- Zero commission trading

- Easy To Use App

- Regulated By The FCA

- $5 Withdrawal Fees

- Heavily promotes active trading and CFDs

Who are eToro?

eToro is a pioneering social trading platform and investment brokerage that stands at the forefront of the fintech revolution. Offering both traditional investment opportunities as well as the ability for users to copy the trading strategies of successful investors, eToro has made its mark in democratizing the financial markets.

Founded in 2007 by Yoni Assia, Ronen Assia, and David Ring in Tel Aviv, Israel. Since its inception, the company has evolved and expanded, bringing innovative features to its platform, such as CopyTrader™ and social feeds, blending social networking and trading.

eToro’s reputation for being a trustworthy platform can be attributed to:

Experience and Innovation: With over a decade and a half in the industry, eToro has remained at the cutting edge, consistently introducing novel features that merge technology, social networking, and finance.

Regulation: eToro operates under the scrutiny of top-tier financial bodies. Depending on the region, eToro is regulated by authorities such as the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC), ensuring global compliance and the safety of its users.

Diverse Community: eToro is proud of its global community, which spans millions of users from over 140 countries. This diverse user base often provides feedback, allowing eToro to continuously enhance its platform.

Transparency: Known for its open stance, eToro has been forthcoming about its fee structure, potential risks, and provides comprehensive educational resources to assist both novice and experienced traders.

Is eToro Good For Beginners?

While eToro has many features available on their app, it is still easy to navigate and use for beginners. This combined with commission-free trading and ready-made investment portfolios makes it a good place to get started with investing.

They also have a great educational section on the platform, teaching you about the basics of investing, trading and even crypto and the blockchain. It’s great to see the company trying to educate its users getting into the investing world for the first time.

What Products Does eToro Offer?

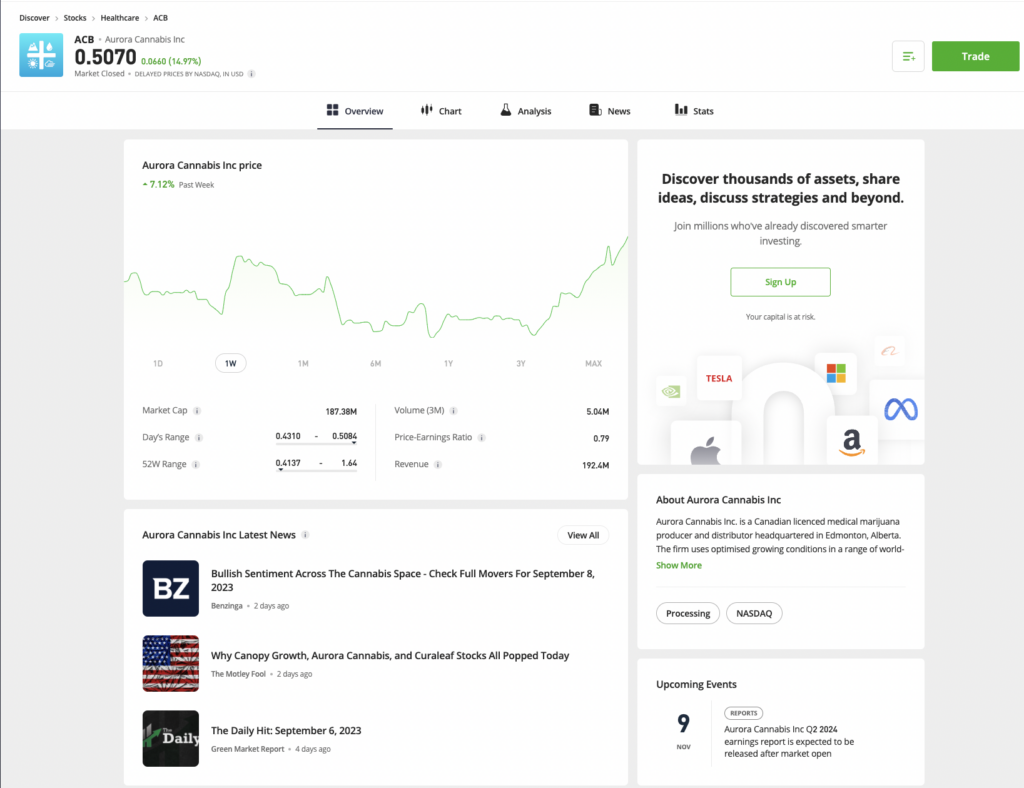

Stock Investing

eToro users have access to over 3,000 stocks on the platform as well as a wide range of ETFs. This allows you to build out your own portfolios with the stocks and ETFs you like, giving you full control over your money. You can get started investing on eToro with as little as £7.50 ($10).

In the UK eToro has also partnered with Moneyfarm to provide its users with access to a Stocks and Shares ISA. Moneyfarm provides a range of risk-based managed portfolios for you to invest in, without having to choose your own investments.

When users open a Moneyfarm ISA, they will be able to view their account balance through the eToro platform.

CFD Trading

In the UK eToro offers contract for differences (CFD) trading. These are a type of derivative that allows traders to speculate on the price movement of various financial instruments without owning the underlying asset.

It is important to note that trading CFDs is extremely risky and you can lose more than you initially started with as contracts involve borrowing capital. On eToro 81% of retail trading accounts lose money. Here at Money Sprout, we don’t recommend trading CFDs as it’s not a good long-term trading strategy for most people.

Crypto Investing

As well as stocks eToro offers users the ability to trade cryptocurrencies. Currently, they offer over 60 crypto assets on the platform. This includes some of the most popular coins such as:

- Bitcoin

- Ethereum

- Dogecoin

- Litecoin

- Uniswap

- & Many More

Etoro has wallets allowing users to store their crypto on the platform. It can also be sent off of eToro to an external wallet if you want to.

Smart Portfolios

Smart portfolios are pre-made portfolios curated by eToro analysts. If you want to get started investing but don’t want to put together your own portfolio this is a great way to do it. They have a range of different portfolios that focus on different sectors of the market including Dividend Growth, Utilities, Technology, Web 3.0 and more.

The portfolios are regularly rebalanced by the eToro investment team, allowing you to have a passive approach to investing.

These portfolios require a minimum investment of $500 to get started.

eToro Fees

eToro has a range of different products available and each of them has a different fee structure. Let’s take a look at them below:

Stocks

Trading stocks on eToro is relatively inexpensive as they do not charge platform or commission fees. The main expense comes from their FX rates and a $5 withdrawal fee when taking money off the platform.

| Fee Type | Price |

|---|---|

| Management Fees | Zero |

| Broker Fees | Zero |

| Rollover Fees | Zero |

| Ticket Fees | Zero |

| FX Fees | Charged on UK deposits to exchange GBP to USD (More Info Below) |

| Withdrawal Fees | $5 Per Withdrawal |

FX rates are charged at different prices depending on when the transactions occur. Weekdays come in at 0.25% and weekends come in at 0.5%.

| Rate | Currencies | Times |

|---|---|---|

| 0.25% above currency supplier rate | eToro-approved currencies** | Sunday 10:02pm–Friday 10pm UK |

| 0.5% above currency supplier rate | eToro-approved currencies** | Friday 10:01pm–Sunday 10:01pm UK |

| 0.55% above currency supplier rate | All other currencies | At all times |

Crytpo

For crypto, eToro have a simple fee structure. On all transactions they will charge a simple and transparent 1% fee. This 1% fee is added to the market price. As soon as you open the position, you will see a 1% “loss” on the position. This is because the P&L includes the 1% trading fee which has been deducted.

When you make a purchase you will gain full ownership of those crypto assets and can transfer them off platform if you wish.

CFDs

For CFDs fees are charges based on the spread. The spread is the difference between the buy and sell price of an asset. This is a common way for trading platforms to charge fees.

Each difference currency pair, commodity or stock is charged at a different rate. This rates are measured in PIPs. PIP stands for “Percentage in Point”. One PIP is the smallest price change that a given exchange rate can make and therefore refers to the very last digit of a price. A PIP is used to measure the change in the price of one currency in relation to another.

You can see the full list of eToro CFD fees here.

If this sounds complicated, it’s because it is. Most people lose money trading CFDs. That’s why we prefer a solid long term investing strategy.

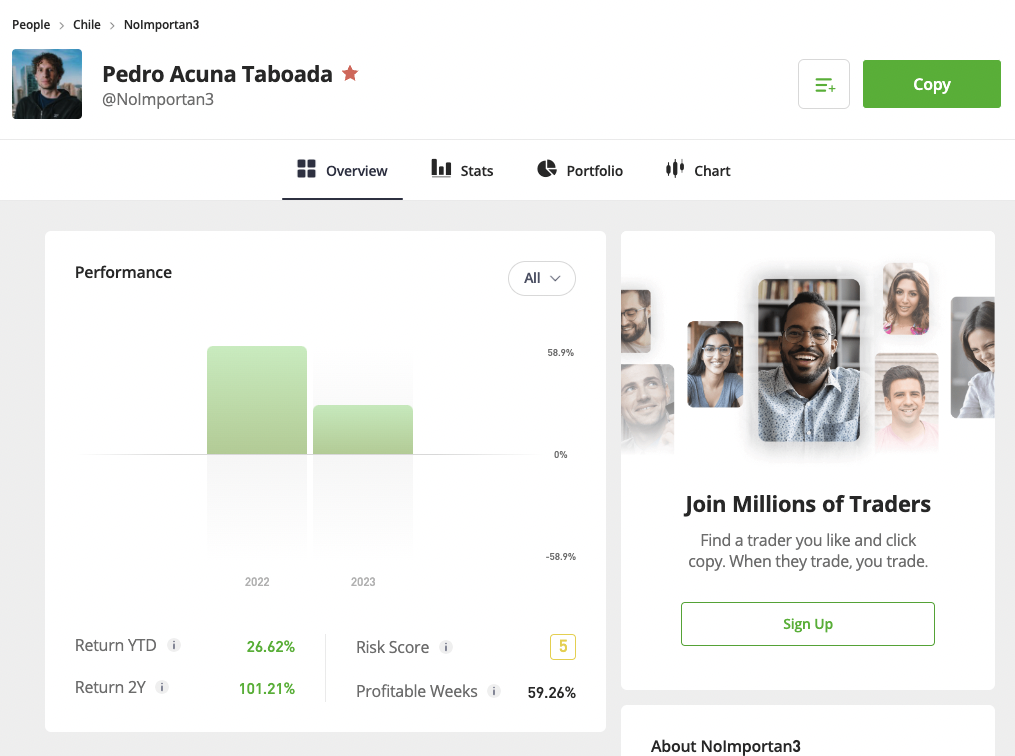

eToro Copy Trading

One of the most unique features of eToro is their copy trading feature. Rather than being a trading platform, eToro has added a social aspect as well.

They give you the ability to follow and copy the best-performing traders on the platform.

How it works:

- Choose a trader to copy (there is no additional charges to use the copytrader feature)

- When they make a trade, so do you. The trades they make are replicated in your portfolio in real-time.

These traders have profiles which you can view before copying them. You can see their stats, portfolio and historical performance. Most of them will outline the strategy they are using and how they plan to manage the portfolio.

While this is an interesting feature, it’s not something I would be throwing my whole investment portfolio into. Putting my portfolio in the hands of a random guy on the internet doesn’t seem like the smartest decision to me. It may be fun to throw some money at one of these for fun but it certainly isn’t part of my long term investing strategy.

Is eToro Safe?

Yes, eToro is safe. They are authorised by the Financial Conduct Authority (FCA) and are also a part of the Financial Services Compensation Scheme (FSCS).

The FCA ensures that eToro is following financial regulations and is fit to look after your money.

The FSCS covers you up to £85,000 if eToro ever went out of business.

eToro Support

Customer support is one of the main factors I look at before choosing a company to invest with. I personally like to be able to get on the phone and talk to the people who are managing my money.

eToro have two methods to contact them:

- Open an email support ticket (response expected in 48 hours)

- Live chat which is available 24 hours a day from Monday to Friday

I like the fact they have a live chat feature but having a phone support team would be a preferred option.

eToro Reviews

eToro has great reviews on Trust Pilot coming in with a score of 4.4 Stars from over 20,000 reviews. 4.4 Star is extremely good in the world of brokerage apps.

62% of the reviews are 5-star with 22% of them being 1-star. 22% at 1-star is quite high compared to a lot of other investing apps we have reviewed on the site.

The majority of positive reviews talk about the great support they have had with the customer service team at eToro and how easy the platform is to use.

When it comes to negative reviews, there are quite a few complaints about accounts being locked pending more documents and information from users as well as some people complaining about the support team.

Final Thoughts

Overall, I think that eToro is a good platform however it has a lot of features that can lead new investors down a bad path. For example, CFD trading and Copy Trading can lead to people trying to get rich quick rather than following a long term investing strategy.

Here at Money Sprout we try to improve peoples financial situation by helping them make good choices over long periods of time. The temptation to use these “flashy” features can lead people to making poor decisions.

There is nothing wrong with their investing platform and it offers over 3,000 stocks to choose from but personally I think there are better platforms out there. I would recommend going with Hargreaves Lansdown or Trading 212 for a fully fledged brokerage experience.

Read More From Money Sprout: