Mortgages are a hot topic in the UK in 2023. As the Bank of England base rate increased to over 5%, mortgage rates followed, leaving us with the highest mortgage rates in the past decade. If you’re thinking about buying a house or your fixed rate is coming to an end, you may be wondering about current average mortgage payments and interest rates.

In this article, we’re going to take a look at how much the average monthly mortgage payment is as well as some of the factors that will determine the rate you pay. Let’s jump in.

Quick Stats

- As of June 2023, the average house of £287,546 would have a payment of £1,441.36 monthly, with a 25% deposit over 25 years at a 6.39% rate.

- The North East is currently the cheapest place to purchase a house with an average monthly payment of £807/month while London is the most expensive with an average monthly payment of £2,646 per month.

- The average household is now paying £490 more per month on their mortgage.

Average Mortgage Payment In The UK

If we take the latest House Price Index data and the current average mortgage rates we can get an idea of the average mortgage repayment on each different house type in the UK.

The numbers below are as of June 2023 with a 25% deposit:

| Property Type | Price | Interest Rate (2-year fixed) | Term | Monthly Repayment |

|---|---|---|---|---|

| Average House | £287,546 | 6.39% | 25 years | £1,441.36 |

| Detached | £451,157 | 6.39% | 25 years | £2,261.48 |

| Semi-Detached | £279,059 | 6.39% | 25 years | £1,398.82 |

| Terraced | £234,373 | 6.39% | 25 years | £1,174.82 |

| Flat | £231,037 | 6.39% | 25 years | £1,158.10 |

These numbers have increased significantly in 2023. For example, back in December 2021, you could get a 2-year fixed mortgage for 2.34%. At that rate, an average house costing £287,546 would have a monthly payment of £950.20 per month compared to the current payment of £1,441.36. That’s a massive difference of £490 per month eating into people’s household budgets.

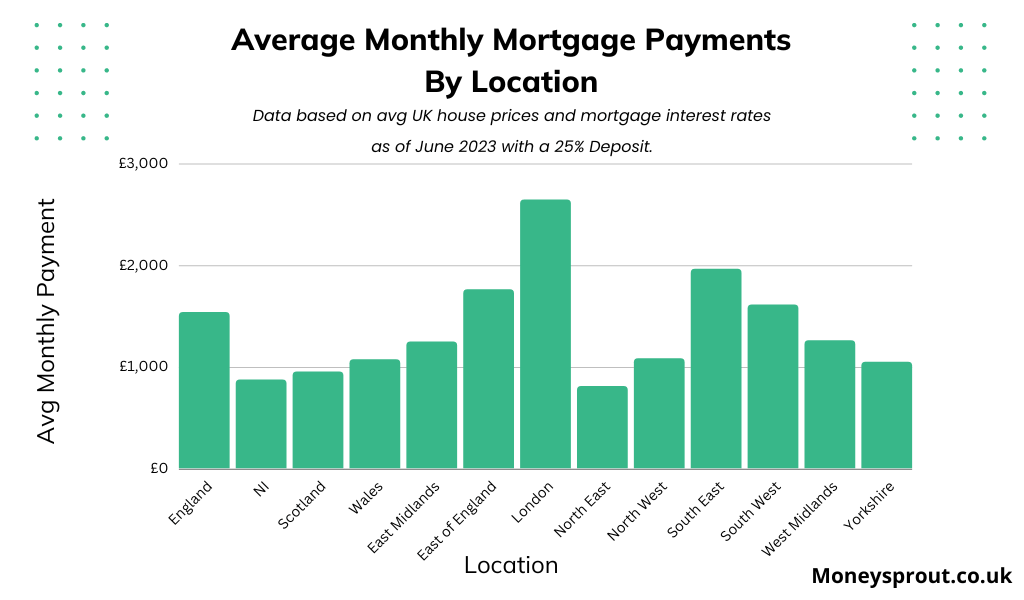

How Mortgage Payments Differ Between Locations

By using the average house price Index for June 2023 we can get an idea of average mortgage payments across the UK.

We have taken the house price data for each region and worked out the average monthly mortgage payment based on a 25-year mortgage at an average interest rate of 6.39%.

| Country and Geos | Average House Price | Mortgage Required (25% Down Payment) | Average Monthly payment |

|---|---|---|---|

| England | £306,447.00 | £229,835.25 | £1,536.10 |

| Northern Ireland (Quarter 2 – 2023) | £173,898.00 | £130,423.50 | £871.69 |

| Scotland | £189,424.00 | £142,068.00 | £949.51 |

| Wales | £213,477.00 | £160,107.75 | £1,070.08 |

| East Midlands | £248,678.00 | £186,508.50 | £1,246.53 |

| East of England | £351,213.00 | £263,409.75 | £1,760.50 |

| London | £527,979.00 | £395,984.25 | £2,646.56 |

| North East | £161,034.00 | £120,775.50 | £807.20 |

| North West | £215,631.00 | £161,723.25 | £1,080.88 |

| South East | £391,406.00 | £293,554.50 | £1,961.97 |

| South West | £321,152.00 | £240,864.00 | £1,609.81 |

| West Midlands Region | £250,743.00 | £188,057.25 | £1,256.88 |

| Yorkshire and The Humber | £208,867.00 | £156,650.25 | £1,046.97 |

The North East has the cheapest average monthly payment at £807 per month while London has the most expensive average payment at an average of £2,646 per month.

Scotland, Wales and Northern Ireland are the only other locations where the average house has a payment under £1,000 per month.

The rise in mortgage interest rates over the past 2 years has increased these payments significantly. For example, the same house in the West Midlands in 2021 would only have cost £690 per month. While wages are also increasing they are not increasing at the same rate as interest rates, putting many people in a bad financial situation.

Average Fixed Mortgage Interest Rates In The UK

As of September the average interest rate on a 95% LTV, 2-year fixed mortgage is 6.61%. A 60% LTV, 2-year fixed is slightly lower at 5.96%.

In the chart below you can view the latest mortgage interest rates for home buyers in the UK. Each line represents a different Loan To Value ratio as well as rates for 2-year and 5-year fixed-rate mortgages.

The chart below will stay updated with the latest mortgage interest rates we have.

When the Bank of England base rate increases, mortgage rates follow. Mortgage rates will usually hover around 1-2% higher than the current base rate. Throughout late 2022 and 2023, we have seen significant increases in the base rate bringing it to its highest level since the 2008 financial crisis. It is expected that rate increases will stop as it approaches 5.5 – 6% hopefully stabilising the mortgage market.

As we can see in the chart above, the market rates available have started to fall since July. Whether or not the rate continues to increase will depend on whether or not the government can get inflation under control.

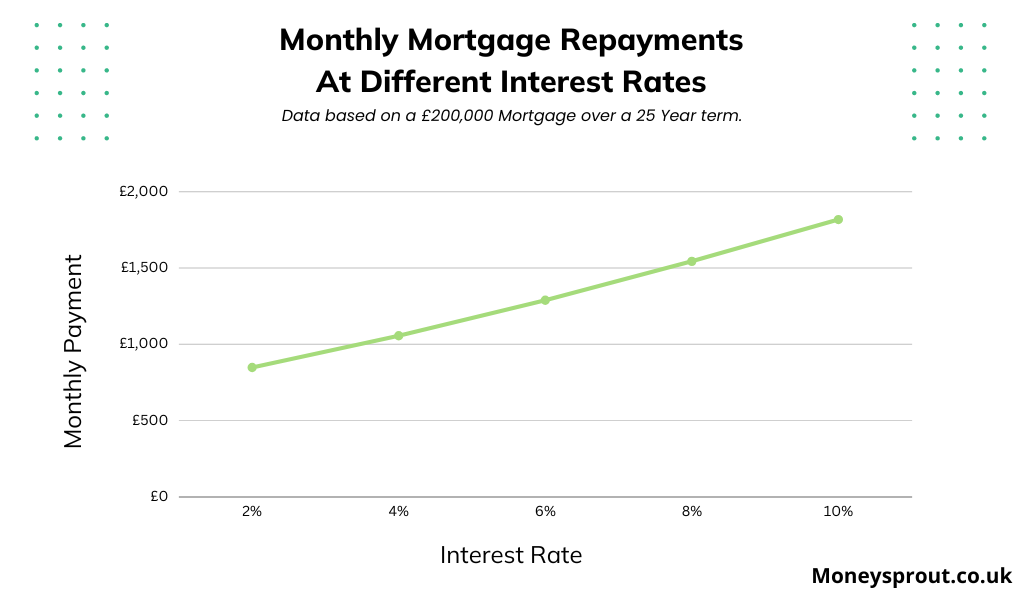

How Does The Interest Rate Affect Mortgage Payments

The higher the interest rate on your mortgage the more you will pay in interest each month and over the course of your mortgage.

If you have a £100,000 mortgage and have a 2% interest rate, you will pay £2,000 per year in interest. This equates to approximately £167 per month. While interest rising from 2-4% may not sound bad, it is. This isn’t a 2% increase. It’s a 100% increase on what you previously paid. Moving from 2-4% means you would now be paying £4,000 per year in interest or £334 per month. That’s a significant jump in your payments.

In the past few years, we have jumped from 2% rates to 6% rates meaning people are having to pay three times more interest than they used to.

In the real world a £200,000 mortgage used to cost you £848/month on a 25-year term at 2%. That same mortgage at 6% interest costs you £1,289 per month.

A £200,000 mortgage at 2% would see you pay £254,313 in total over the 25-year term of the mortgage. At 6% the same mortgage costs you a total of £386,581. That means a small 4-point increase in the mortgage rate costs you £132,268 more over the life of the mortgage. That’s a lot of money and shows the importance of trying to lock in a lower rate if you can.

In the UK, most of our mortgages are 2 year fixed or 5-year fixed with a small amount of companies offering 10-year fixed rates. This means you will likely re-finance when your fixed term is up. It’s best to shop around during the re-finance stage to lock in the best rates.

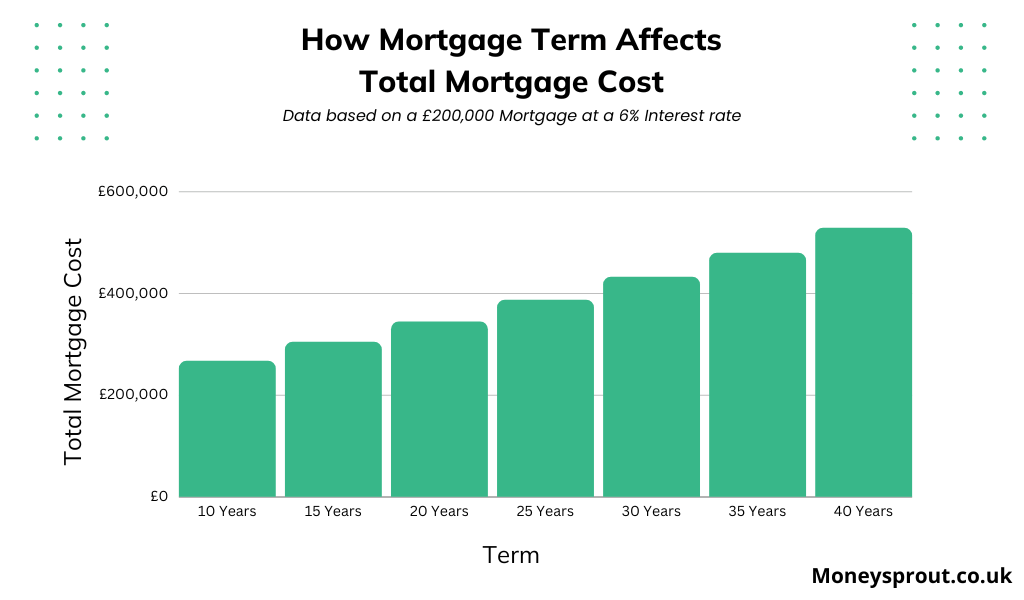

How Mortgage Term Affects The Overall Cost Of Your Mortgage

In the UK there is a wide range of mortgage terms available. The most popular is the 25-year mortgage with 30 and 35 years not far behind. Some companies will even offer 40-year terms if you are young. On the other side of the spectrum, you can essentially make your mortgage as short as you want as long as the payments are affordable for you.

Taking a mortgage over a longer term can make your monthly payments cheaper but will ultimately result in you paying more for your mortgage.

The longer term you take your mortgage over, the more you will pay in interest, as you pay interest on your mortgage balance for a longer period of time.

A £200,000 mortgage over 25 years at 6% results in total payments of £386,581 and a monthly payment of £1,289. The same mortgage over a 40-year period costs you a total of £528,205 with a monthly payment of £1,100.

While you have £189 less to pay each month, it’s ultimately costing you £141,624 over the lifetime of your mortgage. That’s pretty insane for the sake of £189.

If you can afford it, it’s better to pay off your mortgage as early as possible, especially when interest rates are as high as they are right now.

What Affects The Interest Rate You Are Offered On A Mortgage

When you get offered a mortgage, the rate you receive may be slightly different than the rate advertised. This is because your personal circumstances will affect the rate you are offered. Let’s take a look at which personal circumstances can affect the payments you make.

- Credit Score and History: Your credit score is one of the most significant determinants. Lenders will look at your borrowing history, your record of repaying debts, and any financial mistakes you might have made in the past. A higher score generally means a better rate.

- Loan-to-Value Ratio (LTV): This is the percentage of the property’s value that you’re borrowing. If you have a bigger deposit and therefore a lower LTV, you’re seen as less of a risk and might be offered a better rate.

- Debt-to-Income Ratio: If a significant portion of your income is already earmarked for debt repayments, lenders may see you as more of a risk, potentially leading to a higher rate.

- Employment Status and Income: Being in stable employment and having a steady income can lead to better rates. Self-employed individuals might face more scrutiny and might need to provide more proof of a stable income.

- Property Type and Value: Some types of properties are seen as higher risk than others. For instance, non-standard construction properties might result in a higher interest rate.

- Size of Deposit: The bigger your deposit in relation to the property’s value, the less you need to borrow, which can often mean you’re offered a lower interest rate.

- Age: Younger borrowers might be seen as riskier due to a potentially shorter credit history, but older borrowers might also face challenges, especially if the mortgage term extends beyond the typical retirement age.

- Past Financial Difficulties: If you have had issues like bankruptcies, CCJs (County Court Judgments), or IVAs (Individual Voluntary Arrangements), these can affect your perceived creditworthiness.

- Number of Applicants: Applying with a partner or spouse, especially one with a good credit score and steady income, can sometimes get you a better rate than applying alone.

- Existing Financial Commitments: Outstanding loans, large amounts of credit card debt, or other financial commitments can influence your rate.

- Length of Time at Current Address: Lenders often view stability as a positive factor. If you’ve moved around a lot in a short period, it might be viewed as a negative.

Is It Beneficial To Overpay Your Mortgage?

Overpaying your mortgage in the UK, as in many other places, can have both advantages and disadvantages. Whether it’s a good decision depends on your personal financial situation, goals, and the terms of your mortgage. Here are some pros and cons to consider:

Pros of Overpaying Your Mortgage:

The main reasons to pay off your mortgage early are to reduce the total amount of interest you will and reduce the length of the mortgage. All of the overpayments go directly towards the mortgage principal allowing you to build more equity in your house quickly. Of course, being mortgage-free gives many people a lot of peace of mind. Overpaying can help you get there faster.

Cons of Overpaying Your Mortgage:

The main downside to paying off your mortgage early is potential early payment charges. You will need to see the specific terms of your mortgage to see if they allow you to repay early, pay off a portion without penalty or outright don’t allow it. The second big downside is opportunity cost. For example, if you have a mortgage at a 2% interest rate, it’s probably better to invest your extra money in a stock market index which has historically generated returns of over 10% per year.

Things to Consider Before Overpaying:

- Emergency Funds: Ensure you have an emergency fund in place before considering overpayments. It’s advisable to have 3-6 months’ worth of expenses saved up.

- Higher Interest Debts: If you have other debts (like credit card debt) with higher interest rates than your mortgage, it generally makes sense to pay those off first.

- Pension Contributions: Consider maximizing your pension contributions to benefit from tax reliefs and potential employer matches.

- Investment Opportunities: Depending on the interest rate on your mortgage and the expected return from investments, it might make more financial sense to invest extra money rather than overpay the mortgage.

- Fixed Rate Periods: If you’re in a fixed-rate period, there might be restrictions on how much you can overpay without incurring a penalty.

Ways To Decrease Your Mortgage Payment

Many people are struggling to cover their bills right now and mortgage payments are one of the largest bills in the household budget. Some of these methods will result in you paying more in the long term but can reduce the payment in the short term.

Avoid Staying On A Variable Rate

If your fixed-term deal is up, you will automatically get put on the standard variable rate. This is likely a more expensive rate than locking in a new mortgage deal. Shop around and see if you can get a cheaper fixed-rate deal. This could save you £100s per month.

Increase The Term You Will Pay Over

As mentioned above, a longer term will result in cheaper monthly payments. If you need to reduce your payments finding a new longer-term deal could result in a reduced monthly payment however it is important to remember this will result in you paying more in total.

Utilise An Offset Mortgage

If you have substantial savings, some banks will let you hook up your savings to your mortgage and reduce your mortgage interest instead of paying you interest. This allows you to keep your savings liquid without paying down your mortgage directly. Some banks even allow you to hook up friends and family savings reducing your mortgage payments even more.

Re-mortgage To Cheaper Rate

Even if you are on a fixed-rate deal, it may be beneficial to switch to a new cheaper fixed-rate deal if rates have gone down significantly since taking your mortgage out. It’s important to take into account all fees associated with the switch to ensure that it’s actually cheaper to switch.

Pay Down Your Mortgage

This one might be a bit obvious but paying off a chunk of your mortgage will reduce your monthly payments. If you have savings liquid, it may be wise to use them to pay off a chunk of your mortgage rather than keep them in a savings account, especially is the mortgage rate is higher than the savings interest rate. Just ensure you still have an emergency fund in place.

Final Thoughts

Average mortgage payments have risen at a rapid rate during 2023 putting strain on many household budgets. These high rates are expected to stay around until at least 2025 when we will hopefully see a sharp decline in rates back down to around 3% or so. Time will tell.

Read More From Money Sprout: