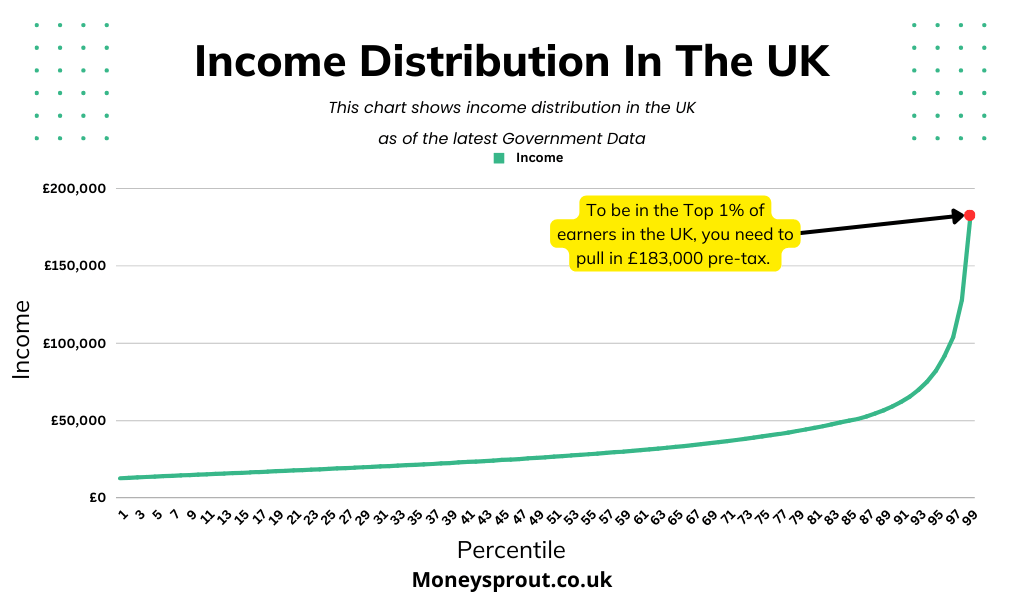

The Top 1% of earners are said to be the “financial elite” in the UK. Some see this as a goal to strive for, while others look down upon them when talking about income inequality. In the UK our government publishes yearly data on income levels of our population.

In this article, we will look at how much you need to make each year to reach the “Top 1%” as well as the best careers to get there. Let’s jump in.

How Much Do Top 1% Earners Make In The UK?

According to the latest government data, the top 1% of earners make an annual income of £183,000 annually in the UK. This is significantly more than the average UK income of £33,280 in the UK.

This is pre-tax income which is made up of multiple income sources such as salary, dividends, interest and more. As we all know, we don’t get to keep everything we make. The tax man has to take his cut.

What Is £183k After Tax In The UK

On a £183k income, you will be paying in the additional rate tax band and you will lose all of your tax-free allowance as you are making over £125,140 per year. This means you will pay 20% tax on income up to £50,720, then pay 40% from £50,721 to £125,140 and finally pay 45% tax on the remaining £57,860.

You will also have to pay National Insurance. Here’s how it all breaks down.

On a £183k salary, you will pay £67,310 in Income Tax and £9,665 in National Insurance leaving you with a take-home pay of £106,025 per year. That’s a large chunk of your income going towards taxes.

This is based on the full income being a salary. Many high earners will earn some of their money as dividends or even interest which they would pay less tax on.

Therefore, if you want to be in the Top 1% of post-tax earners, you will have to bring home more than the £106,025 you would be bringing home on a salary of £183,000.

How Much Do You Have To Make After Tax To Be In The Top 1%

Being in the Top 1% pre-tax does not automatically put you in the Top 1% of post-tax earners. This is because the Top 1% of earners usually have multiple sources of income such as a salary and dividends. Dividends are taxed at a lower rate than standard income, so those who earn £183,000 pre-tax with a chunk of it in dividends, will pay less tax than someone earning their whole £183,000 as a salary.

If you want to be in the Top 1% of post-tax earners, you will have to earn more than £121,000 after tax.

The £106,025 you would bring home on a £183,000 salary would put you in the Top 2% of post-tax earners in the UK or 98th percentile.

What Percentage Of Total Income Do The 1% Make

According to the IFS, the highest 1% of earners account for 14% of total earnings in the UK. This figure increased significantly in the 1980s as overall inequality increased. However, throughout the 1990s and most of the 2000’s this group of earners pulled away from the rest of the population while income inequality was largely stable or falling over that period.

What Is A Top 1% Net Worth In The UK

Just because you are earning a Top 1% income, doesn’t mean you are in the Top 1% of wealthiest people in the UK. To become wealthy, you have to save, invest and make your money work for you. You can earn as much as you like, but if you spend it all, you will never become rich.

According to the latest data from the Office For National Statistics, households need to be worth at least £3.6 Million to be in the Top 1%.

Reaching a net worth of £3.6M is possible without ever being a Top 1% earner. For example, if you invest £50,000 per year at 8% per year, you would have a Net Worth of over £3.8M in just 25 years. While this requires a high income, it can be done if you are consistent with your investments over long periods of time.

You can use our compound interest calculator to see how long it would take to reach a Net Worth of £3.6M.

How To Become A Top 1% Earner In The UK

If you want to become a Top 1% earner in the UK, you will need to work in a specialised field that has salaries that reach this level or alternatively, start your own business that can pay you a salary or dividends of over £183,000 per year.

Here are some fields that have the potential to reach this high level of income:

- Medicine: Especially specialists such as surgeons, anaesthetists, and radiologists.

- Finance: Positions like investment bankers, hedge fund managers, private equity professionals, and senior roles in banking and asset management.

- Law: Senior partners at major law firms, particularly in specialties like mergers and acquisitions or international law.

- Corporate Executives: CEOs, CFOs, COOs, and other high-level executive positions at large corporations.

- Entrepreneurship: Starting and scaling a successful business can lead to substantial earnings, although it also comes with significant risk.

- Tech Industry: Top software engineers, especially those with specialized skills, and senior positions at tech companies such as CTO or lead architect.

- Professional Athletes: This is very selective, but top athletes, especially in popular sports like football, can earn significant salaries and endorsement deals.

- Entertainment Industry: Successful actors, musicians, producers, directors, etc.

- Real Estate Development: High-end developers or investors in the property market.

- Aviation: Airline pilots for major carriers, especially with seniority.

- Engineering and Project Management: Especially those involved in major projects such as oil & gas, infrastructure, etc.

- Sales and Commission-Based Roles: Particularly in industries like luxury goods, real estate, or enterprise software.

- Consultancy: Senior partners or specialists in top management consulting firms.

- Pharmaceuticals: Senior roles in research and development, or executives within large pharmaceutical companies.

- Digital Marketing: Those who start their own successful agencies or master affiliate marketing.

Final Thoughts

If you are trying to reach the Top 1% of earners in the United Kingdom you’re going to need to make £183k or more pre-tax and if you want to join the club as a post-tax earner you will need to be making £121,000 or more after tax.

Read More from Money Sprout: