You may have heard people say that it’s important to invest early on in life. You hear it a lot in the personal finance space. However, it may not click until you actually see the numbers behind it.

In this article, I’m going to show you how big of a difference investing early in your life can make to your overall returns. Let’s jump in.

The Importance Of Investing Early Video

The Wealth Multiplier

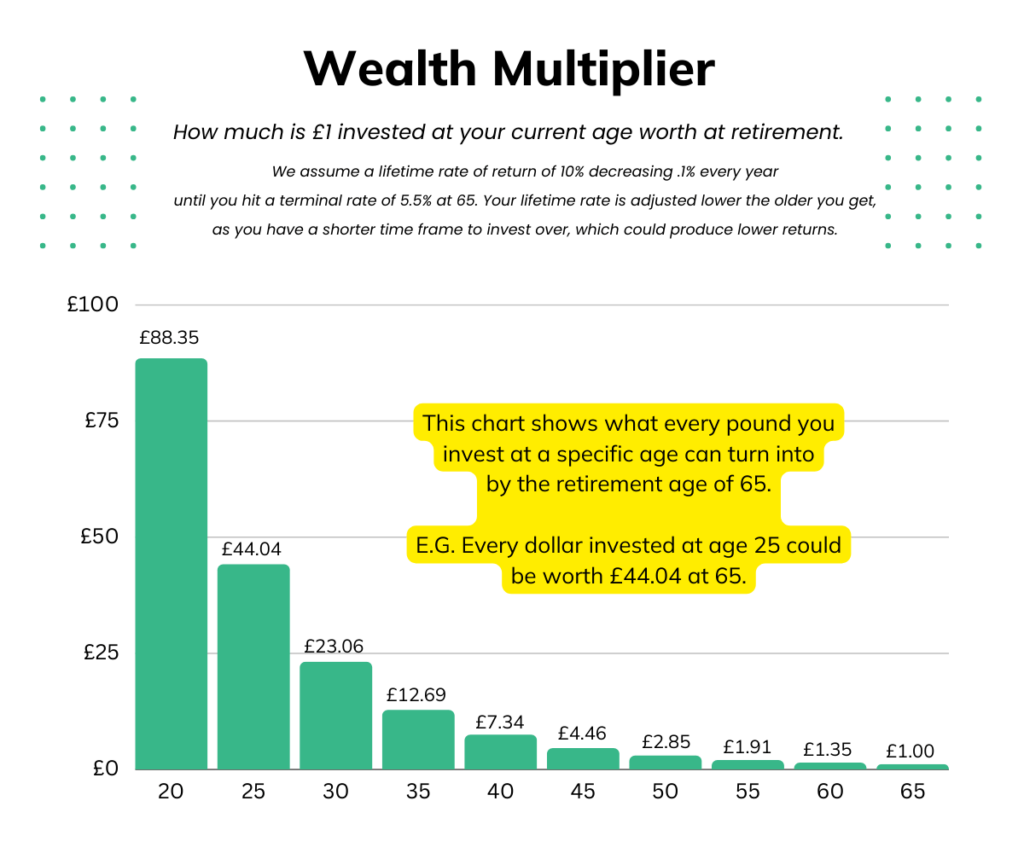

The Wealth Multiplier is a term I first heard from the Money Guys who are an American-based finance brand. When I saw these numbers illustrated in a graph, it set a fire under me to invest as much money as possible in my 20s. We are going to use the same calculations they have used illustrated for the UK.

The Wealth Multiplier is essentially how much £1 invested at a certain age will be worth at the retirement age of 65.

We are going to be using an annualized return of 10.00% to work out our calculations. This is the return of the S&P 500 over the last 50 years with dividends reinvested. It’s important to note that this does not account for inflation. In inflation-adjusted returns, you would have got approximately 7% returns over the past 50 years.

In the chart below, the lifetime rate of return is decreased by 0.1% per year from age 20 – 65. This accounts for the shorter period of time you have to invest.

As you can see, investing early is extremely valuable. At age 20 every pound invested could be worth £88 whereas at age 30 every pound is only worth £12.69.

This starts to make you think about money differently. Now you look at every pound you are spending in your 20s as a much larger amount of money. That £4 morning coffee is costing you £352 in retirement, every single day when you are 20 years old.

Now, I’m not one to say you should deprive yourself of all joy in life to save for retirement, you shouldn’t. However, knowing these numbers should make you much more intentional about how you spend. It really makes you think “Is this actually worth it?” when you are buying something.

Most people will struggle to invest in their early 20s as they may be in education or in a low-paying job just starting their career. However, everything you can invest during this period will give you a massive head start as you enter your late 20s and early 30s. Even if it’s only £100 per month.

Let’s take a look at how much you need to invest each month to become a millionaire based on your age.

How Much You Need To Invest Monthly To Become A Millionaire – By Age

The earlier you start investing, the less you will need to invest monthly over your lifetime. The figures in the chart below show you how much you need to invest per month starting at different ages.

You hear a lot of people say “I’ll start investing later” as retirement seems so far away. However, the longer you delay starting the more of your income will have to go towards investing ot reach a comfortable retirement.

If you start at age 20 and simply invest £95 per month until you reach retirement, you could have £1 Million. If you wait until 30 years old, you will have to invest £340 per month to reach £1 Million. That’s doable for most people however, if you leave it later than your early 30s things start to get much harder.

If you start investing at 35, you will have to invest £606 per month to reach £1 Million by 65. That’s a significant chunk of income considering the median take-home monthly salary for 30-39 year olds is £2,295. £606 is approximately 25% of your salary each month. Meanwhile, someone who started at 20 years old still only has to invest £95 per month.

If you put off investing until your 40s this is where things really start to get tough. You will have to invest over £1,000 per month to reach £1 Million invested. As you have a growing family, a mortgage to pay, and trips away, saving £1,000 per month can become a lot harder.

If you are lucky enough to be reading this in your 20s, just get started. Small amounts make a significant difference at this age. If you’re a little older, it’s never too late. You just have some catching up to do.

Starting Investing In Your 20s vs Your 30s

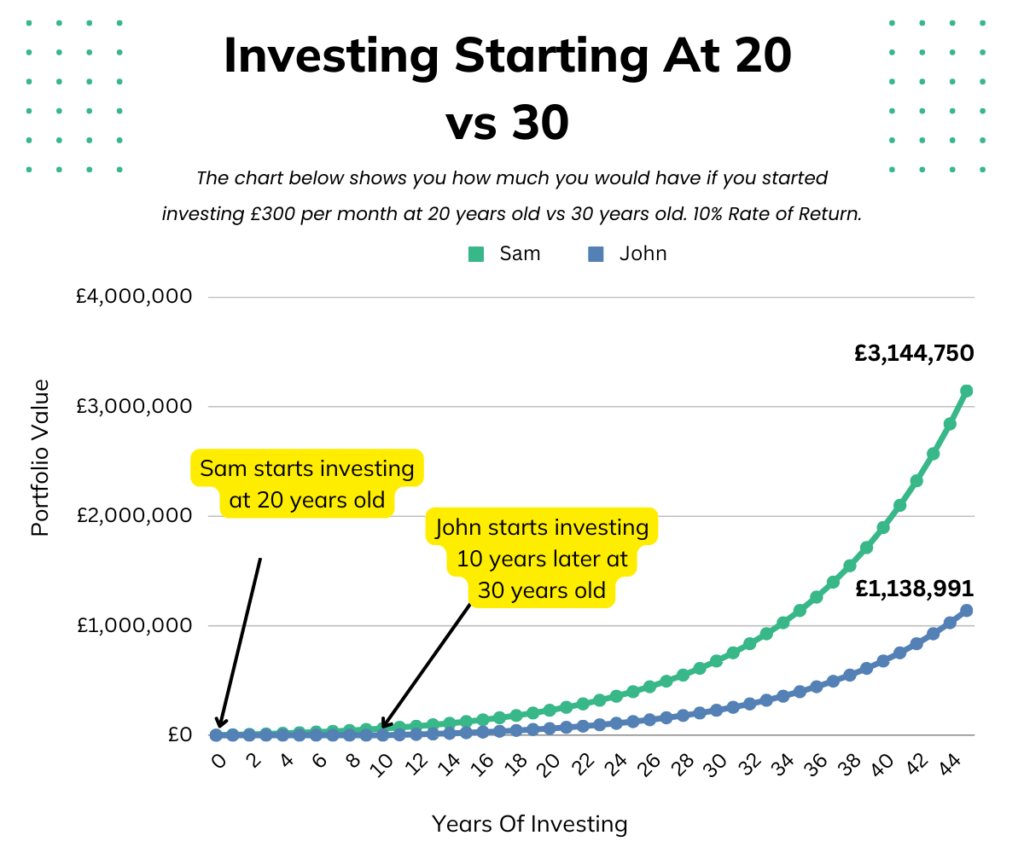

Now we know how important it is to invest early in life, let’s take a look at an example. We have two people Sam and John. Both of them are going to invest £300 per month but Sam starts and 20 and John starts at 30. For this example, we will give them both the same 10% rate of return for illustration purposes.

By the retirement age of 65, both Sam and John have a solid retirement pot but Sam’s is significantly larger. By starting investing 10 years earlier he ends up with over £2 Million more. The craziest part is, he only deposited £36,000 more than John. However, those first 10 years allow the power of compound interest to really kick in as you hit your 60s.

It may seem hard to find this money in your 20s to invest, but if you can find it, it will have a dramatic impact on the type of retirement you can live. If you’re in your 30s or 40s and still haven’t started, it’s time to get a move on. I would recommend checking out our guide for beginner investors to get started.

The best time to start investing was 30 years ago, the second best time is today

How To Reach Coast FIRE Investing Early In Life

For many the thought of investing your whole life is daunting and maybe something that you don’t want to do. However, if you want to have a successful retirement, it’s a wise idea.

One way to avoid having to invest for your whole life is to start investing early and reach “Coast FIRE”. This is a variation of Financial Independence Retire Early. Coast FIRE means growing your portfolio to a size where you no longer have to contribute to it for it to reach your retirement goal.

For example, if you invest £100,000 by age 30 and never contribute any of your own money to the portfolio again, it would reach £1.6 Million by the time you retire at 65, based on an average return of 8%.

While this may take a lot of sacrifice early on, it gives you much more freedom with your money in your 30s and 40s as you know your retirement is already secured.

You can learn more about building a Coast FIRE strategy in our full guide.

Ready To Start Investing?

If you’re ready to start investing we would recommend checking out our beginners guide to investing and taking a look at our top recommended investment platforms.

|

Best Zero Commission Platform

|

Best Managed Platform

|

Most Trustworthy Platform

|

Cheapest Provider For ETF Investing

|

Best For Trading

|

|

Type:

Self Managed

|

Type:

Managed

|

Type:

Self Managed

|

Type:

Self Managed/Managed

|

Type:

Self Managed

|

|

4.8

|

4.0

|

4.5

|

5.0

|

3.5

|

|

Minimum Deposit:

£1

|

Minimum Deposit:

£500

|

Minimum Deposit:

£1

|

Minimum Deposit:

£100

|

Minimum Deposit:

$10

|

Final Thoughts

Hopefully, these charts blew your mind as much as they did mine. It certainly lit a fire under me to invest more money right now in my 20’s vs spending on luxuries. Following these principles, I have been able to reach over £100k in my investment portfolio by 26 years old.

In fact, I could actually stop investing right now and still have over £1 Million in retirement by following a Coast FIRE strategy. That’s the beauty of building a small pot in your 20s. You can invest early and let compound interest do the hard work for the next 35 years.

Read More From Money Sprout: