In this review, we are going to take an honest look at Freetrade, one of the most popular commission-free brokers on the market. We’re going to take a look at fees, investment options and customer reviews for the platform.

Freetrade was a pioneer in the early days of low-fee trading but since they launched, a lot of viable competitors have arrived on the market. Let’s see if they’re still a good place to manage your investments in 2023.

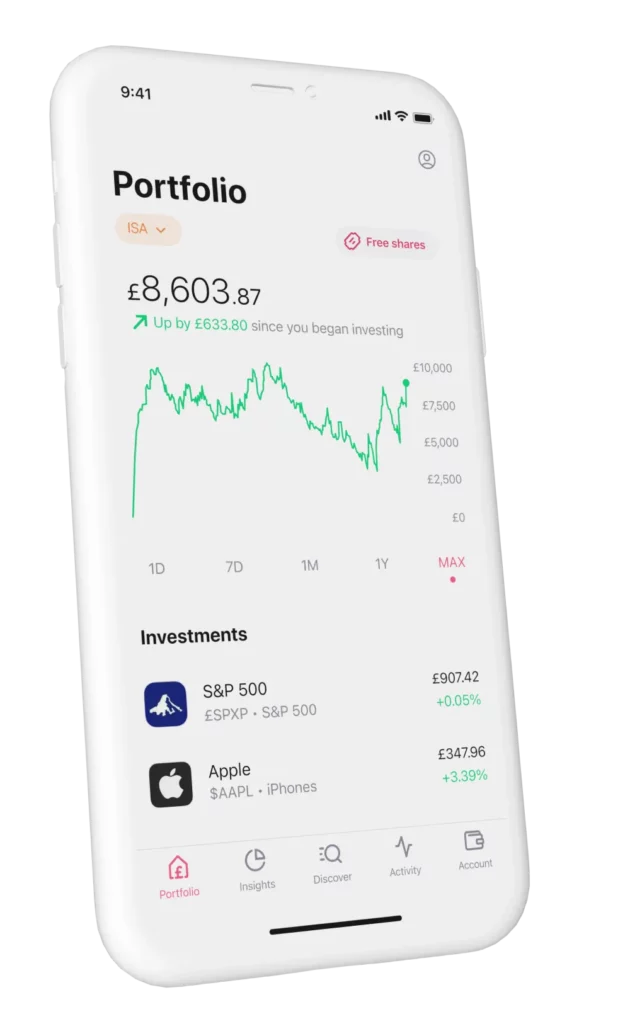

Freetrade is a pioneer of zero-commission trading platforms. They offer ISAs, General Investment Accounts, and Pensions. With over 6,000 stocks to invest in and an easy-to-use app, Freetrade is a great platform for beginner investors.

- Zero Commission on trades

- Easy to use platform

- Low minimum deposit and fractional shares making it great for beginners

- Monthly subscription fees to access more stocks and ISA/Pension accounts

- High FX Fees

- No phone support

Who Are Freetrade?

Freetrade is a pioneering UK-based stockbroker, offering a modern and intuitive platform for commission-free investing. Catering to the needs of the contemporary investor, Freetrade provides access to a vast range of stocks and shares, enabling users to create diverse portfolios without the burden of traditional fees.

Founded in 2016 by Adam Dodds and Davide Fioranelli in London, Freetrade’s inception came at a time when the demand for simplified and accessible investing was on the rise. From its humble beginnings as a startup, it has swiftly become a prominent player in the UK’s investing landscape, setting itself apart with a focus on simplicity and affordability.

Here’s what makes Freetrade a reliable choice for investors:

- Innovation and Fresh Perspective: Unlike many older firms, Freetrade’s relatively recent entry into the market ensures they harness the latest technologies and user-centric design principles, making investing more approachable for the masses.

- Regulation: Operating in the UK, Freetrade is regulated by the Financial Conduct Authority (FCA), ensuring rigorous standards and protection for its user base.

- Growing User Base: In a short span of time, Freetrade has amassed a significant number of users, a testament to its value proposition and user trust.

- Transparency: Freetrade prides itself on a transparent approach, with clear fee structures (or lack thereof, given its commission-free stance) and an emphasis on user education and empowerment.

In essence, Freetrade represents a new wave of investing, breaking down traditional barriers and offering a fresh, user-friendly approach to stock trading and portfolio building.

Is Freetrade Good For Beginners?

Freetrade is a reasonably good place for beginners to start their investing journey however there are some things that let the app down.

Free Trades – As it says in the name, Freetrade offers commission-free trading. This means when you are buying and selling shares, you don’t have to pay any broker fees on the transaction. This allows investors with small portfolios to invest without fees eating massively into their portfolios.

Fractional Shares – Many platforms require users to purchase a full share of a company. For many popular companies, a share can cost hundreds of dollars. For new investors, this makes it almost impossible to invest. Freetrade offers fractional shares allowing you to purchase a portion of a share for as little as £2.

Easy To Use – Freetrade has a modern easy-to-use app. Signing up and purchasing your first shares is a simple process.

Room For Investors To Grow – Unlike digital wealth advisor platforms, Freetrade is a fully-fledged brokerage. While they don’t offer managed portfolios they do offer over 400 ETFs allowing you create easy to create easy-to-manage diversified portfolios. If you do want to start trading individual stocks, Freetrade has over 6,000 stocks to choose from.

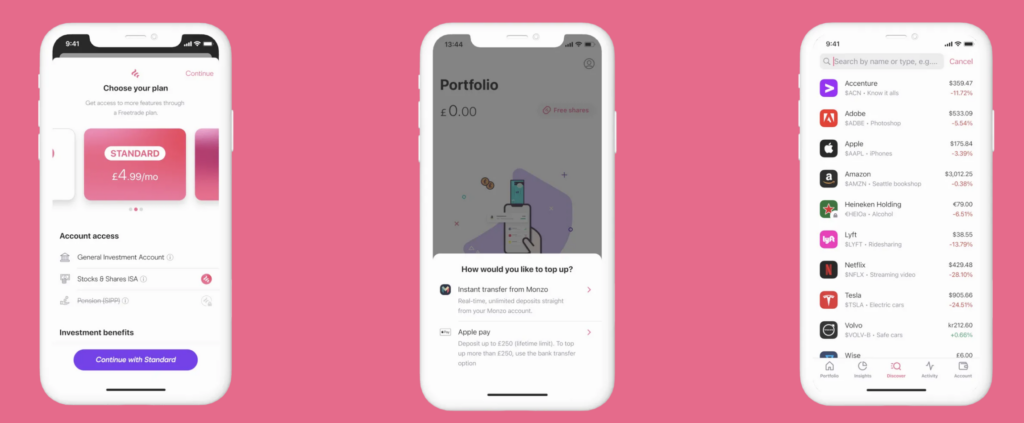

Monthly Subscription Fee – This is one part of Freetrade I’m not a fan of. To access ISAs, pensions and the full range of stocks you will have to pay a monthly subscription fee.

What Products Does Freetrade Offer?

Freetrade offers three different accounts you can invest through. This includes a General Investment Account, Stocks and Shares ISA and a Self Invested Personal Pension (SIPP).

General Investment Account

This is a general investment account with no tax benefits. If you have gains of more than your capital gains allowance for the year, you will have to pay tax on your profits.

On the free plan, this account allows you to trade over 1,500 stocks and ETFs commission-free. If you’re on one of the paid plans you will get access to over 6,000 stocks on this account.

Stocks & Shares ISA

This account allows you to invest up to £20,000 per year without paying any tax on your profits, even when you withdraw. You pay no tax on capital gains, income, or dividends. Remember you can only have £20,000 spread across multiple ISAs in a single year.

To access a Stocks & Shares ISA on Freetrade you will need to be on either their standard plan or their Plus plan. These plans cost £5.99/month and £11.99/month respectively.

Pensions

You can manage your personal pension within Freetrade through a SIPP (Self Invested Personal Pension). Any money added to your pension will get a 25% bonus from the government, potentially more if you’re a higher-rate taxpayer. You can then manage your own pension investments.

To access a pension on Freetrade, you will need to be on the Plus plan which costs £11.99/month.

What Investments Does Freetrade Offer?

Freetrade offers a comprehensive range of investments on its platform. This includes access to over 6,000 US, UK and European shares as well as over 400 ETFs to invest in.

Stocks and Shares

Freetrade gives you instant access to over 1,500 Stocks on their free plan via a general investment account. If you join their standard or plus plans you can access over 6,000 stocks.

You can view a full list of stocks available on Freetrade here.

ETFs (Exchange Traded Funds)

Freetrade has over 400 exchange-traded funds (ETFs) to invest in commission-free. ETFs are investment funds that are traded on stock exchanges, similar to individual stocks. They typically track an index, commodity, bonds or a basket of assets and offer a way for investors to diversify their portfolios without buying each individual security.

This is a great way to diversify your portfolio without having to purchase a large amount of individual stocks. Some funds will focus on certain markets, while others will focus on a specific sector or even theme such as AI or Ethical Investing.

Unique Freetrade Features

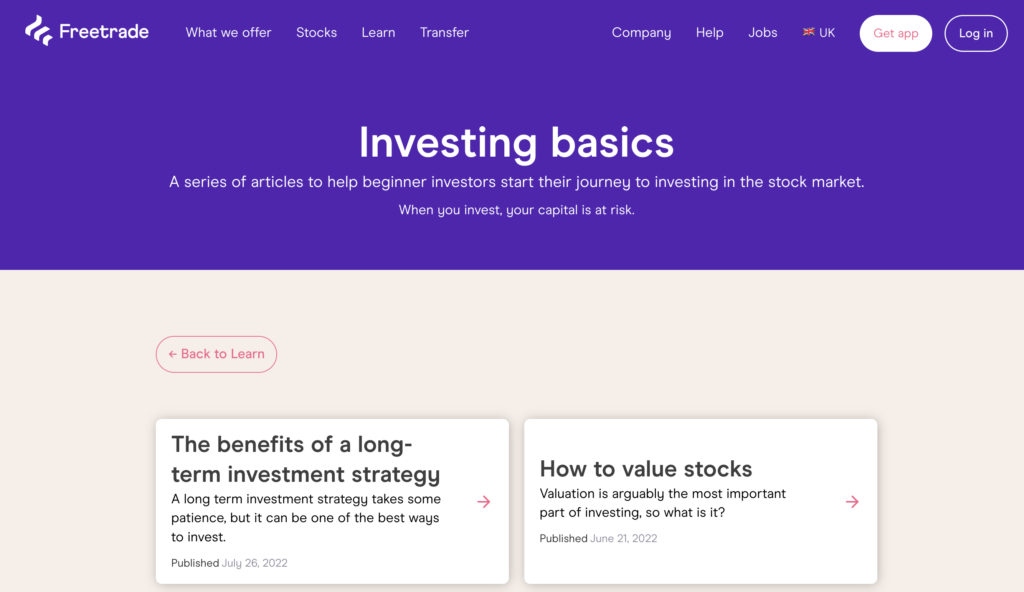

Learn Section

Freetrade has a great learning section on its website. This helps educate new investors on the basic principles of investing. That’s our mission here at Moneysprout so it’s always great to see trading platforms doing their part to educate their users.

Freetrade Fees

Freetrade was one of the first stock brokerages to offer commission-free trading. While they still don’t have commission fees, there are some other fees you should be aware of, if you are using the platform.

Freetrade bases its fees on the 3 Subscription plans it offers. Below you can see what products you have access to on each plan as well as the fees you will pay.

| Plans | Basic | Standard | Plus |

|---|---|---|---|

| Monthly Fee | £0.00/Month | £5.99/Month | £11.99/Month |

| General Investment Account | ✅ | ✅ | ✅ |

| Stocks & Shares ISA | ❌ | ✅ | ✅ |

| Self-Invested personal pension (SIPP) | ❌ | ❌ | ✅ |

| Commission-free trades | ✅ | ✅ | ✅ |

| FX Fees | 0.99% | 0.59% | 0.39% |

Personally, I don’t like that they force you into a subscription if you want to open an ISA or a Pension. There are plenty of other platforms out there that allow you to open these accounts for free. One is Trading 212, where you can trade commission-free and subscription-free on a general investment account or stocks and shares ISA.

If you are making a lot of trades on US stocks on a monthly basis, it could be worth it to get on their Standard or Plus plans, just for the reduced FX fees. On a £1000 trade, you would be paying £9.90 on the basic plan but only £3.90 on the Plus plan. If you are making more than 3 trades per month you’ll save money on the higher subscription plan.

Does Freetrade Pay Interest On Uninvested Cash?

Freetrade pays interest on a small amount of cash on their Standard and Plus plans.

| Plan | Basic | Standard | Plus |

|---|---|---|---|

| 1% Interest On A Maximum £2k uninvested cash | ❌ | ✅ | – |

| 3% Interest On A Maximum £4k uninvested cash | ❌ | – | ✅ |

It’s great that Freetrade offers some interest on un-invested cash however, the limits are fairly small. As your portfolio starts to grow you could have a lot more un-invested cash sitting around than £4k. Most other platforms offer interest on all of your un-invested cash.

Is Freetrade Safe?

Yes, Freetrade is safe. They are authorised by the Financial Conduct Authority (FCA) and are also part of the Financial Services Compensation Scheme (FSCS).

The FCA ensures that Freetrade is following strict financial regulations to keep your money safe.

The FSCS covers you up to £85,000 if Freetrade ever went out of business.

Freetrade Support

If you have problems with Freetrade, you have three ways to contact them. You can talk to them through an in-app chat feature. email and their social channels.

While this is great, they do not have a phone number available for customers to contact them. For me, when people are dealing with my money, I ideally like to be able to get on the phone with them. This is a feature a lot of new modern brokerages have dropped in exchange for live chat.

If you’re like me and want to be able to talk to the people who are managing your money, I would recommend checking out Hargreaves Lansdown.

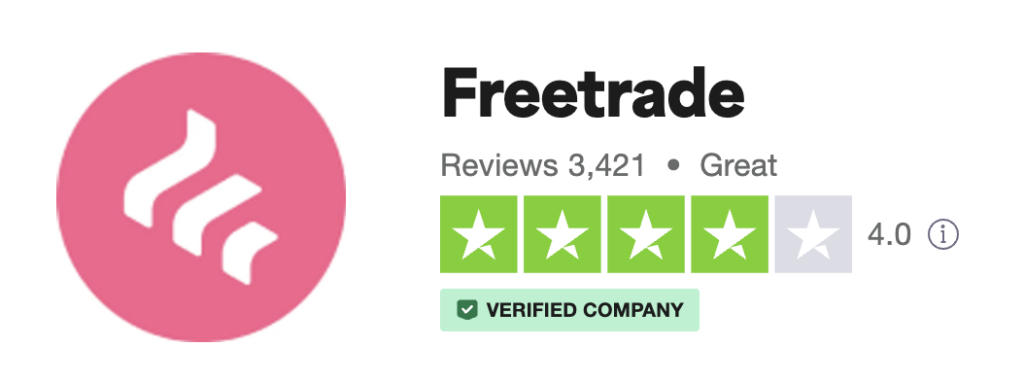

Freetrade Reviews

Freetrade has a solid rating on Trustpilot with a score of 4 Stars from over 3,000 reviews. A rating of 4 or above is a great score for any financial app.

67% of the review are 5-star with 15% of them having a 1-star review. The majority of positive reviews talk about how easy the platform is to use and the transparency around fees.

The main negative reviews come from people complaining about the subscription fees as well as quite a few comments on having a poor customer support experience.

Does Freetrade Offer Options Trading?

On Freetrade, you can only trade stocks and ETFs. Unfortunately, they do not offer any options trading right now. Alternative brokers such as Plus500 and Degiro offer options.

Who Should Use Freetrade?

Freetrade is a great brokerage for a wide range of users. They have an easy-to-use app and a large offering of stocks and shares. Beginner investors can get started with fractional shares allowing them to build a portfolio without having large amounts of money.

However, while I have nothing overly negative to say about Freetrade, I do think that Trading 212 is a better option unless you require a pension account. It offers many of the same features and more while charging lower fees. For that reason only, I would recommend it over Freetrade.

Freetrade Alternatives

If you’re looking for a commission-free platform that is great for beginners, Trading 212 would be my pick as an alternative to Freetrade. Let’s take a look at them side by side and see how they stack up against each other.

| Platform | Freetrade | Trading 212 |

|---|---|---|

| Commission | Zero | Zero |

| Products | – Stocks and Shares ISA – General Investment Account – Pension | – Stocks & Shares ISA – General Investment Account – CFD Trading Account |

| Minimum Deposit | £1 | £1 |

| Subscription Fees | Free/£5.99/11.99 | Zero |

| FX Fees | 0.99%/0.59%/0.39% | 0.15% |

| Stocks Available | Over 6,000 | Over 12,000 |

| Interest On Cash | 1% on Standard Plan (Up to £2k) 3% on Plus Plan (Up to £4k) | USD – 2.25% GBP – 2% EUR – 1.5% These rates apply to all uninvested money in your portfolio |

| Trust Pilot Rating | 4.0 Stars | 4.6 Stars |

As you can see Trading 212 comes out on top in terms of fees and even interest on un-invested cash. The only real reason to use Freetrade over Trading 212 is if you’re looking to set up a pension.

I want to make it clear that there is nothing terribly wrong with Freetrade, just that Trading 212 is a better option and is the market leader for a reason.

When it comes to comparing Freetrade to legacy brokers such as Hargreaves Lansdown and AJ Bell, it definitely beats them in terms of fees.

Final Thoughts

I think that Freetrade ultimately is a great platform that’s easy to use and offers a lot of features for investors. However, with that said it would not be my personal first pick for a brokerage.

If you are looking for zero-fee trading I would personally go with Trading 212 which offers zero-commission trading, no platform fees and 0.15% FX fees on their app. It’s also a modern app taking on the zero commission market and in my opinion, doing a better job of it.

Trading212 is a zero-commission trading platform offering general investment accounts, ISAs and CFD accounts. They are a trusted broker who has been around for almost 2 decades now. They have a range of features such as pies and multi-currency accounts which aren't offered by other brokerages.

Read More From Money Sprout: