If you’re struggling to get your first £100k saved and invested, you’re not alone. This is likely the hardest £100k you will ever have to save. After the first £100k, things start to get easier.

I just crossed the £100k mark for the first time between my investments and emergency fund and trust me it was tough. In this article, we’ll take a look at why that first £100k is so hard and why every £100k after that gets easier and easier.

You have probably heard the quote “The first £100k is a b**tch but you have to do it.” The quote originates from Charlie Munger’s answer to a question at the 1990 Berkshire Hathaway shareholder meeting. During the meeting a young man stood up and complained he was having trouble getting started investing. His Net Worth wasn’t increasing as fast as he would like. That’s when Charlie replied with his famous quote.

The first £100k is a b*tch but you have to do it. I don’t care what you have to do – if that means walking everywhere and not eating anything that wasn’t purchased with a coupon, find a way to get your hands on £100,000. After that, you can ease of the gas a little bit.

Charlie Munger

Let’s take a look at how long it takes to reach that first £100k invested. If you prefer to watch, I’ve also made a video on the topic.

How Long Does It Take To Reach £100,000 Invested

How long it takes you to get to your first £100k will depend on a number of factors. One is how much you are contributing to your portfolio each year. The second is the rate of return you get.

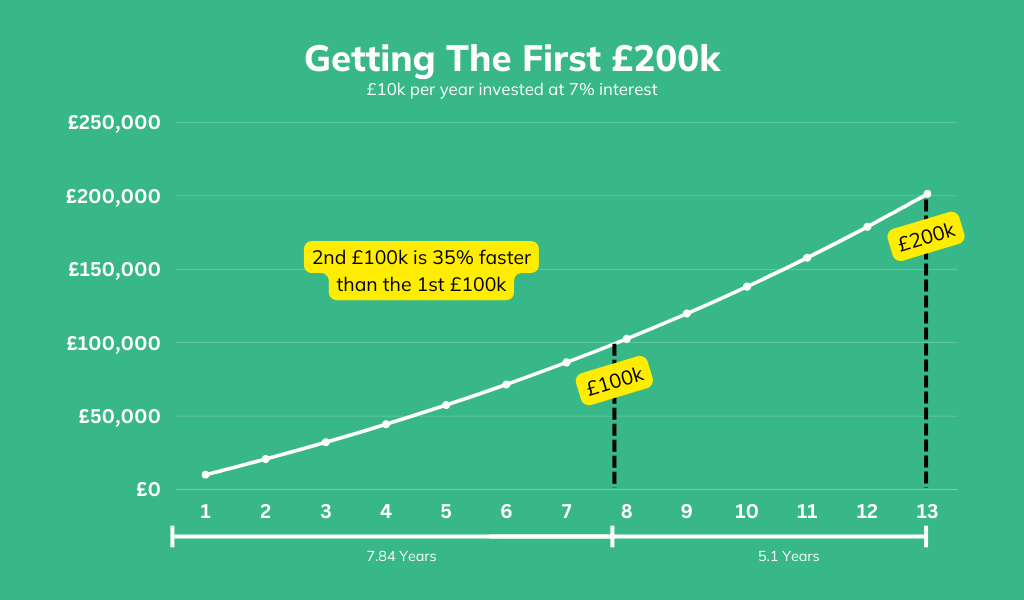

In the example below, we are investing £10k per year at a 7% interest rate.

As you can see it would take you 7.84 years to reach your first £100k.

In your first £100k most of the money comes from your own contributions. Compound interest hasn’t really had a chance to kick in yet. In the grand scheme of things, 7-8 years is a short period of time. When looking at average interest rates you may not even get a 7% return throughout this period.

If you do get a 7% return, approximately £76,000 would come from your contributions and £24,000 from your gains. If you got a 4% return approximately £84,000 would come from your contributions and £16,000 from interest.

Before you reach £100k, your rate of return doesn’t matter a huge amount. You just don’t have enough money for it to make much of a difference. The table below shows you how long it will take to reach £100k at different interest rates.

| Interest Rate | Time To £100k (£10k/Year Contributions) |

|---|---|

| 3% | 8.88 |

| 4% | 8.58 |

| 5% | 8.31 |

| 6% | 8.07 |

| 7% | 7.84 |

| 8% | 7.64 |

| 9% | 7.45 |

While the difference between a 3% and 9% rate of return is astronomical over your investing life, it doesn’t make much difference in the early years. Even if you got a 3% rate of return, it would only take you a year longer than a 7% return. Before £100k, the amount of money you contribute is much more important.

In my early years, I wouldn’t spend much time focusing on trying to “beat the market” or picking individual stocks. Personally, I think this is a waste of time at this stage in your investing journey. Your time is much better spent leveling up your skills and focusing on earning as much money as possible, so you can contribute more. In my opinion, Index funds are the perfect option at this stage of your investing journey.

Now we know why it’s so hard to reach the first £100k, let’s look at the math behind why every £100k after it gets so much easier.

Why Every £100k After The First Comes Much Quicker

If it takes 7.84 years to reach your first £100k, you might think that it would take you 78 years to reach £1 Million. However, that’s not the case. As your money compounds over time, you will get there much faster.

While the first £100k took 7.84 years to reach, the second will only take you 5.1 years even though you are still only contributing £10k per year. This is because your money really starts to work for you. The compounding interest makes up a much larger portion of your account.

Your second £100k will come 2.74 years faster than the first which is 35% faster. This is because you are getting returns on your initial £100k which are now significant (£7,000+ per year) as well as your continued contributions.

As your portfolio grows, each £100k comes faster and faster. The chart below shows you how long it takes to go from £0 to £500k. The bigger your portfolio gets, the faster it grows.

One of the most shocking aspects of this is the fact that it takes less time to go from £600k to £1 Million, than it did to get your first £100k.

It takes 7.84 years to reach your first £100k but only 6.37 years to go from £600k to £1 Million invested. If you invested £10k per year and were able to get a 7% average return, you would reach millionaire status in 31 years. That right there is the power of compound interest.

Want to start tracking your Net Worth every month? Check out our google sheet template which makes tracking easy.

Easily track your net worth in google sheets with these easy to use template. Add all of your banks accounts, stock accounts, properties and liabilities. Track how your net worth trends month over month so you can keep on top of your finances.

How Contributions Effect Time To £100k

The chart below shows you how long it will take you to get to each £100k depending on the amount you contribute each year. Obviously, the more you contribute every year, the faster you will reach £100k.

If you can max out your Stocks and Shares ISA each year, you could get there in approximately 4.44 years.

| Amount Contributed Per Year | Years To £100k (7% Avg. Interest) |

|---|---|

| £2,500 | 19.16 |

| £5,000 | 12.6 |

| £10,000 | 7.84 |

| £15,000 | 5.66 |

| £20,000 | 4.44 |

| £25,000 | 3.65 |

How To Reach £100k As Quick As Possible

Getting to £100k is no easy task but if you take the right steps, you can get there quicker than you think. If you are starting young, you have a lot of things you can take advantage of. Especially, if you are in your 20s.

Be Frugal

Being frugal is the starting point for saving and investing towards your first £100k. While most people turn their nose up at skipping the £5 Starbucks every day, it does in fact save you a lot of money. When you are young, I would recommend living fairly minimalist. You don’t need to impress anyone, drive fancy cars or take on debt for expensive clothes (looking at you Klarna users).

While I’m not someone who advocates living a miserable life just so you can scrimp and save, I do think you should be intentional about where you spend your money. Does the thing you are buying really bring you a lot of value.

For example, so many people are driving cars with £300/month payments instead of buying a £3000 2010 Honda. That’s £3600 a year right there you can invest. Your life won’t be any different with a nicer car. It’s nice for a while to get a new car but ultimately it drives you from A to B. Invest that money in your 20s. Every £1 you invest at £20, is worth £88 at retirement. Those £300/month payments cost you a lot more than £300.

For me, experiences are the best place to spend your money in your 20s. Have fun and set aside a reasonable portion of your income toward savings.

Live At Home If You Can

While I understand this isn’t available to everyone, it is available to a lot of people. If you plan to get a job fairly close to your family home, I would highly recommend staying in it until your mid to late 20s. You are going to be able to save so much money by not having any bills for a 5-7 year period. You can quite literally have your cake and eat it too.

Even on a £25,000 per year salary you can save £1,000 per month and have £700 left over to spend on whatever you want.

One of my biggest regrets was not taking advantage of living at home for longer. I probably could have put an extra £10k down on my deposit if stayed at home for an extra year and had not rented.

Have A Budget

Make sure you know where your money is going each month. If you are not conscious about your spending, you’ll be sure to spend every penny you make. You can grab a free copy of my budgeting sheet for google sheets. It will help you track all of your income and outgoings and make sure you are saving and investing enough money each month.

Why You Can “Let Of The Gas” At £100k

The main reason you can let off the gas after £100k is because you have a large enough portfolio to make reasonable yearly gains without contributing more. This will depend on your age but if you can reach £100k by the time you are 30 years old, you could hit £1.6 Million at retirement if you had an 8% average return without investing another penny.

Once you reach that £100k mark the “Snowball” effect really starts to take place. If you know that retirement is set without investing any more money, it gives you a lot of freedom to pursue a job you potentially like or maybe even start a business.

While I still think you should be investing consistently after you hit £100k even if you are under 30. it gives you a really nice financial cushion to fall back on.

Ready To Start Your Road To Your First £100k?

If you’re ready to start investing your way to £100k, you may want to open an investment account. One of my favorites is Trading212 and you can get up to £100 in free shares when you sign up. Capital is at risk.

Trading212 is a zero-commission trading platform offering general investment accounts, ISAs and CFD accounts. They are a trusted broker who has been around for almost 2 decades now. They have a range of features such as pies and multi-currency accounts which aren't offered by other brokerages.

- Commission Free Trading

- Access to over 12,000 Stocks and Funds

- Impressive features such as Pies and Multi-currency

- No phone support

Final Thoughts

Now you know why it’s so hard to get your first £100k but much easier to get every £100k after that. Hopefully, if you had been discouraged about how long it was taking to get to £100k, this article has helped you to understand that the grind is worth it. Once you reach that first £100k, things will move a lot quicker. Good luck!

Read More From Money Sprout: