It’s no secret that London is the most expensive city in the UK. Housing is much more expensive than the rest of the UK as well as the general cost of living. A pound simply won’t stretch as far in London as it would elsewhere in the UK. With that said, London is the financial hub of the UK and also offers opportunities with higher salaries that aren’t available in other locations.

In this article, we are going to take a look at salaries and the cost of living in the city to determine what a good salary in London actually is. Let’s jump in.

Quick Overview

A good salary in London that allows you to live a comfortable lifestyle is approximately £50,000 per year. This will allow you to rent an apartment and afford some luxuries such as eating out and holidaying once per year. If you have a partner who also earns money, it will allow you to split the cost and live a much better lifestyle.

What Is The Average & Median Salary In London

According to the latest ONS Data published in October 2022, the median salary in London is £36,749 and the average salary is £49,539. These figures include part-time and full-time workers.

The UK median salary is £27,756 per year which is almost £9,000 less than the median in London. When looking at the mean average the UK is £33,402 per year whereas London is £49,539 per year, approximately £13,000 more.

The mean is calculated by adding all of the salaries together and dividing by the number of people earning a salary. The median is the midpoint of everyone’s salary in London. The median generally gives a better idea of what most people earn. The mean is usually inflated by extreme outliers who pull the average up.

| Salaries | Median | Average |

|---|---|---|

| London | £36,749 | £49,539 |

| United Kingdom | £27,756 | £33,402 |

Average Salary By Job In London

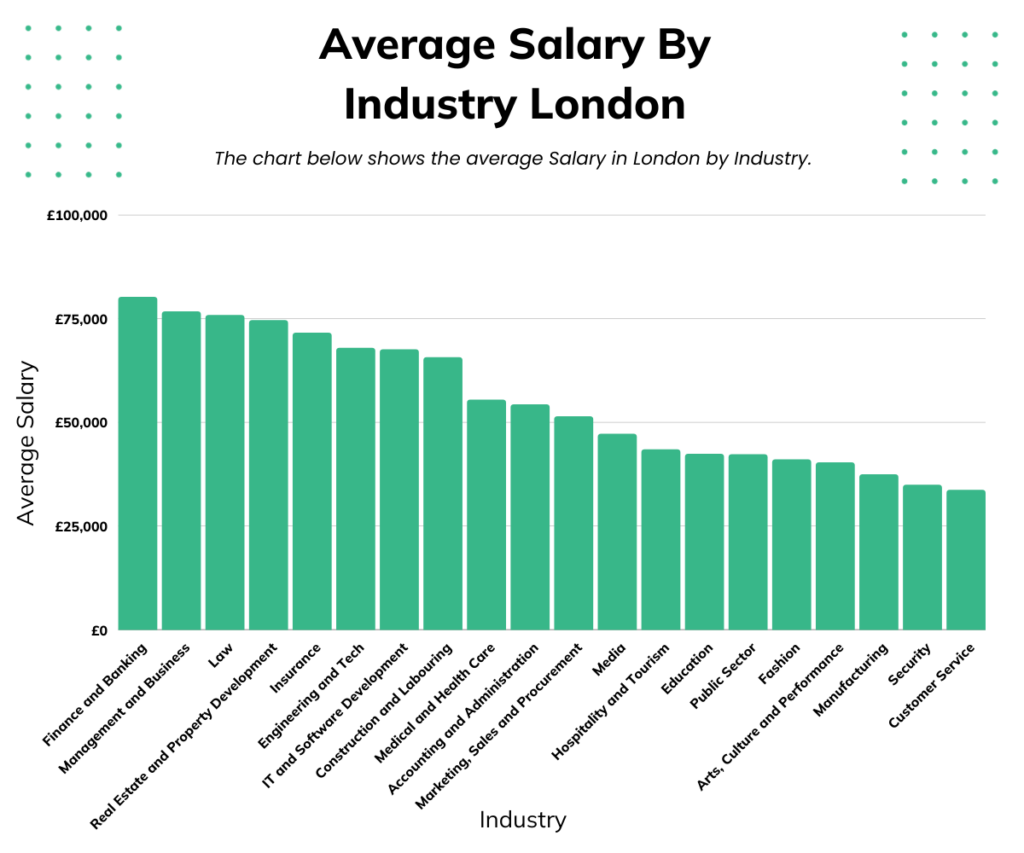

Average salaries vary wildly in London by job. For example, if you work in finance or tech you can earn a lot more than someone who works in hospitality or retail. Let’s take a look at the average and median salaries for different sectors in London.

| Ranking | Industry | Median Yearly Salary |

|---|---|---|

| 1 | Finance and Banking | £80,202 |

| 2 | Management and Business | £76,687 |

| 3 | Law | £75,826 |

| 4 | Real Estate and Property Development | £74,607 |

| 5 | Insurance | £71,594 |

| 6 | Engineering and Tech | £67,935 |

| 7 | IT and Software Development | £67,576 |

| 8 | Construction and Labouring | £65,639 |

| 9 | Medical and Health Care | £55,452 |

| 10 | Accounting and Administration | £54,305 |

| 11 | Marketing, Sales and Procurement | £51,435 |

| 12 | Media | £47,202 |

| 13 | Hospitality and Tourism | £43,472 |

| 14 | Education | £42,396 |

| 15 | Public Sector | £42,252 |

| 16 | Fashion | £41,033 |

| 17 | Arts, Culture and Performance | £40,316 |

| 18 | Manufacturing | £37,446 |

| 19 | Security | £34,935 |

| 20 | Customer Service | £33,716 |

The career path you choose in London will massively impact the amount of money you can earn in your career. As you can see from the table above, the highest-paying industries are Finance, Management & Business and Law.

Making a move to London to pursue one of these high-paying careers is likely worthwhile. There is more opportunity to significantly increase your salary in London than there is in other cities.

However, if you moved to London to take on a customer service role you’re probably not making enough to make it worthwhile. You might make more gross but the cost of living is so much higher it’s not worthwhile.

Median Annual Earnings For Full-Time London Employees

| Salaries | Median | Mean |

|---|---|---|

| London | £41,866 | £57,362 |

| United Kingdom | £33,000 | £39,666 |

For Full-time employees, the median average salary in London is £41,866. This is significantly more than when we look at the data with part-time employees included.

The mean average is £57,362 annually. This is approximately £17,000 more than the mean average in the whole of the UK. The higher earning opportunities in London pull this number up considerably.

What Is A Good Salary In London

To live a comfortable life in London you will need a salary of around £50,000 per year which would pay you £3,100 per month after tax. This should allow you to get an apartment in the city with a roommate/partner who is also contributing to the bills. If you are sensible with your money, you should also be able to save a portion of your income as well as treat yourself to some dinners out and other entertainment. If you manage to land a job in the £60k range you should really start to have some more freedom with your money.

Obviously, the median income is much lower than this, so it is possible to live in London on a lower salary. However, we wouldn’t consider the median income to be “good” as you will likely be living paycheck to paycheck.

Even though people in London have the highest average salaries, they also have the lowest average disposable income according to ONS & Numbeo Data. People in London have the lowest disposable income in the UK at £2,016. The area with the highest disposable income is Derby with a disposable income of £14,520 per year.

Many people get attracted to London with the high salaries but don’t realise they will actually have less money to spend on themselves due to the extreme cost of living.

Cost Of Living In London

Now we know the average salaries in London, let’s take a look at the average cost of living in the city. We can look at average housing costs as well as the general cost of living.

Housing Prices In London

According to home let, the average rent price in London is £2,179 per month as of September 2023. This is 12% higher than it was a year ago. Even someone who is earning £50,000 per year would struggle to pay this rent and other expenses alone.

However, this data is also taking into account very expensive properties in the city. If you are looking for a studio or 1-bed apartment, the average rent will be lower. You can also move further outside the city and travel in for work to get cheaper rates.

To live in the city center, you really need to be a two-income household or be splitting rent with other roommates.

The heatmap below shows you the average rents for a 2-bed apartment depending on the area you want to live. Further outside the city, you can find some places for under £1,200.

These heat maps are provided on the government website and can provide you with a rough idea of how much your rent will be depending on the type of property you may want to rent.

For most people in London, housing takes up around 50% of their post-tax income.

General Cost Of Living

It’s not only house prices that are higher in London. Your general daily expenses are going to add up much quicker as well. A quick bite to eat at lunch is likely to cost you more than other regions outside of the city. Want to go out for dinner? That’s more expensive.

After work pints? Those are significantly higher than the UK average as well. According to Finder the average pint in the UK is £4.21 whereas the average pint in London is £5.90.

All of these little things that seem small individually add up over time. You need to account for a rise in prices when budgeting to live in the city.

How To Budget For Living In London

If you are planning to move to London and know how much you are going to earn, I would highly recommend making a budget. This will help you see how much money you need to spend to live each month and how much you have left over to save and invest.

We have a monthly budget for Google Sheets that allows you to track all of your income and expenses to ensure you stay on track with your budget. You can use this to figure out if you will be able to sustain yourself in London.

- Monthly Budget Overview

- Custom Categories

- Transaction Log

- View Daily Spending Overview

- Track Needs, Wants, Savings/Investments & Debts

How To Save Money When Living In London

If you’re new to London, you may be wondering about some ways you can save money while living in the city. Here are some things you can do to help lower your expenses while living in the city.

1. Oyster Card and Contactless Payments

An Oyster card is a smart card that can be loaded with credit to pay for journeys on public transport in London. It’s cheaper than buying a paper ticket. Alternatively, using contactless payment methods like debit or credit cards can also offer similar fare rates.

2. Markets Over Supermarkets

While supermarkets are convenient, London boasts a range of local markets like Borough Market, Camden Market, and Brick Lane Market where you can find fresh produce, unique items, and street food often at a more affordable price.

3. Free Museums and Attractions

London is home to many world-class museums and attractions that are free to enter, such as the British Museum, National Gallery, and Tate Modern. Opting to visit these can save significant amounts, especially for families.

4. Cycle Instead of the Tube

Consider renting a Santander Cycle (often referred to as “Boris Bikes”) for short distances. Not only is it a healthy alternative, but it can also be cheaper than other modes of transport for short distances.

5. Off-Peak Travel

Traveling during off-peak hours can significantly reduce the cost of train and tube fares. If possible, plan your journeys during these times to save money.

6. Explore Local Pubs

Instead of going to the more touristy and pricier bars and restaurants, explore local pubs. They often have deals and offer a more authentic experience.

7. Student and Senior Discounts

If you’re a student or senior, always ask about discounts. Many places, including theaters, attractions, and even some restaurants, offer reduced rates.

How To Make More Money Living In London

Living in London can be tough if you have a lower income. If you have extra time on your hands at night or on weekends, starting a side hustle could be a great way to supplement your income.

There are lots of offline and online jobs you can do depending on your preference. I have created a full list of side hustles (many of which I have personally made money with) that you can check out here.

London Compared To Other Parts Of The UK

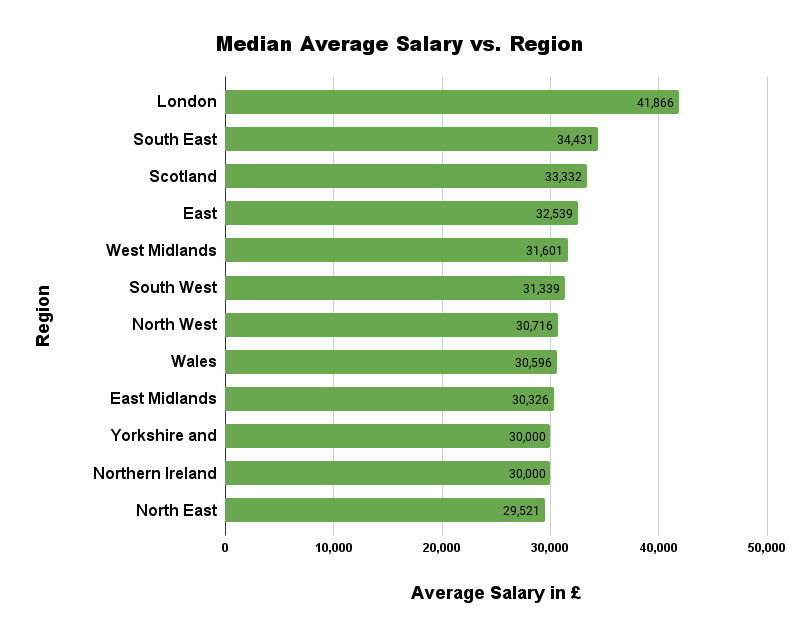

London is the most expensive city in the UK but just how much more expensive is it than other regions in the UK. The chart below shows the regions with the highest and lowest average salaries.

London has the highest average median salary at £41,866 while the North East has the lowest average salary coming in at £29,521.

Frequently Asked Questions

Is £30k A Good Salary In London

A £30k salary in London will be tough to live on. Covering rent and living costs will eat away at most of your budget. This won’t leave you very much money left over for entertainment and saving/investing.

You will also likely be living in a worse house or apartment than you would if you were living in a cheaper cost-of-living location across the UK. You will most certainly have roommates or at a minimum be living with a partner contributing to living expenses as well.

Unless you have a great job opportunity that will see you getting paid a much higher salary in the near future, you will likely be able to live a much more stress-free, financially secure life elsewhere in the country.

Is £50k A Good Salary In London

Yes, you can live in London on a £50k per year salary. This is £8,134 more than the average salary for Londoners. While this is great a significant proportion of your income is still going to go towards rent.

Average wages are approximately 30% more than in areas such as the North East however average rent prices are 300% more in London. This leaves Londoners with very little disposable income after everything is said and done.

While £50k should make for comfortable living in London, it won’t go as far as you might think. Living with a partner or roommate is a great way to massively cut down your living costs.

Is £75k A Good Salary In London

With an annual income of £80k, you can comfortably afford to live in London. This amount surpasses the average Londoner’s earnings by £38,134. It enables you to secure a nice flat, and indulge in occasional dining out and entertainment, all while responsibly setting aside 20% for retirement savings.

Average wages in London are about 30% higher than in the North East. However, London’s rent prices are roughly 300% higher. This drastically cuts the disposable income of many Londoners, compared to those living in other UK regions.

You should be comfortable on £80,000 per year in London and potentially be able to save more than the recommended 20% of your income if you get aggressive with your savings. We recommend living with a roommate to try and cut down on living costs.

What Is The Lowest Salary You Can Live With In London

If you rent a room or split the rent with someone else you could possibly get by in London with around £30k. However, it will definitely be tight and you are unlikely to be able to save anything meaningful towards your retirement.

If you want to live alone you will likely need at least £45k per year to get yourself a decent studio or one-bed apartment. This will allow you to live a comfortable enough lifestyle but again, savings will be limited.

Final Thoughts

Now you know roughly how much you need to live a comfortable life in London. It definitely takes more money to live the same lifestyle in London as it would elsewhere in the UK but there is also much more opportunity to increase your salary.

If you are living with roommates or a partner it will make your lifestyle much more comfortable as your expenses will be more manageable.

Read More From Money Sprout: