Your fixed rate mortgage is about to end and you are not sure what happens next. Should you stay with your current lender or shop around for a new deal? You will want to consider the advantages and disadvantages of a fixed or variable mortgage, as well as where you can find the best deal in the current market.

What happens when my fixed rate mortgage ends is a question we get regularly. In this article we’ll break down exactly what happens.

Quick Overview

When your current mortgage deal ends you will automatically go onto a variable mortgage with your lender. You should shop around for a new mortgage deal rather than just staying on this one as it’s likely not the best deal available to you. It’s a good idea to speak to your current lender, or maybe contact a mortgage broker to help you with this. It may be best to fix your mortgage rate in the current market or stick with a variable rate until interest rates decrease.

What Happens After My Fixed Rate Deal Ends?

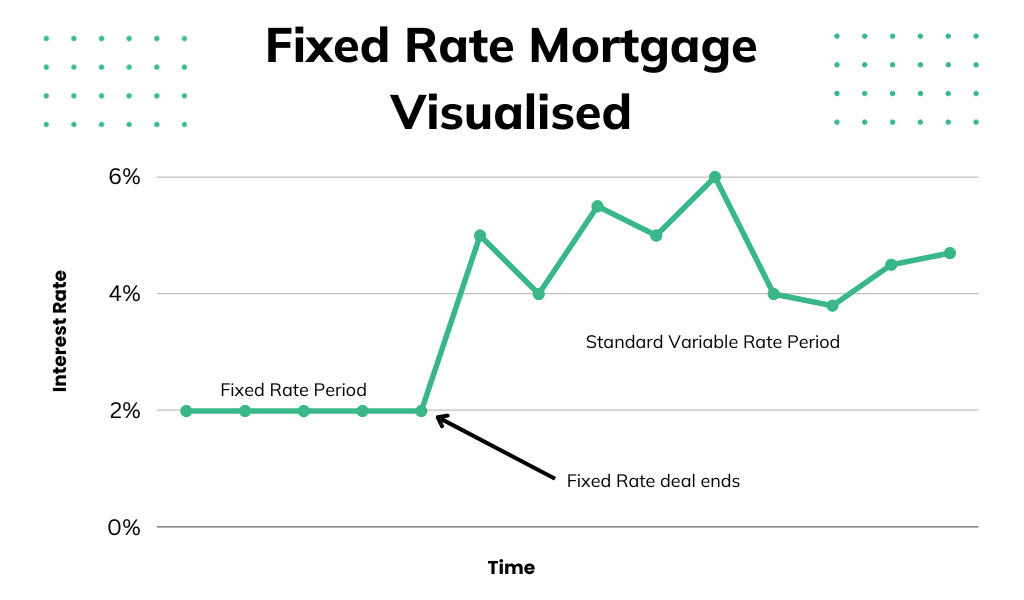

Your fixed rate deal is about to end, but what happens next? If you don’t another deal to switch to, you will be automatically transferred to your current mortgage provider’s standard variable rate (SVR) mortgage. The interest rates for this type of mortgage vary depending on the Bank of England’s base rate. This means that they will fluctuate during your mortgage term, whereas a fixed rate mortgage is fixed until the end of the term.

There are four steps that you should complete in order to secure yourself the best mortgage deal that you are eligible for in the current market.

Find Out When Your Current Deal Ends

Your current deal is ending soon, but it is important to know exactly when this is. You don’t want to be taken by surprise and get moved over to your lender’s standard variable rate without realising.

The end of your fixed deal should be on the paperwork you received when you took the mortgage out. If you can’t find this, ask your lender when the term ends – they will be able to tell you.

Once you have this information, you know when to start looking for a new deal. It is generally a good idea to begin shopping around 6 months before your current deal ends. Don’t worry if your deal ends sooner, just start looking now to give yourself the best range of options.

It is also a good idea to be aware of how much you pay each month on your current mortgage deal. This will give you an idea of how much you can afford and if you need to budget more for a new deal, if the rates have gone up.

Speak to Your Current Mortgage Provider

You should first speak to your mortgage provider about finding a new deal with them. As a current customer, they may be able to offer you a better rate. It is likely that they have a mortgage advisor you can speak to. This is somebody who should be able to give you advice on which rates you can access with them, as well as what the variable rate will be once your current deal ends.

You can also speak to your lender if you are worried about struggling with your repayment plan once you go onto a variable rate. If interest rates are high when your current deal ends, you could end up paying a lot more per month than you were previously. Instead of not being able to meet these new repayments, it is best to have an open and honest conversation with your lender. Tell them you are struggling and ask them what they can do to help.

A new mortgage charter was introduced in June 2023 to ensure that mortgage lenders provide their customers with support during times when their monthly payments increase significantly. For instance, you may be able to switch to an interest-only mortgage for up to six months. This will allow you to reduce your payments and budget for when they go back to normal. It also doesn’t have an adverse effect on your credit score as long as you adhere to the terms and conditions.

Contact a Mortgage Broker

Mortgage brokers can sometimes give you lower-than-market rates because they have long standing clients who are willing to do exclusive deals with them. It is possible that a mortgage broker can provide you with a better deal than you can access yourself. However, since they are a business, they also have to make money through commissions, fees and price hikes, as well as being competitive. For this reason, it is better to not rely completely on a mortgage broker.

We recommend checking out Habito who can find you a great deal in the mortgage market for free as they get paid by the mortgage providers rather than their clients.

Buying a home and arranging a mortgage is a complicated process. Habito is a free service that makes buying a home easy. They have access to over 20,000 mortgages from 90 lenders allowing you to get the best deal on a mortgage.

Best of all, the service is free as Habito gets paid by the lenders.

- Free mortgage comparison service

- Provides a complete home buying service

- 4.8 Stars on Trustpilot (8,374 Reviews)

- 20,000 Mortgages and 90 Lenders available

Shop Around for a Deal

You should also shop around for a new mortgage deal by looking at reputable comparison websites. Doing all these steps may be time-consuming, but it is worth it if you are planning to fix your mortgage rate for another year or two. The last thing you want is to fix yourself at a bad rate. Once you have a few quotes, consider your options carefully.

Which is Better, a Fixed Rate or Variable Mortgage?

While you are looking for another mortgage deal you will want to consider whether a fixed rate or variable mortgage is better for you. Fixed mortgage interest rates are generally cheaper, so it may sound like a no brainer to go with one. But interest rates fluctuate, so you may end up fixing yourself to a bad deal and paying a lot more. Make sure you consider the advantages and disadvantages of both types of mortgage.

Advantages of a Fixed Rate Mortgage

- Stability: You know exactly how much you are going to pay each month for the term of your fixed mortgage, so you can budget accordingly.

- Low rates: Fixed rate mortgages typically have lower interest rates than variable mortgages. This is because the lender is sure of your business for a specific period of time, making it easier for them to offer a lower rate.

- Protection: You are protected from interest rate rises. Should they suddenly increase very steeply, you might find yourself paying a lot more in interest.

Disadvantages of a Fixed Rate Mortgage

- Locked in: If you get locked in to a fixed rate mortgage during a period when interest rates are very high, you could end up paying the same high rates when interest has decreased elsewhere.

- Early repayment charges: You may face steep charges if you want to exit your fixed rate mortgage early, or overpay on it. It is worth considering hidden costs like these before committing to a fixed rate mortgage.

- Fees: Mortgage providers typically charge higher fees for you to fix your mortgage than if you take out a variable rate. If you find yourself fixing every year or two, these fees can add up.

Advantages of a Variable Mortgage

- Flexibility: You can leave a variable mortgage at any time. This gives you an advantage if interest rates suddenly fall because you can take advantage of the market without having to wait for your fixed term to end.

- Introductory offers: Variable mortgages can be offered with an introductory low rate. If you don’t want to fix straight away, it might be an idea to take advantage of an introductory offer and switch later on.

- You might be selling: If you are thinking of selling your house soon you can switch to a variable mortgage to avoid paying an early termination fee if you sell your house sooner than your fixed rate term ends.

Disadvantages of a Variable Mortgage

- High rates: Interest rates are almost always higher with variable mortgages than with fixed term ones. This is why a lot of people choose to fix.

- Less stability: A variable rate changes not only alongside the Bank of England’s base rate, but also at your lender’s discretion. They can increase it at any time.

- Budgeting challenges: Due to the fact that the interest rate on your mortgage fluctuates, your monthly repayments can change without warning. You may find it difficult to budget for a sudden extra cost.

Final Thoughts

It is best to start planning for what happens when your fixed rate mortgage ends about 6 months before it happens. This will give you time to speak to your lender, shop around for a new deal and decide whether you want to go onto a new fixed or variable mortgage rate. The last thing you want is for your repayments to increase dramatically, without warning because your lender has moved you on to their standard variable rate mortgage.

Read More From Money Sprout: