The average mortgage application process is around 6 months. However, with many pitfalls and delays, it can take much longer for first-time buyers. It’s important that you know exactly what steps are involved when getting a mortgage and roughly how long they can take.

This will give you reasonable expectations heading into the home-buying process and will make the process as stress-free as possible.

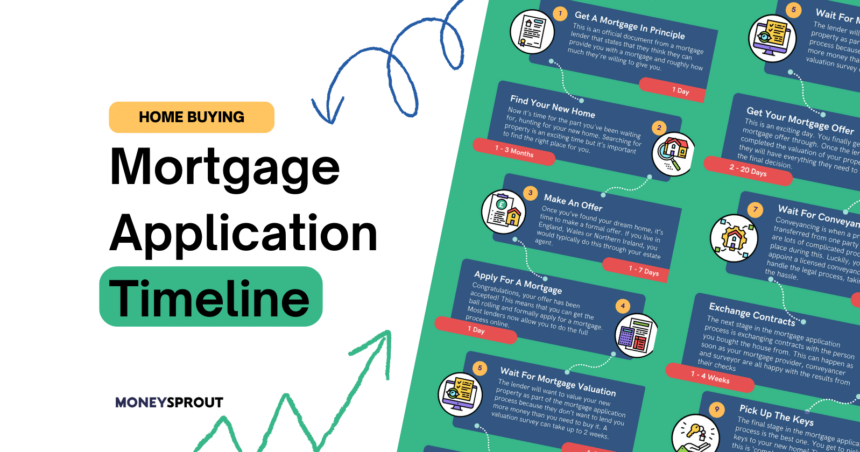

Quick Overview

There are 9 separate steps to the mortgage application process, from applying for a mortgage in principle to actually picking up the keys to your dream home. We’ll go into detail about each step in this article, but here’s a helpful overview of the timeline:

- Apply for a mortgage in principle: 1 day

- Find your new home: 1-3 months

- Make an offer: 1-7 days

- Apply for a mortgage: 1 day

- Receive your mortgage valuation: 1-2 weeks

- Get Your Mortgage Offer: 2-20 days

- Wait for conveyancing: 6-12 weeks

- Exchange contracts: 1-4 weeks

- Pick up the keys: 1 day

Step 1 – Apply for a Mortgage in Principle

Before you even start looking for your new home you should apply for a mortgage in principle. This is an official document from a mortgage lender that states that they think they can provide you with a mortgage and roughly how much they’re willing to give you.

Typically they offer you 4-5 times your annual salary. But this can vary, depending on factors like your credit rating, job security and whether you’re applying for a mortgage with somebody else. Most applications are filled out online, so you can get a quote within 24 hours.

It’s crucial that you apply for a mortgage in principle before house hunting to get an idea of how much you can borrow. This enables you to work out exactly what your budget is for your house.

Since the lender is only giving you an estimate based on the information you provide them, it’s important that you’re completely truthful when filling in your application. Otherwise, you may find that you go to apply for a mortgage later on and either get offered less than you need to buy your house or don’t get offered one at all.

Tip: A mortgage in principle is also known as a decision in principle, so don’t get confused if you see this wording – they are the same thing.

Step 2 – Find Your New Home

Now it’s time for the part you’ve been waiting for, hunting for your new home. Searching for property is an exciting time, but can also feel overwhelming because there are so many factors to consider.

Where you buy is as important as what you buy. We recommend checking out the area you’re interested in before even viewing properties there. You can visit for the day to see what it’s like. Research transport links and local schools if you need to commute for work or are planning a family.

To narrow down your search, first think about whether you want a flat or a house. Is having lots of garden space important to you? Or, do you want something with minimal maintenance? It’s likely that you’ll view multiple properties in the area before finally deciding on the right one for you.

Tip: Most mortgage in principle only last 60-90 days. If it takes you longer than 3 months to find a property you like, you may have to re-apply.

Step 3 – Make an Offer

Once you’ve found your dream home, it’s time to make a formal offer. If you live in England, Wales or Northern Ireland, you would typically do this through your estate agent. Tell them how much you’re willing to bid and they will pass this on to the property owner. The process is slightly different in Scotland because you need to engage a solicitor to make your offer for you.

How you approach offering is up to you. Some people underbid to try and get a better deal. Others overbid because they are anxious about losing out. Just be aware that other people may be offering as well, so the property owner may take some time to think over their options. It isn’t unusual for them to come back with a counteroffer that encourages you to negotiate. For these reasons, the offer process typically takes up to a week.

Tip: Consider your offer carefully before making it. You can become legally committed to buying the property once it has been accepted and you don’t want to have any regrets.

Step 4 – Apply for a Mortgage

Congratulations, your offer has been accepted! This means that you can get the ball rolling and formally apply for a mortgage. Most lenders now allow you to do the full process online, but you may want the help of a mortgage advisor or mortgage broker if you are a first-time buyer.

Completing your formal mortgage application can take a full day, even if you do it online. To make the process go as smoothly as possible you should have all these important documents to hand:

Proof of identity

The mortgage lender will want to know that you are who you say you are. They’ll need to see proof of your identity, such as a passport or driving licence with an up-to-date address.

Proof of address

Proof of your current address (not the property you’re moving into) can include things like a bank or credit card statement, or a utility or council tax bill.

Proof of employment

The lender will need to know that you’re employed and how much you earn, so they can calculate how much to lend you. They might want to see your most recent P60 and 3 months’ worth of payslips, or tax assessments and proof of earnings if you’re self-employed.

Proof of outgoings

It’s not just about how much you earn – the lender will also want to know how much you spend on a monthly basis. You can usually provide them with bank or credit card statements as proof of your outgoings.

Tip: Applying for a mortgage leaves an imprint on your credit file, so it’s best not to make lots of applications in a short amount of time.

Step 5 – Wait For Your Mortgage Valuation

The lender will want to value your new property as part of the mortgage application process because they don’t want to lend you more money than you need to buy it. A valuation survey can take up to 2 weeks. Most surveys are conducted in person, but nowadays some are done completely remotely, using a computer and data from the property.

If you have offered more on the property than the lender thinks it is worth, unfortunately, they may not be able to lend you the full amount. It’s possible that you can top your deposit up if you have extra cash saved, but you should still consider all factors when making your initial offer.

Tip: You may have to pay a fee for your mortgage valuation, anywhere from £150 – £1,500.

It’s not just the mortgage lender who will want to check out the property. You will also want to get your new home surveyed by a licensed professional in order to flag any problems. After all, it would be a nasty shock if you found out that your home had some serious issues after you moved in.

If problems are found by your surveyor, you can use this information to either negotiate on price or withdraw your bid entirely, depending on how serious they are. Hopefully, no issues will be uncovered, setting your mind at ease so that you can move into your new property without suddenly uncovering a damp spot that you weren’t aware of.

Step 6 – Get Your Mortgage Offer

This is an exciting day. You finally get your mortgage offer through. Everything just became a little more real. Once the lender has completed the valuation of your property, they will have everything they need to make the final decision.

It usually takes around 2-20 days for your offer to come through after the Mortgage Valuation has been completed.

Even though you have the mortgage offer, it still could be revoked if circumstances change. For example, if you change jobs after receiving your mortgage offer, they could pull the offer as your circumstances have changed significantly.

Step 7 – Wait for Conveyancing

Conveyancing is when a property is legally transferred from one party to another. There are lots of complicated processes that take place during this. Luckily, you’re obliged to appoint a licensed conveyancer or solicitor to handle the legal process, taking away most of the hassle.

You will have to pay a legal fee of up to £1,500, or even more if there are complications. But this is well worth the money to ensure that the full rights of the property are transferred over to you. Some mortgage lenders may be able to appoint a conveyancer for you and add the fees onto the amount you borrowed for your mortgage.

If there are no hold-ups or issues uncovered by your legal representative, this process can take anywhere between 6 – 12 weeks. Something that may slow you down is a property chain.

What is a property chain?

A property chain is where somebody’s buying process depends on other people buying property, creating a chain. For example, Sally is buying a house from John and John is buying a house from Rachel. Sally can’t move into John’s house until John can move into Rachel’s house.

Tip: There are different rules for conveyancing in England, Scotland, Wales and Northern Ireland. It’s important that you follow the right processes for where you live.

Step 8 – Exchange Contracts

The next stage in the mortgage application process is exchanging contracts with the person you bought the house from. This can happen as soon as your mortgage provider, conveyancer and surveyor are all happy with the results from their checks. It is basically where the legal rights of the property transfer from the previous owner to you. You’ll have to hand over your house deposit and get building insurance in place.

Exchanging contracts sounds like a 1-day job, but it can actually take 1-4 weeks. This is because if you are in a chain, you have to wait for everybody else to be ready to exchange contracts. If just one person isn’t ready, there may be a delay.

Tip: Get a quote for building insurance early on in the process so you can have it in place when the contracts are exchanged.

Step 9 – Pick Up the Keys

The final stage in the mortgage application process is the best one. You get to pick up the keys to your new home! The proper name for this is ‘completion.’ As part of the exchange process, a completion date will be set. This is the official date that ownership is transferred over to you and you can usually move into your new home any day from completion.

Tip: Plan your move before completion to make sure that everything goes as smoothly as possible. You may need to hire a moving service or take time off work.

Final Thoughts

Hopefully after reading this guide you’re feeling much more prepared for the mortgage application process than before. At first it can seem daunting but with help from a mortgage advisor or online platform the process will hopefully move smoothly for you. Good luck purchasing your next house!

Read More From Money Sprout: