If you’re sitting on £5000 that you want to invest, congratulations. That’s a great position to be in. However, in this environment, if your money isn’t working for you, it’s losing its value to inflation.

That’s probably led you to think about investing your money to make a return. In this article, I’m going to break down some of the ways you can invest £5000. Different types of investments will come with varying degrees of risk. What’s best for you will be based on your own financial situation.

Quick Overview

If you want to invest £5000 for the long term and have diversified investments, my personal choice would be index funds. They give you broad exposure to the stock market without taking on as much risk as investing in individual stocks. They’re also passive and require little time to set up and manage.

Best Ways To Invest £5,000

There are several ways to invest £5,000 depending on your investing goals. The methods below are some of the most popular ways anyone can invest.

Index Funds & ETFs

Index funds & ETFs allow you to invest in a diversified basket of stocks with low fees. These funds simply track pre-determined indexes and do not actively trade. This makes them much cheaper than a mutual fund.

There are hundreds of index funds available that target different markets. Some of the most popular Indexes are the FTSE 100 which consists of the 100 largest companies in the UK and the S&P 500 which has 500 of the largest companies in the US. You can invest in these by buying shares in funds such as VUSA or Vanguard FTSE 100 Index.

By investing in these you are getting exposure to the whole market rather than an individual company which gives you more diversification. You can also invest in Index funds that target specific markets. For example, if you want to invest in AI but don’t want to put all of your money in one or two companies, you could invest in an AI ETF such as the Wisdom Tree Artificial Intelligence UCITS ETF.

I have a large portion of my investment portfolio in a single Index fund called the Fidelity World Index. This fund is made up of approximately 70% US Stocks and 30% International stocks, giving me diversified exposure to the world markets.

This allows me to be passive with my investments and not spend too much time analysing individual stocks.

If you are planning to invest your £5,000 for 5+ years, Index funds could be a good choice. It’s important to note that when you invest, the value of your shares can go down as well as up.

Growth Stocks

Growth stocks are stocks that are expected to grow at a rate significantly above the average growth for the market. They usually do not pay dividends as they are re-investing their cash back into the business to grow at a faster rate.

Investors expect to make their money through capital gains. While these companies come with a chance at greater returns, they also come with more risk. The main risk is that the expected growth doesn’t continue into the future. You’re usually paying a high price-to-earnings ratio for growth stocks as their earnings are expected to grow in the future. If this growth doesn’t materialize, it can cause the share price to fall dramatically.

You can invest in individual growth stocks or invest in an ETF that invests in a range of growth stocks giving you more diversification.

If you are looking for higher future returns growth stocks could be the best choice for your £5000 but they also come with the risk of losing a lot or even all of your money.

Dividend Stocks

If you are looking to generate cash flow from your £5000, dividend stocks can be a great option. When you buy shares in some companies, they will pay a dividend which is a portion of the profits paid to shareholders. These payments are usually paid quarterly.

When you get paid a dividend you can either re-invest that money or take it out as cash. Many dividend investors like to re-invest their dividends which buys them more shares and then pays them a larger dividend on the next dividend date. Others will invest in dividend stocks and live off the cash flow, similar to investing in a rental property that pays rent.

You can either invest in individual dividend stocks or invest in a dividend ETF which tracks a specific basket of dividend stocks. For example, the WisdomTree US Equity Income UCITS ETF is an ETF that invests in US high dividend yield equities.

£5000 isn’t going to provide you with huge dividends every year but it’s a great starting position and seeing those dividends flow in can be really motivating to continue your investing journey.

Savings Account

For the past decade or so we have had little to no interest on our savings, however in the past year we have seen the Bank Of England increase the base rate which has led banks to offer better rates on savings.

Currently, you can get anywhere from 4-6% depending on the type of savings account you open. If you want easy access to your money you can use Chip. They currently offer 4.84% on their easy-access savings account.

Chip is an award-winning savings and investment app. They became popular with their high-interest savings account but also offer investment services and automatic saving.

While technically you are not “investing”, you should at a minimum be getting a reasonable interest rate on any money you have sitting in your bank account.

Property

£5000 isn’t going to be enough to invest in your own property however there is another option called a REIT. This is a Real Estate Investment Trust. You can buy these through your investment app of choice.

These trusts pool the capital of multiple investors and buy up properties allowing individual investors to earn dividends from Real Estate investments without having to buy, manage or finance any properties themselves.

If you want a hands-off approach to investing in property with a small amount of money such as £5000, a REIT is a good option.

Bonds

Bonds are a type of investment that represents a loan made by the investor to a borrower, usually a corporation or government. When you invest in bonds, you are essentially lending money to the issuer in exchange for interest payments over a fixed period of time, followed by the return of the bond’s face value at maturity.

If you are focused on protecting your initial investment (£5000), bonds can be a good choice. High-quality bonds, especially government bonds, are seen as safe investments. They typically pay interest at regular intervals, providing a steady income stream. This can be particularly appealing for investors seeking a predictable return.

Education

This may not be one you expected to see on this list but it could provide you a lot larger return than any investment I have mentioned above.

Sometimes getting a certain certification, learning a new skill or taking on education to gain a promotion can be the best investment you can make. If learning something new costs you £2500 but gets you a pay rise of £5000 per year, that is well worth the investment and will pay you a much larger return over a 5 – 10 year period than most stocks.

For example, right now AI is becoming more and more popular. If you can learn how to use it correctly and provide value to the company you work for, knowing how to use it well, you could get a promotion.

Business

If you’re interested in starting and growing your own business, it could be a great place to invest your money.

For example, I used to have a website in the gaming space. We would write articles on games, creators etc and it would cost me about £15 per article. However, on average that article would generate about £30 over the course of 6 months. That’s a 100% return on my money in 6 months.

For me, investing £5000 into more articles is going to get me a much better return than investing in stocks, savings accounts etc. If you are interested in it, starting your own business is one of the best ways to invest £5000.

How To Invest £5,000 In The Stock Market

For most people, the easiest investment to make for a long period of time is investing in the Stock Market through Index funds. Below I have laid out the exact steps you can take to get started investing in Index Funds today.

Step 1 – Open a Brokerage Account

To invest in the stock market, you will need to open an investment account. There are currently a lot of options on the market. You can read our guide to the best investment platforms for more details but there are a couple of platforms I like.

Trading212 is a great platform for most investors. It has zero commission trading and has access to a very large range of stocks and funds. Hargreaves Lansdown is also a great choice but comes with slightly higher fees however these are a lot less if you are investing in Index Funds rather than individual stocks.

Capital is at risk when investing.

Trading212 is a zero-commission trading platform offering general investment accounts, ISAs and CFD accounts. They are a trusted broker who has been around for almost 2 decades now. They have a range of features such as pies and multi-currency accounts which aren't offered by other brokerages.

Hargreaves Lansdown is one of the most trusted investment platforms in the UK. They offer amazing customer service with access to someone on the phone at any time. However, these come at a high price in terms of fees.

Step 2 – Choose Your Account Type

Now you have created a brokerage account you need to decide the type of account you want to open. This could either be a Stocks and Shares ISA or a General Investment account.

Stocks & Shares ISA

A Stocks and Shares ISA allows you to invest without having to pay tax on dividends or capital gains. You can invest up to £20,000 (At the time of writing according to HMRC) in the account each year.

Not having to pay tax when you sell shares or when you receive a dividend is huge especially when you are compounding your returns over years and decades. You can also withdraw your money at any time without penalties in a stocks and shares ISA.

General Investment Account

This is a general investment account with no tax benefits. You can buy and sell shares as you please but will have to pay capital gains tax on any profit over your yearly allowance of £6,000.

Step 3 – Choose Your Investments

Once your accounts are set up, you can start choosing your investments. In most brokerages, you will be able to invest in many of the investment types we mentioned above. This includes Index Funds, Dividend Stocks, Growth Stocks, Bonds and REITs.

Choose the investment of your choice and start investing. Our guide to investing for beginners is a good place to learn more.

What Are Your Investment Objectives?

When choosing an investment route, you should consider your investment objectives. You should take into consideration:

- Investment Timeframe – If you are investing for retirement and have 30 years to get there, you have more time to allow your investment to recover if it drops in value. If you are saving for a house and want to purchase in the next 3 years, it’s probably not a good idea to invest in volatile assets as the value may drop and not have enough time to recover before you need to use the money.

- Risk Tolerance – Higher-risk investments have the potential to generate higher returns but also have a higher risk of losing money or even going to zero. If you want to take less risk consider investing in diversified index funds, bonds, or even just a savings account if you know you will need the money soon.

- Capital Appreciation or Cash Flow – You will need to decide if you are investing in cash flow or capital appreciation. If you want cash flow investing in a savings account, dividend stocks, bonds or REITs may be the best option. If you want capital appreciation investing in growth stocks and accumulation ETFs may be the best option.

- Liquidity – You may be concerned about how liquid your investments are. This is essentially how easy it is to sell your investment. For example with most blue chip stocks, you can sell them instantly and have your money within days if not hours. However, if you bought a property, selling that is going to be a much longer process, therefore it is described as being illiquid.

It’s important to think about these objectives and any others that you may have before you decide to make any investment decisions.

How To Manage Risk When Investing £5,000

Managing risk when investing £5000 involves several key strategies to ensure that your investment aligns with your financial goals and risk tolerance. Here are three to four important points to consider:

- Diversification: Avoid putting all your money into one type of investment or one single asset. Spread your £5000 across different asset classes (such as stocks, bonds, and real estate) and within those classes (like different sectors, industries, or regions). Diversification can reduce the impact of any one investment’s poor performance on your overall portfolio.

- Understand Your Risk Tolerance: It’s crucial to know how much risk you are comfortable taking. Consider factors like your investment time horizon, financial goals, and emotional capacity to handle market fluctuations. For instance, if you’re investing for a long-term goal and can tolerate some volatility, you might allocate more to stocks. Conversely, if you need the money in the short term or prefer stability, bonds or savings accounts might be more appropriate.

- Research and Due Diligence: Before investing in any asset, conduct thorough research. Understand what you’re investing in, the risks involved, and the historical performance. This applies whether you’re buying stocks, bonds, mutual funds, or any other investment vehicle. If you lack the time or expertise to research, consider low-cost index funds or ETFs, which offer diversification and are managed by professionals.

- Regular Review and Rebalancing: Monitor your investments regularly to ensure they still align with your goals and risk tolerance. Rebalancing your portfolio periodically (e.g., once a year) is important to maintain your desired asset allocation. This might involve selling some investments that have grown and buying more of those that have decreased in value.

Remember, managing risk doesn’t mean eliminating it entirely but rather understanding and mitigating it to an acceptable level. It’s also advisable to consult with a financial advisor, especially if you are new to investing.

Saving Vs Investing £5,000

Saving:

- Purpose: Saving is for short-term goals or emergency funds.

- Safety: Your money is in safe places like savings accounts or certificates of deposit (CDs).

- Risk: Very low risk, meaning your money is not likely to decrease in value.

- Returns: Low interest rates, which might not keep up with inflation.

- Accessibility: Easy to access your money quickly and safely.

Investing:

- Purpose: Investing is for growing your wealth over a long time, like for retirement.

- Options: You can invest in stocks, bonds, mutual funds, or real estate.

- Risk: Higher risk because the value can go up or down based on the market.

- Returns: Potential for higher returns compared to saving.

- Liquidity: Less liquid, meaning it might take time and cost to turn investments into cash.

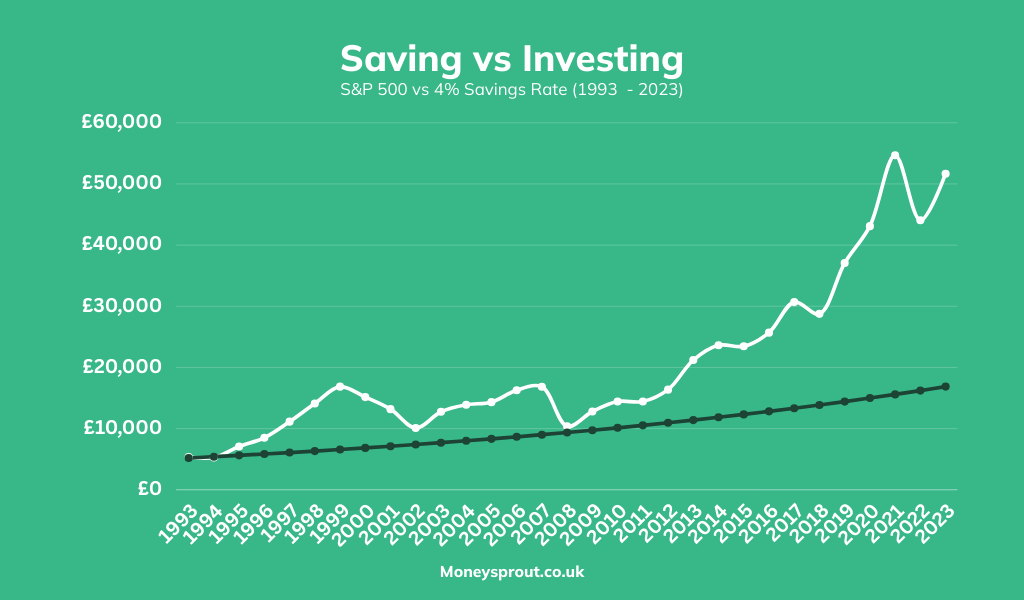

In the past, investing in a broad market index fund has massively outpaced savings over longer time periods. I have put together the chart below which shows you how much a £5,000 investment would have returned in the S&P 500 from 1993 to 2023 vs a savings account that got a consistent 4% return over the same time period.

As you can see investing in the S&P 500 significantly outperformed the returns a hypothetical 4% savings account would have returned. Of course, when you invest, there are a lot more ups and downs but over a long enough time horizon, investing in the broad market has historically out performed savings.

The option you choose will be based on your financial goals, how much risk you can handle, and when you need the money.

Final Thoughts

Hopefully, this article has given you a better idea of the options available to you when investing your £5,000. Remember when you invest there is always a risk that your investment drops as well as goes up. If you’re investing you should be invested for the long term.

Read More From Money Sprout: