Have you ever wondered just how much money you need to earn to be in the top 2% of earners in the UK? They have incomes higher than 98% of the population. That’s impressive but just how much do you need to be in that Top 2% bracket.

In this article, we will look at how much you need to make each year to reach the “Top 2%” as well as the best careers to get there.

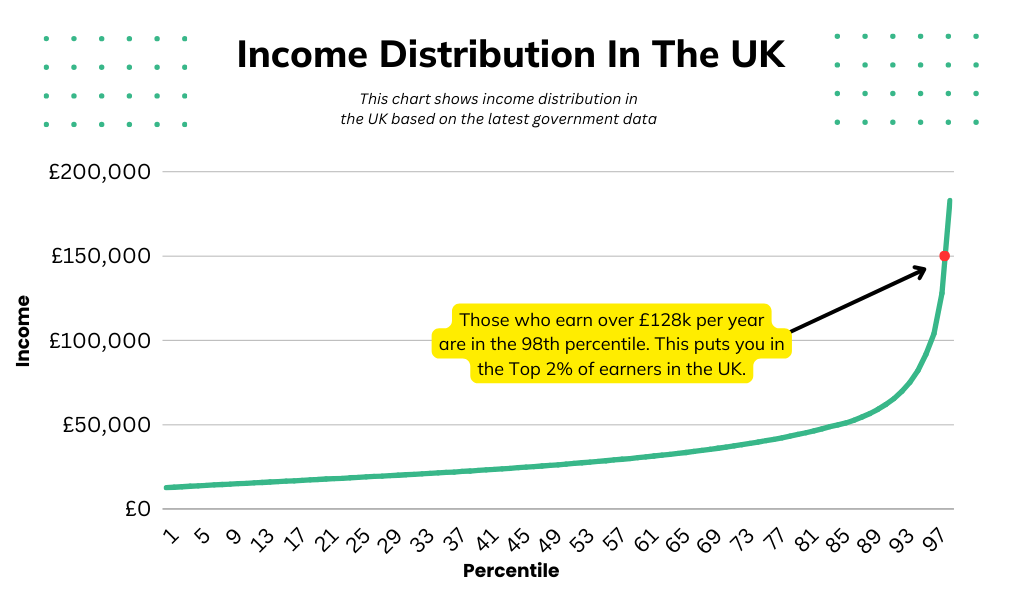

How Much Do Top 2% Earners Make In The UK?

According to the latest government data, the top 2% of earners make an annual income of £128,000 annually in the UK before tax. This is significantly more than the median average UK income of £33,280 in the UK.

This is pre-tax income which is made up of multiple income sources such as salary, dividends, interest and more. As we all know, we don’t get to keep everything we make. The tax man has to take his cut.

What Is £128k After Tax In The UK

On a £128k income, you will be paying in the additional rate tax band and you will lose a portion of your tax-free allowance as you are making over £125,140 per year. You will pay a total of £43,660 in income tax yearly.

You will also have to pay National Insurance. Here’s how it all breaks down.

On a £128k salary, you will pay £43,660 in Income Tax and £7,878 in National Insurance leaving you with a take-home pay of £76,462 per year. That’s a large chunk of your income going towards taxes.

This is based on the full income being a salary. Many high earners will earn some of their money as dividends or even interest which they would pay less tax on.

Therefore, if you want to be in the Top 2% of post-tax earners, you will have to bring home more than the £76,462 you would be bringing home on a salary of £128,000.

How Much Do You Have To Make After Tax To Be In The Top 2%

Being in the Top 2% pre-tax does not automatically put you in the Top 2% of post-tax earners. This is because the Top 2% of earners usually have multiple sources of income such as a salary and dividends. Dividends are taxed at a lower rate than standard income, so those who earn £128,000 pre-tax with a chunk of it in dividends, will pay less tax than someone earning their whole £128,000 as a salary.

If you want to be in the Top 2% of post-tax earners, you will have to earn more than £88,900 after tax.

The £76,462 you would bring home on a £128,000 salary would put you in the Top 4% of post-tax earners in the UK or 96th percentile.

What Is A Top 2% Net Worth In The UK

Just because you are earning a Top 2% income, doesn’t mean you are in the Top 2% of wealthiest people in the UK. To become wealthy, you have to save, invest and make your money work for you. You can earn as much as you like, but if you don’t follow the number one rule of personal finance, spend less than you make, you will never get wealthy.

According to the latest data from the Office For National Statistics, households need to be worth at least £2,9 Million to be in the Top 2%.

Reaching a net worth of £2.8M is possible without ever being a Top 2% earner. For example, if you invest £50,000 per year at 8% per year, you would have a Net Worth of over £3.8M in just 25 years. While this requires a high income, it can be done if you are consistent with your investments over long periods of time.

You can use our compound interest calculator to see how long it would take to reach a Net Worth of £2.8M.

How To Become A Top 2% Earner In The UK

If you want to become a Top 2% earner in the UK, you will need to work in a specialised field that has salaries that reach this level or alternatively, start your own business that can pay you a salary or dividends of over £183,000 per year.

Here are some fields that have the potential to reach this high level of income:

- Medicine: Especially specialists such as surgeons, anaesthetists, and radiologists.

- Financial Management: Financial managers oversee financial activities in organizations, such as planning, directing, and coordinating accounting, investment, and risk management strategies.

- Information Technology (IT) Leadership: IT directors or Chief Information Officers (CIOs) are responsible for managing an organization’s technology infrastructure, ensuring its smooth operation, and implementing strategic IT initiatives.

- Legal Professionals: Lawyers, especially those working in corporate law, can earn substantial incomes, as can senior partners at law firms.

- Engineering Management: Engineering managers lead engineering teams, coordinate projects, and oversee the development and execution of engineering plans.

- Investment Banking: Investment bankers facilitate financial transactions, mergers, and acquisitions, earning substantial bonuses and commissions.

- Pharmacy: Pharmacists dispense medications and provide expertise on their proper use, often earning high salaries in the healthcare sector.

- Data Science: Data scientists analyze and interpret complex data to inform business decisions, and they are in high demand in various industries.

- Actuarial Science: Actuaries use mathematical and statistical techniques to assess financial risks for insurance companies, pensions, and other financial institutions.

- Dentistry: Dentists diagnose and treat dental issues, offering a range of services from routine check-ups to complex dental procedures.

- Aviation: Airline pilots and flight engineers operate aircraft, ensuring passenger safety and on-time arrivals.

- Marketing Management: Marketing directors are responsible for creating and implementing marketing strategies to promote products and services.

- Oil and Gas Extraction Management: These managers oversee the extraction and production of oil and gas resources, which can be a high-paying field.

- Management Consulting: Management consultants provide expertise to organizations seeking to improve their performance, strategy, and operations.

- Software Development Management: Software development managers lead teams of developers in creating software applications and systems.

Final Thoughts

If you are trying to reach the Top 2% of earners in the United Kingdom you’re going to need to make £128k or more pre-tax and if you want to join the club as a post-tax earner you will need to be making £88,900 or more after tax.

Read More From Money Sprout: