Have you just landed or are considering taking a new job with a £45k salary? You may be wondering whether or not this is a good salary. With inflation rising and wages staying stagnant it’s hard to know how much you need to live, save and have fun.

Let’s take a look at how much you will actually get from the £45k salary, whether it’s good for your age, and how it stacks up against other people who live in your region.

Quick Overview

A £45k salary is significantly above the Median average salary of £33,280 in the UK. If you live outside of London this is considered a good salary. £45,000 is more than enough to provide for you and your family. If you live in London this salary is slightly above the average salary for London which is £41,866.

How Does £45k Compare To The Median UK Salary?

£45,000 per year is a lot more than the £33,280 Median average salary in the UK. You’re making almost £12k more per year than the average person. That’s good.

However, it’s not that simple. If you live in London you are much closer to the average salary of £41,866. Your money also won’t go as far in the capital as there is a much higher cost of living.

Ultimately, if you live outside of London £45k is a very good salary. It is more than enough for you and your family to live. Especially if you have another full-time earner in the house. You should be able to comfortably cover your bills and have money left over for entertainment and saving/investing.

What Is £45k After Tax In The UK?

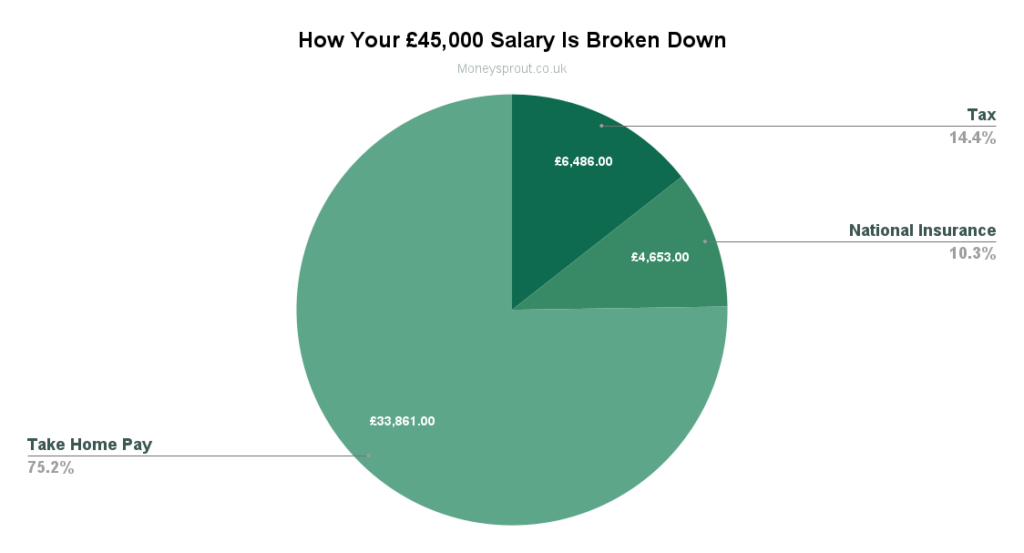

You have done the hard work of landing a £45k job but you won’t be bringing all of that home. You will have to pay Tax and National Insurance before you get your cut.

On a £45k salary, you will be in the 20% Tax bracket. However, everyone gets a free untaxed allowance of £12,570. This means you will only be taxed on the remaining £32,430.

You will pay £6,486 in Income Tax and £4,653 in National Insurance.

This leaves you with a Net take-home pay of £33,861 per year or £2,822 per month.

If you have student loan payments, they will also get taken out before your pay hits your account.

Is £45k A Good Salary For Your Age?

When looking at the median average salary broken down per age group, we can see that £45k is considerably more than the average in all age groups.

| Age | Median Average Yearly |

|---|---|

| 18-21 | £20,888 |

| 22-29 | £28,413 |

| 30-39 | £35,526 |

| 40-49 | £37,825 |

| 50-59 | £35,402 |

| 60+ | £31,340 |

Only a small amount of graduates in their 20s will land a £40k+ job right out of University. These will likely be investment banking or Law positions. They’re also likely to be based in London.

If you are in your 30s and are earning £45k, this is a good salary for someone with 4-5 years of on-the-job experience and has now picked up a middle management role. You may find there is more opportunity to climb the ladder in your current company or potentially make a switch to a more lucrative job in the same field.

No matter your age, if you are earning £45k outside of London, you’re on a pretty good salary. If you’re in your peak earning years and are struggling to increase your salary, you may have to consider starting your own business if you want to make significantly more in the same field.

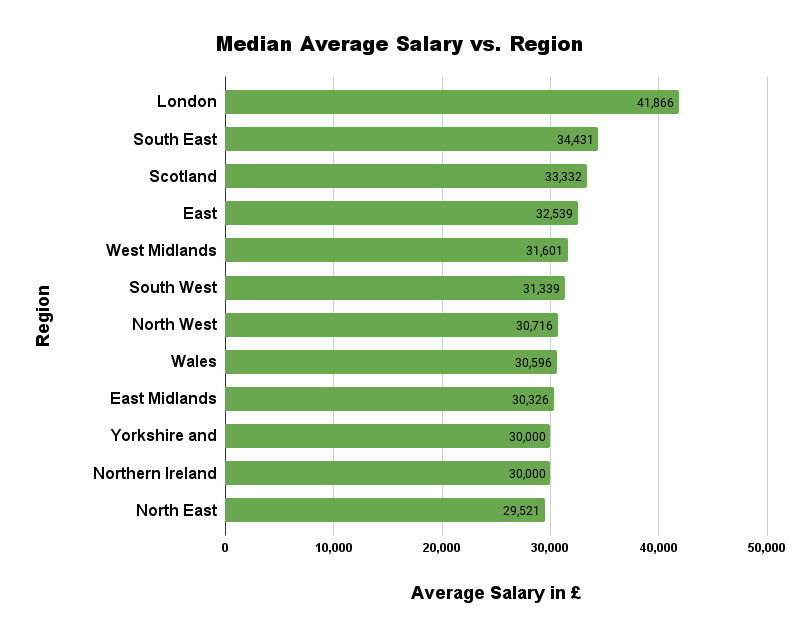

Is £45k A Good Salary Where You Live?

Where you live will have a significant impact on how far your £45k salary will go. For example, the average salary in the North East is £29,521 whereas the average salary in London is £41,866.

Therefore if you are earning £45k in a lower average salary region in the UK, your £45k is great by comparison. The lower-earning regions usually also have a lower cost of living.

Someone earning £45k in the North East is likely going to be able to save and invest much more of their pay each month as their household expenses should be much lower.

If you are earning £45k anywhere in the UK outside of the capital you are doing well and should be able to live comfortably.

Can You Live In London With £45k Per Year?

Yes, you can live in London on a £45k salary per year. This is £3,134 more than the average salary for Londoners. Even though £45k is above average in London the cost of living is extremely high.

Average wages are approximately 30% more than regions such as Northern Ireland however the average rent prices are 300% more in London. This leaves Londoners with much less disposable income than other UK cities.

While £45k is a good salary it is still going to be tight living in London on £45k per year. If you can find a housemate or live with a partner, this will significantly increase your living standards.

Budget Template For £45k Salary

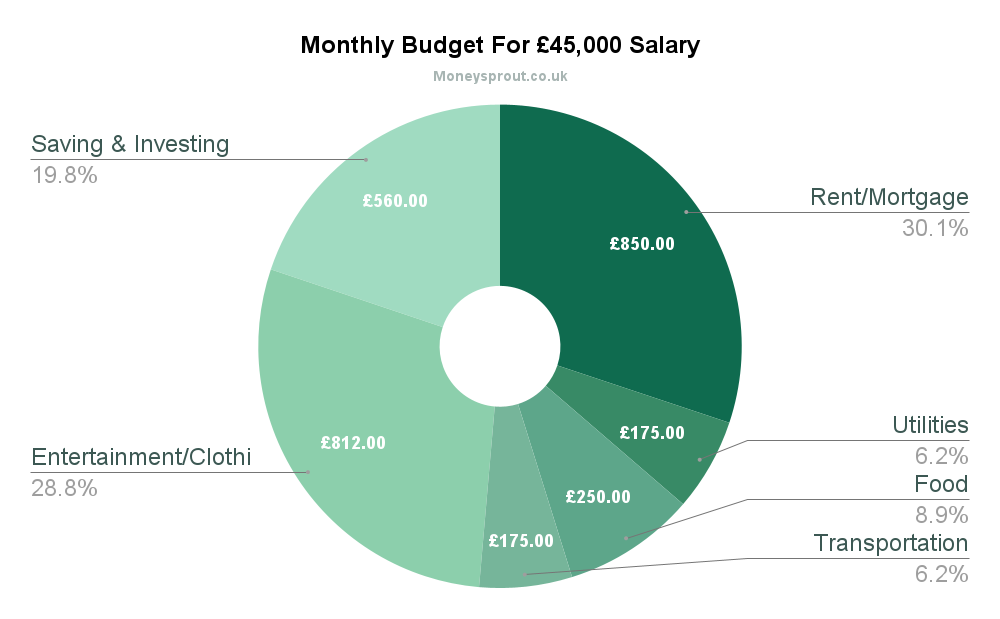

While £45k is an above-average salary in most of the UK, it doesn’t mean you can just spend money on anything you like. Setting a solid budget each month allows you to keep your spending on track and ensure you are saving and investing for the future.

On a £45k salary, you are bringing home £2,822 per month. I have put together a rough budget template below to help get you started. However, everyone’s financial situation is personal so you may need to adjust some figures to suit your needs.

We will follow the 50/30/20 rule. This means roughly 50% goes towards needs, 30% to living life, and 20% to savings/investing.

| Expense | Budget |

|---|---|

| Monthly Net Income | £2,822 |

| Rent/Mortgage | £850 |

| Utilities | £175 |

| Food | £250 |

| Transportation | £175 |

| Entertainment, Clothing | £812 |

| Saving & Investing | £560 |

If you want to get into more detail with your own personal budget, I would recommend checking out our Monthly Budgeting Google sheet.

- Monthly Budget Overview

- Custom Categories

- Transaction Log

- View Daily Spending Overview

- Track Needs, Wants, Savings/Investments & Debts

Housing On A £45k Salary

Housing is likely to be your biggest expense over the course of your life. On a £45k salary, you should be able to comfortably buy a house after you have saved up for your deposit.

To save a deposit, I would personally cut back significantly on my entertainment expenses for 2-3 years. If you can save £800 a month, you should have a £20k to £30k deposit in 2-3 years. It will take sacrifices but will benefit you massively in the long run.

When renting initially I wouldn’t go for the biggest, high-end apartment or house you can find. Realise that your initial housing is temporary and cut back a little. This can help you to reach your goal of buying a house much faster.

How Much To Spend On Rent With A £45k Salary

When it comes to renting, the general rule is to spend around 30% of your net take-home income. This means on a £45,000 salary you should be spending approximately £850 per month on your rent.

If you’re living in London or the South East you may need to stretch this a little further. In the rest of the UK, you should be able to find a reasonably nice property for £850 per month.

If you can also live with a partner or housemate who is contributing to housing expenses you can save a lot of money on housing. This gives you more money to contribute towards saving and investing.

Can I Get A Mortgage On A £45k Salary?

Yes, a £45k salary is more than enough to get a mortgage and purchase a house. If you are buying with a partner you will also be able to borrow quite a bit more. The first step is saving up for a minimum of 5% deposit however I would recommend aiming for 10% if you can.

In most cases, you will be able to borrow 3.5x to 5x your pre-tax income.

On a £45k per year salary, you will be able to borrow approximately £180,000. With interest rates currently around 6%, this would give you a monthly payment of £1,079 on a 30 Year Mortgage.

This is slightly above our recommended £850 for housing. Personally, if I was buying alone, I would buy a smaller house in the £160,000 range with a £150,000 mortgage. This would give you an £899 payment on the same terms.

If you have a partner who is also working full-time and contributing to the household, then a £180,000 mortgage should comfortably fall within your budget.

How To Become Financially Free On £45k A Year

If you live outside of London, you should not be struggling to live on a £45,000 per year salary. If you are, you’re making some significant financial mistakes. Here are a few fundamental personal finance rules you should follow to become financially stable.

Create A Budget

Creating a budget is the first step to becoming financially free. Knowing where your money is going each month allows you to be intentional about when you spend money.

You can use the template we provided above to start your budget and customise it to fit your lifestyle.

Get Out Of Debt

If you have any bad debts, your first priority should be paying them off. This might be credit card debt, car payments, personal loans, etc. With high-interest rates, these debts will make you struggle to ever get ahead financially.

Pay off these debts as fast as you can, starting with the highest interest first. Once you wipe out your debt you can start to focus on setting yourself up for financial success.

On £45k per year, you should be able to wipe out most debt quickly. If you have a car that has a £30,000 loan on it and you have no investments or emergency fund, it’s time to sell it and buy something more affordable.

Build An Emergency Fund

Once you cleared your debts, it’s time to start securing your future. An emergency fund allows you to be prepared when things go wrong. If you get laid off at work, your car breaks down you don’t have to stress. This money is specifically there to fix these problems.

You should aim to save 6 months of essential expenses. This is housing, food, and essential bills. For someone on a £45k salary, this is likely around £1600 per month. You should aim to save £9600 in an emergency fund.

Keep this money in a high-interest savings account and only touch it for ACTUAL emergencies. Even if you lost your job you have plenty of time to find a new one, without having to stress out too much.

Start Investing

Once you have an emergency fund and have wiped out any bad debts, it’s time to start investing. You may already invest some money in a pension each month through a workplace pension scheme. If they offer a match, you should be maxing this out first.

You have a couple of options for investing. If you are planning to invest for retirement and don’t ever plan on touching the money until then, I would recommend investing in a SIPP (Self Invested Personal Pension) due to the tax relief benefits and government bonus.

I personally try to max out my stocks and shares ISA first as I like to have access to the money at any time, in case an opportunity comes up, such as buying rental property or investing back into my own business.

Either way, setting up one of these investment vehicles and investing in simple index funds is one the most popular ways to start investing.

Final Thoughts

£45k in the UK is a good salary and is above 80% of all pre-tax incomes in the UK. This puts you in the top 20% of earners. That’s something to be proud of, but don’t let it stop you from going after more. If you live in London this salary won’t go as far but you should have more opportunities for promotion and pay rises over the next 5-10 years.

This salary is more than enough to look after you and your family while also investing. If you have a partner who also works you can live a very comfortable lifestyle.

Check out other salaries: