Car insurance is one of those expenses that we all hate paying. However, if you’re unlucky enough to ever need to use it, you’ll be glad to have it. In the UK, car insurance has risen significantly in 2023.

As car insurance premiums lagged in 2022 we are now taking a double hit seeing prices rise significantly more than usual. Most people didn’t see a rise in their premiums last year and will see a significant jump this year. Between rising fuel prices and expensive insurance, motoring is getting expensive.

Let’s take a look at how much you can expect to pay for your insurance based on your age.

Car Insurance Stats 2023

- The average car insurance cost in the UK is £776

- Young drivers pay significantly more than older drivers. Drivers aged 21 paid an average of £1,772, compared to £413 for 69-year-olds.

- 63% of drivers under 25 use a black box policy which can monitor their driving and lower their insurance premiums

- Inner London is the most expensive place for car insurance, while the South West are the cheapest

- Car insurance is 24% cheaper for 25-29 year olds compared to 20 to 24-year-olds.

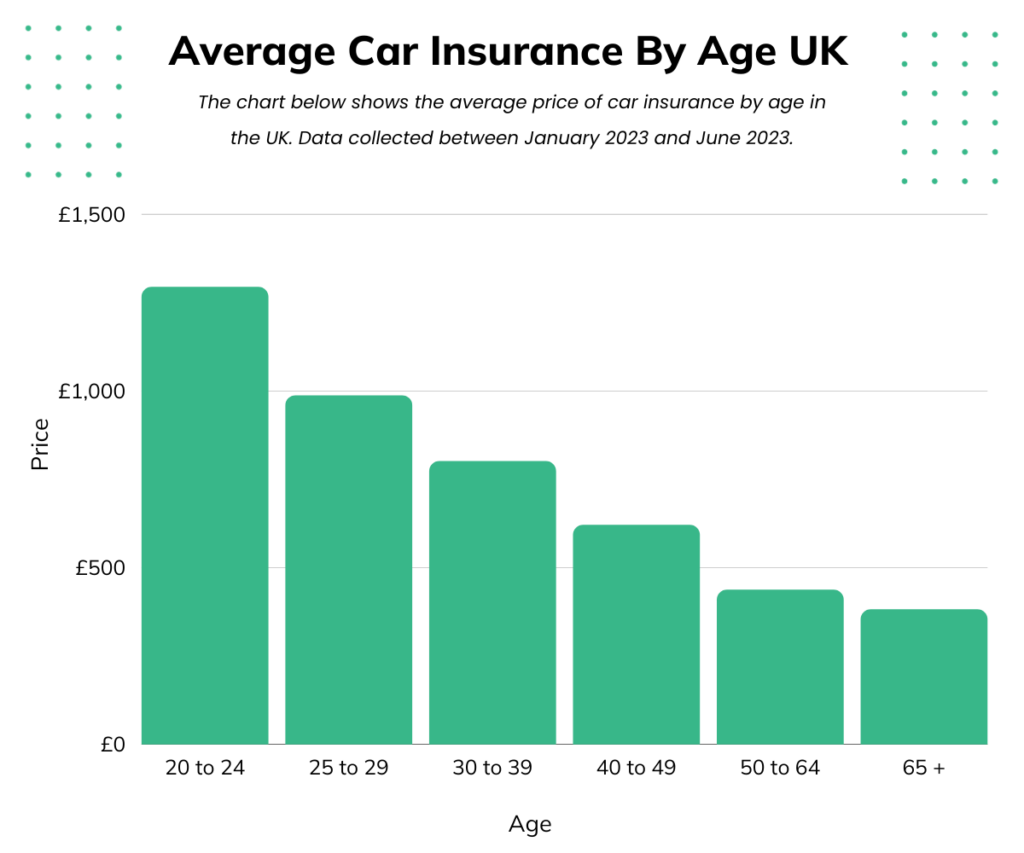

Average Car Insurance By Age UK

The chart below shows the latest data from Compare the Market on car insurance cost by age. We can see that insurance gets cheaper the older you get. This is due to risk levels.

Someone with 10 years of driving experience is less likely to have an accident than someone who has just recently passed their test.

There is a myth that your car insurance price plummets when you hit 25 years old. While it does drop it’s only on average by 24%. The premium then continues to decline all the way into your 50s.

As you reach your 70s you may find that your insurance increases as deteriorating health can lead to more risk for insurers.

| Age Of Main Driver | Average Annual Premiums |

|---|---|

| 20 to 24 | £1,294.08 |

| 25 to 29 | £987.06 |

| 30 to 39 | £800.88 |

| 40 to 49 | £620.68 |

| 50 to 64 | £437.04 |

| 65 + | £381.92 |

How To Get Cheaper Car Insurance

Your quoted premium may be higher than you expected from your existing provider. However, that doesn’t mean you can’t get a cheaper policy. Let’s take a look at 3 ways you can get cheaper insurance on your car in the UK.

1. Utilise Comparision Websites

- Explore Multiple Providers: Different insurance companies may offer varied quotes for the same driver profile and vehicle. Leveraging comparison websites allows you to explore a myriad of options, ensuring that you secure a policy that provides maximum value.

- Annual Check-In: Even if you’ve found a good deal, the insurance landscape is dynamic. Ensure to re-compare policies annually to ascertain if your current provider still offers the most economical option.

2. Enhance Your Vehicle’s Security

- Approved Security Devices: Installing Thatcham-approved security devices, such as alarms, immobilisers, and trackers, could potentially reduce the risk of theft and therefore, your premium.

- Safe Parking: Where you park your vehicle overnight is pivotal. A secured garage or a driveway is often viewed more favourably compared to street parking. If possible, ensure your vehicle is parked securely to reduce risk and potentially, your premium.

3. Optimise Your Excess and Coverage

- Voluntary Excess: Agreeing to pay a higher voluntary excess (the amount you pay towards a claim before the insurance kicks in) can reduce your premium. However, ensure that the excess is affordable, lest it becomes a financial burden in the event of a claim.

- Tailor Your Cover: Ensure your coverage is aligned with your needs. Sometimes, paying for add-ons or a level of cover that exceeds your requirements can unnecessarily inflate your premium. Analyse your driving patterns, vehicle usage, and other factors to choose a policy that’s not excessively padded.

Bonus Tip: Leverage No-Claims Discount:

- Protect Your Bonus: A no-claims discount can significantly reduce your premium. If you accrue a few years without making a claim, this demonstrates to insurers that you’re a lower risk, which can notably diminish your cost. Some insurers offer the option to protect this bonus, which might be worthwhile to preserve the discount even if you need to make a future claim.

7 Things That Effect Your Car Insurance Price

Getting car insurance can be a complex task, especially for young drivers. However, age is just one piece of the puzzle. There’s a range of factors that insurers in the UK utilise to calculate your premium. Let’s take a look at the 7 most important factors in determining your car insurance price.

Age and Experience

Young Drivers: Individuals aged between 17 and 25 often face steeper premiums. Statistics indicate that younger drivers are more likely to be involved in accidents, hence the heightened risk is mirrored in their insurance cost.

Mature Drivers: As drivers mature and accumulate years of experience, their premiums typically decline, reaching a nadir around middle age. Elderly Drivers: Drivers above a certain age, often 70, may witness a surge in premiums due to potentially diminished driving skills and higher accident rates.

Vehicle Type

Your car of choice tells a story to the insurers. High-performance or luxury vehicles not only cost more to repair or replace but might also be enticing to thieves. The group your vehicle falls into (there are 50 insurance groups in total) will significantly influence your insurance costs.

Location

Where you reside and where the car is stored can massively impact your insurance premium. Urban areas, with higher traffic and crime rates, might inflate your premium, whereas rural areas might offer some respite.

Claims History

Your track record as a driver is under the insurer’s microscope. A history peppered with claims, especially at-fault ones, will likely ramp up your insurance costs. Conversely, a no-claims bonus can fetch you a generous discount on your premium.

Usage and Mileage

The purpose and distance driven also weigh in. A car used for commuting and clocking high mileage might incur higher premiums than one used for leisurely weekend drives, attributing to the increased risk associated with more time on the road.

Additional Drivers

Adding other drivers, especially younger or less experienced ones, to your policy can elevate the cost. Conversely, including a more experienced driver might trim down your premium, given they share the driving responsibility and ostensibly reduce the risk.

Security and Safety

Enhancing your car’s security with approved alarms, immobilisers, and secure parking can trim down the perceived risk and subsequently, your premium. Conversely, lacking these might amplify your costs.

Additional Note: Optional Add-Ons and Coverage Types Your choice in policy type (third-party, third-party fire and theft, and comprehensive) and any additional covers like breakdown assistance or legal cover will also influence the final cost. More extensive coverage equates to higher premiums.

Average Car Insurance Cost For A New Driver

Admiral stated in July 2023 that young drivers aged 17 and 18 should expect to pay 77 percent more than the national average, with an average annual premium of £1,840. Drivers aged 19 to 21 can expect to pay 39 percent more than the average premium of £1,840 while those aged 22 to 25 typically pay around £1,140.

It may seem unfair that young drivers get charged so much but the statistics back up the prices. Drivers aged 17 to 24 make up only 7% of UK license holders however this age group is involved in 24% of all fatal collisions.

What Are The Cheapest Cars To Insure

According to Car Wow, the 15 cheapest cars to insure in the UK are:

- Volkswagen Polo

- Hyundai i10

- Volkswagen Up

- Kia Picanto

- Dacia Sandero

- Ford Fiesta

- Seat Ibiza

- Renault Clio

- Skoda Fabia

- Kia Rio

- Toyota Aygo X

- Nissan Micra

- Fiat 500

- MG3

- Fiat Panda

Final Thoughts

Now you know how age can affect the price of your car insurance. Hopefully, some of these tips and tricks will help you get a significant discount on your premiums. Prices have been rising significantly this year, so it’s important to do everything you can to get a reasonable price for your insurance.

Never take your renewal price from your existing provider without first using comparison sites to check for a better deal. Just ensure that any new deal you are looking at provides you with the same level of coverage.

Read More From Money Sprout: