Just like 2023 before it, 2024 looks like it’s going to be a tough year for already cash-strapped families. According to The Independent, food and energy bills are still far higher than they were before the Pandemic, with forecasts being somewhat difficult to read.

You may spend as much in 2024 on household bills as you did in 2023, or you may see them lower slightly.

That’s where this article comes in. We’re going to look into how much you can expect to spend on your household bills, as well as provide a few tips on how to lower those bills for people who feel like they’re spending too much.

Quick Overview

In the UK, the average household spends £16,679 per year on household bills across five key categories – housing, utilities, communications, council tax, and insurance. Gas and electricity cost £2,797 per year, with the average household having an annual spend of £1,566 on TV, phone, and internet services. This amounts to £1,390 monthly on household bills.

Key Facts and Figures

- The average mortgage owner spends £1,485 per month, which is the combined cost of their mortgage and household maintenance.

- Gas and electricity cost an average of £233.08 per month, that’s expected to fall during 2024.

- The ONS says that average weekly earnings were £666 for November 2023. Multiplied by 52, that amounts to £34,632 – a little over double household costs.

What Are Household Bills?

Before we get started, let’s answer a key question:

What are household bills?

The simple answer is that this term covers any bills that have to do with your home. Your mortgage, gas, electricity, water, and council tax all fall under this umbrella, as do your phone, TV, and internet bills. Home and contents insurance should also be in this category, as are home repairs, but the latter isn’t consistent given that you may not need to do any maintenance during the year.

Food, interestingly, isn’t a household bill even though it’s essential. If you want to see how much the average food bill is in the UK, you can check out our article on the subject.

With that out of the way, let’s dig into some numbers.

Average Household Bills in the UK

These figures are based on Office of National Statistics (ONS) survey data adjusted for inflation by Nimblefins unless otherwise stated.

To come up with a total for the average UK household bills, we’ll break the numbers down into the previously mentioned categories, starting with the most obvious one.

Housing

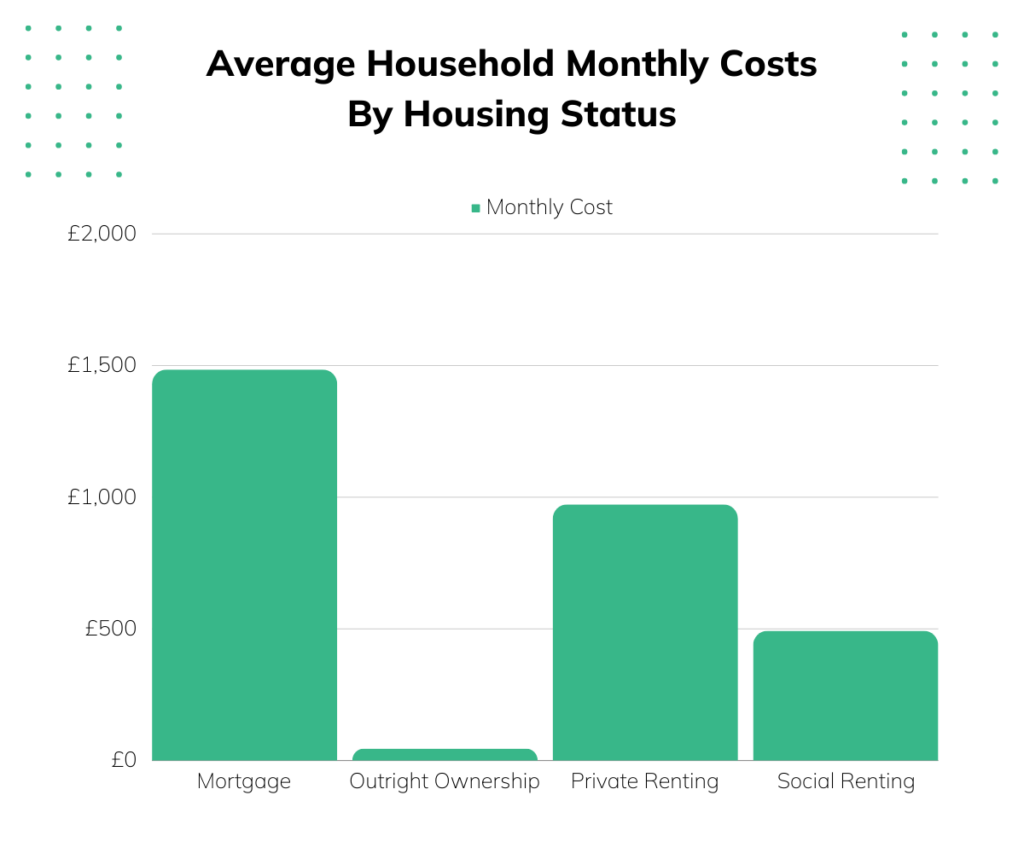

The cost of housing varies depending on the type of housing. Somebody with a mortgage will typically face higher monthly costs than somebody who rents or lives in social housing because the mortgage owner has to take repairs into account. These maintenance issues are the reserve of the council for social housing and your landlord if you rent.

According to Nimblefins, the average UK household has monthly outgoings of £400 for housing, though the figures look a little different depending on your housing status. Furthermore, this average doesn’t quite seem to gel with the numbers it provides. The average across the following four categories works out to £749.25, rather than £400:

| Housing Status | Monthly Cost | Annual Cost |

|---|---|---|

| Ownership with Mortgage | £1,485 | £17,816 |

| Outright Ownership | £46 | £550 |

| Private Renting | £973 | £11,675 |

| Social Renting | £493 | £5,921 |

Even if we assume that £749.25 is the correct figure, you can see how the far lower cost of outright ownership skews the numbers. Taking that out of the equation, the average would be a little over £983 per month. Bear in mind that these figures also include household repairs and maintenance, meaning yours may be much lower (or higher) depending on the amount of work you put into your home.

Utilities

Utilities cover your gas, electricity, and water bills, with the average household spending £270 per month on these three essentials. That amounts to £3,245 per year – over £1,000 more than the £1,927 price cap that Ofgem put in place in January 2024.

How is that possible?

First, the Nimblefins’ figures also account for your water bill, while Ofgem’s price cap doesn’t. Statista forecasts the annual average to be £448 by the end of 2024, though that still leaves £870. That brings the second issue into play – Ofgem’s price cap isn’t a set monthly figure.

Although the cap is supposedly set at £1,927, that’s more of an estimate. The actual cap applies to the kilowatt-hour (kWh) rates attached to your electricity and gas. While those have a limit, households that use more electricity and gas will naturally spend more than those that don’t, with excess usage potentially resulting in you spending more than the £1,927 cap.

Let’s look at how all of this breaks down:

| Utility | Monthly Cost | Annual Cost |

|---|---|---|

| Gas and Electricity | £233.08 | £2,797 |

| Water | £37.30 | £448 |

Council Tax

Your council tax rates will vary depending on your band and the number of people living in your home. Single people get a small discount of 25%, as well as a 50% discount being applied if everybody in your home is considered “disregarded.”

According to Nimblefins, the average household spends £139 per month on council tax, creating an annual bill of £1,674. It’s also worth remembering that households don’t pay council tax during February and March, with these two months being accounted for in the figures.

Communications

The communications category lumps together your phone, TV, and broadband bills, all of which can vary remarkably. Somebody who pays for cable spends more on TV than someone who doesn’t splash out, for instance. Streaming services – such as Netflix and Amazon Prime – also fall under this category.

Nimbelfin says that the average household spends £130 per month on “communications” expenses, amounting to an annual spend of £1,566.

Insurance

Home and contents insurance aren’t mandatory. However, many mortgage providers won’t offer you a mortgage if you don’t have them. You also likely won’t be paying home insurance if you rent, as your landlord or the council takes care of that. In these cases, you’ll typically pay contents insurance alone.

Regardless, Nimblefins’ figures suggest that the average household spends £100 per month on insurance, with annual costs reaching £1,203.

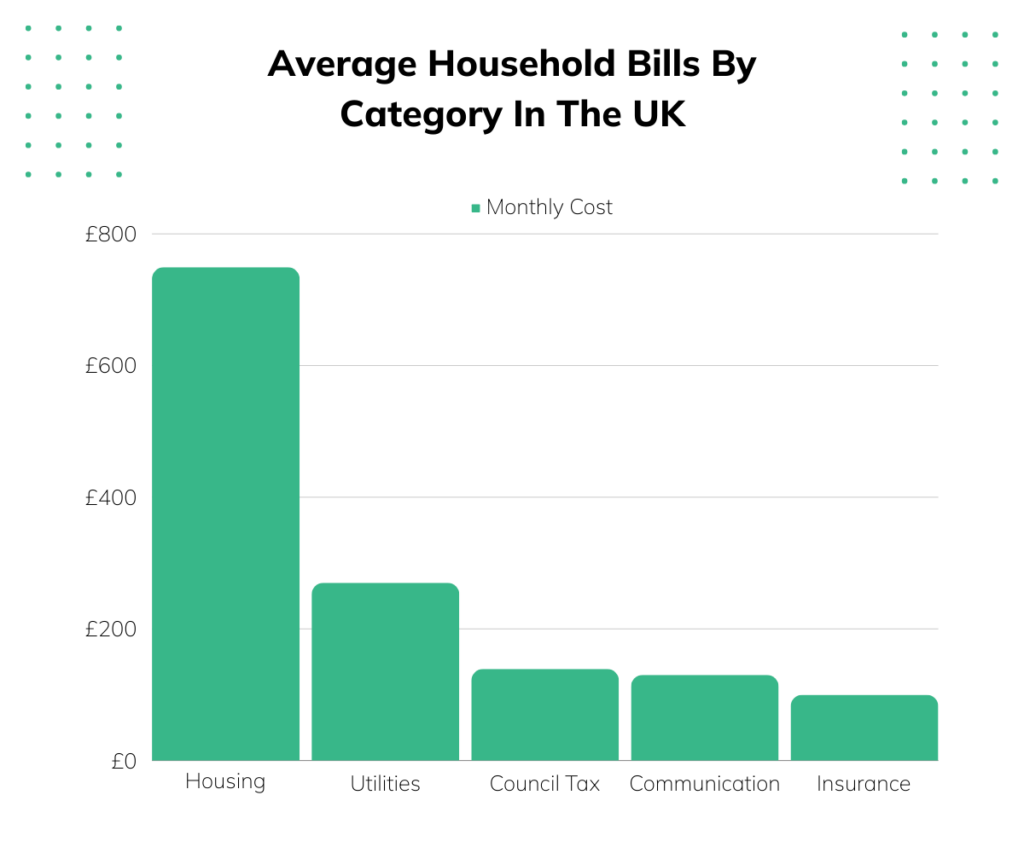

Household Bills Broken Down – The Total

With the bills broken down into categories, let’s look at the total you can expect to pay both monthly and annually.

| Household Bill | Average Monthly Cost | Average Annual Cost |

|---|---|---|

| Housing | £749.25 | £8,991 |

| Utilities | £270 | £3,245 |

| Council Tax | £139 | £1,674 |

| Communication | £130 | £1,566 |

| Insurance | £100 | £1,203 |

| Totals | £1,388.25 | £16,679 |

Note that these numbers don’t include the cost of food, transportation, furniture, or personal items. None of these costs apply directly to running your home.

How to Lower Your Household Bills

If your household bills are causing you some pain, we’ve put together a list of five tips that may help you cut them down.

1 – Cut Communications Bills

Though your TV license is a static bill, the same doesn’t apply to your phone, internet, streaming services, or cable bill. For instance, Uswitch says the average home spends £26.88 per month on broadband. You could achieve – or drop below – that average by renegotiating your contract, switching suppliers, or downgrading to a slower broadband service.

2 – Lower Your Energy Usage

Dropping your thermostat by 1 degree Celsius – ideally so it’s between 18 and 21 degrees – substantially lowers your gas usage. As for electricity, turn off lights, switch off devices when they’re not in use, and consider having a water meter installed if you believe you use less than the average amount of water.

3 – Take Advantage of Council Tax Discounts

Living on your own? Make sure you’re claiming the 25% council tax discount for which you’re eligible. You may also be due a council tax reduction if you’re disabled, or a carer for a disabled person, or if everybody in your home is a student studying full time.

4 – Check Out the Warm Home Discount

The Warm Home Discount Scheme could cut £150 off your energy bill, assuming you qualify. Visit Gov.uk to find out, though those who are potentially eligible should receive a letter in January 2024 telling them so.

5 – Fix Your Mortgage

The average standard variable rate for a mortgage in the UK is 8.19%, at the time of writing. Switching to a two-year fix could knock that down by a couple of percentage points, potentially saving mortgage owners a couple of hundred pounds per year.

Will Household Bills Rise in 2024?

This is a tough question to answer.

The government believes that energy bills will fall during 2024, despite the January 2024 price cap increase. The same likely goes for mortgage rates – suppliers kicked off the year by slashing their rates and, assuming interest rates continue their slow decline, they should start offering even lower rates by the end of the year. Of course, those on fixes with higher rates will have to wait out their mortgage (or pay penalty fees for breaking it) before benefitting from those rates. Inflation is also expected to fall – with the government anticipating an average of 2.2% by the end of 2024.

There are some downsides, however. The government has granted councils the right to raise council tax by up to 3% for the year, though not all will take advantage of this. But generally, household bills may come down slightly during the year.

How Much of Your Income Should Go to Household Bills?

Here at Money Sprout we recommend starting with the 50/30/20 budget. 50% or less of your post-tax income should go to neccessities. Approximately 35-40% will be on household bills with the remaining going to your other nexessary purchases such as clothing and food. Consider that your barometer – if you’re spending more, then you may be spending beyond your means.

Wrapping Up

The shock of over £16,000 of your money going toward household bills every year may be tough to handle, but it looks like good news is on the horizon. Interest rates and inflation are both likely to fall over the year, with energy bills following suit. The latter will be especially important – a substantial decline could save you hundreds of pounds.

Hopefully, the tricks we’ve shared here can help you slash your bills as those declines come into effect.

Read More From Money Sprout: